Introduction

- Taiwan's LCD TV shipments reached 10.24 million units, slightly better than the 10.18 million units forecasted in the previous third-quarter-2015 report. The volume increased over 10% sequentially thanks to demand from the year-end holidays in Europe and North America.

- Taiwan's LCD TV shipments to North America achieved sequential growth in the fourth quarter of 2015 mainly thanks to year-end holiday demand.

- Demand from the year-end holidays helped boost the sales of 50-inch and above LCD TVs in the fourth quarter of 2015, relatively increasing the shipment share of related panels in the quarter.

NOTE: Unless otherwise indicated, all figures and tables in this report refer to output from Taiwan makers.

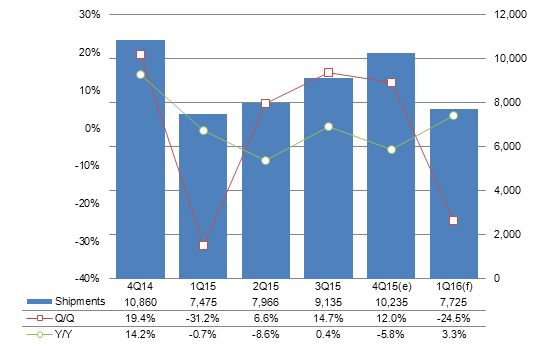

Chart 1: Taiwan LCD TV shipments, 4Q14-1Q16 (k units)

Source: Digitimes Research, February 2016

- Taiwan LCD TV shipments reached 10.24 million units, slightly better than the 10.18 million units forecasted in the previous third-quarter-2015 report. The volume increased over 10% sequentially thanks to demand from the year-end holidays in Europe and North America

- Although shipments in the fourth quarter of 2015 still suffered a drop from the same quarter a year ago, it is the only quarter to have over 10 million unit shipments in 2015.

- Shipments will decrease 24.5% sequentially in the first quarter of 2016 because of seasonality and the better-than-expected performance in the fourth quarter of 2015.

Shipments breakdown

Business models: OBM, OEM/ODM

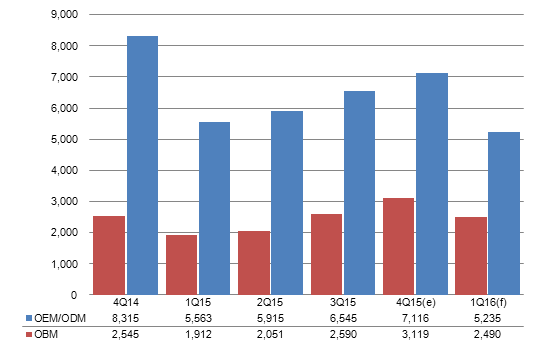

Chart 2: Shipments by business model, 4Q14-1Q16 (k units)

Source: Digitimes Research, February 2016

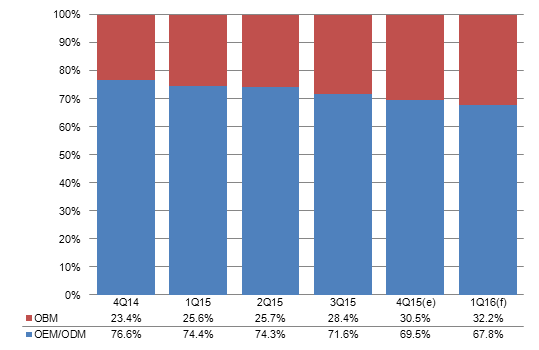

Chart 3: Shipment share by business model, 4Q14-1Q16

Source: Digitimes Research, February 2016

- Compal Electronics' shipments to Toshiba are considered as OBM shipments starting from the fourth quarter of 2015.

- Toshiba has licensed Compal to sell Toshiba-branded LCD TVs in North America and Europe and Digitimes Research believes Compal has officially taken control of the related brand operations and has changed its shipments to OBM type.

- Shipments of Toshiba-branded LCD TVs accounted for about 80% of Compal's overall shipments in the fourth quarter of 2015.

Geographic markets

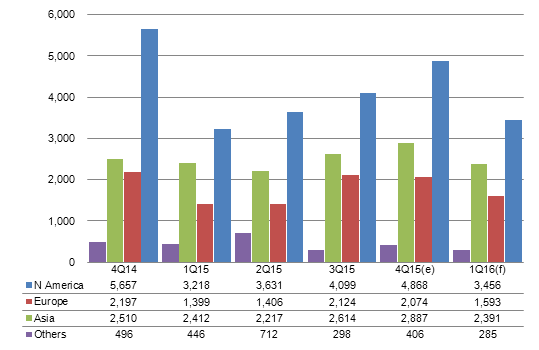

Chart 4: Shipments by region, 4Q14-1Q16 (k units)

Source: Digitimes Research, February 2016

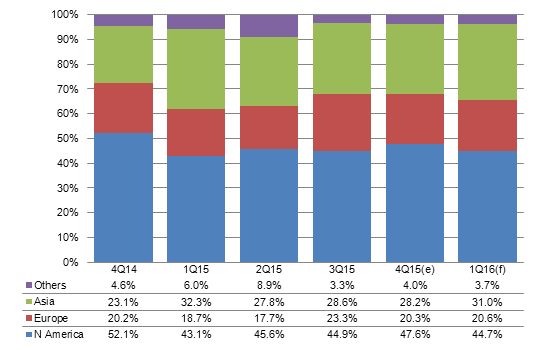

Chart 5: Shipment share by region, 4Q14-1Q16

Source: Digitimes Research, February 2016

- Taiwan LCD TV shipments to North America achieved sequential growth in the fourth quarter of 2015 mainly thanks to the year-end holidays demand.

- However, compared to the volume from the same quarter a year ago, the shipments to North America were down 13.9% in the fourth quarter of 2015 as Foxconn Electronics (Hon Hai Precision Industry) had lost its procurement orders from the Mexico government.

- Taiwan's shipments to Asia grew 10.4% sequentially in the fourth quarter of 2015 as TPV's shipments to LeTV and Amtran's shipments to Xiaomi both enjoyed growth.

- TPV and Foxconn's LCD TV shipments to Europe were about the same as the previous quarter, but Compal's shipments were lower, causing Taiwan's overall shipments to Europe to drop 2.4% sequentially.

Screen sizes

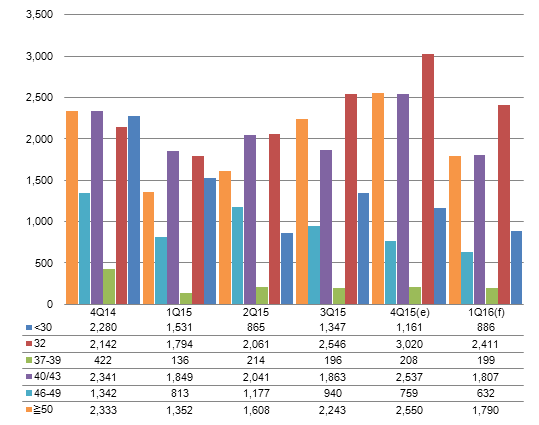

Chart 6: Shipments by screen size, 4Q14-1Q16 (k units)

Source: Digitimes Research, February 2016

- Demand from the year-end holidays helped boost sales of 50-inch and above LCD TVs in the fourth quarter of 2015, relatively increasing the shipment share of related panels in the quarter.

- Demand for 46- to 49-inch LCD TVs was overshadowed by demand for both the 50-inch and above, and the 40- to 43-inch segments.

- Shipments in the 40- to 43-inch segment grew 36.2% sequentially in the fourth quarter of 2015 mainly because vendors cut their 40-inch LCD TV prices to attract year-end holiday demand. Some vendors even offered 40-inch LCD TVs at US$149 on Black Friday.

- Taiwan's 32-inch LCD TV shipments rose 18.6% sequentially in the fourth quarter of 2015, contributed mainly by Compal's new orders from LG and Amtran's 32-inch LCD TV orders.

- With 39-inch panel supply gradually shrinking, Taiwan's shipments for the size of LCD TVs are only around 200,000 units every quarter. Only Amtran still has clients with demand for 39-inch LCD TV model.

- Sub-30-inch LCD TV shipments declined 13.8% sequentially in the fourth quarter of 2015 and will drop another 23.7% in the first quarter of 2016. Foxconn stopped shipping procurement orders to the Mexico government for 23.5-inch LCD TV in the fourth quarter of 2015.

Makers

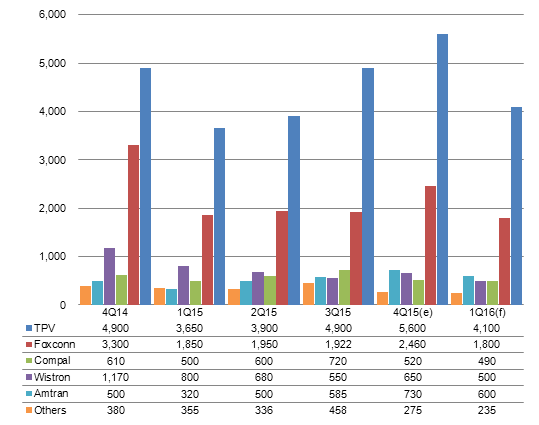

Chart 7: Shipments by top-6 makers, 4Q14-1Q16 (k units)

Source: Digitimes Research, February 2016

- TPV's LCD TV shipments surpassed five million units in the fourth quarter of 2016. TPV has both ODM/OEM and OBM shipments and its ODM/OEM shipments performed stronger than OBM shipments in the quarter.

- Despite losing Mexico government's procurement orders, Foxconn's shipments were still up 28% sequentially in the fourth quarter of 2015 thanks to increased orders from Sony and LeTV.

- Amtran enjoyed 24.8% sequential growth in fourth-quarter-2015 shipments due to strong growths in orders from Vizio and Xiaomi.

- Wistron's shipments grew 100,000 units from the previous quarter in the fourth quarter of 2015 mainly thanks to increased orders from Vizio.

- TPV's shipments to all its clients will drop sequentially due to seasonality, but the volume will benefit from orders from a new TV brand vendor client in China.

- The effect of losing Mexico government's procurement orders will become more obvious for Foxconn in the first quarter; however, the maker is still expected to see its orders from LeTV better than a year ago.

- Amtran has kept a tight partnership with Xiaomi and the China-based vendor is shifting more of its LCD TV orders to Amtran for production.

- Vizio has been increasing its orders to Amtran, which is relatively impacting Vizio's orders to Wistron. However, Wistron will start shipping products to a new LCD TV brand vendor client in China.

- Since Toshiba's LCD TVs are expected to have difficulties achieving major sale growth, Compal will see its shipments in the first quarter of 2016 being impacted. As for its other client LG, the Korea-based vendor has shifted parts of its LCD TV orders to TPV, but before the new models become available in the market, Compal will continue to be the main Taiwan supplier of LG.

- China-based Hisense has acquired the license to sell Sharp branded LCD TVs in North America, but Sharp's existing LCD TV orders with TPV (via Best Buy) and Amtran will continue shipping in the first quarter of 2016.

- Since China-based LeTV and Xiaomi are mainly outsourcing their LCD TV orders to Taiwan LCD TV makers, it has prompted several new China-based LCD TV brand vendors such as Whaley Technology, PPTV and CIBN to choose Taiwan makers for partnership. TPV and Wistron have benefited the most.

- As for China's other LCD TV brand vendors, Skyworth is increasing its orders to Taiwan makers, while Hisense's partnerships with Taiwan makers are weakening, but the vendor still places orders.

Source: Digitimes Research, February 2016

Annual shipments

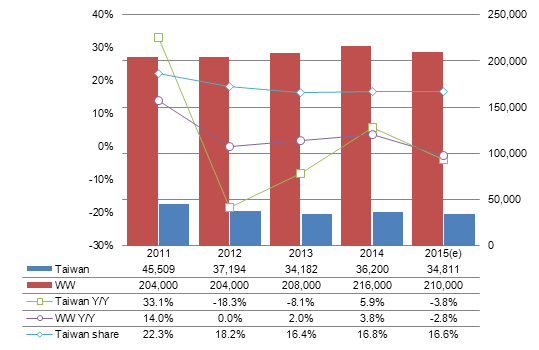

Chart 8: Taiwan and worldwide LCD TV shipments, 2011-2015 (k units)

Source: Digitimes Research, February 2016

- Taiwan's LCD TV shipments will drop 3.8% on year to reach 34.81 million units in 2015.