Table 1: Key factors affecting the 4Q21 and 1Q22 China smartphone industry (supply)

Table 2: Key factors affecting the 4Q21 and 1Q22 China smartphone industry (demand)

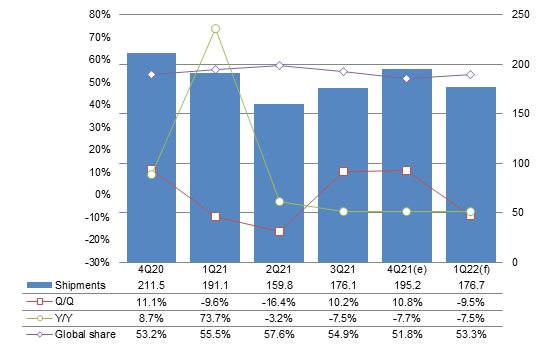

Chart 1: China smartphone industry shipments, 4Q20-1Q22 (m units)

Chart 6: China smartphone industry's export shipments, 4Q20-1Q22 (m units)

Chart 7: Export shipments by Chinese vendor, 4Q20-1Q22 (m units)

Introduction

According to Digitimes Research's statistics and analyses, China-based smartphone brands shipped a total of 195 million phones in fourth-quarter 2021 as they aggressively ramped up shipments in the traditional high season in an attempt to make their whole-year target.

The volume represented a 10.8% growth from a quarter ago. However, compared to the level seen in the corresponding period of 2020, despite the year-end holiday demand in overseas markets and e-commerce promotions during shopping festivals such as Singles' Day, the volume still declined 7.7% amid the weakening market demand in China, the lingering chip shortage and vendors no longer making active efforts to grab Huawei's lost market share.

Looking into first-quarter 2022, with overseas markets entering the traditional low season and the outlook for festive sales during the Lunar New Year holidays being clouded by the weak economy, China-based smartphone brands are expected to focus efforts on depleting their inventory and their shipments are estimated to decline 10% from the prior quarter.

In terms of fourth-quarter 2021 shipments by China-based smartphone brands, Xiaomi, Oppo and Vivo were able to maintain shipment momentum driven by inventory preparation for the high season. Oppo and Vivo enjoyed a double-digit sequential growth while Xiaomi exhibited an 8.5% sequential growth due to a higher base period. The three vendors together shipped 123 million phones, representing 63.3% among the total shipments by China-based brands, a slight increase from their share of 62.7% in the prior quarter.

Although Huawei continued to ship phones powered by Qualcomm's exclusive version 4G chips while launching multiple new affordable 4G phones based on its existing stock of MediaTek processors, with 80% of the phones sold in China being 5G enabled, Huawei's shipments kept weakening in fourth-quarter 2021.

Honor, on the other hand, enjoyed continuingly growing shipments quarter after quarter. Its fourth-quarter 2021 shipments not only stood firmly above the 10-million-unit level but also set a new single-quarter high since it started to operate as an independent brand. Transsion was able to maintain a strong shipment momentum with its outstanding supply chain management. It delivered over 20 million phones in fourth-quarter 2021, putting it very close to the whole-year shipment target set in early 2021.

Lenovo performed brilliantly thanks to brisk festive sales in North America. Despite the chip shortage, its fourth-quarter 2021 shipments still reached a new high since fourth-quarter 2017, putting it neck and neck with Honor. The other tier-2 and smaller brands also benefited from the high season demand and maintained sequential shipment growth but they were still plagued by the component shortage and rising costs.

For first-quarter 2022 outlook, based on the surveys conducted on the supply chain, Digitimes Research thinks China-based smartphone brands' shipments will return to reasonable levels as they take into account the weak phone upgrade momentum as well as the traditional low season and thus will not keep aggressively stocking up on components and ramping up shipments to grab market shares without considering actual market demand as they did fourth-quarter 2020 through first-half 2021.

Accordingly, China-based smartphone brands' first-quarter 2022 shipments are estimated to decline 9.5% from the prior quarter and 7.5% from the prior year. For whole-year 2022 outlook, China-based smartphone brands will ship more phones in the second half than the first half, delivering the usual seasonal performances as in years past.

Key factors affecting China's smartphone industry

Supply: 4Q21 and 1Q22

On the manufacturing side, the worsening chip shortage still curtails smartphone shipment growth but new processors entering the market helps narrow the supply-demand gap.

The tight supply of 4G smartphone application processors (AP) continues to limit shipments by Xiaomi, Oppo and Vivo in overseas markets. Although Qualcomm and MediaTek no longer require the bundling of 4G AP and system PMICs and China-based brands have also begun to largely use domestically produced PMICs, there is still little improvement to the shortage due to the scarce supply.

With increasing use of AMOLED display panels, OLED display driver ICs (OLED DDI) which are produced on the 40nm/28nm node with the tightest capacity continue to be in shortage.

New Realme phones equipped with Unisoc's 4G chips were launched in late third-quarter 2021 and the shipments were ramping up in fourth-quarter 2021, which helped filled the 4G phone supply-demand gap on the market.

Huawei launched new foldable 4G flagship P50 Pocket but its shipments were mainly driven by the sales of the entry-level and mid-range Nova and Enjoy series. Due to the chip supply issues and weak 4G phone demand in China, Huawei's shipment volume remained small.

Honor introduced the entry-level and mid-range X and Play series in fourth-quarter 2021 while featuring the mid-to-high-end Honor 60 at year-end 2021, which successfully pushed its shipments to a new high.

In fourth-quarter 2021, Xiaomi enjoyed growing shipments driven by brisk inventory preparation demand in overseas markets. However, it offered the deepest promotional discounts during Singles' Day among smartphone brands in view of the strong competition from Honor as well as a high inventory level, indicating Xiaomi was trying as hard as it could to deplete its inventory.

Oppo and Vivo both saw their shipments on the rise as they actively marketed multiple new affordable phones to capture the high season demand.

Transsion's fourth-quarter 2021 shipments reached the peak for the year as it enjoyed brisk year-end shopping demand in its target markets including South Asia and other emerging countries.

Lenovo continues to take over LG's lost market share. Its outlook is promising despite the component shortage and its shipments are expected to trend upward.

Tier-2 brands and white-box vendors aggressively ramped up shipments in preparation for the high season but were still plagued by the component shortage and rising costs.

Source: Digitimes Research, January 2022

Demand: 4Q21 and 1Q22

China market

E-commerce operators attempted to spur consumer spending with strong shopping festival campaigns and smartphone brands were actively cooperating by offering deep discounts in hopes of stimulating buying interest. However, lackluster sales actually made little contribution to shipment increase.

With limited help from Lunar New Year holiday gift buying, the market is expected to still experience weak demand going into first-quarter 2022.

As Apple's strategy to feature enhanced spec without price increase for iPhone 13 generated effects and old iPhone 12 models after discounts still enjoyed stable demand, China-based brands felt the squeeze on their shipments to the domestic market.

Negative macroeconomic factors on top of the China government cracking down on cram schools and Internet companies set consumer confidence in low gear.

Overseas market

Economic recovery was on track in markets abroad and year-end shopping demand effectively spurred shipments.

Amid multiple negative factors including skyrocketing raw material costs on top of container shortage, port congestion and labor shortage leading to logistics problems, the world is plagued by rising inflation, which will take a heavy toll on consumer spending.

Source: Digitimes Research, January 2022

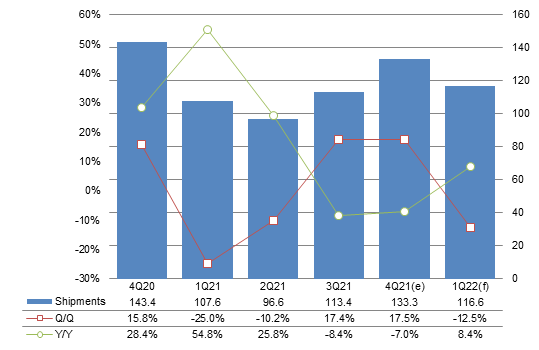

Chart 1: China smartphone industry shipments, 4Q20-1Q22 (m units)

Source: Digitimes Research, January 2022

Based on the statistics gathered from surveys Digitimes Research conducted on the supply chains in Taiwan and China, thanks to inventory preparation demand in the high season, fourth-quarter 2021 smartphone shipments by China-based vendors increased from the prior quarter level, amounting to 195 million units.

Singles' Day and Christmas promotions enabled fourth-quarter 2021 shipments to maintain growth momentum, climbing 10% sequentially. However, the lingering component shortage curtailed Xiaomi's, Oppo's and Vivo's shipment momentum that they ramped up to grab Huawei's lost market share, causing fourth-quarter 2021 shipments to decline 7.7% from the level seen in the corresponding period of last year

Apple's aggressive pricing strategy successfully spurred its shipment growth in fourth-quarter 2021 while Samsung was able to gradually recover from the slump arising from disruptions to its production in Vietnam. As a result, the share of China-based brands' smartphone shipments among the global total fell to 51.8%, the lowest since the post-pandemic recovery starting second-quarter 2020.

China-based vendors are expected to ship a total of 176 million phones in first-quarter 2022, down nearly 10% quarter-over-quarter and 7.5% year-over-year mainly as markets at home and abroad enter a traditional low season and the domestic demand shows no sign of improvement.

Shipment breakdown

Vendors

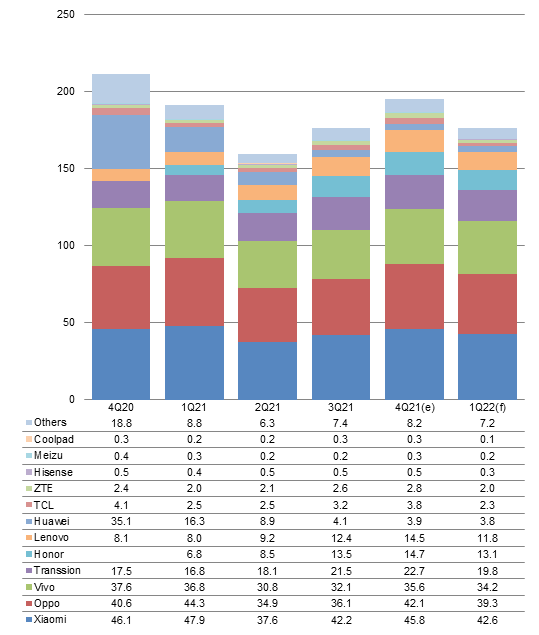

Chart 2: Shipments by Chinese vendor, 4Q20-1Q22 (m units)

Source: Digitimes Research, January 2022

The top four China-based vendors in terms of fourth-quarter 2021 shipments remained Xiaomi, Oppo, Vivo and Transsion. Honor was slightly ahead of Lenovo to rank No. 5.

Huawei's shipments fell below four million units. Digitimes Research expects Huawei to maintain shipments in the range between three million and four million units per quarter throughout 2022 with continuing access to Qualcomm's 4G chips to hold on to its market visibility.

Honor's shipments stayed above the ten-million-unit mark to come to 14.7 million units in fourth-quarter 2021, a new single-quarter high since it began to operate as an independent brand.

In fourth-quarter 2021, Honor successfully marketed the mid-to-high-end Honor 60 series to extend its shipment momentum while strengthening its offerings across all price ranges with X30, Play 5 Vitality Edition and other entry-level and mid-range phones.

In fourth-quarter 2021, Xiaomi, Oppo and Vivo all exhibited weaker shipment momentum compared to first-quarter 2021 as their Singles' Day promotions failed to significantly spur buying interest and they faced strong competition from Apple's aggressive pricing strategy.

Xiaomi's fourth-quarter 2021 shipments amounted to 45.8 million units. Xiaomi had been ramping up shipments for several quarters but began to turn conservative in the face of the component shortage as well as a rising channel inventory level.

Oppo's (including its subsidiary brands Realme and OnePlus) shipments climbed to 42.1 million units in fourth-quarter 2021 thanks to not only the festive season demand in China but also the sales performance of entry-level and Realme phones in markets abroad.

Vivo shipped 35.6 million phones in fourth-quarter 2021. In an attempt to end the slump it was in since early 2021, Vivo focused efforts on boosting the shipments of phones in the low- and mid-price range including the Y and iQOO Z series.

In response to the weak domestic market demand and the rival smartphone brands' strategy to highlight cost-performance ratios, Vivo launched new Vivo T1 and T1x, featuring compelling cost-performance ratios for the first time.

Shipping 22.7 million phones, Transsion was able to maintain growth in fourth-quarter 2021 and ship 79.1 million phones in 2022, setting a new record of whole-year shipments in the company's history. Digitimes Research expects Transsion's shipments to stay above 20 million units every quarter throughout 2022 as it maintains good supply chain management and strengthens its established presence in the market of feature phone to smartphone upgrades.

After LG exited the market, Lenovo continued to take over LG's market shares in America, buoying its fourth-quarter 2021 shipments to 14.5 million units, the best performance since third-quarter 2017.

Going forward into first-quarter 2022, although new flagship phones are scheduled to debut in first-half 2022 and there will be Lunar New Year holiday promotions to stimulate market demand, overseas markets will enter low season, there will be fewer working days and China's domestic demand will remain weak. As such, China-based brands are expected to make conservative shipments. Xiaomi, Oppo and Vivo are set to experience both on-quarter and on-year shipment declines.

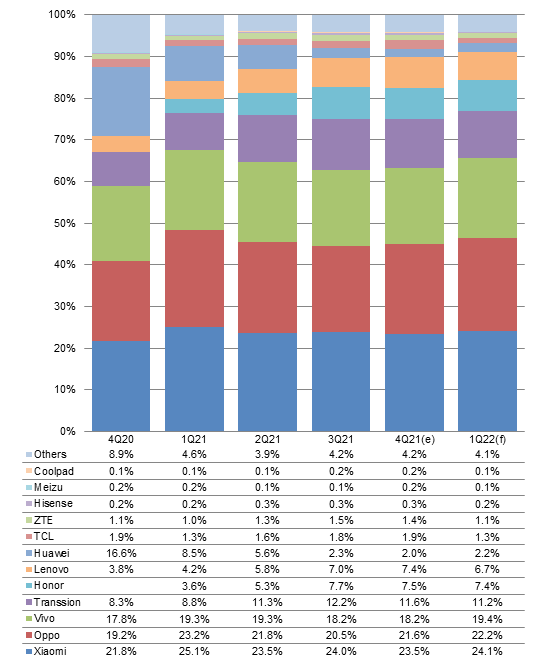

Chart 3: Shipment share by Chinese vendor, 4Q20-1Q22

Source: Digitimes Research, January 2022

The top three brands (Xiaomi, Oppo and Vivo) represented 63.3% of the phones shipped by all China-based vendors in fourth-quarter 2021, expanding moderately from their 62.7% share in the prior quarter. This indicates amid a saturating market, large brands with competitive advantages can hold tight to their market share.

With its share among China-based brands stabilizing at around 2%, Huawei receded to a tier-2 brand.

Honor's fourth-quarter 2021 shipments maintained at a similar level to the prior quarter, showing its efforts toward overseas market had yet to generate results, which weakened the growth in Honor's share among China-based brands.

Lenovo's share among China-based brands increased moderately while Transsion's decreased, indicating the year-end shopping demand in North America and Latin America was somewhat stronger than that in Africa and South Asia.

Going forward into first-quarter 2022, the top three China-based brands Xiaomi, Oppo and Vivo will account for 65.7% of the phones shipped by all China-based vendors, surging 2.4 percentage points sequentially. Honor will maintain a similar share while Lenovo may see its momentum weaken amid the traditional low season in overseas markets.

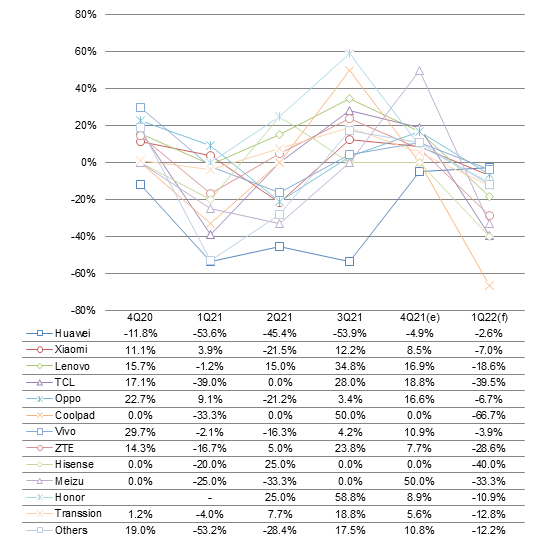

Chart 4: Q/Q shipment growth by Chinese vendor, 4Q20-1Q22

Source: Digitimes Research, January 2022

With the exception of Huawei, the other China-based smartphone vendors all enjoyed sequential growth in fourth-quarter 2021 shipments. Among tier-1 brands, Lenovo exhibited the largest sequential growth.

Xiaomi's sequential growth came to 8.5%, lower than the growth of Oppo, Vivo and Honor, as Xiaomi had been stepping up overseas shipments quarter after quarter, resulting in a higher base period.

Oppo's shipments increased 16.6% while those of Vivo climbed 10.9% from the prior quarter. Oppo marketed multiple phones equipped with MediaTek's 4G processors and Realme largely used Unisoc's 4G chips so the shortage of 4G processors somewhat mitigated. Aside from Oppo, Vivo also debuted a slew of phones based on MediaTek's 4G processors, which played a crucial role helping the smartphone brands strive for their whole-year shipment targets.

Lenovo had maintained over 15% sequential shipment growth since second-quarter 2021 to aggressively target LG users.

Benefiting from year-end shopping demand and the easing component shortage, tier-2 brands showed more significant sequential shipment growth on top of a low base period.

Looking into first-quarter 2022, with new phones contributing little to market demand recovery, tier-1 brands are expected to make conservative shipments and all China-based vendors are set to experience sequential declines across the board.

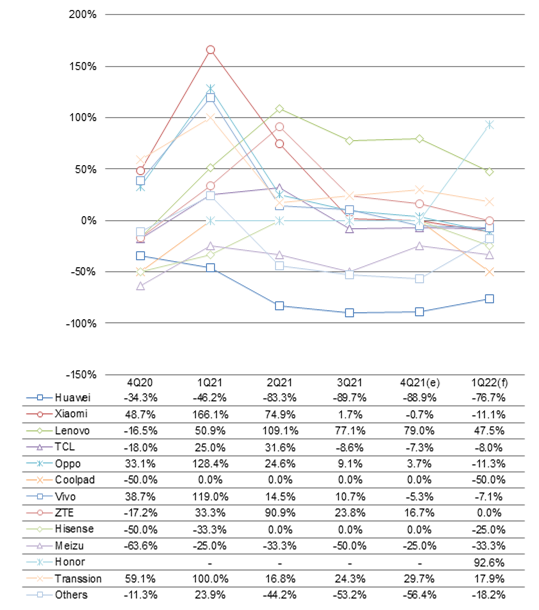

Chart 5: Y/Y shipment growth by Chinese vendor, 4Q20-1Q22

Source: Digitimes Research, January 2022

Tier-1 China-based brands led by Xiaomi and Oppo have divided almost all of Huawei's lost market share, giving rise to the lackluster annual growth in their fourth-quarter 2021 shipments. Lenovo and Transsion, on the other hand, both captured opportunities in their respective target markets and thereby delivered brilliant annual growth in their fourth-quarter 2021 shipments.

With its growth reaching the ceiling, Xiaomi experienced a slight on-year decline on top of a high base period.

Oppo's shipments increased 3.7% from a year ago as it largely boosted shipments in a desperate attempt to reach its whole-year target. This also posed concerns over a high inventory level that it will have to deplete going forward.

Vivo's shipments declined 5.3% from a year ago, indicating it was still plagued by the weak domestic demand while sustaining a more serious impact from the component shortage than Xiaomi and Oppo.

With Transsion's efforts toward emerging markets generating results, its fourth-quarter 2021 shipments soared 29.7% from the prior year level. The share of smartphone shipments among all of Transsion's phone shipments continued to trend upward.

Trying aggressively to win over LG users, Lenovo hoisted its shipments to North America and Latin America, showing over 70% annual shipment growth for three consecutive quarters.

Looking into first-quarter 2022, with Huawei's market share getting all divided and the distribution of market shares among China-based vendors stabilizing, weak phone upgrade demand and low season factors will result in a 10% on-year decline in the smartphone shipments by the top three China-based brands.

After operating as an independent brand for a year, Honor will see its single-quarter shipments double from a year ago.

Lenovo and Transsion will be able to maintain high annual increase with room for growth from the levels seen in the corresponding period of 2021.

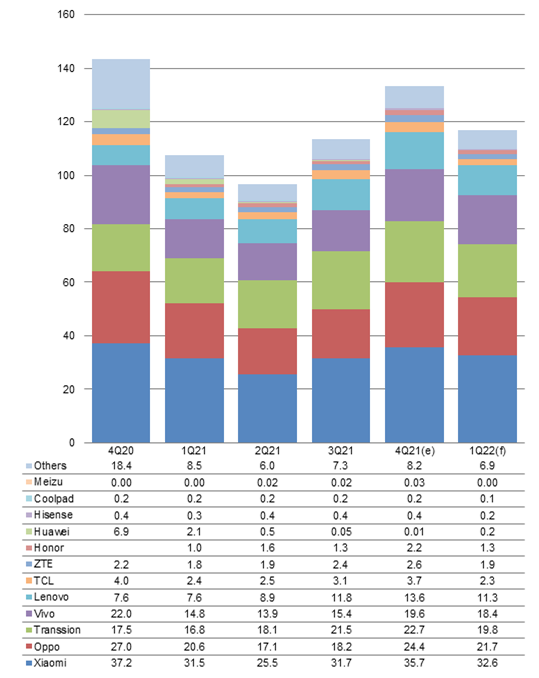

Exports

Chart 6: China smartphone industry's export shipments, 4Q20-1Q22 (m units)

Source: Digitimes Research, January 2022

Fourth-quarter 2021 overseas smartphone shipments by China-based vendors came to 133.3 million units, soaring 17% quarter-over-quarter. The volume was the highest single-quarter shipments for the year.

The top three brands Xiaomi, Oppo and Vivo made the most contribution to the sequential increase in overseas shipments by China-based vendors.

Compared to the corresponding period of 2020, the volume declined 7.4% mainly as the 4G chip supply was still tight and the market demand was quickly recovering after the COVID-19 situation mitigated in fourth-quarter 2020 (although there were several waves of COVID-19 resurgences in 2021), resulting in a high base period.

For first-quarter 2022 outlook, overseas shipments by China-based vendors are estimated to fall 12.2% sequentially amid the low season in overseas markets. However, on an annual basis, overseas shipments by China-based vendors are expected to increase 8.4% as China-based brands will no longer actively grab market shares in China as they did in early 2021 and therefore allocate more shipments to markets abroad to meet the 4G phone demand.

Chart 7: Export shipments by Chinese vendor, 4Q20-1Q22 (m units)

Source: Digitimes Research, January 2022

The rankings among China-based vendors in terms of fourth-quarter 2021 overseas smartphone shipments were Xiaomi, Oppo, Transsion, Vivo and Lenovo. The other China-based vendors' shipment volumes paled in comparison.

With more than 80% of the phones sold in China being 5G enabled, Huawei virtually has no room for survival. Huawei already undertook plans to make a comeback to overseas markets in fourth-quarter 2021, which is expected to contribute to its shipments starting early 2022.

Enjoying continuingly growing shipments to Europe and Latin America, Xiaomi saw its fourth-quarter 2021 overseas shipments reach a new high to come to 36.1 million units, up 13.9% from the prior quarter.

Oppo and its subsidiary brands Realme and OnePlus together shipped 24 million phones abroad, surging 31.4% from a quarter ago. Realme's performance in the entry-level segment was a key growth driver.

Vivo shipped 19.5 million phones abroad, up 26.9% from last quarter, as it tried to fill the supply-demand gap resulting from the chip shortage in the prior quarters.

Transsion's overseas shipments grew 5.6% sequentially to reach 22.7 million units, closely trailing behind Xiaomi and Oppo.

Lenovo's overseas shipments climbed 15.5% from the prior quarter. The volume was also a new record for the company's single-quarter shipments since fourth-quarter 2017.

Going into first-quarter 2022, most China-based vendors are set to experience a decline in overseas shipments amid the low season in markets abroad.

Xiaomi's and Oppo's overseas shipments will slide nearly 10% while Vivo's will dip 5.5% sequentially due to a lower base period.

Transsion and Lenovo, mainly targeting overseas markets, will experience a more than 10% sequential decline.

Chart 8: Export shipment share by Chinese vendor, 4Q21

Source: Digitimes Research, January 2022

With China's domestic demand showing no sign of recovery, tier-1 China-based brands' ratios of overseas shipments moderately increased in fourth-quarter 2021 as they prepared inventory for the high season demand abroad.

Xiaomi's ratio of overseas shipments climbed from 75.2% in the prior quarter to 78.9%, Oppo's climbed from 50.5% to 56.9% and Vivo's climbed from 47.9% to 54.8%, indicating that China's domestic demand was not improving.

In response to pressure from Apple and Honor, Xiaomi, Oppo and Vivo shifted focus toward overseas markets.