5G penetration and accelerated digital transformation boost the growth of semiconductor and tech product companies. Global decarbonization and car sales recovery benefits the automotive industry, especially their EV businesses. The 2022 Asia Supply Chain 100 (ASC 100) Ranking reveals megatrends in the tech sector.

Toyota receives the first-place title for a second year

Half of the companies, in the ASC100 top 10 revenue ranking, were automakers, with Toyota Motor reigning on the list again with a revenue of around US$282 billion.

Though COVID-19 and the chip shortage worldwide forced it to cut production, Toyota saw a 13.8% year-over-year (YoY) revenue growth in 2021. Like most of its counterparts, the carmaker benefited from the firm demand in the US, China and Japan.

Toyota's global consolidated vehicle unit sales increased 7.6% in FY2022 (April 2021 to March 2022), according to the company's financial summary. Sales revenues in Asia grew the most at 29.4% in Japanese Yen, thanks to production volume and unit sales increase. Exchange rate changes also played a role.

The ongoing spread of COVID-19 and government responses have kept the Japan-based automaker curbing production in selected plants. In addition, geopolitical tensions may cause more ramifications to the supply chain. Therefore, Toyota projected its FY2023 sales revenue growth would scale back at 5.2% (in JPY).

Samsung Electronics remained in second place with US$243.9 billion in revenue, which was mainly driven by its semiconductor, cell phone and computer-related businesses.

Hon Hai Precision Industry saw 17.2% growth in 2021, receiving US$214.6 billion in revenue. Besides the high demand for IT and consumer electronics products, the enterprise's mastering supply chain management also helped its growth.

Honda Motor received US$130.3 billion in revenue in 2021. According to a press release, its motorcycle business saw a higher sales revenue growth at 22.3% (in JPY) in FY2022, contributed by an increase in Brazil. The automobile business revenue grew 6.6% in FY2022, which was primarily generated in Asia.

As the largest motor group in China, SAIC Motor received US$120.9 billion in revenue. Its vehicle unit sales increased 5.5% in 2021. Moreover, its new energy vehicle sales rose 128.9% from the previous year, becoming third place worldwide.

Hyundai Motor received US$102.7 billion in revenue in 2021. Multiple China-based media reports said the automaker's unit sales in the country dropped more than 23%, citing intense competition as a factor. However, Hyundai has announced an expansion in the EV business. It will likely create more revenue with its EV ambition.

Hitachi beat Sony to grab seventh place with US$92 billion in 2021 revenue. According to financial results, its revenue growth mainly came from a business establishment in the automotive systems segment and an acquisition in the energy segment. The recovery of demand for machinery helped, too.

Sony's revenue was about US$89.7 billion in 2021. Picture, electronics products & solutions and music segments contributed most to the company's sales. The company has sold more than 17.3 million PlayStation 5 consoles around the world but expects the supply will decrease this year due to materials availability.

Nissan motor reported US$79.3 billion in revenue last year. However, unlike its counterparts on the top 10 list, the Japan-based automaker saw a 4.3% decrease in vehicle unit sales in the fiscal year ended at the end of March 2022, mainly because of semiconductor shortages. But the company managed to increase its revenue through an improvement in sales quality and exchange rate fluctuations, according to the financial results.

Lenovo Group became one of the top 10 for the first time. Its revenue reached US$70 billion in 2021 and grew 26.7%, the highest among the top 10. According to the company, new IT service requirements, demand for cloud services and hybrid working, together with the accelerated digital transformation investments drove its revenue growth. For example, the premier PC segments with workstations and gaming contributed high growth last year.

Lenovo expected the market would remain strong and stable in 2022. Moreover, Bloomberg recently reported that the Chinese government has asked government entities and nation-owned enterprises to stop using personal computers and software produced by foreign companies. The policy is expected to benefit Lenovo's future sales.

2022 ASC100: Top 10 companies by revenue | |||||

Ranking | Company | Industry | Country | 2021 revenue (US$M) | YoY growth |

1 | Toyota Motor | automotive manufacturing | Japan | 282,073 | 13.8% |

2 | Samsung Electronics | tech products and equipment | South Korea | 243,922 | 21.2% |

3 | Hon Hai Precision Industry | tech products and equipment | Taiwan | 214,657 | 17.2% |

4 | Honda Motor | automotive manufacturing | Japan | 130,303 | 6.8% |

5 | SAIC Motor | automotive manufacturing | China | 120,975 | 11.8% |

6 | Hyundai Motor | automotive manufacturing | South Korea | 102,723 | 16.0% |

7 | Hitachi | machinery | Japan | 92,082 | 17.0% |

8 | Sony | consumer electronics | Japan | 89,753 | 12.3% |

9 | Nissan Motor | automotive manufacturing | Japan | 79,383 | 10.2% |

10 | Lenovo | tech products and equipment | China | 70,555 | 26.7% |

Compiled by DIGITIMES Asia

Contemporary Amperex Technology (CATL), a world-leading electric vehicle (EV) battery maker, was listed in ASC100 for the first time and stood out with the most annual revenue growth at 175.4%. It also enjoyed the most Q1 revenue growth in 2022 at 159%.

With production capacity increasing in 2021, CATL's business was boosted by global EV adoption. Tesla took up 10% of the sales. Moreover, the China-based company has seen the most battery installation worldwide for five years, according to SNE Research.

While EV battery sales brought CATL the most revenue, its battery material and energy storage businesses grew tremendously last year at 350.7% and 601% in Renminbi, respectively.

As for the 2022 outlook and beyond, the company was aware of various challenges brought by COVID-19 and the growing number of competitors. On top of that, battery material prices have surged, creating cost pressure and prompting the company to raise sales prices.

2022 ASC100: Top 10 companies by revenue growth | |||||

ranking | company | industry | country | 2021 revenue (US$M) | YoY growth |

1 | CATL | electrical components | China | 20,262 | 175.4% |

2 | TCL Technology | consumer electronics | China | 25,387 | 126.1% |

3 | China International Marine Containers Group | machinery | China | 25,395 | 85.1% |

4 | Luxshare Precision Industry | electronic components | China | 23,940 | 77.2% |

5 | BOE Technology Group | electronic components | China | 34,009 | 72.4% |

6 | MediaTek | semiconductor | Taiwan | 17,667 | 60.9% |

7 | LG Innotek | electronic components | South Korea | 12,964 | 59.6% |

8 | LONGi Green Energy Technology | semiconductor | China | 12,559 | 57.4% |

9 | Hisense Home Appliance Group | consumer electronics | China | 10,478 | 49% |

10 | BYD | Automotive manufacturing | China | 33,549 | 47% |

Compiled by DIGITIMES Asia

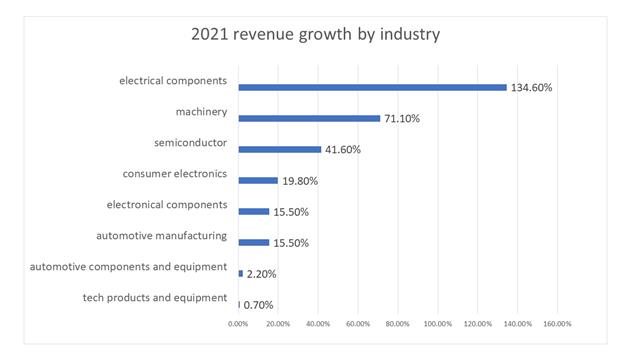

Electrical component, machinery, and semiconductor sectors grow prominently

When analyzing the 2021 revenue by industry, automotive manufacturers received more than US$1.1 trillion, accounting for 33.5% of the total. The tech products and equipment sector received the second most and took up 29.6% of the overall revenue.

Furthermore, electrical components saw the highest revenue growth at 134.6%, followed by machinery (71.1%) and the semiconductor sector (41.6%).

Compiled by DIGITIMES Asia

The electrical component industry enjoyed the most growth mainly because the number of companies in this category rose from four to seven this year. All the companies operate EV or energy storage-related businesses and have benefited from the electrification and decarbonization around the world.

For example, CATL, LGES and Samsung SDI are prominent battery makers. Nidec Corporation, a Japan-based electronic components maker, supplies EV motors to China's Guangzhou Automobile and Peugeot of France, according to Reuters. With the demand rising, Nidec announced plans to build a production hub in Serbia and considered starting a joint venture with Hon Hai Technology Group of Taiwan for EV motors development.

Additionally, TBEA, a China-based company that started as a manufacturer of power transformers and other electrical equipment, has gained a foothold in the photovoltaic and wind energy markets. It saw the second-highest YoY revenue growth in the electrical components group at 46.3%.

On the other hand, the semiconductor industry saw a 41.6% growth in 2021, with Japan-based Renesas listed in ASC100 for the first time. TSMC was the front runner with its revenue at US$56.8 billion and MediaTek saw the most YoY growth at 60.9%.

Chip demand surged in 2021 thanks to concerns about supply chain disruption resulting from COVID-19. The new hybrid working accelerated digital transformation and increased the need for chips, too.

According to TSMC's annual report, ongoing 5G penetration and expansion of high-performance computing (HPC)-related applications mainly contributed to its growth in 2021. Moreover, the electronics supply chain kept inventory levels high to deal with the intense market demands, benefiting TSMC's foundry business.

The company's advanced technologies (7-nanometer and beyond) took up 50% of its wafer revenue in 2021. N5 technology, which is in its second year of volume ram-up, accounted for 19% of wafer revenue.

MediaTek hit the record annual revenue and earnings per share (EPS) in 2021, becoming the fourth largest IC designer in the world. The company attributed its significant growth to early deployment in 5G and WiFi 6 markets, which allows it to involve in the whole product life cycle and expand.

MediaTek's shipment of 5G smartphones also increased last year. According to Counterpoint Research, the company led the industry with around 38% of the global market share in cell phone chips.

However, the cell phone market is expected to go downward in 2022, especially in China. DIGITIMES previously reported that 5G has reached market saturation in the country. COVID lockdowns, and global inflation would also impact the demand.

The good news is MediaTek has been developing WiFi 6 and 5G CPE (Customer Premise Equipment). Moreover, the PMIC segment also contributes to the company's growth. The increase in non-cell phone businesses is likely to offset the decline of cell phone-generated revenue in 2022.

The chip shortage is unlikely to be solved entirely in 2022. Artificial intelligence (AI) and 5G proliferation will keep up as well as the digital transformation. In addition, automakers are still competing for chips. As a result, the strong demand will continue to raise the semiconductor industry's growth.

The machinery industry's 2021 revenue growth was mainly driven by Hitachi's contribution. The Japan-based company received more than US$92 billion in 2021.

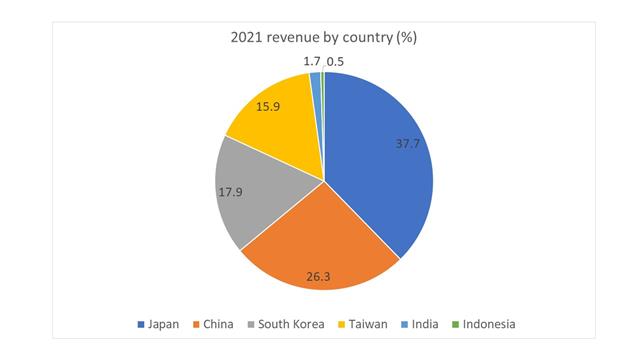

Auto market recovery benefits Chinese suppliers

Thirty-seven China-based companies were on the list of ASC100 2022, followed by Japan's 34 companies. As for the revenue by country, Japan-based enterprises contributed the most at US$1.3 trillion.

However, Japan only saw 6.4% in revenue growth while China and South Korea both enjoyed a gain of more than 20%. Taiwan had a 17.9% growth in 2021.

Compiled by DIGITIMES Asia

SAIC Motor led China-based companies with a revenue close to US$121 billion, followed by Lenovo's US$70.5 billion and Foxconn Industrial Internet's US$68.2 billion. Among the 37 Chinese enterprises, 11 were in the automotive manufacturing group and 11 were in the tech products and equipment industry.

The automotive manufacturing group was the primary driving force of China's revenue growth, taking up 32% of the country's overall revenue. Most automakers saw double-digit growth in 2021, with companies like BYD and Great Wall Motor growing more than 40%.

The automotive industry in China saw stable advancement in 2021. The production and sales grew again after a three-year decrease, according to data from the China Association of Automobile Manufacturers (CAAM).

Moreover, the number of vehicle export surpassed two million cars for the first time, creating a historical 100% growth. More than 310,000 of the vehicles were new energy vehicles (NEVs), including EVs. CAAM said NEVs have become the primary driving force for the market.

CAAM expected car sales in China would increase by around 5% in 2022. NEV sales would significantly grow by 42%, reaching five million cars. The automotive market in China still has much potential, especially with the surging demand for NEVs. In addition, CAAM said the chip shortage should be mitigated this year and would help the production.

Japan's car industry faces challenges, impacting growth

As a world-leading car manufacturer, 15 of the Japan-based companies on ASC100 2022 were in the automotive manufacturing or automotive components and equipment industries. Together, these companies received US$797 billion, accounting for over 60% of the country's overall revenue on ASC100.

Unlike China, which has a few companies with more than 40% growth, most Japanese automotive enterprises saw a 10% to 20% increase in 2021. As a result, they could not push their country's increase as fierce as their counterparts.

According to data from the Japan Automobile Manufacturers Association (JAMA), Japan manufactured 7.8 million cars in 2021. The production decreased 2.7% from the previous year and was a record low in 45 years. A Kyodo News' report said the drop resulted from the chip shortage and difficulties in purchasing components created by COVID spread in Southeast Asian countries.

Carmakers are facing the same challenges this year. Companies such as Toyota have scaled back production early this year. Unlike its Chinese or European counterparts that have largely benefited from EV sales, Japan-based automakers are likely to see limited growth again in 2022.

The semiconductor industry in Japan enjoyed better revenue growth in 2021, but only two of them were on the list. Tokyo Electron grew 42.2% and Renesas Electronics had a 34.5% increase.

LG Innotek grows the most in South Korea, while Hon Hai keeps leading in Taiwan

South Korea-based companies received US$625.5 billion in revenue in 2021, with Samsung Electronics leading with US$243.9 billion. Many companies such as LGES, Samsung SDI and Hyundai Motor have aggressively invested in EV-related businesses. It is worth noting how their investment will help the country's revenue growth in the future.

Furthermore, South Korea enjoyed a 21.5% revenue growth in 2021. LG Innotek had the highest growth at 59.6%, followed by SK Hynix at 38.4%.

Samsung Electronics' revenue was largely boosted by businesses related to semiconductors, cell phones and computers. In addition, thanks to the global semiconductor demand, revenues generated by the company's foundry business hit a record high in Q4 2021.

Given that the 5G penetration rate and the demand for HPC would keep increasing, Samsung Electronics expected its smartphone and semiconductor businesses to continue growing above the average in 2022.

On the other hand, LG Innotek received a record revenue of US$12.9 billion in 2021. According to previous DIGITIMES reporting, its growth was likely driven by the sales to Apple. The company's annual report shows that the sales of camera modules to a major customer rose 73.2% last year. The industry suspected that customer was Apple.

LG Innotek supplied close to 70% of Apple's iPhone camera modules by the end of 2021, according to industry sources. The new iPhone 14 model, which is expected to be released this year, will likely increase LG Innotek's revenue.

Additionally, the same 14 Taiwan-based companies stayed on the ASC100 2022 list. Eight of them were in the tech products and equipment group, accounting for 76.3% of the country's overall revenue in 2021.

The top revenue-generator is Hon Hai Precision Industry. The company received US$214.6 billion, about 3.7 times TSMC's revenue. MediaTek enjoyed the most growth at 60.9%, followed by AU Optronics (AUO) at 43.8%.

According to AUO, its revenue in the first half of 2021 was driven by the demand for consumer electronics such as TVs and laptops. In the second half of the year, mobile PC and devices, including cell phones, took up a higher proportion of the company's revenue at 30% and more.

About ASC 100:

Asia Supply Chain 100 (ASC100) 2022 ranks the top 100 Asian tech companies, focusing on electronics, information & communication technology, machinery, and automobile industries, by their revenue in 2021. The top 100 companies were able to manage uncertainties and succeed. Based on the rankings, DIGITIMES Asia also summed up the findings and insights in a series of articles.