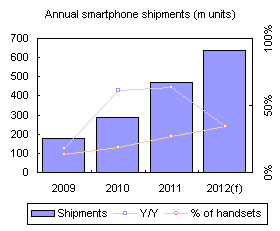

Global smartphone shipments will top 630 million units in 2012, representing on-year growth of 35%, which is more moderate annual growth than seen in previous years. Smartphone shipments in 2010 and 2011 both enjoyed growth of more than 60%. Growth will decelerate in 2012 due to the high base, as well as a slowdown in consumer spending in Western Europe.

In the second half of the year, global smartphone shipments will reach 344 million units and quarterly shipments during 2012 will register sequential growth through the last quarter of the year. The shipment ratio for the first and second halves of 2012 is estimated at 45:55.

Quarterly shipments during 2012 will manage on-year growth through the last quarter of the year. But the growth will slow at a gradual pace and likely decelerate to 22% in the fourth quarter.

Table 1: Major events affecting the smartphone market in 2H12

Chart 1: Emerging market shipments: China, India and Russia set to enjoy over 70% growth in 2012

Chart 2: Qualcomm promoting reference designs (QRD) in China

Chart 3: New OS competition - Android 4.1 vs. iOS 6 vs. WP 8

Table 2: iOS 6 upgrade only for certain models, and support is diverse

Android 4.1 with enhanced features; early release of PDK for hardware developers

Chart 9: Android 4.1 with enhanced features; early release of PDK for hardware developers

Apple to ship over 64 million iPhones in 2H; sees shipments peak in 4Q

Nokia weakness remains; 2H shipments barely to reach 20 million

Huawei 2012 shipments to almost top 35 million; high-end models to drive 2H sales

Chart 20: RIM BlackBerry quarterly shipments, 2012 (m units)

ZTE shipments to approach 30 million; 2H to account for 60% of total

Motorola Mobility relying too much on US market; 4Q shipments to slip

Chart 23: Motorola Mobility quarterly shipments, 2012 (m units)

Chart 24: Top 10 vendors' annual smartphone shipments, 2010-2012 (m units)

Top-10 brands in 2012: Five to see growth below industry average

Chart 28: Smartphone shipment share byoperating system, 2012

Chart 29: Top 2 smartphone OS market share - Android and iOS, 1H12-2H12

Chart 31: Despite having its own platform, Samsung is even more reliant on Android than HTC

Chart 34: Share of Androdid shipment by smartphone vendor, 2011-2012

Chart 35: Share of WP shipment by smartphone vendor, 2011-2012

Chart 36: Annual shipment growth rate trends for the major platforms, 2010-2012

Chart 37: Smartphone operating system market share, 2009-2012