The wearables market is a growing focal point for many vendors and players in the display panel supply chain. This Digitimes Research Special Report looks at developments in panel applications in the wearable industry, with a specific focus on panel makers in Greater China. The report also covers the investments being made moving forward (through 2017) in order to meet end-market demand, including capacity expansion for small- to medium-size TFT LCD and AMOLED panels.

This Digitimes Research Special Report also provides in-depth analysis regarding the technological and strategic advantages from makers both in China and Taiwan, and compares their shipment prospects from 2015-2017 to give readers a comprehensive understanding of how the panel supply chain in Greater China is shaping developments in the wearables market.

Chart 1: Cost factors and technology barriers for smart devices

China makers will have 10 AMOLED production lines in operation in 2017

Table 4: China AMOLED fabs and production timelines, 2014-2017

Table 5: Taiwan AMOLED fabs and production timelines, 2014-2017

China will surpass Taiwan in small- to medium-size AMOLED production in 2015

Chart 8: Taiwan and China small- to medium-size AMOLED panel production, 2014-2017 (k2m)

BOE balancing investments in both large size and small- to medium-size AMOLED panels

Chart 9: BOE small- to medium-size AMOLED and LCD capacity, 2014-2017 (k2m)

Table 8: CPT and HannStar wearable display development plans

Table 10: Taiwan PMOLED makers, wearable display development plans

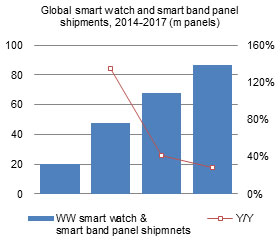

Chart 11: Global panel shipments for smart watches and smart bands, 2014-2017 (m panels)

Chart 12: Global smart watch and smart band panel shipments, 2014-2017 (m panels)

Chart 13: Greater China smart watch panels shipments, 2014-2017 (m panels)

Chart 14: Greater China share of worldwide smart watch panel shipments, 2014-2017

Chart 15: Greater China smart band panels shipments, 2014-2017 (m panels)

Chart 16: Greater China global share of smart band panel shipment, 2014-2017