Demand for enthusiast class PC hardware which offers high-performance, reliability, and above all gives the end-user the ability to tweak, fine-tune and tinker, has seen a rapid increase over the past few years. While the overall desktop market has reached stagnation and begun to decline, annual growth in the number of overclockers between the period first-quarter 2013 and first-quarter 2014 was around 50%, and growth between first-quarter 2014 and first-quarter 2015 increased even further at around 100%, according to data compiled in the latest HWinsights Quarterly Report.

"PC component makers and vendors have, over the past several years, seen their key markets - mainstream (high-volume) and gaming (high-margin) - steadily cannibalized by alternatives including tablets, notebooks and games consoles," noted Pieter-Jan Plaisier, Director, HWBOT. "With their market shares and margins under constant pressure, the healthy overclocking market represents an opportunity hardware vendors simply cannot continue to underutilize with outdated product positioning and marketing strategies."

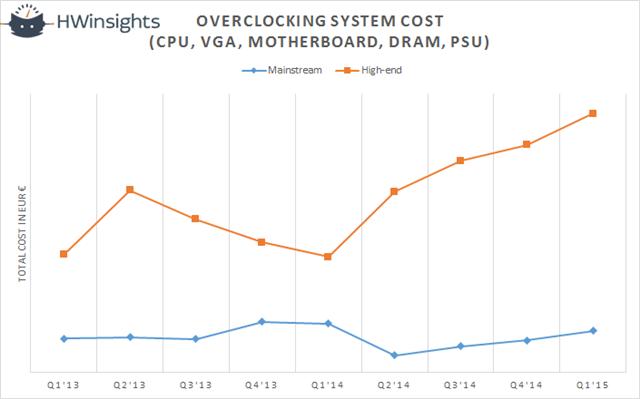

One defining characteristic of the overclocking segment is that buyers are typically more than willing to pay a premium for the right components. Furthermore, in contrast to the mainstream and gaming desktop markets, budgets in the overclocking segment are actually increasing, HWinsights data showed. The total component cost of a typical mainstream overclocking system in first-quarter 2015 averaged EUR1050 (US$1175) increasing EUR70 on quarter, while spending on a high-end system reached EUR2610, up from EUR2385 in the previous quarter. These figures can be compared to typical spending of sub-US$500 on mainstream or sub-US$1000 on gaming desktops.

Another key feature of the overclocking segment is its particularly rapid upgrade cycle. Mainstream consumers commonly wait until their current hardware fails before buying a replacement, and gamers have a typical upgrade cadence of every 2-3 hardware generations. Meanwhile, overclockers, are driven to own the latest-and-greatest, even if it offers only a marginal improvement over their current hardware, HWinsights noted.

The growing overclocking segment presents an opportunity to open new markets and increase average selling prices (ASPs) for key component suppliers (in particular CPU, graphics card, motherboard, DRAM and PSU), as well as case and cooling solution players, and specialist system integrators, according to HWinsights.

For players looking to succeed in the segment, the main challenges they are likely to face are relatively high technological and cost barriers, due to the increased R&D and component expenses involved in meeting the stringent quality standards demanded by the market, HWinsights noted.

In addition, vendors may struggle to adapt their current "branding and specification" oriented marketing strategies to effectively engage the overclocking community, which is strongly influenced by word-of-mouth recommendations and constantly updated overclocking competition rankings.

Total overclocking system cost by quarter

Source: HWinsights