In the face of natural resources being gradually depleted by humans, and the average temperature of the Earth gradually increasing, governments around the world are actively engaging in the development of green energies as well as incorporating equipment that is even more energy-efficient. LED lighting is highly efficient, environmentally friendly, power saving, flicker free, and has a long usage life, making them a popular option for replacing traditional incandescent light bulbs, which has driven up the prospects for the LED lighting industry. In 2014, output of the global LED lighting industry was approximately US$17.8 billion, representing 68% growth compared to 2013, with penetration rates exceeding 20%.

With prices for LED lighting equipment are rapidly dropping, the range of applications for LED lighting will continue to grow. According to a study conducted by LEDinside, the scale of the global lighting industry in 2015 will reach US$8.21 billion, out of which LED lighting applications could account for up to US$25.7 billion, thereby reaching a market penetration rate of 31%. It is worth noting that the use of LED light bulbs in automotive lighting is increasing and could become the second largest market for LED lighting applications.

Home lighting industry enters a price war, with vendors turning to industrial and commercial applications

With support from governments around the globe, product prices continuing to drop, and consumers demanding energy-conserving products, demand for LED lighting is set to dramatically increase. According to ITRI's IEK research center, by 2019, the LED lighting market will reach US$72.6 billion, accounting for approximately 47.7% of the global lighting market. Europe, which has always pursued environmental protection, is still the market with the highest demand for LED lighting, accounting for approximately 23% of the global market. In addition to the home LED market continuing to show strong demand, the commercial lighting and outdoor construction lighting markets are also continuing to grow.

The world's second largest LED lighting market is China, which will account for up to 21% of the overall market. With continued strong demand, China could become the world's largest market for LED lighting within 1-2 years. However, China is also the primary manufacturer of global LED lighting products, and with a large number of vendors competing with each other, prices are already rapidly dropping, which has also forced the prices of LED lighting equipment to drop globally.

According to the secretary-general of the Taiwan LED Lighting Industry Alliance (TLLIA), Hong-Ching Hsiao, with LED lighting technologies continuing to improve, the luminous efficacies for LED lights are the same as those for traditional compact fluorescent lamps (CFL), while the usage life of LED lights are 3 times those of CFLs, which means that LED lighting has officially entered a stage of practical application. However, due to over production, many vendors are starting to engage in price wars. The price of a 60WLED light bulb has already dropped to US$10, with the price of 3W LED light bulbs dropping to CNY1.45 (US$0.23). This type of blind and negative competition is undoubtedly bad and short-sighted, and is detrimental to the healthy development of the LED industry in the long run.

Compared to the Chinese market (which is caught in a price war), the US and Japanese markets (which are currently ranked 3rd and 4th globally), have global market shares of only 19% and 9%, respectively. However, since their home markets began incorporating LED lighting relatively early, they have recently been developing toward the commercial lighting industry. With continued support and subsidies from the US government, market demand for high-quality LED lighting equipment continues to grow. Vendors are also willing to obtain certification in order to be able to obtain government subsidies, while the strongest commercial market demand is in the replacement of LED light tubes (surpassing demand for LED light bulbs).

Japan was the first country in the world to use LED lighting, and with penetration rates for the home market exceeding 90%, its LED vendors are shifting their focus to the commercial and industrial lighting markets. Currently, there is a trend for chain stores and schools to start incorporating LED lighting equipment. As for industrial and outdoor lighting, smart lighting technologies developed by individual vendors emphasize the ability to provide suitable lighting under different usage scenarios and conditions.

Wen-Gui Chang, senior manager at Infineon, says that since the ceiling in large warehouses are relatively high, it is difficult for the infrared sensing technologies used with traditional CFLs to effectively sense the movement of people, and therefore cannot meet the requirements of smart lighting. The same problem exists for outdoor lighting. In comparison, lighting solutions that use LED light bulbs combined with radar-based sensing technologies allow LED lights to switch on and off more accurately, resulting in better control of precious energy resources.

New opportunities for high profit margins in automotive LED lighting

With the entrance barrier for the production of LED lighting equipment continuing to decrease, the global market has found itself caught in price competition. Samsung Electronics announced in 2014 that it would reduce its LED lighting business and terminate its overseas LED tube light business. Philips, on the other hand, has chosen to develop new applications for the health care market, such as blue medical LED lights for curing psoriasis, which can help patients with mild and moderate psoriasis control their conditions without any side effects.

In addition to the aforementioned special applications, many vendors have selected to enter the high-profit-margin automotive LED lighting space. LEDinside research manager, Li-Sun Lu, says that although vendors have obtained certification for automotive LEDs, the barrier for entering the supply chain has been relatively high. However, with compound growth rates possibly reaching 9% (the compound annual growth rates for exterior automotive (daytime) running lights as well as near/far distance headlights may be even higher, reaching 21% and 48%, respectively), major vendors are rushing to enter this emerging market and it is unlikely that price competitions will appear any time soon.

Traditional headlight designs for cars have primarily focused on illumination, in recent years however, headlight design has become an integral part of the overall design of the vehicle, with headlights trending towards small sizes and having a wide range of styles, which is why the choice of light sources has switched from traditional light bulbs LED light bulbs. Wen-Gui Chang believes that in addition to being small in size, LED light bulbs are also power-saving and have long usage lives, which help extend the usage lives of relative components in the car, allowing the quality of the overall vehicle to be increased.

In the past, LED light bulbs could only be found in luxury cars. In recent years, benefitting from improvements in the yields of high-power LED light bulbs as well as rapid drops in terms of unit price, LED lighting has gradually spread from high-end vehicles to mid-range vehicles as well, allowing the exterior automotive lighting market to steadily develop. LEDinside estimates that the value of just the near/far distance headlights and fog light segments of the LED light bulb market will reach US$313 million by 2018. As for daytime running lights, benefitting from regulations in various countries, compound growth rates will reach as high as 21% in the next 5 years.

The Zhaga standard ushers in the era of interchangeable components

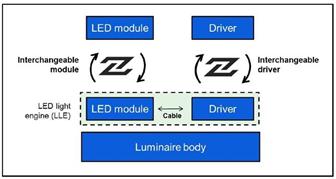

In spite of the scale of LED lighting applications become larger and larger, incompatibility issues between LED modules and LED drivers from different brands have resulted in lighting equipment specifications having to change whenever an LED lighting equipment vendor switches suppliers, which has caused many problems. In order to solve this problem and be able to produce products with standardized specifications, the global lighting industry has formed the Zhaga Consortium to produce a set of interface standards for LED lighting equipment for LED component vendors to follow.

Zhaga's goal in promoting standardized designs is to prevent a small number of vendors from monopolizing the market by intentionally changing product specifications, and to allow components such as LED modules and LED drivers to be interchangeable. This way, lighting equipment vendors can focus on the external design of their products, while COB array manufacturers can focus on providing differentiated (in terms of cooling features or lighting quality, for example) LED components, instead of having to spend time and energy on connection specifications between components.

Musa Unmehopa, secretary general of the Zhaga Consortium, says that many lighting equipment vendors want the LED lighting standards (such as those for the mechanical dimensions of relative modules, the locations of electrodes, and light emitting surface diameters, etc. ) to be produced as soon as possible. In the long term, these standards will help reduce the costs of LED lighting equipment production as well as accelerate the penetration of LED lighting. In the specifications already released by the Zhaga Consortium, six rectangular or square modules have already been defined, with the PCB dimensions being 12 x 15mm, 16 x 19 mm, 19 x 19 mm, 20 x 24 mm, 24 x 24 mm, and 28 x 28 mm, respectively. Other detailed parameters that have been defined include the location of the LES center, the size and location of the electrodes, as well as the position point for heat dissipation measurements.

The benefits of the Zhaga standards may not be immediately apparent, but in the long run, they will help the LED lighting industry develop in a healthier and more robust direction. Once LED component vendors and lighting equipment vendors are able to focus on their respective aspects of the ecosystem, the penetration rate of LED lighting will accelerate, thereby helping to reduce the rising of temperatures on the planet.

Common certifications for LED lighting equipment

CE certification

CE is a mandatory certification label. Products that wish to circulate freely on the EU market must have the "CE" label, regardless of whether they were produced by a vendor from within the EU or by a vendor from another region.

MET certification

The MET certification label is used in the US and Canada. Products that have obtained the MET label have passed relative tests and comply with US as well as Canadian standards, allowing those products to enter these two markets.

CSA certification

CSA is Canada's largest safety certification institution as well as one of the world's most well-known safety certification institutions. It can provide safety certification for mechanical, construction material, electronic, computer equipment, office equipment, environmental protection, health care, fire safety and prevention, sports and exercise, as well as entertainment products.

GS certification

GS certification is a voluntary certification based on the German Product Safety Act (GPGS) and in compliance with the EU's EN standards or Germany's DIN industrial standards. IT is a German safety certification label that is recognized throughout Europe.

Zhaga's goal in promoting standardized designs is to prevent a small number of vendors from monopolizing the market by intentionally changing product specifications, and to allow components such as LED modules and LED drivers to be interchangeable.

Photo: Zhaga