Taiwan server players' revenues from products including server motherboards, servers, storage and related network equipment, continued to enjoy growth on year to surpass NT$500 billion in 2015.

As for worldwide server shipments, thanks to a strong performance in the fourth quarter of 2015, the volume rose 9.8% on year to reach 11.08 million units (motherboard) in 2015. Datacenter server shipments will continue to grow strongly on year in 2016 thanks to rising demand from the cloud computing market, while shipments from traditional server brand vendors are expected to increase slightly on year, helping overall worldwide server shipments to grow by 5.9% on year in 2016. Digitimes Research expects server shipments to have a chance to grow significantly after Intel releases its next-generation Purley platform in the second quarter of 2017.

With growing demand from the cloud computing market, Taiwan's server shipments grew 12.5% on year to break 10 million units in 2015, accounting for 90.7% of worldwide shipments and the percentage is expected to grow to 91.1% in 2016. Inventec, Foxconn Electronics (Hon Hai Precision Industry), Wistron and Quanta Computer are the top-4 server ODMs in Taiwan, but their combined share in Taiwan's server shipments dropped on year in 2015 as major server brand vendors such as Dell, distributed their orders to other ODMs to lower their risks. However, the share is expected to rise in 2016.

Chart 5: Global server shipments by vendor location, 2012-2016 (k units)

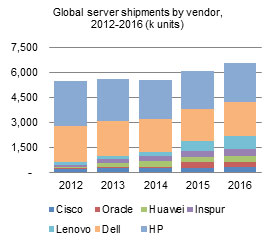

Chart 6: Global server shipments by vendor, 2012-2016 (k units)

Chart 7: Taiwan server motherboard shipments, 2013-2016 (k units)

Chart 8: Server motherboard shipments by Taiwan maker, 2014-2016 (k units)

Chart 9: Server motherboard shipment share by Taiwan maker, 2014-2016

Chart 10: Shipment share by maker, for major server OEMs, 2015

Chart 11: Shipment share by maker, for major server OEMs, 2016

Chart 12: Server revenues as share of total Foxconn revenues, 2014-2016

Chart 13: Foxconn server motherboard shipments, 2014-2016 (k units)

Chart 14: Foxconn server motherboard shipments by customer, 2015-2016 (k units)

Chart 15: Server revenues as share of total Inventec revenues, 2014-2016

Chart 16: Inventec server motherboard shipments, 2014-2016 (k units)

Chart 17: Inventec server motherboard shipments by customer 2015-2016 (k units)

Chart 18: Server revenues as share of total Quanta revenues, 2014-2016

Chart 20: Quanta server motherboard shipments by customer, 2015-2016 (k units)

Chart 21: Server revenues as share of total Wistron revenues, 2014-2016

Chart 23: Wistron server motherboard shipments by customer, 2015-2016 (k units)

Chart 24: Server revenues as share of total Mitac revenues, 2014-2016

Chart 26: Mitac server motherboard shipments by customer, 2015-2016 (k units)

Analysis of CPU, BMC, power supply IC and connector components

Analysis of hard disk, thermal module, power supply, mechanical parts, PCB and slide suppliers