Analytics is essentially different from analysis: Analysis is work that analyzes things based on historical data; analytics is a forward-looking inference from given data.

In general, senior analysts can usually achieve the "analysis" level, providing market information that the general public, and even professionals cannot interpret or research on their own. But only the top-of-the-line service providers can provide forward-looking references for informed decisions. To attain this level, it is crucial to identify your customers' needs by understanding their business model and developing SWOT analysis.

Emerging advanced tools have taken data driven industry analysis to a new level which poses a crisis as well as an opportunity. Because not only market research institutions are unfamiliar with it, companies in general are getting even more disoriented. But as long as market research institutions take some further steps, they can provide relatively high-quality information. The cost of acquiring high-quality information is still low as a percentage of overall corporate revenues. Raw data is virtually related to volume and the rest of the service such as data analysis and interpretation provided is purely based on the price the customer is willing to pay, or else knowledge workers would end up with a futile pursuit. Keep in mind that there is always a price for knowledge. Customers may just do the talking, but professionals must implement and take actions.

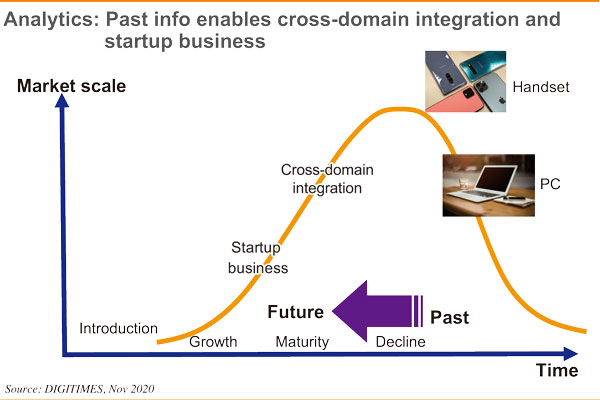

For enterprises, they can avail themselves of contents with macro perspectives and basic analysis structure at least to shun outrageous miscalculation of the megatrends of the industry. During the 1990s, nearly 40% of global PC sales came from the North American market, 30% from European demand, nearly 10% from Japan and 20% from the rest of the third world. Such numbers exemplify the contribution to knowledge dissemination by consulting companies such as IDC and Gartner. But the possibility of deriving nowadays business opportunity of smart applications and V2X (vehicle-to everything) from the PC and handset industries involves both macro and micro industry knowledge. You have to master both in order to devise strategy planning and judgment.

In a Go game, the collective efforts of a large group of beginners would stand no chance of defeating a professional player who masters the strategies and tactics. If you think your company needs a fundamenal change or is still getting nowhere after many attempts of change, try to talk to a consulting firm. But be sure to study what they are capable of in advance. If you want to understand the global channel structure, JFK may be a good choice. If you are interested in the structure of the global market, you may contact IDC. But if you are concerned about the dynamics and trends of the Asia-Pacific supply chain, then DIGITIMES has a role to play. Consulting institutions with different market positioning provide different services and assign different project leaders for different topics. There are different prices for different researchers.

(Editor's note: This is part of a series by DIGITIMES Asia president Colley Hwang about industry research work.)