TD-LTE has become the mainstream global choice for the construction of 4G asymmetric frequency spectrum networks, with the GSA calculating that commercial TD-LTE services were already in operation by 21 carriers in 17 countries worldwide as of the third quarter of 2013. This Digitimes Research Special Report examines the current global status of TD-LTE, and forecasts developments in the TD-LTE supply chain in China and worldwide through 2016.

Dual-mode networks are preferred option in mature telecom markets

Asia Pacific region and Europe key regions for TD-LTE development

Chart 1: Global distribution of commercial TD-LTE networks as of 3Q13

Chart 2: Distribution of TD-LTE users in 2Q13, and TD-LTE user number forecasts for 2012-2016

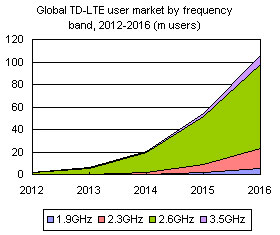

70% of TD-LTE users will be covered by 2.6GHz services by 2016, with the use of 3.5GHz set to rise

Chart 3: Frequency band usage for commercial TD-LTE networks worldwide, 3Q13

Chart 4: Global TD-LTE user market by frequency band, 2012-2016 (m users)

Table 1: Versions and publication years for 3GPP's main standards

Chart 6: LTE-Advanced expands number of uplink and downlink antennae

Mobile application services with high data traffic need further development

Chart 10: China mobile data traffic and revenues, by voice and data services, 1H11-1H13

FD-LTE frequency band allocation takes into account strengths of each carrier

Chart 11: China 4G LTE frequency spectrum bands and carrier usage allocation plans

Lower LTE frequency bands prove difficult to obtain, while number of base stations continues to grow

FD/TD-LTE hybrid networks increase construction costs for carriers

Chart 13: China Mobile's TD-LTE network is now in actual trial operation

Table 2: TD-LTE user numbers for the big 3 China carriers (m users)

Table 3: Market presence comparison for China's major LTE base station equipment makers, 2013

Technological difficulties of multi-mode, multi-band services

Strategic objectives for fostering domestic tier-one manufacturers

Table 4: Overview of bidding for China Mobile's TD-LTE contracts, 2012-2013

Table 5: Development trends for the 4 types of TD-LTE chip vendor

Chart 15: Competitive positioning and development of major TD-LTE chip vendors in 2013

Table 6: Potential applications for the two types of TD-LTE chip

TD-LTE chip market outlook - multi-mode requirements bolster initial average prices

Data devices will dominate the TD-LTE market, while development will lag 1.5 years behind FD-LTE

Multi-mode, multi-band standards create challenges and changes in the industry ecosystem

TD-LTE data device shipments will surpass 23 million in 2016, with higher shipments and lower prices

Chart 18: Global shipment/ASP forecasts for TD-LTE devices, 2013-2016