The China LED industry has developed a breakneck pace over the last two years, largely thanks to a clear government policy on solid-state lighting (SSL) and the inclusion of LED as one of the key areas of industry for development within the 12th Five Year Plan (12th FYP). While the 12th FYP took effect from 2011, the government published a revised set of 12th FYP Semiconductor Lighting Technology Development Projects in 2012. The revised plans increase many of the numerical indicators and targets from the old version, demonstrating China's desire to up the pace of LED industry development. Digitimes Research compares the two versions for analysis.

While the government has established clear industry policies, the China LED industry still lacks the 20-year history of the Taiwan or Japan industries. The breakdown of sectors in which it is competitive and uncompetitive therefore differs significantly from those regions. Digitimes Research believes that China is most competitive in rare earth materials, LED packages, and end product applications; it is relatively weak in other areas.

This report mainly focuses on China's LED chip and packaging sector because in recent years, the number of MOCVD equipment in China has been growing rapidly due to strong government subsidies. This makes the development of the country's upstream and downstream LED sectors intriguing. There are considerable variations in the level of success achieved by the various major players, and these differences are analyzed in terms of financial position, capacity and industry presence. Digitimes Research believes Sanan Optoelectronics has the highest rating, followed by Electech, Epilight, Tsinghua Tongfang and Silan Azure.

The rise of China-based LED chip makers has also stimulated the growth of the regional LED package industry. However, China's industry ecosystem for the LED package sector differs from those of other regions most notably in terms of fragmentation, with more than 1,000 companies involved compared to only a handful of significant players in other regions. Digitimes Research has a number of players as indicators based on their relatively large size and greater potential for development; the largest of these are Nationstar, Honglitronic, Ledman, Refond, Jufei (JF), and Z-Light.

Nationstar has the greatest potential for future industry presence, with a very comprehensive industry chain covering upstream LED chips and downstream end lighting products. Honglitronic and Z-Light are more focused on downstream LED lighting development, while Ledman, Refond and Jufei are all mainly expanding LED package capacity. In overall terms, Nationstar is the most competitive and is likely to remain the number one China-based LED packaging company.

Table 2: China's revised SSL policies in terms of the industry as a whole

Table 3: Analysis of the competitiveness of the China LED industry

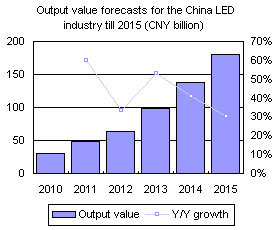

Lighting-related output value forecasts for the China LED industry

Chart 1: China LED industry output value forecast, 2010- 2015 (CNY billion)

Table 4: Financial position of China's major LED chip makers in 2012

Table 5: Comparison of MOCVD capacity for China's LED chip makers

Table 6: Industry presence analysis for China-based LED chip makers

Table 7: Comparison of the competitiveness of China's major LED package firms (CNYm)

Chart 3: Sanan revenues and operating profits, 2010-3Q12 (CNYm)

Chart 4: Sanan's total number of MOCVD equipment, 2008-2014 (MOCVD units)

Chart 5: Sanan and Formosa Epitaxy revenues and profits (US$m)

Chart 6: Sanan and Formosa Epitaxy net change of cash (US$m)

Chart 7: Sanan and Formosa Epitaxy total combined capacity (Equipment units)

Chart 8: Total and expected capacity of Epistar-related firms (Equipment units)

Chart 11: Revenues and gross margins of Electech's LED-related business unit, 2010-3Q12 (CNYm)

Chart 12: Electech's total number of MOCVD equipment, 2011-2012 (Equipment units)

China tier-two LED chipmakers-Silan Azure, Epilight, Tsinghua Tongfang

Chart 13: Silan Azure revenues and gross margin, 1H10-3Q12 (CNYm)

Chart 15: Silan Azure's number of MOCVD equipment, 2010-2012 (equipment units)

Table 11: Monthly LED chip capacity for Silan Microelectronics group, 2010-2015

Chart 19: Epilight consolidated revenues and profits, 2007-2012 (CNYm)

Chart 20: Eplight MOCVD capacity, 2009-1H12 (Equipment units)

Chart 21: Heifei Irico Epilight LED equipment and chip production percentage, 2011-2014

Chart 23: Irico Group LED supply chain capacity breakdown by application, 2012

Table 12: Heifei Irico Epilight LED chip product structure (annual capacity)

Chart 24: Tsinghua Tongfang revenue breakdown by application, 1H12

Chart 25: Tsinghua Tongfang semiconductor and lighting business unit revenues, 2008-2012 (CNYm)

Chart 26: Tsinghua Tongfang Nantong plant MOCVD equipment move-in schedule

Chart 27: Tsinghua Tongfang LED TV and lighting market development

Chart 28: Tsinghua Tongfang subsidiary development in downstream products

Chart 29: Market price of 7W LED light bulbs in China, September 2012 (CNY)

China tier-one packaging houses- Nationstar, Honglitronic, and Ledman

Table 16: Nationstar, Honglitronic, and Ledman company background

Chart 30: Leading China packaging house revenues, 1Q11-3Q12 (CNYm)

Chart 32: Nationstar, Honglitronic, Ledman - Breakdown by international sales, 1H12

Chart 33: Nationstar, Honglitronic, Ledman - Patents by company

Chart 37: Refond, Jufei sales by product, first three quarters of 2012

Chart 39: Refond, Jufei international and domestic sales, 1H12

Table 24: Jufei LED packaging capacity expansion plan (CNYm)

Chart 41: Jufei annual LED packaging capacity, 2010-2013 (million units)

Chart 42: Z-Light's LED packaging and end market product development