Taipei, Taiwan, October 13, 2011 - With China expecting slower growth in regional solar markets such as Europe over the next few years, the government has set out to increase domestic demand during its 12th Five Year Plan period (2011-2015), and installed solar PV system capacity is targeted to hit 10GWp by 2015, according to a recent Digitimes Research Special Report titled "The role of PV in China's energy policy through 2015."

China is already the world's largest manufacturing center for solar power equipment. According to figures from Digitimes Research, production of silicon wafers and crystalline silicon (c-Si) solar cells will reach 14.8GWp and 15.1GWp respectively in 2011, accounting for more than 50% of total global production.

Five of the world's ten largest solar cell factories are located in China, and China's GCL and Suntech are the two biggest players in the global PV silicon wafer and solar cell industries. As the cost of solar power systems continues to fall year on year, China-based manufacturers' market share will continue to increase, the report explains.

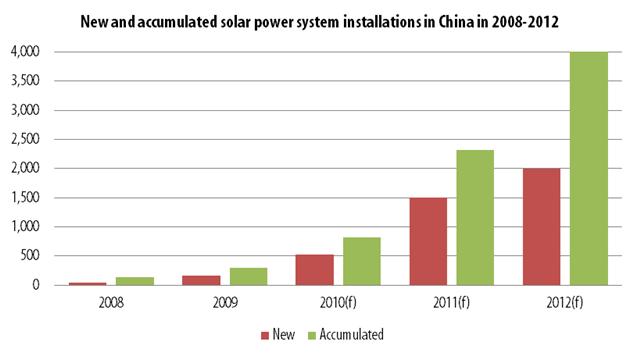

China's solar power market has grown rapidly since taking off in 2009. In 2010, the newly added capacity of solar PV systems reached 522MWp, and will likely break through the 1.5GWp barrier in 2011. China's Development Plan for New Energy Source Industries gives China's targets for total installed capacity in solar PV systems as 10GWp by 2015, rising to 50GWp by 2020.

The role of PV in China's energy policy through 2015

About DIGITIMES Research

DIGITIMES Research is the research arm of DIGITIMES Inc., Taiwan's leading high-tech media outlet. Operating as an independent business unit, DIGITIMES Research focuses on monitoring key high-tech industries, while also guiding clients toward suitable new business as well. Market intelligence and analysis is provided to more than 1,000 corporate customers worldwide. Research and consulting services cover a full range of industries, including information and communications technology (ICT), flat panel display (FPD), renewable energy and semiconductor design and manufacturing.

Contacts:

Michael McManus (Michael.mcmanus@digitimes.com)

Shannen Yang (Shannen.yang@digitmes.com)