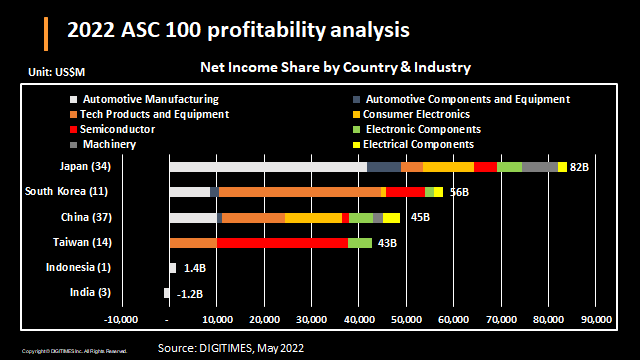

Of the top 100 supply chain companies in Asia, 96 of them are from Japan, China, Taiwan and South Korea, and they are core surces of influence on the supply chain in Asia. However, these companies are facing the problem of low gross profit, but the problem of low gross profit differs from country to country, and the profit structure of different fields also shows the difference of competitiveness of each country, and the methods and strategies they rely on to adjust the industry structure.

Japan's total profit reached US$82 billion, with 34 companies in the 2022 edition of the ASC 100 list. Their revenues reached US$1.32 trillion, but the operating margin was only 6.2%, with profits coming mostly from the auto sector. In terms of economies of scale and profitability in the electronics and semiconductor sectors, Japan is hardly a match for Taiwan and South Korea. As the car industry moves to a new era of electic vehicles (EV) and self-diving vehicles, Japan faces the heaviest pressure amng all Asian countries. countries.

Although 37 Chinese companies are among the top 100 in the ASC 100 list, their total revenue is still not as high as Japan's, and their operating margin is even lower than Japan's 6%. If we take into account the many incentives provided by the Chinese government and the contribution of the local market, the profitability of Chinese companies is even lower than that in Taiwan and Japan. However, the Chinese companies are more evenly spread across the automotive, technology and consumer electronics sectors, which shows the ambition and progress of China as the world's second largest economy.

Taiwan has no large-scale automobile manufacturing industry, and the main source of profit is semiconductors. The electronic product manufacturing industry, which is known for its production in massive volumes, contributes 75% of the revenue but less than 25% of the profit among the 14 Taiwanese companies in the list.

Since most of the electronics assembly plants in Taiwan rely on OEM orders from major US brands, it is difficult to expect immediate improvement in the short term if we cannot break away from such a structure. The only possible opportunity is to find an entry point in the field of EVs and future vehicles, and the opportunity also lies in the next wave of production in ASEAN and South Asian countries after China, and in the business opportunities that EVs may bring.

For the second year in a row, South Korea has seen 11 companies in the ASC 100 rankings. South Korea has outstanding companies in the automotive, technology products, and semiconductor sectors, with 11 South Korean companies earning US$56 billion in profit, exceeding even the US$45 billion of 37 Chinese companies and the US$43 billion of 14 Taiwanese companies.

The contribution of South Korea's semiconductor and automotive industries is similar, while Samsung Electronics remains a world-class player in cell phones and communication products, allowing the 11 South Korean companies to achieve an average profit margin of 7%.

Among the top 100 companies in ASC 100 list, only one is from Indonesia and three from India, which shows that they are not yet key players in the Asian supply chain. At this stage when India is trying to take over from China and become the next production hub of the world, India, as represented in ASC 100, made losses due to TaTa's poor performance in the automotive industry. And India also lacks local firms that can be partners for world-class manufacturers in the electronics manufacturing industry.

If India and Indonesia want to squeeze into the core supply chain in Asia, they must break the traditional framework and adopt a more efficient model to make it possible.

It is definitely a difficult challenge for Asian supply chains to improve profitability by relying on traditional OEM orders for automotive, electronics and machinery products. However, in the new era of EVs, Internet of Things (IT), and software-hardware integration, the value of local applications must be continuously enhanced in conjunction with the domestic environment. ASEAN and South Asian countries should join forces with other advanced industrial countries in Asia to enhance the integration of hardware and software and the manufacturing capability of key components to meet the opportunities and challenges of the coming era.