Table 1: Key factors affecting tablet shipments, 2Q21 (Brand)

Table 2: Key factors affecting tablet shipments, 2Q21 (Components)

Table 3: Key factors affecting tablet shipments, 2Q21 (Demand)

Chart 2: Shipments by product - iPad, non-iPad branded and white-box, 1Q20-2Q21 (m units)

Chart 3: Shipment share by product - iPad, non-iPad branded and white-box, 1Q20-2Q21

Chart 8: Shipments by touchscreen technology, 1Q20-2Q21 (m units)

Chart 9: Shipment share by touchscreen technology, 1Q20-2Q21

Chart 14: Detachable notebook shipments, 1Q20-2Q21 (k units)

Chart 15: Shipments of detachable notebooks by OS, 1Q20-2Q21 (k units)

Chart 16: Shipment share of detachable notebooks by OS, 1Q20-2Q21

Chart 17: Shipments from Taiwan makers and share of global shipments, 1Q20-2Q21 (m units)

Chart 18: Taiwan tablet shipments by maker, 1Q20-2Q21 (m units)

Introduction

According to Digitimes Research's statistics, global tablet shipments amounted to 35.95 million units in first-quarter 2021, down 22.7% quarter-over-quarter but up 45.5% year-over-year in line with expectation.

IC shortage has yet to exert a significant impact on the tablet market. Market demand still dictates tablet shipments. With the pandemic easing, global tablet shipments fell back to the usual low season level in first-quarter 2021 and are expected to show slow momentum going into second-quarter 2021 with consumer demand in low gear. Second-quarter 2021 global tablet shipments are projected to decline 6.6% sequentially.

In terms of the rankings among tablet brands based on first-quarter 2021 shipments, Apple, Samsung, Amazon and Lenovo remained the top four. Huawei moved up in ranking as it tried to clear its tablet inventory but it will not be shipping tablets from second-quarter 2021 onward.

Newcomer Honor will be taking over Huawei's market presence but it needs time to build up its brand image so Honor will not be able to move into the top three as Huawei did any time soon.

Going forward into second-quarter 2021, among the top four brands, Lenovo will surpass Amazon by a small margin. Microsoft will move up to No. 5. Apple will maintain its shipment volume with the launch of new iPad Pros.

The non-Apple camp's shipments will slide significantly from the level of the prior quarter, which will be the main reason behind the decline in global tablet shipments in second-quarter 2021. It should be noted that white-box vendors sustain a serious impact from the ongoing IC shortage. White-box tablets are therefore being replaced by low-cost brand tablets and they are likely to completely fade out of the market starting 2022.

Analyzing brand tablet shipments in terms of sizes in first-quarter 2021, the share of 8.x-inch tablets showed a large increase as white-box tablets got replaced by low-cost brand tablets from Amazon and other vendors, causing white-box tablet shipments to plunge in first-quarter 2021. This also correspondingly resulted in a decline in the share of 10-inch and larger tablets. Moving into second-quarter 2021, buoyed by new iPad Pro shipments, the share of 11-inch and larger tablets is estimated to come close to 20%, to set a new record.

With respect to Taiwan-based OEMs, their shipments of tablets slid from the level of the prior quarter due to a decrease in old iPad Pro shipments in first-quarter 2021. With new iPad Pro being launched, shipments of tablets by Taiwan-based OEMs will exhibit a sequential increase, buoying their share among global brand tablet shipments to stand above 40% again.

Key factors affecting tablet shipments

2Q21: Supply side

In second-quarter 2021, Huawei will no longer ship tablets and its tablet business is taken over by Honor, a span-off independent brand.

New iPad Pros entering the market will buoy iPad Pro shipments to soar 154% sequentially.

By bundling large and small tablets to promote sales, Samsung looks to boost 8.4-inch tablet shipments.

Huawei cleared out its tablet inventory in first-quarter 2021 and stopped shipping tablets from April onward.

Shipments of Honor's new products launched in late first-quarter 2021 will gradually ramp up with supply in second-quarter 2021 exceeding that in first-quarter 2021.

To prevent component shortage from disrupting its supply, Amazon will continue to actively prepare its inventory in second-quarter 2021 to get ready for the shopping season in second-half 2021.

Microsoft's first-quarter 2021 shipments got deferred, resulting in an increase in Microsoft's supply in second-quarter 2021.

Component costs are on the rise but white-box tablet prices cannot go up in correspondence. White-box tablet vendors have no choice but to absorb the increase in costs so white-box tablet supply will continue to trend downward.

Source: Digitimes Research, January 2021

Benefiting from their effort to stock up on components in second-half 2020, most tablet brands do not experience a significant impact on their shipments by the recent component shortage.

As the largest consumer electronics brand, Apple is also the biggest customer of component suppliers so they provide products to Apple at the top priority. As such, Apple will not face IC shortage until second-quarter 2021 at the earliest.

Samsung lacks RF ICs for its mobile devices. Tablets mostly connect to networks via Wi-Fi communication so Samsung's tablet shipments sustain less influence from RF IC shortage. Moreover, Samsung is the largest customer to panel maker BOE and OEM Wingtech and has been given their top priority in supply.

Lenovo's shipments come short of those of Apple, Samsung and Amazon and its assembly orders to OEMs are dispersed. To OEMs, Lenovo places scattered orders and thus is not given priority.

Lenovo plans to boost its tablet shipments in 2021, in an effort to secure additional component supply by raising its orders. However, its first-half 2021 shipments are still affected by IC shortage.

Honor began shipping tablets in first-quarter 2021 but it still needs time to build up its brand image. Its shipment volume remains small in the beginning and with the component inventory Huawei stocked up, Honor is experiencing little influence from the component shortage.

Amazon mainly ships 7-inch and 8-inch small-to-mid size tablets, rather than large tablets that fall under the influence of the shortage of DDI for large display panels. In addition, Amazon's assembly orders are largely given to China-based Huaqin. It is Huaqin's biggest tablet customer. Amazon's shipments are thus not affected by the current IC shortage.

Microsoft mainly provides 12.3-inch Surface Pro, which uses large display panels. As leading panel maker LGD has a hard time keeping up with demand, first-quarter 2021 shipments fell short of expectation by 20% and are deferred to the next quarter.

With their small-volume orders, white-box vendors have no say in the situation and are given the lowest priority. They suffer the most serious IC shortage.

Source: Digitimes Research, January 2021

2Q21: Demand side

Shipments for education tablet projects were completed in first-quarter 2021. US schools started to reopen in late first-quarter 2021 with students attending classes at nearly half of the schools. Tablet demand growth will therefore slow down.

Component shortage results in a large gap in notebook computer supply, prompting some consumers to use high-spec tablets instead for their WFH needs. This trend will stay unchanged and keep driving demand for large tablets.

The US government started to send out stimulus checks in March 2021, up to US$1,400 per individual. This will help spur consumer spending.

Source: Digitimes Research, January 2021

Global tablet

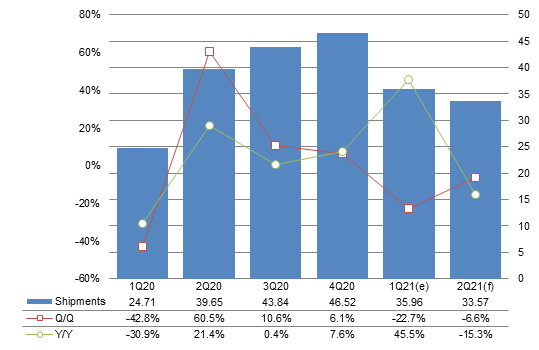

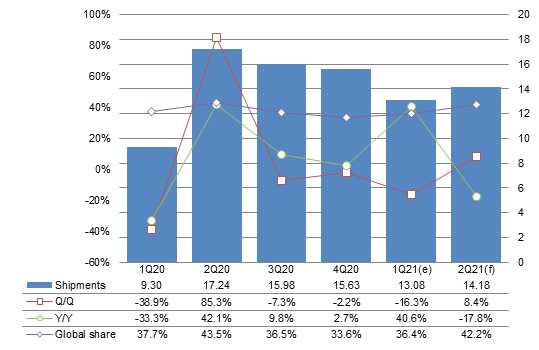

Chart 1: Global tablet shipments, 1Q20-2Q21 (m units)

Source: Digitimes Research, May 2021

First-quarter 2021 global tablet shipments amounted to 35.96 million units, down 22.7% from a quarter ago but up 45.5% from a year ago, in line with expectation.

First-quarter 2021 shipments fell back to the usual low season level (comparable to first-quarter 2019 shipments). Without supply uncertainties, tablet market demand is slowing down.

Second-quarter 2021 global tablet shipments are estimated to come to 33.57 million units, remaining a normal low season volume. On a year-over-year basis, the volume represents a 15.3% decline.

Tablet shipments started to ramp up in second-quarter 2020 with COVID-19 getting relatively contained, resulting in a higher based period, so second-quarter 2021 global tablet shipments will exhibit a relatively large year-over-year decline.

Shipment breakdown

Shipments by product

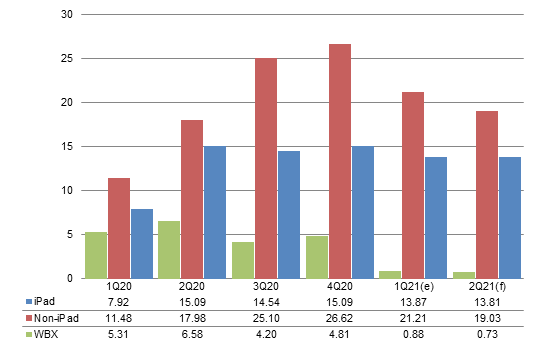

Chart 2: Shipments by product - iPad, non-iPad branded and white-box, 1Q20-2Q21 (m units)

Source: Digitimes Research, May 2021

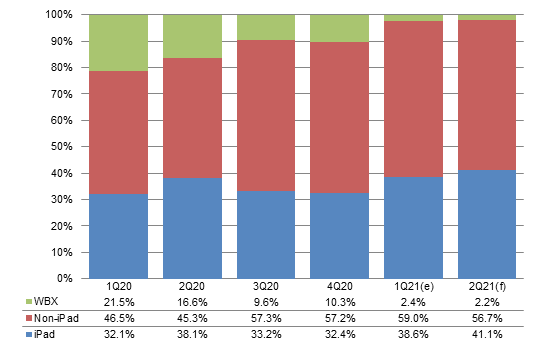

First-quarter 2021 iPad shipments came to 13.87 million units, down 8.1% from the prior quarter. The volume is expected to edge downward to 13.81 million units going into second-quarter 2021.

Although shipments of 10.2-inch iPad increased moderately from the prior quarter as they were delivered to fill orders from education projects, orders for old iPad models got largely reduced ahead of new iPad Pro launch, causing total iPad shipments to fall below expectation.

Despite pending IC shortage, new iPad Pro with significantly enhanced spec going on the market is expected to spur shipments and stabilize overall shipments of the iPad series in second-quarter 2021.

Non-Apple brands shipped a total of 21.21 million tablets in first-quarter 2021, sliding 20.3% quarter-over-quarter but outperforming expectation, mainly because white-box vendors experienced a rapid decline and their demand was taken over by low-cost brand tablets. Non-Apple brands' second-quarter 2021 shipments are estimated to fall 10.3% sequentially with Huawei exiting the tablet market.

Amazon enjoyed brisk shipments despite the low season, its volume exceeding the usual low-season levels seen in the past. Furthermore, Huawei filled remaining orders and cleared out its tablet inventory and with Honor joining the game, non-Apple brands were able to outperform expectation.

Huawei to stop shipping tablets will affect non-Apple brands' performance in second-quarter 2021. Honor will be making shipments but it will take time for its volume to ramp up to Huawei's usual level.

White-box vendors shipped 0.88 million tablets in first-quarter 2021, plunging 81.7% from the prior quarter, far below expectation. IC shortage and rising costs seriously dampened white-box vendors' willingness to make shipments. Second-quarter 2021 white-box tablet shipments are estimated to further decline to 0.73 million units.

Chart 3: Shipment share by product - iPad, non-iPad branded and white-box, 1Q20-2Q21

Source: Digitimes Research, May 2021

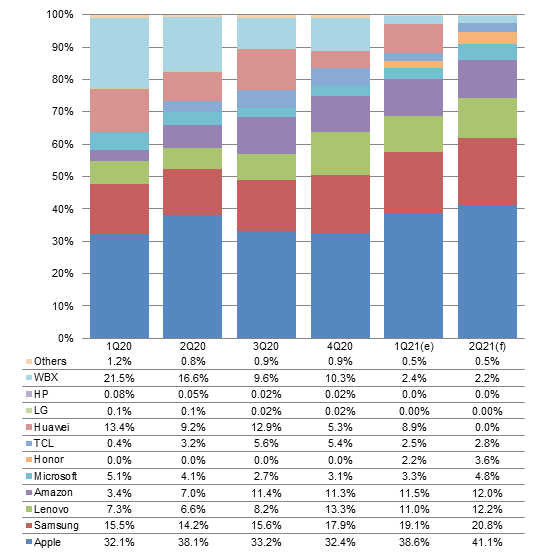

Shipments by vendor

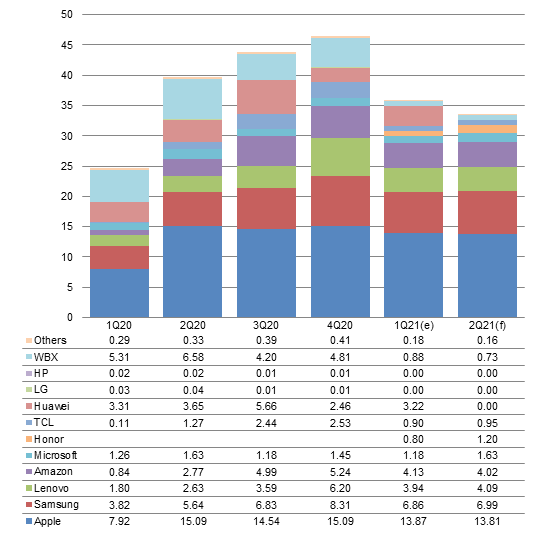

Chart 4: Shipments by vendor, 1Q20-2Q21 (m units)

Source: Digitimes Research, May 2021

In terms of first-quarter 2021 tablet shipments, Apple and Samsung remained No. 1 and No. 2. Amazon moved up to No. 3, pushing Lenovo to No. 4. Huawei sat at No. 5.

With 10.2-inch iPad shipments remaining brisk, Apple experienced a smaller decline in first-quarter 2021 shipments than non-Apple brands, which buoyed Apple's share of shipments up 6.2pp from a quarter ago.

Thanks to successful channel promotion strategies, Samsung enjoyed an increase in its 8.4-inch tablet shipments, boosting its share of shipments up 1.2pp in first-quarter 2021.

Amazon took over white-box tablet demand and saw its share of shipments climb 8.1pp from the level seen a year ago.

Huawei's share of shipments rose 3.7pp from last quarter as it cleared out its tablet inventory.

Going forward into second-quarter 2021, Apple and Samsung will still secure their No. 1 and No. 2 ranking. Lenovo will surpass Amazon by a narrow margin. They will sit at No. 3 and No. 4.

Apple's share of shipments will expand to 41.1% in second-quarter 2021, a new high in history, thanks to the launch of new iPad Pro boosting its shipments and a decline in non-Apple brands' shipments.

Among non-Apple brands, only Samsung, Lenovo and Microsoft will still enjoy shipment growth in second-quarter 2021. Each of the three will see their share of shipments increase one to twopp sequentially.

Huawei stopped tablet shipments from April onward. Honor's shipments are ramping up and its share of shipments is expected to grow 1.4pp from the prior quarter.

Chart 5: Shipment share by vendor, 1Q20-2Q21

Source: Digitimes Research, May 2021

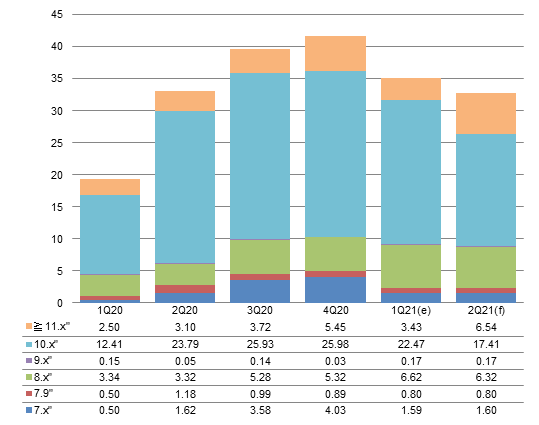

Shipments by panel size

Chart 6: Shipments by panel size, 1Q20-2Q21 (m units)

Source: Digitimes Research, May 2021

The share of 11-inch and larger models among brand tablet shipments fell below the 10% mark in first-quarter 2021.

The decline was due to a reduction in old iPad Pro shipments and a sequential increase of 24.4% in 8.x-inch tablet shipments.

The share of 8.x-inch tablets shot up from a quarter ago mainly driven by Amazon's 8-inch tablets and Samsung's 8.4-inch tablets performing better than the other models.

The share of 11-inch and larger models is expected to further expand in second-quarter 2021, making the shipments and share of 10.x-inch tablets decline.

Apple's new iPad Pro will come with significantly enhanced spec, spurring shipments of 11-inch and 12.9-inch tablets. Furthermore, Microsoft's first-quarter 2021 shipments got deferred to second-quarter. The share of 11-inch and larger models is therefore expected to surge 10.1pp from the prior quarter.

Chart 7: Shipment share by panel size, 1Q20-2Q21

Source: Digitimes Research, May 2021

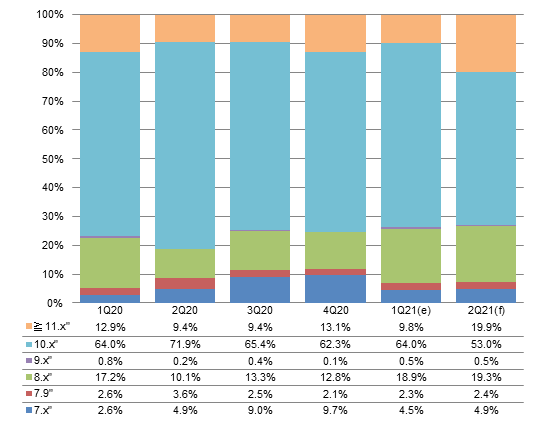

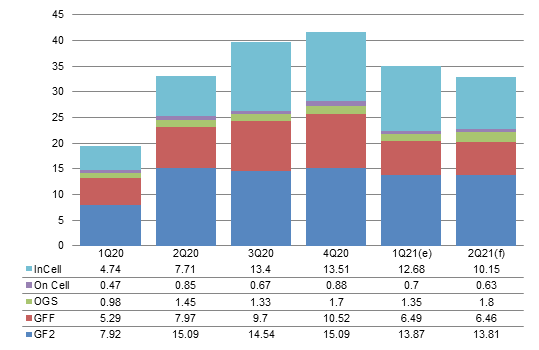

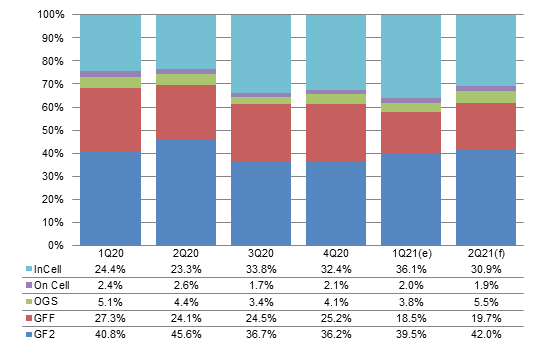

Shipments by touchscreen technology

Chart 8: Shipments by touchscreen technology, 1Q20-2Q21 (m units)

Source: Digitimes Research, May 2021

Chart 9: Shipment share by touchscreen technology, 1Q20-2Q21

Source: Digitimes Research, May 2021

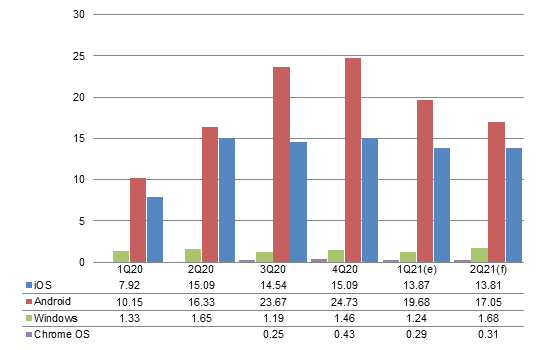

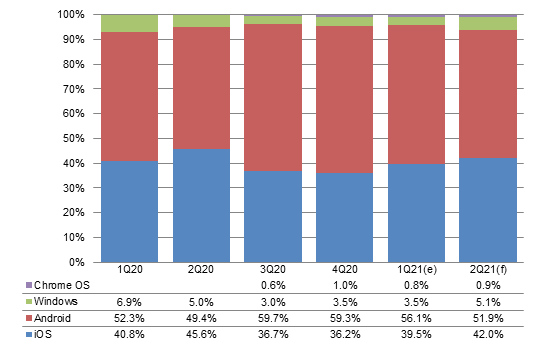

Shipments by OS

Chart 10: Shipments by OS, 1Q20-2Q21 (m units)

Source: Digitimes Research, May 2021

The share of iOS-based tablets among global brand tablet shipments increased in first-quarter 2021.

Apple's shipments declined by a smaller extent than those of non-Apple brands amid the low season thanks to brisk market demand for 10.2-inch iPad, buoying the share of iOS-based tablets up 3.3pp. The share of Android-based tablets correspondingly fell 3.1pp.

Going forward into second-quarter 2021, Apple's shipments will climb with new iPad Pro being launched while non-Apple brands' shipments will continue to slide amid the low season. With one going up and the other going down, the share of iOS-based tablets will exceed 42%.

The share of Windows-based tablets will grow to 5.2% in second-quarter 2021 as Microsoft's Surface shipments getting deferred from first-quarter 2021 results in an increase in its second-quarter 2021 shipments.

Chart 11: Shipment share by OS, 1Q20-2Q21

Source: Digitimes Research, May 2021

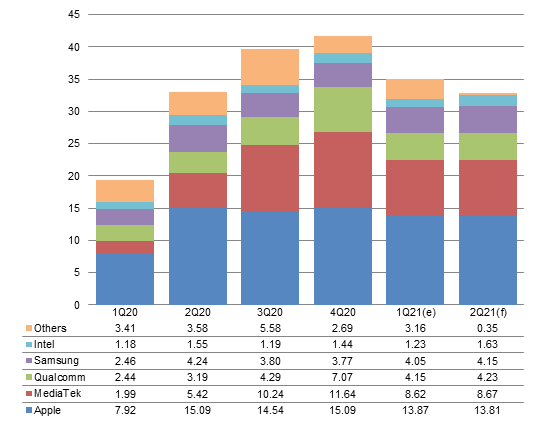

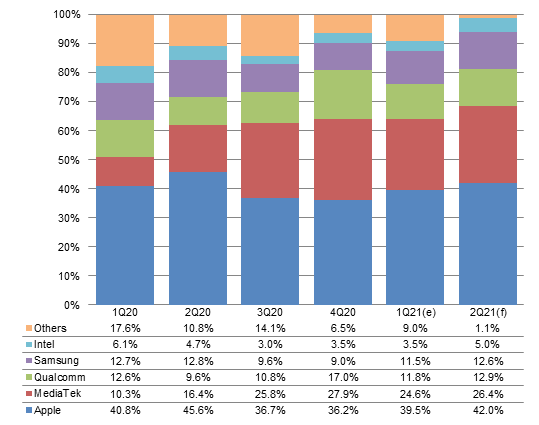

Shipments by AP supplier

Chart 12: Shipments by AP supplier, 1Q20-2Q21 (m units)

Source: Digitimes Research, May 2021

In terms of first-quarter 2021 tablet shipments categorized by AP supplier, the share of Apple's processors and the share of Samsung's processors both showed an increase.

The share of Apple processors rose 3.3pp from the prior quarter with the growth in Apple's share of tablet shipments.

The share of Samsung processors grew 2.5pp sequentially as Samsung's 8.4-inch tablets based on its own processors enjoyed brisk sales.

The share of MediaTek processors and the share of Qualcomm processors declined from the prior quarter due to a decrease in the share of non-Apple tablet shipments.

The sequential growth in Huawei's share of tablet shipments resulted in a sequential increase of 2.5pp in the share of the category of other processors.

With Hisilicon, whose processors are categorized as other processors, exiting the tablet market, the shares of non-Apple processors will exhibit growth across the board in second-quarter 2021.

The share of Apple processors is set to further climb 2.6pp with Apple's tablet shipments outperforming non-Apple brands'.

As Amazon maintains steady shipments and Honor adopts Mediatek processors, the share of MediaTek processors will increase by a larger extent than the share of Qualcomm processors.

The share of Intel processors will climb 1.5pp with Microsoft's shipments ramping up.

Chart 13: Shipment share by AP supplier, 1Q20-2Q21

Source: Digitimes Research, May 2021

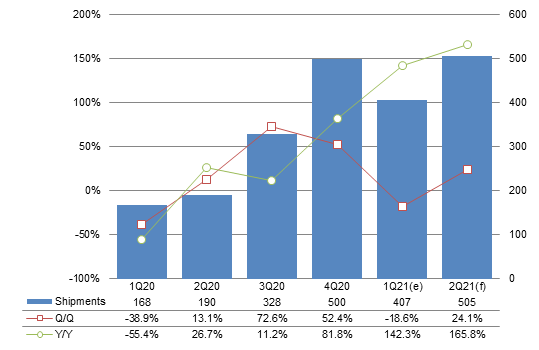

Shipments of detachable notebooks

Chart 14: Detachable notebook shipments, 1Q20-2Q21 (k units)

Source: Digitimes Research, May 2021

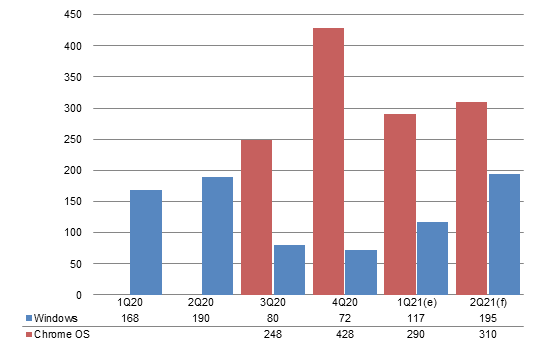

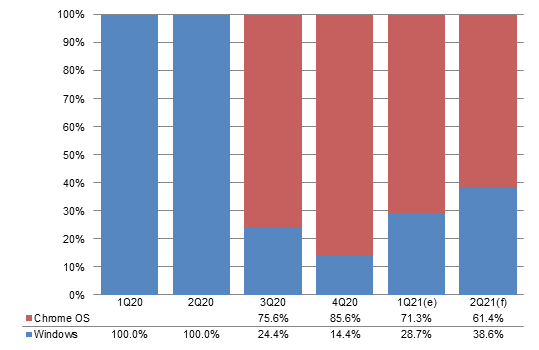

Chart 15: Shipments of detachable notebooks by OS, 1Q20-2Q21 (k units)

Source: Digitimes Research, May 2021

Chart 16: Shipment share of detachable notebooks by OS, 1Q20-2Q21

Source: Digitimes Research, May 2021

Shipments from Taiwan makers

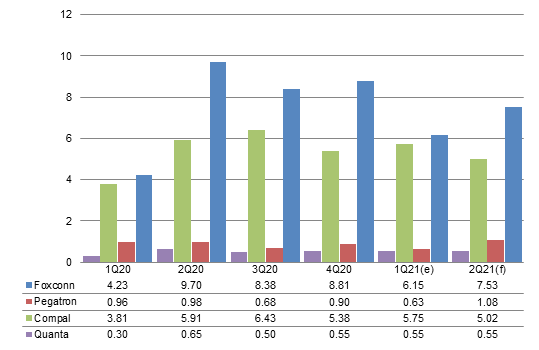

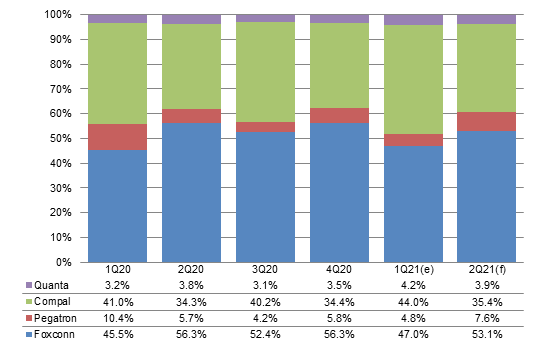

Chart 17: Shipments from Taiwan makers and share of global shipments, 1Q20-2Q21 (m units)

Source: Digitimes Research, May 2021

Although 10.2-inch iPad shipments maintained at a high level in first-quarter 2021, shipments of old iPad Pro models and Microsoft's Surface series declined. As such, shipments of tablets manufactured by Taiwan-based OEMs slid 16.3% sequentially. However, Taiwan-based OEMs' share of tablet shipments among the global total exhibited little change as the decline in Apple's tablet shipments was smaller than that in non-Apple tablet shipments (which are mostly manufactured by China-based OEMs).

Moving forward into second-quarter 2021, Apple will enjoy the effect of new iPad Pro being launched while Microsoft's first-quarter 2021 orders are deferred. The two brands will deliver larger growth in shipments compared to the other brands. Taiwan-based OEMs, mainly serving these two brands, will see their shipments climb 8.4% sequentially and their share further expand to 43.2%.

Chart 18: Taiwan tablet shipments by maker, 1Q20-2Q21 (m units)

Source: Digitimes Research, May 2021

The increase in the ratio of 10.2-inch iPad manufactured by BYD in first-quarter 2021 caused Foxconn's share among shipments of brand tablets manufactured by Taiwan-based OEMs to fall 9.3pp sequentially.

Compal's share of shipments expanded 9.6pp sequentially thanks to shipment growth of 10.1-inch tablets manufactured for Amazon.

Pegatron's share of shipments dipped 1pp from the prior quarter due to a decline in Microsoft's shipments.

Looking into second-quarter 2021, with new iPad Pro being launched, Foxconn's share of shipments will rebound 6.1pp as it manufactures new iPad Pro under exclusive OEM agreement. This will cause Compal's share of shipments to fall back 8.6pp.

Microsoft's first-quarter 2021 shipments getting deferred to second-quarter 2021 will drive Pegatron's share of shipments up 2.8pp.

Quanta manufactures Surface Go with a smaller size, of which the shipment growth will pale in comparison to that of mainstream 12-inch and larger tablets, so Quanta's share of shipments is expected to decline.

Chart 19: Taiwan tablet shipment share by maker, 1Q20-2Q21

Source: Digitimes Research, May 2021