Application processors (AP) have developed rapidly from mobile communications products into an increasingly wide range of applications, including the PC and server sectors. While ARM architectures remain the mainstay for mobile applications, x86-based APs are making progress rapid enough to concern those in the ARM camp. The top five suppliers of ARM architecture-based APs - Qualcomm, Apple, Samsung, MediaTek and Spreadtrum, currently account for around 90% of the market. Digitimes Research looks at each supplier's strengths and weaknesses through a comprehensive analysis of technology, architecture, product positioning and shipments, providing the industry with an overview of the latest trends and developments in the AP industry.

Smartphone core performance and architecture development trends

Tablets continue to move into sectors traditionally dominated by PCs

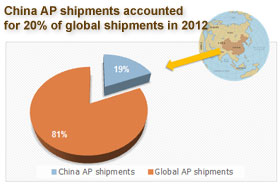

Chart 2: Greater China AP shipments accounted for 20% of total global shipments in 2012

Development of non-standard ARM architectures will be limited

Burden of process technology costs becomes increasingly heavy

Chart 3: The top 5 suppliers accounted for about 90% of global APs shipments in 2012

Chart 5: Key factors affecting Qualcomm's AP shipments in 2013

Chart 6: Shipment structure for Qualcomm AP products, 1Q13 (m chips)

Shipment growth will depend on success of its upcoming products

MediaTek fights back from China into the international market

Chart 11: Projected breakdown of MediaTek's AP shipments, 2013

Chart 12: Samsung is a major player throughout the semiconductor supply chain

Challenges from Qualcomm, MediaTek, Lenovo and Marvell in 2013

Chart 15: Breakdown of Spreadtrum's AP shipments, 2012-2013 (m chips)