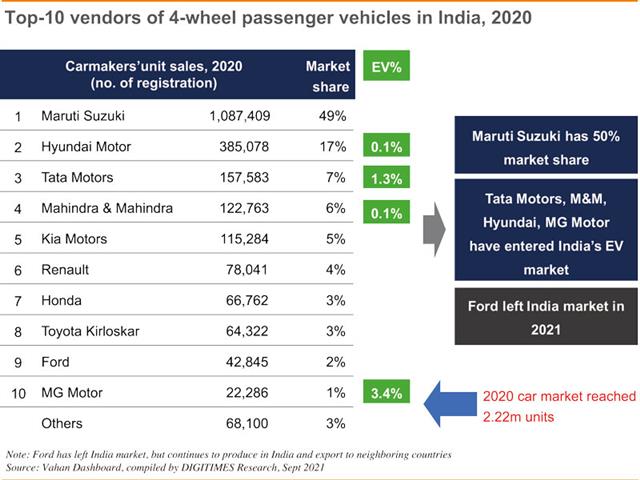

Who is the leader in the Indian car market? Suzuki accounts for almost 50% market share of the world's fifth-largest market of 2.71 million cars per year. Suzuki is not a top-tier brand in Japan. The key factor of Suzuki's success in India is that Suzuki Motor embraces a one-stop-shopping service strategy for the Indian market from car manufacturing to maintenance, insurance, and driving training courses. On top of that, its integration in the upstream and downstream of supply chains along with half a century of long-term in-depth operation in the Indian market is unrivaled. Perhaps owing to its satisfactory operation, Suzuki Motor is not active in the electric vehicles (EV) market.

Hyundai and Kia are affiliated Korean enterprises that jointly account for a significant market share of 22% in India. South Korea's auto industry plays a key role in both the Northeast Asian country's GDP and export structure. For Hyundai Group, to capitalize on EV business opportunities are imperative, and South Korea's battery industry is very strong. If they give all-out efforts for the EV market, they could be even more dominant than Suzuki. But that could provide opportunities for Taiwanese businesses, US enterprises and Suzuki to forge an alliance.

India's local enterprises TATA and Mahindra have a market share of 6-7% each, with little competitiveness in the international market at present. Indian enterprises can only be graded as "national" level manufacturers. It is apparent when the vehicle market switches from the traditional internal combustion engine cars to EVs, enterprises will face pressure to transform and upgrade their operations, and this will give foreign businesses the opportunities to expand further in the Indian market.

Other enterprises such as Renault, Ford, GM, Toyota and Honda have also entered the Indian market. But Ford has announced its withdrawal from the Indian market, retaining local factories to serve as an export base in South Asia. The Indian market seems to be large, but in fact it is a decentralized market that requires sophisticated operations. Thus, the pressure of expenses on corporate operations is tremendous.

If this is the case, medium-sized or manufacturing-oriented foreign enterprises should not operate on their own. Instead, they should primarily position themselves as solution providers, and entrust pricing, service mechanisms, and cost control to local operators.

From the perspective of new technology, EVs are fast, feasible, and can bring immediate results in improving pollution and reducing dependence on oil. We know that the speed and efficiency of disseminating technology know-how and related knowledge are much higher than in the past. The inspiration of China's success and pressure from China has exerted a positive impact on the Indian government's active measures. The development of EVs involves interventions from the public sector such as established regulations, incentive policies, and construction of the infrastructure, which is precisely the source of administrative chaos in India. We cannot expect the country to quickly set policy guidelines and achieve immediate results under such undesirable circumstances.

Four-wheeled EVs show signs of growth

Four-wheelers are the focus of attention: Licenses issued to India's new four-wheelers are between 250,000 and 300,000 vehicles a month. The second wave of Covid-19 infections between March and April had some impact on sales, which nevertheless returned to normal after July or August.

But electric cars as a proportion of newly licensed cars in India remains low. The proportion in the first quarter of 2021 was between 0.2% and 0.3%, rising to 0.4% after July. It is still a long way to achieve the global average. The low proportion is attributed to high prices for electric cars and inadequate charging piles. Tesla has called on the Indian government to lower import tariffs, stimulate investment in infrastructure and the local component industry with the build-up of EV sales. The call was also supported by Hyundai/Kia, which accounts for 22% of the national market share.

In the long run, four-wheelers have the most business opportunities. All related enterprises are eager to cash in on business opportunities in the Indian market. But considering pricy electric cars and scarce charging stations, how to persuade the government to speed up infrastructure construction is the top priority.

(Editor's note: This is part of a series of analysis on India's industry and market by DIGITIMES Asia president Colley Hwang.)