Based on analysis of the major platform companies and the white box market, Digitimes Research forecasts that global tablet shipments (including both branded and white box models) will overtake notebook shipments in 2013, growing by 38.3% on 2012 levels to hit 210 million units. Shipments of branded tablets alone are forecast to reach 140 million units.

The aggressive pricing of the Nexus 7 and Nexus 10 is likely to give Google strong momentum in 2013. Digitimes Research projects that Google will become the number two tablet vendor, while Apple will retain the top spot, with its share of branded tablet shipments declining slightly to 55.6%. Factoring in white box tablets, Apple's share of all tablet shipments will drop below 40%.

The explosion in white box tablet shipments in 2012 means that Android will overtake iOS to become the largest platform in 2012. Combined shipments of all Android tablets - including branded, white box, Amazon and Barnes & Noble devices - are projected to hit 121 million units in 2013, representing 40.2% growth on 2012 figures.

Digitimes Research also projects that global shipments of branded and white box tablets will top 300 million by 2015, with branded devices accounting for more than 200 million units and white box tablets for around 100 million.

Global shipments and shipment share for branded and white box tablets by size, 2011-2012

Global branded tablet shipments and shipment share by OS, 2011-2012

Global shipments of branded and white box tablets, 2011-2012

Comparison of shipments of white box tablets and other convertible/mobile devices

Handset and tablet shipment ratio for iOS and Android, 2011-2012

Comparison of CPUs for mainstream white box and branded tablets

US$40 white box tablet design solutions: Low-end CPU, TN panel, G+P touch sensor

Global branded and "brand + white box" tablet shipments and shipment share by OS, 2012

Global shipments and shipment share for branded and "brand + white box" tablets by size, 2012

New forces in the industry created by the rise of white box tablets

Tablet shipments for global brands and China-based solution vendors, 2012

Tablet shipments for Taiwan-based ODM/EMS firms and China-based solution vendors, 2012

Four key aspects of the platform war: Platform size, ecosystem, cohesion, profitability

The four main platform firms each face different growth obstacles and bottom lines

Share of Android tablet shipments for Google and other official Android tablet vendors, 2012

Quarterly revenues for Microsoft divisions corresponding to Windows and Office, 2009-2012

Microsoft's Surface shipment targets (as provided by the upstream supply chain), 2012-2013

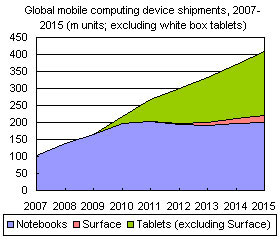

Forecast of global shipments of mobile computing devices, 2007-2015

Competing ecosystems could make it difficult for the Surface RT to move into the tablet market

Surface tablets will not find it easy to move into the small tablet sector

Various Microsoft divisions are adapting to the imminent crisis with different strategies

Global shipments of branded tablets (Excluding white box), 2010-2015

Global shipments of branded and white box tablets, 2010-2013

Global branded tablet shipments and shipment share for different size tablets, 2013

Global branded and white box tablet shipments and shipment share for different size tablets, 2013

Global branded tablet shipments and shipment share by platform, 2012-2013

Global branded and white box tablet shipments and shipment share by platform, 2012-2013

Global shipments and shipment share for various Android tablet brands, 2012-2013

Global shipments and shipment share for each type of Windows tablet, 2012-2013

Tier 1 hardware brand vendors' tablet shipments and shipment share, 2012-2013