This Digitimes Research Special Report provides a market forecast of the 2014 application processor market (AP). In addition to shipment forecasts for each major vendor, Digitimes Research presents the various development trends in AP design, including the decision to implement 64-bit architecture, the development direction of eight core applications, the evolution of the bigLITTLE core designs, the advancements of GPU architecture, and overall software developments for supporting new processor architecture.

The analysis includes each major AP vendor's respective development and market strategies, thus providing readers with a roadmap for how the market will develop in 2014 and the role of the major players.

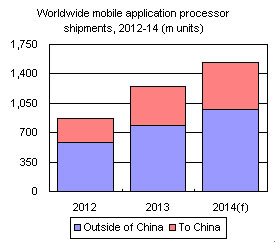

Chart 1: Worldwide mobile apps processor shipments, 2012-14 (m units)

Forecast for global 2014 mobile AP market and major suppliers

Chart 2: iOS vs. Android - Transition from 32-bit to 64-bit architecture

Chart 3: Atom vs. ARM core processors - Power/performance ratio, 2011-14 (measuring per watt)

Intel improving competitiveness through its manufacturing edge

Chart 7: Unit share of 32- and 64-bit APs for Android devices

Chart 10: MediaTek AP shipments and shipment forecast, 2012-14 (m units)

Chart 11: MediaTek chip design - balance between performance, power and price

Chart 12: Qualcomm AP shipments and shipment forecast, 2012-14 (m units)

Chart 13: Apple AP shipments and shipment forecast, 2012-14 (m units)

Chart 15: Samsung AP shipments and shipment forecast, 2012-14 (m units)

Chart 16: Spreadtrum AP shipments and shipment forecast, 2012-14 (m units)

Chart 17: Allwinner AP shipments and shipment forecast, 2012-14 (m units)

Chart 18: Rockchip AP shipments and shipment forecast, 2012-14 (m units)

Chart 19: Broadcom AP shipments and shipment forecast, 2012-14 (m units)

Chart 20: Marvell AP shipments and shipment forecast, 2012-14 (m units)

Chart 21: Intel AP shipments and shipment forecast, 2012-14 (m units)

Chart 23: Top-3 mobile DRAM vendors market share forecast, 2014

Chart 24: Wide I/O technology matures but adoption slows due to costs

Chart 25: eMMC specs continue to upgrade; UFS requires support from AP developers

Chart 26: Top-5 eMMC device manufacturers, market share forecast, 2014

Chart 29: Imagination GPU architecture and performance difference

Chart 30: ARM Mali 700-series GPUs divided into high-end and mainstream segments

Qualcomm's Adreno faces constrains in entry-level device market

Chart 32: Bay Trail utilizes Intel's own HD Graphics technology