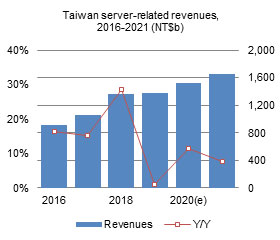

Taiwan makers saw revenues from server-related hardware and software including motherboards, full-rack systems, networking equipment and storage equipment, increase by about 11% on year to reach over NT$1.5 trillion (US$52.88 billion) in 2020, higher than the 7% growth in server shipments in the year.

Taiwan's server-related product revenues are expected to grow further by 7.6% on year in 2021 as demand from US- and China-based first-tier datacenter operators continued to pick up.

Global server shipments resumed on-year growth in 2020, driven by rising demand for cloud computing services and work-from-home solutions amid the coronavirus pandemic. Related demand will continue rising in 2021 due to the lingering pandemic, driving up shipments by another 5.6% on year. Intel and AMD are set to make mass deployments of their new-generation CPUs in the first half of 2021 and demand for cloud computing services will continue boosting server orders from datacenter operators.

Chart 2: Taiwan server-related revenues by maker, 2016-2020 (NT$b)

Chart 3: Taiwan server-related revenue share by maker, 2016-2020

Chart 5: Global server shipments by client type, 2017-2021 (k units)

Chart 6: Global server shipment share by client type, 2017-2021

Chart 7: Global top server player shipments, 2020-2021 (k units)

Chart 9: Taiwan server shipments by maker, 2017-2021 (k units)

Chart 11: Taiwan maker-client shipment matrix, 2020 (k units)

Chart 12: Taiwan maker-client shipment matrix, 2019 (k units)

Chart 19: Inventec server shipment share by client, 2016-2020

Chart 25: Foxconn server shipment share by client, 2016-2020

Chart 31: Mitac server shipments by client, 2016-2020 (k units)