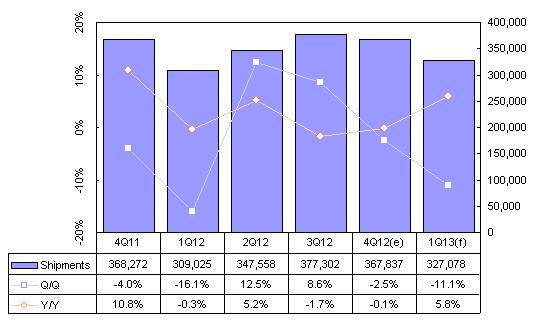

Chart 1: Small- to medium-size TFT LCD panel shipments, 4Q11-1Q13 (k units)

Chart 4: Overall shipments by technology, 4Q11-1Q13 (k units)

Chart 6: Handset panel shipments by technology, 4Q11-1Q13 (k units)

Chart 7: Handset panel shipment share by technology, 4Q11-1Q13

Chart 8: DSC panel shipments by technology, 4Q11-1Q13 (k units)

Chart 12: Taiwan's small- to medium-size TFT LCD shipments and global share, 2010-2015 (k units)

Introduction

- Taiwan shipped 367.84 million small- to medium-size TFT LCD panels in the fourth quarter of 2012, decreasing 2.5% sequentially and 0.1% from the same period one year earlier.

- Taiwan's small- to medium-size TFT LCD panel shipments are expected to decrease 11.1% sequentially but increase 5.8% on year to 327.08 million units in the first quarter of 2013.

NOTE: Unless otherwise indicated, all figures and tables in this report refer to output from Taiwan makers.

Chart 1: Small- to medium-size TFT LCD panel shipments, 4Q11-1Q13 (k units)

Source: Digitimes Research, January 2013

- The fourth quarter is traditionally the slow season for small- to medium-size TFT LCD panels, and the fourth quarter of 2012 was no exception, with Taiwan's panel makers seeing a 2.5% quarter-on-quarter contraction in shipments to 368 million units. The weak global economy also contributed to weak year-on-year growth, which actually saw a 0.1% contraction on shipment levels in the fourth quarter of 2011, the second consecutive quarter with negative year-on-year growth rates.

- Handset panel demand was significant in the fourth quarter of 2012 as major global handset vendors launched a series of new models. Demand from the China white-box handset market also remained largely unaffected by the seasonal slump, helping Taiwan-based panel makers to buck the overall trend and achieve 0.5% quarter-on-quarter growth in the handset panel sector; the handset sector's share of overall small- to medium-size panel shipments for Taiwan's panel makers also increased by 2.4 points in the fourth quarter to 80.4%.

- Shipments for other application sectors declined due to seasonal factors. Chunghwa Picture Tubes (CPT) and E-Ink Holdings changed their production strategy and reduced the share of production allocated to niche products, with shipments falling 23% on the previous quarter. The MP3 player sector fell by 19.4%, while the digital camera sector shrank by 13.9%, largely due to the replacement of such devices by smartphones; the onboard vehicle display sector also declined by 13.9% quarter on quarter.

- Innolux (formerly Chi Mei Innolux, or CMI) benefitted greatly from large orders for handsets placed by major handset vendors with Foxconn and Chi Mei Communication Systems (CMCS), with which it is affiliated; as a result Innolux's small- to medium-size panel shipments overtook CPT in the fourth quarter of 2012, making the firm the second largest Taiwan-based manufacturer by shipments after HannStar Display.

- The first quarter is the traditional slow season for small- to medium-size TFT LCD panels, and the first quarter of 2013 will see Taiwan's small- to medium-size TFT LCD panel shipments fall 11.1% quarter-on-quarter to a projected 327 million units. In terms of year-on-year growth, the continuing close relationships between Taiwan panel makers and brands such as Nokia and Sony will boost demand for handset display panel products higher than the level seen in the same period of 2012; consequently, overall small- to medium-size LCD panel shipments will grow 5.8% on the figures for the first quarter of 2012.

- The effect of the slow season will cause a contraction in Taiwan-based manufacturers' shipments for all application sectors for small- to medium-size panels during the first quarter of 2013. The seasonal effect will be less pronounced in niche products, which are included in the "Other" sector in this report; the "Other" sector will see shipments contract by just 1.0%, the lowest of any sector; the low-end medium-size panel sectors will see the most severe decline with shipments for portable DVD players falling 38.3% and shipments for digital photo frames falling 29.4% in the first quarter, largely thanks to inventory adjustments and market share erosion from white-box tablets.

- All Taiwan's major panel makers will see shipments contract due to the effects of the slow season. AU Optronics (AUO) will be least affected as its shipments for major international tablet makers increase, while Wintek will be hard hit as it continues to increase its touch panel shipment share, as will E-Ink, as its major clients' tablet product ranges enter a period of transition. HannStar and Innolux will remain the top two Taiwan-based manufacturers of small- to medium-size TFT LCD panels by shipments.

Shipments breakdown

Applications

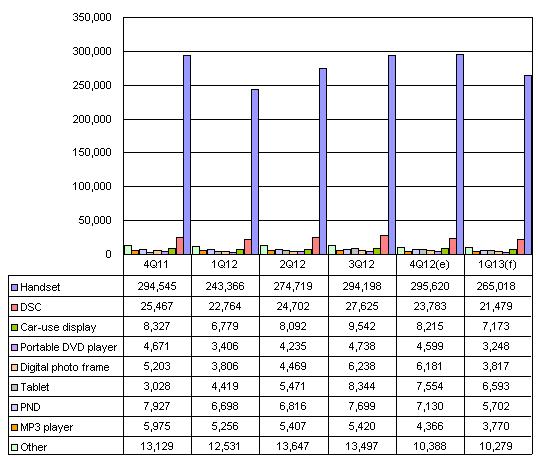

Chart 2: Shipments by application, 4Q11-1Q13 (k units)

Source: Digitimes Research, January 2013

Chart 3: Shipment share by application, 4Q11-1Q13

Source: Digitimes Research, January 2013

- Taiwan-based manufacturers' small- to medium-size TFT LCD panel shipments for all application sectors fell in the fourth quarter of 2012, except for the handset sector, which saw 0.5% growth.

- The digital camera application sector was badly hit with a 0.8 point drop in shipment share during the fourth quarter, as smartphones replaced digital cameras and compounded the effects of the seasonal slump.

- The "Other" segment will contract by just 1.0%, while other application sectors will all see shipments contract by 9% or more in the first quarter of 2013.

Technology: LTPS and a-Si

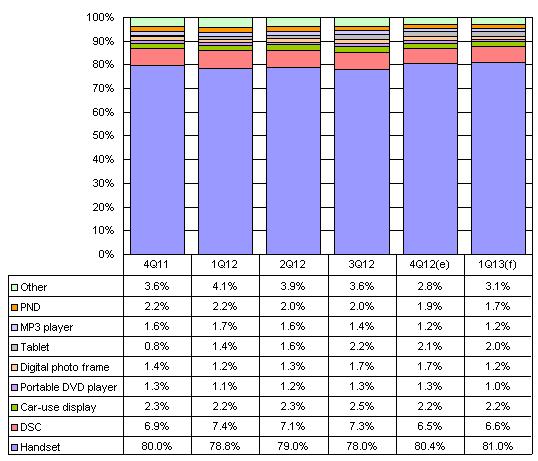

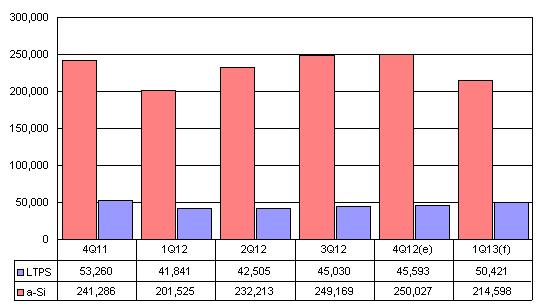

Chart 4: Overall shipments by technology, 4Q11-1Q13 (k units)

Source: Digitimes Research, January 2013

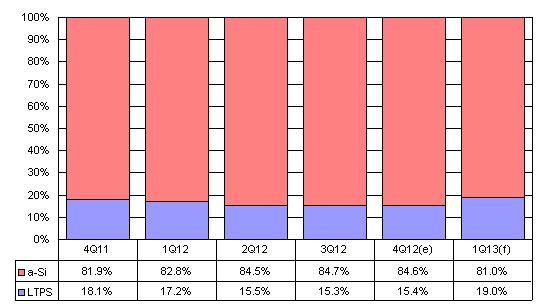

Chart 5: Overall shipment share by technology, 4Q11-1Q13

Source: Digitimes Research, January 2013

- Taiwan-based manufacturers' LTPS TFT LCD handset panel shipments grew 1.3% in the fourth quarter due to global smartphone demand.

- LTPS TFT LCD's share of Taiwan-based manufacturers' small- to medium-size panel shipments rose 0.2 points to 14.2% in the fourth quarter of 2012.

- As international handset makers continue to focus on smartphones, demand for the relevant panel products in the first quarter of 2013 will remain significant, despite the effects of the slow season; demand for high-performance LTPS TFT LCD panels will see shipments rise quarter on quarter..

- Small- to medium-size LTPS TFT LCD panels' share of overall shipments for Taiwan-based panel makers will rise 3.1 points in the first quarter of 2013 to 17.3%.

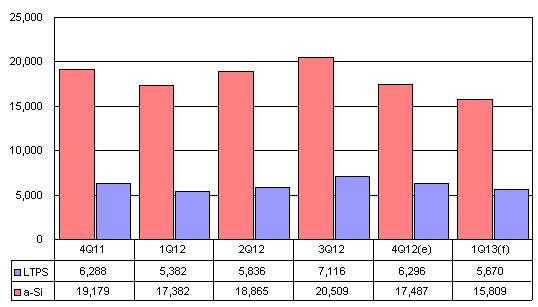

Chart 6: Handset panel shipments by technology, 4Q11-1Q13 (k units)

Source: Digitimes Research, January 2013

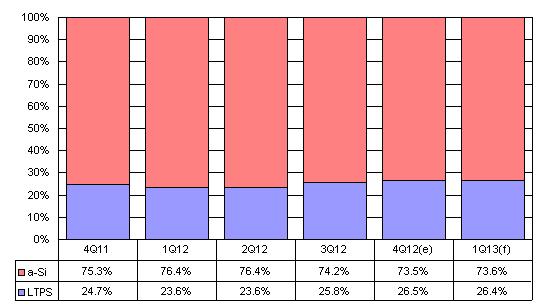

Chart 7: Handset panel shipment share by technology, 4Q11-1Q13

Source: Digitimes Research, January 2013

Chart 8: DSC panel shipments by technology, 4Q11-1Q13 (k units)

Source: Digitimes Research, January 2013

Chart 9: DSC panel shipment share by technology, 4Q11-1Q13

Source: Digitimes Research, January 2013

Makers

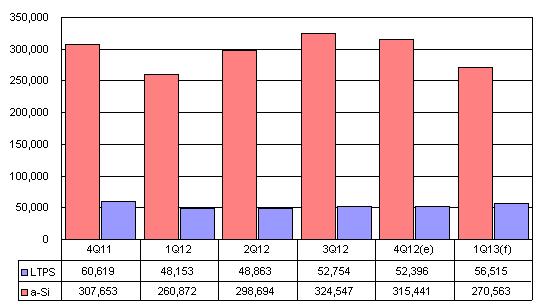

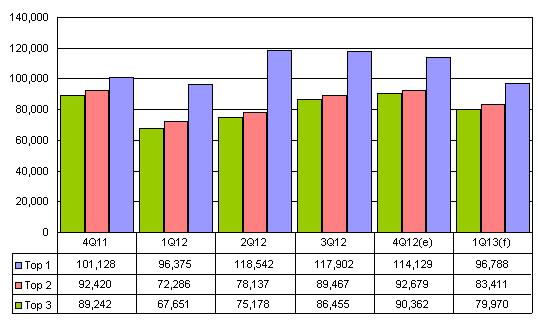

Chart 10: Top-3 makers' shipments, 4Q11-1Q13 (k units)

Source: Digitimes Research, January 2013

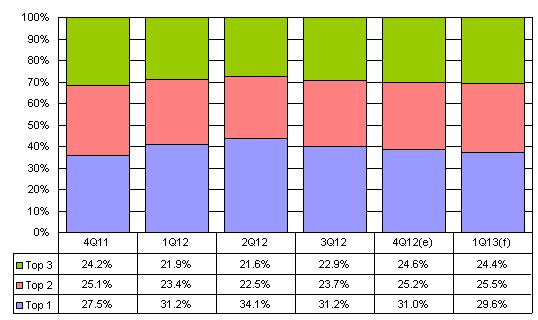

Chart 11: Top-3 makers' shipment share, 4Q11-1Q13

Source: Digitimes Research, January 2013

Source: Digitimes Research, January 2013

- HannStar's handset panel shipments were mainly targeted at the less seasonal China white-box handset market in fourth-quarter 2012, helping the firm to remain the number one Taiwan-based small- to medium-size panel maker by shipments.

- Innolux saw shipments rise 7.2% against the prevailing market trend to overtake CPT as the second largest Taiwan-based small- to medium-size panel maker, largely due to demand from new handsets from major international brands, as well as normal levels of demand for China-based white-box handsets.

- The top three Taiwan-based small- to medium-size panel makers – HannStar, Innolux and CPT – will all see shipments contract by more than 10% in first-quarter 2013 compared to the previous quarter. Smartphone panel orders will help Innolux to offset more of the impact of the seasonal slump than HannStar or CPT.

- While AUO benefits from tablet panel demand from major international brands, Giantplus Technology will benefit from restocking following a large drop in shipments in the fourth quarter of 2012. This will reduce the concentration of Taiwan small- to medium-size panel shipments in the first quarter of 2013, although HannStar and Innolux will remain the top two Taiwan-based small- to medium-size panel makers.

Outlook till 2015

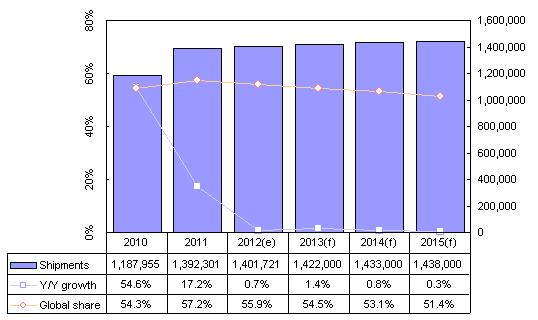

Chart 12: Taiwan's small- to medium-size TFT LCD shipments and global share, 2010-2015 (k units)

Source: Digitimes Research, January 2013

- Looking ahead to 2013-2015, China-based BOE and Tianma, which both started to emulate the success of CPT and HannStar from 2011 onwards, will erode Taiwan-based manufacturers' market share in the low-end medium-sized TFT LCD panel sector. China-based brands' handsets will continue to erode demand for white-box handsets, which will further threaten Taiwan-based manufacturers' position in China's low-end small- to medium-size TFT LCD panel market.

- In the high-end handset, digital camera and tablet application sectors, Japan Display is stepping up production of high-end handset panels with 400ppi or higher pixel density, while Samsung Mobile Display continues to increase AMOLED production. AMOLED will continue to replace TFT LCD in the high-end small- to medium-size panel market. Taiwan-based panel makers will therefore see increasingly fierce competition in the high-end panel market although their market position will be stronger in the midrange smartphone panel market where pixel density stands at 250-300ppi.

- Consequently, while the year-on-year growth rate for Taiwan's small- to medium-size TFT LCD shipments will be higher in 2013 than in 2012, the growth rate is expected to begin to decline year on year from 2014 as Japan Display and LG Display begin LPTS TFT LCD production using 6G factories.