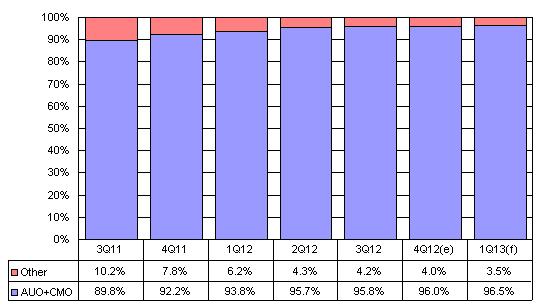

Chart 5: Monitor panel shipments by size, 3Q11-4Q12 (k units)

Chart 7: Notebook/tablet panel shipments by size, 3Q11-4Q12 (k units)

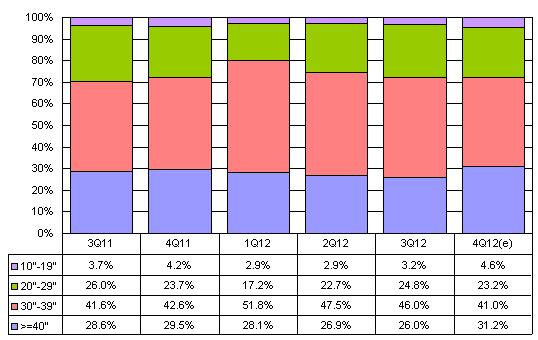

Chart 8: Notebook/tablet panel shipment share by size, 3Q11-4Q12

Table 2: Top notebook/tablet panel suppliers, 3Q11-1Q13 (k units)

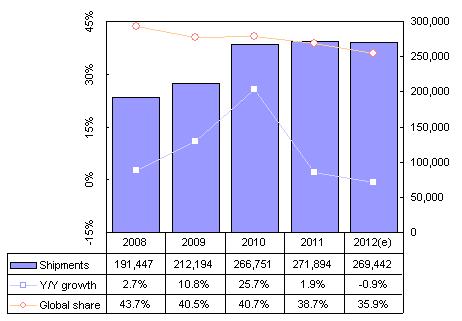

Chart 11: Taiwan large-size panel shipments and global market share, 2008-2012

Introduction

- Taiwan's large-size (9-inch and above) TFT LCD panel shipments decreased 5.92% sequentially but increased 3.93% on year to reach 67.19 million units in the fourth quarter of 2012.

- First-quarter 2013 shipments are expected to decrease 8.12% sequentially and 1.94% on year to reach 61.74 million units.

NOTE: Unless otherwise indicated, all figures and tables in this report refer to output from Taiwan makers.

Chart 1: Large-size TFT LCD shipments, 3Q11-1Q13 (k units)

Source: Digitimes Research, January 2013

- Large-size (9-inch and above) TFT LCD panel shipments from Taiwan-based firms in the fourth quarter of 2012 reached 67.19 million units, representing an on-quarter decrease of 5.9% but an on-year increase of 3.9%. The shipment decrease was higher than expected mainly due to a steep fall of 12.8% in shipments for notebook applications.

- As for TV panels, although the fourth quarter is traditionally a boom season, Taiwan-based firms reduced shipments for 32-inch applications (as well as their proportion in the makers' overall output) and increased shipments for 39- and 50-inch ones. With the same capacity processing larger-size panels, the makers' shipments for TV applications showed a sequential decrease of 2.8% in fourth-quarter 2012. Their China-based rivals who had a strong focus on 32-inch applications saw significant growth in shipments to the segment.

- Due to a lack of support from strong brands, Taiwan-based firms saw fourth-quarter shipments for 9-inch and larger tablets decrease 4.5% sequentially.

- There are two firms in China that have 8.5G production lines – BOE and China Star Optoelectronics Technology (CSOT). In the fourth quarter, both firms showed strong performance in LCD TV panel shipments. BOE reported a sequential increase of 14.2% in fourth-quarter TV panel shipments, far higher than the global average growth rate of 4.2% in the same quarter.

- CSOT saw fourth-quarter TV panel shipments grow by 55.9% on quarter, reaching 5.58 million units, which is almost 40% more than BOE shipments in the same quarter. In terms of unit shipments, CSOT was the fifth largest LCD TV panel maker in the world.

- The China market usually stocks up inventory for the Lunar New Year holidays, and therefore panel demand from TV brands in China only fell slightly in December, benefitting BOE and CSOT.

- In first-quarter 2013, Taiwan-based makers' shipments for large-size TFT LCD panels are expected to reach 61.74 million units, representing an on-quarter decrease of 8.1% and an on-year decrease of 1.9%.

Shipments breakdown

Makers

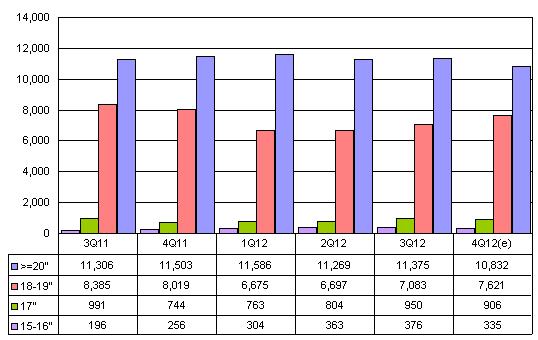

Chart 2: Panel shipment share by maker, 3Q11-1Q13

Source: Digitimes Research, January 2013

- Innolux Corporation (formerly Chimei Innolux, or CMI) saw LCD TV panel shipments drop in the fourth quarter because of reduced shipments to the 32-inch segment. Innolux shifted its LCD TV panel focus to 39- and 50-inch products in order to boost revenues and profits.

- AU Optronics (AUO) has been slower than Innolux in shifting towards larger size TV applications. AUO is expected to report a significant decrease in 32-inch panel shipments in the first quarter of 2013.

Applications

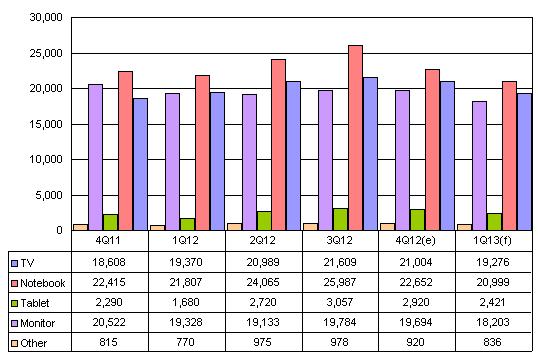

Chart 3: Shipments by application, 4Q11-1Q13 (k units)

Note: Tablet panels refer 9-inch and larger ones.

Source: Digitimes Research, January 2013

Chart 4: Shipment share by application, 4Q11-1Q13

Note: Tablet panels refer 9-inch and larger ones.

Source: Digitimes Research, January 2013

- Large-size panel shipments in the fourth quarter showed sequential decreases across all major applications.

- Monitor panels showed the least decrease because of less pressure from South Korea-based Samsung Electronics, which adopted a strategy to reduce shipments.

- TV panel shipments dropped because Taiwan-based makers decided to lower shipments to the 32-inch segment.

- Demand for notebooks in the end market remained weak, while tablets' popularity continued to rise. Panel makers shifted capacity and resources to producing tablet applications, resulting in a significant drop in notebook panels' share of overall shipments.

- Shipment share for monitor applications increased because Korea-based rival Samsung decreased its monitor panel shipments. The two major monitor makers, Korea-based LG Display (LGD) and Innolux, seized the opportunity and market share. Both firms saw monitor panel shipments increase, well above industry average.

- Taiwan-based makers are expected to report falling shipments for all major applications in first-quarter 2013 compared to the previous quarter. The fall in the tablet segment will be the most significant because the mainstream tablet panel size has shifted from 9-10 inch to 7.x-inch.

- As for PC applications, Taiwan-based makers will likely see first-quarter shipments decrease 7-8% sequentially, similar to the industry average.

- Compared to an industry average decline of 10.3% TV panel shipments in the first quarter, Taiwan-based makers are likely to see an on-quarter drop of only 8.1% due to continuous demand from China-based TV brands.

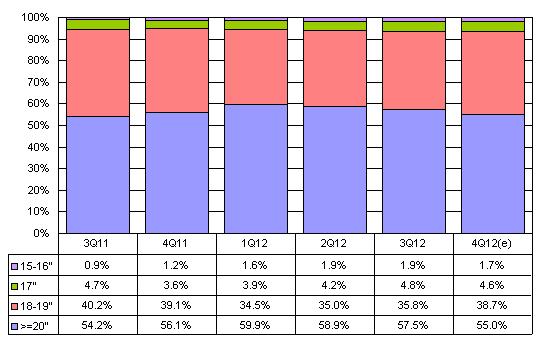

Monitor panels

Chart 5: Monitor panel shipments by size, 3Q11-4Q12 (k units)

Source: Digitimes Research, January 2013

Chart 6: Monitor panel shipment share by size, 3Q11-4Q12

Source: Digtimes Research, January 2013

Source: Digitimes Research, January 2013

- Weak end market demand continued to affect monitor panel shipments in the fourth quarter. Innolux devoted more efforts to monitor panels than to notebook panels. As Samsung decided to reduce monitor panel shipments, Innolux was able to capture the extra market share and reported fourth-quarter shipments growth for the monitor segment.

- Chunghwa Picture Tubes (CPT) and HannStar Display both reduced monitor panel shipments in the fourth quarter. HannStar only provided limited shipments to meet in-house brand monitor demand.

- Monitor panel shipments from Taiwan-based firms in the first quarter are expected to show a sequential decrease of 7.6%.

- Monitor panel shipments from Innolux in the first quarter are forecast to reach 12.11 million units, just slightly below the shipments of LGD to rank at number two in the world. Innolux and LGD have similar levels of monitor panel shipments.

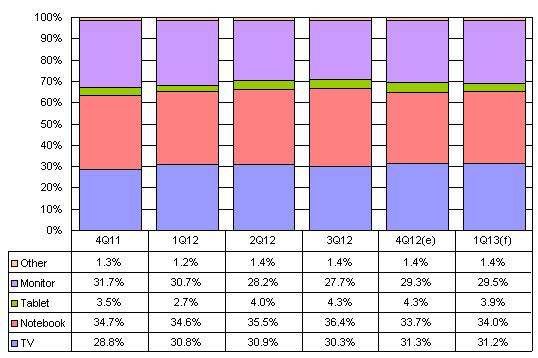

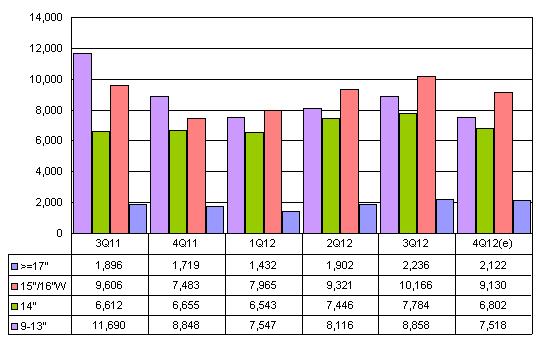

Notebook/tablet panels

Chart 7: Notebook/tablet panel shipments by size, 3Q11-4Q12 (k units)

Source: Digitimes Research, January 2013

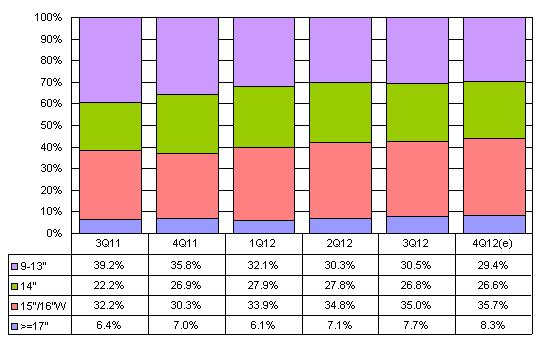

Chart 8: Notebook/tablet panel shipment share by size, 3Q11-4Q12

Source: Digitimes Research, January 2013

Note: Tablet panels are 9-inch and larger.

Source: Digitimes Research, January 2013

- In the fourth quarter of 2012, all Taiwan-based firms reported declines in notebook panel shipments.

- Taiwan makers' shipments to the 9-inch and larger tablet segment in the fourth quarter were far less than those of the top three makers, Samsung, LGD and Sharp.

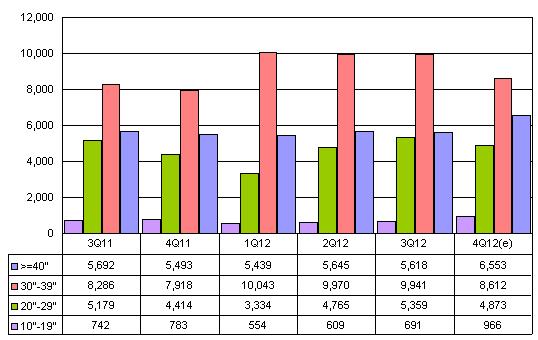

TV panels

Chart 9: TV panel shipments by size, 3Q11-4Q12 (k units)

Source: Digitimes Research, January 2013

Chart 10: TV panel shipment share by size, 3Q11-4Q12

Source: Digitimes Research, January 2013

Source: Digitimes Research, January 2013

- Innolux saw LCD TV panel shipments in the fourth quarter drop slightly on quarter because the firm reduced the shipment percentage for its 32-inch products. Innolux shifted its LCD TV panel focus to 39- and 50-inch products in order to boost revenues and profits.

- Innolux is forecast to see falling shipments to the LCD TV segment in the first quarter, but the decline is expected to be similar to the industry average. TV brands in China still have high levels of TV panel inventories.

- AUO has been slower than Innolux in shifting towards larger-size TV panels. AUO is forecast to have a significant decrease in 32-inch panel shipments in the first quarter of 2013.

Annual shipments

Chart 11: Taiwan large-size panel shipments and global market share, 2008-2012

Source: Digitimes Research, January 2013

- Taiwan's large-size panel shipments dropped 0.9% annually in 2012, as its global market share continued shrinking.

Article edited by Rodney Chan