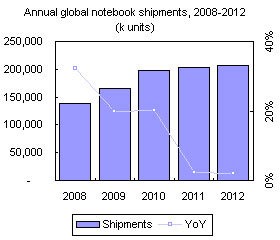

Global economic turmoil has seriously impacted growth in the PC market and it will remain weak (2Q-3Q) leading up to the launch of Windows 8, whose initial benefit will mainly be satisfying delayed demand from the third quarter. For the year, global shipments will reach 207 million, a growth rate of only 2.1% from 2011. The breakdown in notebook shipments between the first and second half of the year will be in a ratio of 47:53.

Notebooks with special form factors are still waiting for a breakthrough opportunity. For example, the penetration rate of ultrabooks is estimated to account for less than 5% of global notebook shipments in the fourth quarter, while notebooks with touchscreen control as well as models with a special form factor are both expected to account for less than 1%.

Notebooks that adopt a solid state drive (SSD) will account for 7.1% of total shipments in the fourth quarter, but around 70% of those shipments will be contributed by Apple products.

In the second half of the year, among notebook ODMs, only Quanta Computer and Compal Electronics will have a strong chance to achieve further growth. In terms of brand vendors, Lenovo, Asustek Computer, Apple and Samsung will all achieve a strong performance to help them gain market share, while HP and Dell will face a decline with Acer expected to maintain its ranking.

Chart 5: Global notebook shipments and growth in 1H12 (k units)

Chart 6: Global notebook shipment growth by product type, 1Q10-2Q12

Chart 7: Major events that will affect notebook shipments in 2H12

Chart 8: Global quarterly notebook shipments, 1Q11-4Q12, (k units)

Chart 9: Annual global notebook shipments, 2008-2012 (k units)

Chart 10: Global notebook shipment proportion by quarter, 2009-2012

Chart 11: Global quarterly netbook shipments, 1Q11-4Q12 (k units)

Chart 12: Ultrabook and SSD-based MacBook shipments, (k units)

Chart 14: Outlook of SSD-based notebook shipments, 4Q11-4Q12 (units)

Chart 15: Transformable notebook shipment forecast scenerios (k units)

Chart 17: Touchscreen notebook outlook, shipments and share (k units)

Chart 18: Touchscreen notebook shipment structure, 3Q12-4Q12

Chart 19: New form factor notebook shipments and share of overall notebook market, 2012 (k units)

Chart 20: Top-10 notebook brands' shipments in each quarter of 2012 (k units)

Chart 21: Top-10 notebook brands' market share in each quarter of 2012

Chart 22: Top-10 notebook brand quarterly shipment growth, 2012

Chart 23: Top-10 notebook brands quartely on-year shipment growth, 2012

Chart 25: Ultrabooks quarterly proportion of notebook shipments, by brand, 2012

Chart 26: SSD-based notebook shipments by brand, 4Q11-4Q12 (k units)

Chart 27: SSD-based notebook share of notebook shipments, by vendor, 4Q11-4Q12

Table 1: Windows 8-based transformable notebook and tablet plans, by vendor, 2012

Chart 28: Notebook brands' transformable notebook shipment forecast (k units)

Chart 29: Transformable notebook share of notebook shipments, by vendor 2H12

Chart 30: Touchscreen notebook shipment forecast, by vendor, 2H12 (k units)

Chart 31: Touchscreen notebook share of total notebook shipments by vendor, 2H12

Chart 34: Top-10 notebook brands' on-year shipment growth in 2012

Table 2: Notebook vendor outsourcing volumes by ODM, 2012 (k units)

Chart 37: Taiwan quarterly notebook shipments and share, 4Q11-4Q12 (k units)

Chart 38: Samsung notebook order volumes to Taiwan ODMs, 2Q12-4Q12 (k units)