DIGITIMES has released its ranking of "Asia Supply Chain Market Cap 100" based on the market capitalization of companies engaging in Asia supply chain manufacturing. These rankings go one step further to capture the dynamics of the ICT and automotive supply chains in Asia. From static rankings and dynamic rates of change, this ranking reflects trends in the electronics and hardware industries.

In addition to a country's overall economic growth and composition, the operational scale, core competitiveness, and transnational business capabilities of large-scale enterprises are also indicators of that country's economic development strength. The market capitalization of a company can also be used as an indicator when evaluating the global competitiveness of a company. The ups and downs of leading enterprises in a country's various sectors reveal the country's levels of industrial competitiveness during different time periods.

Taiwan Semiconductor Manufacturing Company (TSMC), referred to as Taiwan's "Silicon Shield," unsurprisingly continues to lead the Asia-Pacific region in terms of market capitalization, ahead of Samsung Electronics, Toyota, and Sony. Taiwanese companies MediaTek, Hon Hai Precision Industry (Foxconn), United Microelectronics (UMC), Delta Electronics, ASE Group, and GlobalWafers also rank in the top 100 and should not be underestimated.

The impacts of the COVID-19 pandemic, chip shortage, and logistics crisis have actively promoted innovation and created change in the aforementioned companies. They have seized market opportunities to expand their scope of operations and increased their overall competitiveness, all of which have been key for enterprise operations to be recognized by the capital market. But what models have the industry set up to evaluate a company's operational direction and strategic plans? What type of inspiration can it bring to the market? That is what this article explores.

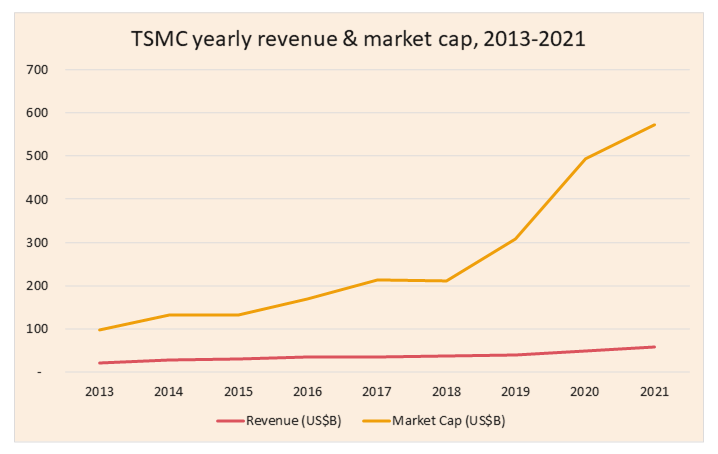

TSMC's market capitalization reaches new highs

TSMC's annual revenue in 2021 reached NT$1.59 trillion (US$57.34 billion) for a year-on-year (YoY) increase of 18.5% and more than 20% in USD, a record high. Additionally, its market capitalization exceeded NT$17 trillion. Although stock prices remained steady throughout the past year, prices soared at the beginning of January 2022, resulting in a sharp rise in market capitalization.

At the conclusion of its investor conference, TSMC solidified its status as the leading global chip foundry. Despite the prospect of declining post-pandemic demand, the company's continuous revenue increase in the first quarter of 2022, annual growth target of 30%, and plan to increase compound annual growth rate (CAGR) in the coming years, adjusting it up from 15% to 15%-20% in USD, show that it remains highly optimistic.

TSMC is confident that 2022 will be another year of strong growth for them. It estimates the annual growth rate of the semiconductor market (not including memory) to be around 9% and the annual growth rate of the wafer manufacturing industry to reach nearly 20%. TSMC believes it will exceed the annual growth rate of the wafer manufacturing industry, expecting its annual growth rate to be as high as 25%-29% in USD.

Dominance in advanced process technologies is what drives TSMC's growth, particularly in 7nm and smaller advanced processes, where it accounts for more than 90% of the market and takes all customer orders except for Samsung. TSMC also holds the leading global wafer foundry position, accounting for more than 50% of the market.

Mass production using TSMC's 3nm process will start in the second half of 2022. In addition to securing a large order from Apple, it has also welcomed new orders from Intel and other customers. TSMC is currently making plans for 2nm and 1nm advanced processes.

TSMC maintains its leading position in advanced processes and continues to make further advancements, rapidly raising the bar for wafer foundry technology and setting a high standard for funding.

Compiled by DIGITIMES, Jan 2022

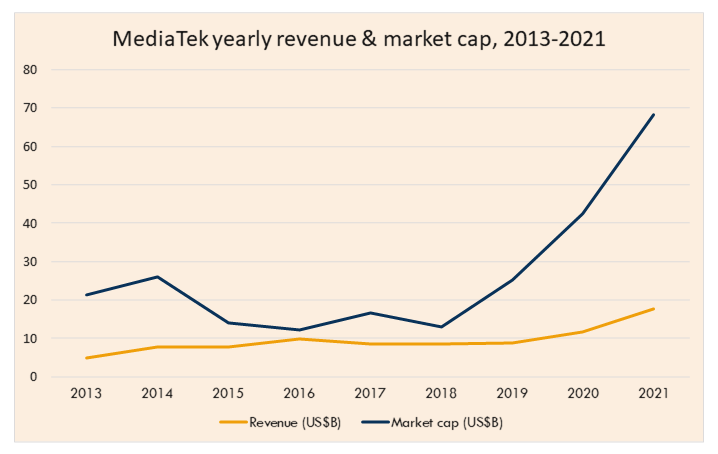

MediaTek leads with strong IC design

The core advantages of Taiwan-based IC design leader MediaTek are its 5G mobile phone SoC design capabilities, its complete AIoT product line, and, most importantly, its leading low-power technology. In the coming Internet of Everything era, all terminal edge products must be able to handle heavier computing and transmission tasks — reducing power consumption and heat generation will be pivotal.

MediaTek's SoC market share is rising steadily and its power consumption performance is better than that of its competitor Qualcomm. Rick Tsai, CEO of MediaTek, stated that MediaTek will be the market leader in low-power performance for the next 10 years.

Looking ahead to 2022 and beyond, the Dimensity 9000, MediaTek's flagship mobile phone SoC, has received positive feedback and is expected to gain market share in the flagship mobile phone market. The long-awaited new millimeter wave (mmWave) SoC product is expected to ship in the second quarter of 2022, with mobile phones using the new SoC expected to launch in the third quarter.

In terms of the non-mobile phone sector, MediaTek's main Wi-Fi chips have caught up with market-leading groups and many Wi-Fi 6/6E products are expected to be released in 2022. Competitors are also expected to start launching new Wi-Fi 7 products in order to expand their shares of the Wi-Fi chip market.

MediaTek emphasized that as long as 5G and HPC trends remain stable, MediaTek will be able to maintain steady growth in the coming years. The company's 2022 revenue target is to exceed US$20 billion. Based on current circumstances, it is very possible MediaTek will reach this goal.

Compiled by DIGITIMES, Jan 2022

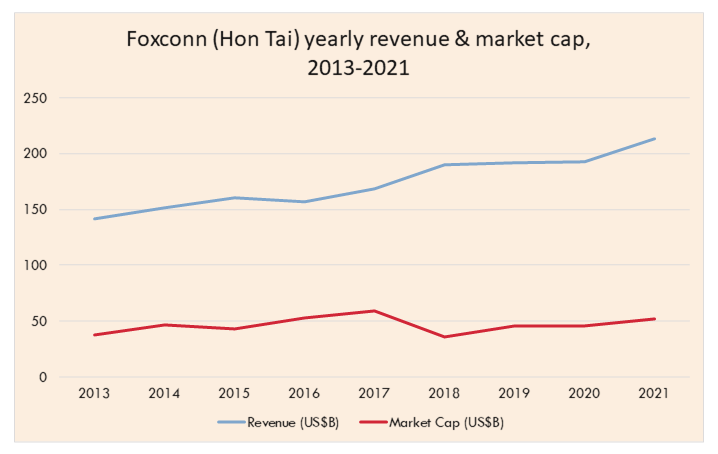

'3+3' is the cornerstone to Foxconn's next step

Consolidated revenue for Foxconn in 2021 reached NT$5.93 trillion, for on-year growth of 10.8%. For companies that have already surpassed the NT$1 trillion mark, maintaining a high degree of growth year after year is no easy feat.

Despite the COVID-19 pandemic, Foxconn has been able to continue growing due to continued demand for ICT and consumer electronics products in the end markets, its extended global production layout, and its grip on its upstream and downstream supply chains. This allows Foxconn to minimize the impact of material shortages.

In addition to maintaining stable growth, Foxconn is also shifting to a "3+3" industry development strategy and continues to deploy in the electric vehicle (EV) and semiconductor sectors. In regard to its development in the EV industry, Foxconn is using standardization, modularization, and platform-based methods to create a new business model. At the same time, in order to maintain its leading position, Foxconn is actively investing in the research and development of new technologies.

Although Chinese companies have been catching up in recent years, Foxconn still has the upper hand in terms of global deployment, production capacity, and accumulated practical experience. In the short term, it will be difficult for competitors to take them on. In the mid-to-long term, Foxconn will have to seek development in new industries in order to maintain growth.

Foxconn's "3+3" strategy and development goals cover three major industries (EVs, digital health, and robotics) and three new technologies (artificial intelligence, semiconductors, and next-gen ICT). Within this strategy, Foxconn already has plans for EVs and semiconductors. If related benefits unfold according to plan, it will positively benefit Foxconn's mid-to-long-term transformation.

Compiled by DIGITIMES, Jan 2022

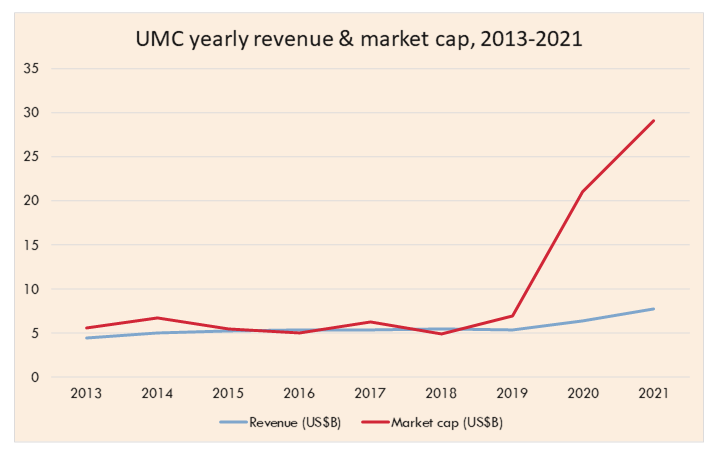

UMC overcomes years of lows with new highs

UMC, a major wafer foundry, performed well in 2021 and posted a new record in the fourth quarter, with December 2021 revenue surpassing NT$22 billion for the first time. Annual consolidated revenue for 2021 reached NT$213.01 billion for YoY growth of 20.47%, setting a new company record and pushing stock prices to new highs. The company's market capitalization also increased significantly.

In terms of global wafer foundry competition, TSMC previously took home the bulk of the profits, while profits of other companies were meager, including UMC who in recent years has exited the advanced process arena.

Because of the COVID-19 outbreak at the beginning of 2020, the housing economy and related demands soared unexpectedly. Wafer foundry production capacity found itself in a supply shortage and in the fourth quarter of 2020 UMC took the initiative by raising foundry prices. Their decision to increase prices quarterly has driven the semiconductor industry to raise prices, causing gross margins, revenue, and profits to soar.

In response to strong demand from customers, UMC announced a NT$100 billion investment plan to expand production of its 12-inch fab in the Southern Taiwan Science Park. It also announced it as obtained long-term agreements, including agreements on production capacity, from several major chipmakers.

Looking ahead, UMC expects demand will remain high. The production capacity utilization rate for its 8-inch and 12-inch fabs will remain fully loaded. At the same time, gross margin will continue to grow. The current industry cycle provides UMC with a good opportunity to strengthen customer relationships, improve technology competitiveness, and expand production capacity, thereby improving UMC's market position.

Compiled by DIGITIMES, Jan 2022

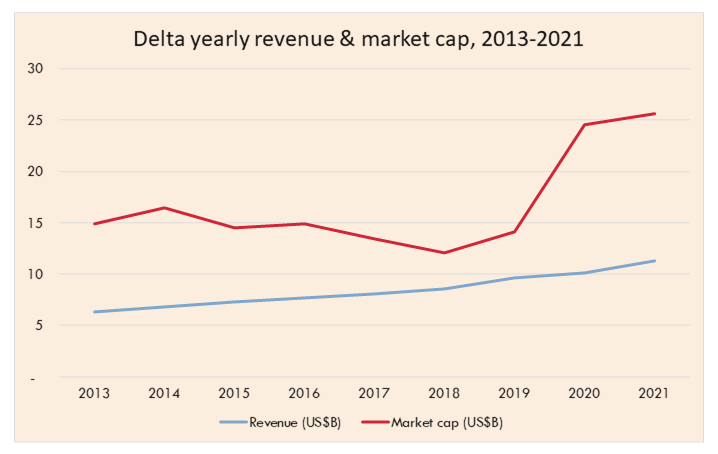

Delta Electronics sets the example for ESG

The global pandemic has led to the rise of many remote application services. Delta Electronics, the world's biggest power supply manufacturer, shifted resources to meet these needs. Market demand for consumer electronics and servers remained steady, which not only allowed Delta to do well in 2021 but also laid a foundation for growth in 2022.

Delta's consolidated revenue for 2021 amounted to NT$314.7 billion for a YoY growth of 11.3%, which not only set a new 15-year record but is also the tenth year in a row of growth.

Delta has been actively expanding from core electronics technologies to systems integration services in recent years, focusing on industrial automation and infrastructure. Delta is currently divided into three business segments: power supplies and components, automation, and infrastructure. The power supply and components section includes four business groups: components, power supplies and systems, automotive electronics, and fans and heat dissipation processing. The infrastructure segment includes ICT and energy, while the automation section includes industrial automation and building automation.

To develop its energy business, Delta is actively moving toward a complete energy business layout, from power generation and storage to improving energy efficiency, even investing in the EV industry. Short-term growth will still be driven by data centers, 5G applications, and automation products. There is potential for EVs to become the focus of mid-to-long-term development.

The explosive growth of the EV industry will be a development advantage for Delta, which has already successfully competed against US and European automakers and occupies a portion of the global charging station market.

In regard to infrastructure, the ICT side is optimistic about new US infrastructure plans. The US's plans focus on 5G-related needs, and increase the capital expenditure for large data centers, which will drive demand for 400G switches and data centers. Additional energy plans focus on EV charging stations, renewable energy, and energy storage. Delta can provide complete solutions for energy generation (solar energy inverters and wind power converters), energy storage, and user devices.

For the automation business, along with the accelerated penetration of 5G and Internet of Things (IoT), businesses are bound to invest more into production line automation. Furthermore, the popularization of EVs has resulted in fast-charging stations being built in ordinary buildings, which has resulted in increased demand for indoor lighting control to be integrated with building automation.

Compiled by DIGITIMES, Jan 2022

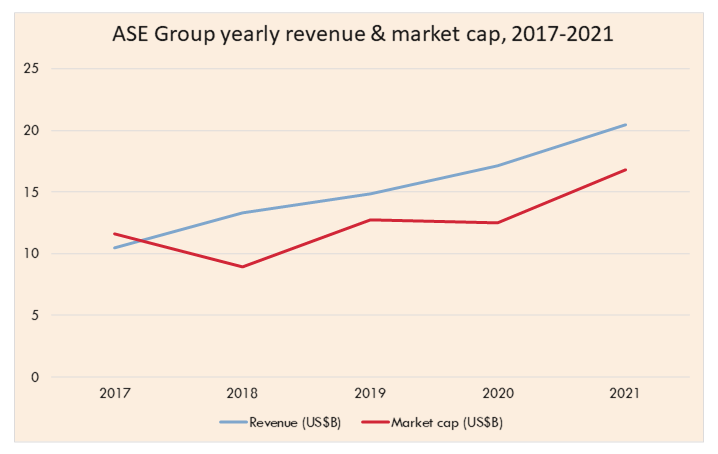

ASE creates synergy by integrating group resources

ASE Technology Holding Company, together with its subsidiaries ASE, Siliconware Precision Industries (SPIL), and USI, has effectively integrated the group's resources to develop synergies. Through forward-looking technology R&D and detailed awareness of industry trends, ASE Technology Holding will strengthen the multiplier effect brought on by systems integration innovation for the digital smart application era driven by 5G, as well as provide competitive miniaturization, and highly efficient, highly integrated technology services. The holding company, by integrating the resources of its different business entities, will continue to combine upstream and downstream supply chain partners to further strengthen technological innovation. The holding company will use the most effective method to reduce operational risk, improve competitiveness to seek win-win situations, and ensure continual growth of the industry chain.

The heterogeneous integration technology developed by ASE integrates electronic components originally manufactured and assembled separately into a system-in-package (SiP). Heterogeneous integration is the key to systems integration development. Not only can it greatly reduce signal delay and energy consumption, but it can also greatly improve bandwidth and performance.

Shifts in market demand and the 5G era have accelerated the development of ASE Group's smart manufacturing and Industry 4.0. In recent years, the group has used the three main axes of automation, highly heterogeneous machine and equipment integration, and highly heterogeneous microsystem packaging integration to promote digital transformation in factories. In 2020, ASE completed the installation of smart manufacturing equipment in 18 smart factories around the world. ASE believes smart factories represent the future of the industry. It will continue to use AI, big data, and smart automation to realize comprehensive digital transformation.

Looking forward, ASE Group COO Tien Wu pointed out that ASE invested about NT$175 million to set up its first smart factory in 2016, but by 2021, the group had 27 smart factories, which accounted for 10% of the group's total production capacity and cost an average of NT$60 million each.

Compiled by DIGITIMES, Jan 2022

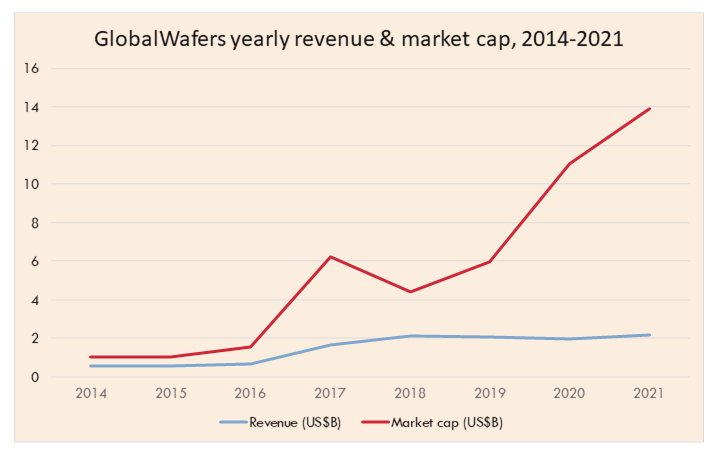

GlobalWafers aims for second in world's top 3 silicon wafer fabs

GlobalWafers' proposed offer of 3.75 billion euros to acquire the German firm Siltronic is set to expire at the end of January. At present, the deal has not yet passed anti-trust regulatory review by competent authorities in China; however, recent market reports note that China is satisfied with the deal and is expected to approve it.

What makes GlobalWafers stand out is its 15 factories in nine countries. The successful merger and acquisition (M&A) of Siltronic will bring those numbers to 19 factories in 11 countries. GlobalWafers will become the world's second-largest semiconductor silicon wafer fab, behind Japan-based Shin-Etsu. Siltronic is actively building a new plant in Singapore, which will strengthen GlobalWafers' future supply power.

However, if the M&A is unsuccessful, GlobalWafers will remain number three in the world. It will continue with its newly expanded production capacity. Subsequent new production expansion plans are expected to be followed up for assessment. Since GlobalWafers is already a member of the RE100, the group has been investing in solar energy for over 10 years and can be considered an ESG pioneer.

Semiconductor silicon wafer materials account for less than 5% of a wafer foundry's costs. Therefore, the focus is put on technology, product quality and stability, which must obtain the approval of wafer fabs and customers. This is a high threshold for new entrants. As a result, the most direct beneficiaries of growing end requirements are well-established silicon wafer fabs such as GlobalWafers and Japan-based Shin-Etsu and Sumco.

The semiconductor industry has entered a new supercycle that is no longer driven by the popularization and growth of computers and mobile phones, but the new demand from the aforementioned emerging industries. The semiconductor production capacity shortage and competition among various industries were pushed to the forefront in 2021. Coupled with geopolitical issues and trade wars, economic regionalization has become a trend. Countries are viewing semiconductors as a national strategic resource and making plans to achieve a certain degree of self-sufficiency in semiconductor manufacturing.

Formerly, production expansion of the silicon wafer upstream used to be carefully evaluated. Currently, downstream customers are eager to expand production and are now concerned newly opened production capacity will face material shortage issues. There was a rush to sign agreements with silicon wafer fabs in 2021, and they were urged to expand production and began planning. However, plans for newly expanded global wafer production still do not meet projections of increasing new demand.

Compiled by DIGITIMES, Jan 2022

A bright future for Taiwan's top 7 companies

Analysis of the competitive strategies of the top 7 companies in Taiwan by market capitalization reveals that digitization, AI implementation, optimization, improvement of professional talent, and CSR implementation are the basis of their core competitive strengths. In addition, these companies are mainly focused on semiconductors, third-generation semiconductors, HPCs, 5G/6G high-speed transmission, future cars, and green energy, all of which are in line with the development trends of popular industries today.

To stand out within the industry, a company must master internal core resources and technologies, be a leader in innovation, and integrate external industrial clusters and resources. Even though the population of Taiwan is small and the appetite in the domestic market is lacking, the problem is that its place within the global industry value chain is mostly concentrated in the low-value manufacturing business sector.

For example, the global nature of TSMC and Foxconn gives them an advantage in global logistics, foundry services with added value upgrades, and customer satisfaction. This allows the companies to play leading roles in technology and manufacturing, as well as establish themselves as the most reputable, service-oriented providers seeking the best interests of their customers. This is also the biggest competitive advantage the aforementioned companies have in their respective industries.

Using the "Diamond Theory" proposed by Michael Porter to deconstruct national competitiveness, as a result of Taiwan's inherent flaws such as insufficient land and labor, Taiwan-based businesses invested in China and Southeast Asia in the early years. At the same time, they carried out global expansion to adhere to the requirements of major international brands.

However, changes in international affairs, such as the US-China trade war and tariff agreements between different regional economies, and the rapid rise of similar quality manufacturing from South Korea and China have gradually reduced the advantages of industrial cluster structure and peripheral support Taiwan once enjoyed. When drawing up operational strategies, companies can no longer only pursue maximization of corporate interests. Now, they must adjust their policies to the new situation and carry out new investments that conform with government policies.

In terms of industry, in addition to actively seeking vertical and horizontal development opportunities in different sectors, the strengthening of new industrial competitiveness through organizational change and the introduction of new business models are also top priorities. If relevant government units institute more forward-thinking policies, it will help companies grow by strengthening infrastructure, the quality of the labor force, and regional alliances. If the government can do this, it is believed Taiwan's industrial development could be even more powerful, achieving greater effects in a short time.

Editor note: DIGITIMES Asia released the "Asia Supply Chain Market Cap 100 Ranking," based on market capitalization data of listed companies that engage in manufacturing activities in the Asia supply chains with the cut-off date set on December 31, 2021.