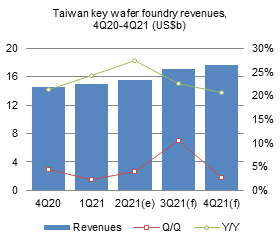

Digitimes Research expects the combined revenues of the top-3 Taiwan-based foundries to increase more than 10% sequentially in third-quarter 2021 amid lingering chip shortage, extending traditional high-season effects and increasing foundry service prices.

Chip supply will remain tight until 2022 so Digitimes Research adjusts the forecast on the combined 2021 revenues of the Taiwan-based key foundries upward to US$65 billion. Digitimes Research is also optimistic about the foundries' 2022 performance.

The chip shortage buoyed the top-3 Taiwan-based foundries' second-quarter 2021 revenues to a historical high. Going forward into third-quarter 2021, chip supply will become even tighter with brisk smartphone, notebook and server shipments in the high season.

Table 1: Key factors affecting Taiwan's wafer foundry industry in 3Q21 (demand and supply)

Table 2: Key factors affecting Taiwan's wafer foundry industry in 2021 and 2022 (demand and supply)

Chart 1: Taiwan key wafer foundry revenues, 2Q20-4Q21 (US$b)

Chart 5: Taiwan key wafer foundry annual revenues, 2018-2022 (US$b)

Chart 6: Taiwan key wafer foundry annual capex, 2018-2022 (US$b)