Global notebook shipments are expected to experience minor declines in 2022 and 2023 as governments will start cutting their COVID-19 subsidies and stimulus checks with the easing of the pandemic, reducing overall demand for notebooks. However, the market is expected to see the next wave of shipment growth between 2024 and 2026 with upgrades to panels and hardware.

Meanwhile, Digitimes Research expects global smartphone shipments to increase 4.7% on year and arrive at 1.3 billion units in 2021 and will see on-year growths between 4-7% every year in the next five years from 2022-2026.

Tablet brands will see a more stable market environment in 2022 with their shipments in the year to pick up moderately by 1.3% from 2021. Although tablet brands will start pushing into the creator market to seek more business opportunities, overall tablet shipments are still likely to shrink over the next five years until 2026.

Key factors affecting 2022-2026 worldwide smartphone shipments

Table 1: Key factors affecting 2022-2026 worldwide smartphone shipments

Chart 2: Shipment to China and non-China markets, 2020-2022 (m units)

Chart 3: Top-7 smartphone vendors' shipments, 2021-2022 (m units)

Chart 7: Shipments by foldable display feature, 2021-2026 (m units)

Table 2: Global smartphone production capacity deployment 2021-2026

Chart 8: Top smartphone vendors' shipments, 4Q20-4Q21 (m units)

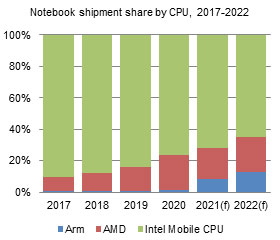

Chart 11: Arm-based notebook shipments by type, 2020-2024 (k units)

Table 3: Key factors affecting 2022 worldwide notebook shipments (supply side)

Table 4: Key factors affecting 2022 worldwide notebook shipments (demand side)

Table 5: Key factors affecting worldwide tablet shipments in 2022 (supply and demand)

Table 6: Key factors affecting worldwide tablet shipments in 2021 and 2022 (component shortages)

Chart 16: Shipments by brand and white-box player, 2017-2022 (m units)

Chart 22: Brand shipments by Taiwan ODMs, 2017-2022 (m units)