India is the world's fifth-largest automotive market, with annual sales of 2.71 million cars, and it is even the biggest market for motorcycles. In a few years, India's population will outpace China's. How can we redefine and understand the characteristics of the Indian market?

I heard of the concept of "from G2 to G2.5" for the first time a couple days ago from Eric Huang, VP and the leader of DIGITIMES' big research programs. If we anticipate that India is going to be the world's third-largest economy, we need to dig into the Indian market and be a bridge of information sharing between Taiwan and India, suggests Eric.

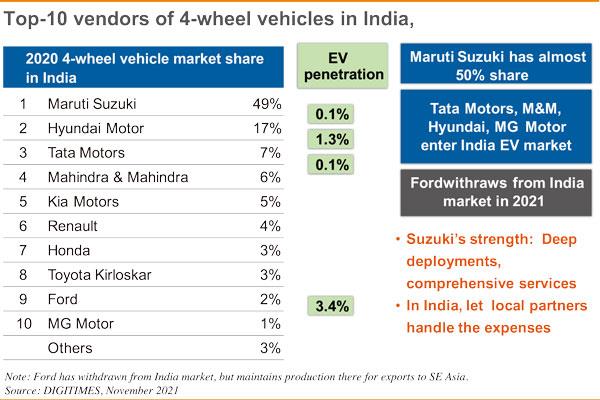

When we studied the Indian car market, we found that the market leader Maruti Suzuki accounts for as much as 49% of the market share. Suzuki Motor is not even within the first-tier vendor list in Japan. But how could Suzuki sweep the complicated and disorganized Indian market?

We came to realize Suzuki Motor adopted a "deep market penetration" strategy. They launched one-stop service plans from sales of cars, maintenance, repair, insurance to driving courses. Suzuki exploited the vertical integration strategy to the extreme to keep competitors at bay.

In contrast to Suzuki, Ford has withdrawn from the Indian market in 2021. India is a large country of fragmented markets made up of a population of nearly 1.4 billion people. Enterprises need to tackle cost problems to achieve economies of scale and minimize costs of imported materials. It is exhausting to operate in the Indian market whose uniqueness must be beyond the understanding of managers who are sent there on short-term missions. The most feasible way is to control costs and share business interests and expenses of marketing and PR initiatives with local partners. Simply put, it should be a relationship of resource leverage, sharing, co-creation and reciprocity.

"Orient Shield" - a recently published book of mine - has discussions of aspects of the Indian market. I started writing "Orient Shield" in mid-May when Taiwan entered soft COVID-lockdown. Everyone had to work from home. COVID-19 brought greater data traffic and booming sales for notebooks and servers which led to the prosperity of Taiwan's supply chain ecosystems and logistics services. Fully aware that Taiwan's role had changed dramatically, I began to write this book to bear witness of the big time. Most of the data in "Orient Shield" are based on real-time data from May to September 2021. The book features matrix thinking based on the interactions of the world's technology trends and the characteristics of Taiwan's ICT industry. It displays a "unique" perspective supported by massive valuable information beyond the understanding of people who do not have access to first-hand information. It's been selling well, and we're preapring for a second printing.

(Editor's note: This is part of a series of analysis of Taiwan's role in the global ICT industry.)