ESG reporting is not merely about numbers and data. It is also about storytelling. More particularly, communicating the company's values to investors, and being able to provide a holistic view of what the company does allow investors to make informed decisions on whether or not they want to invest in this company.

This article explores three ways to produce an insightful ESG report: contrast, constraint, and combination.

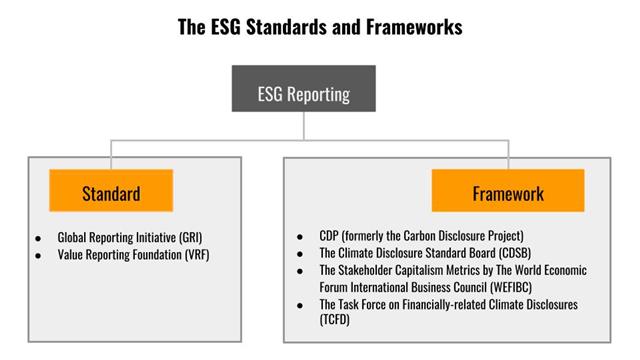

ESG Recipes: Standards and Frameworks

A chef will never make alphabet soup the same as another. Thus, each standard or framework has its own unique ingredients, with no two alike.

Currently, there are two types of organizations that set standards or frameworks for the provision of non-financial information: NGOs and mostly commercial entities such as data vendors, sustainability ratings companies, and company portfolios. This article discusses only five NGOs that set standards or frameworks.

They can be categorized int two groups: non-financial standard-setters in general - Global Reporting Initiative (GRI) and Value Reporting Foundation (VRF); and organizations focused on frameworks for climate disclosures - CDP, the Climate Disclosure Standards Board (CDSB), and the Task Force on Financially-related Climate Disclosures (TCFD).

Source: DIGITIMES, June 2022

The ESG metrics are often misunderstood, and it is important to glean insights into the definitions before we go any further.

A framework can be thought of being a home-cooked meals recipe. It is a set of guidelines and principles that provides some direction but doesn't cover the specifics. It is essentially a set of general principles that shape your thinking about a specific topic but doesn't go into great detail.

Standards can be thought of being a standardized recipe. It contains detailed criteria and metrics for what should be reported on each topic. Generally, there are a number of common qualities for corporate reporting standards: a public interest focus, independence, due process, and public consultation.

Three ways to develop an insightful ESG report

Contrast: Choose what best suits your company's needs

It is essential to study and understand the differences between different standards or frameworks. They enable you to choose what best suits your company's need, for example, audience, report focus, ESG focus and scoring.

Global Reporting Initiative (GRI): Not only is GRI the pioneer on sustainability reporting, but also it is the only standard-setter concerned with accountability for an organization's impact (i.e., positive and negative impacts) on the economy, environment, and people.

The GRI Standards respond to the material needs of all stakeholders, including investors.

The Value Reporting Foundation (VRF): The Value Reporting Foundation offers a collection of resources designed to help business owners and investors grasp the concept of enterprise value.

In November 2020, the International Integrated Reporting Council (IIRC) and the Sustainability Accounting Standards Board (SASB) announced their intention to merge into the Value Reporting Foundation, which was officially formed in June 2021.

These two organizations shared a goal of simplifying and increasing enterprise value, which is evident in the sources provided:

The source of Value Reporting Foundation (VRF) | |

Source | Description |

The Integrated Thinking Principles | Guide board and management planning and decision making |

The Framework | Provide principles-based, multi-capital guidance for comprehensive corporate reporting |

SASB Standards | A tool to inform disclosure to investors and guide investor decision making when embedded in investment tools and processes. |

Source: VRF, compiled by DIGITIMES, June 2022

CDP: CDP (formerly the Carbon Disclosure Project) is a not-for-profit organization. It manages a global environmental disclosure system used by more than 13,000 companies. Companies disclose by completing any or all three CDP questionnaires, including climate change, forests, and water security.

The CDP questionnaire provides an inclusive framework for companies to provide environmental information to their stakeholders. It includes governance and policy, risks and opportunity management, environmental targets and strategy, and scenario analysis.

If you are familiar with the TCFD reporting framework, you will notice that CDP aligns its questionnaires with the TCFD's recommendations. Why so?

CDP recognizes the important role of the TCFD in mainstreaming climate-related information and advancing the availability of financially relevant information for global markets.

The TCFD recommendations will ensure climate information is integrated into mainstream financial reports, providing transparency and a roadmap to meet the commitments of the Paris Agreement.

Thus, the CDP questionnaires have a greater emphasis on elements such as board oversight, climate risk management (including integration into a company's business planning processes), and the use of forward-looking scenario analysis to determine the resilience of a company's strategy to climate risks.

The Task Force on Financially related Climate Disclosures (TCFD): The G20 Finance Ministers and Central Bank Governors has asked the Financial Stability Board to establish an industry-led task force on climate-related financial disclosures, led by chair Mark Carney.

The mission of the Taskforce is to provide decision-useful, climate related information on risks and emerging issues in the financial markets.

Inadequate information about risks can lead to mispricing of assets and misallocation of capital that can potentially lead to concerns about the stability of financial markets, as they can be vulnerable to abrupt corrections.

Additionally, incorrect information about risks can hinder the success of an organization's transition plan. For instance, a time-bound action plan that clearly outlines how an organization will achieve its strategy to pivot its existing assets, operations, and entire business model towards a trajectory that aligns with the latest climate science recommendations.

Chaired by Michael Bloomberg, the TCFD's objective was to formulate a set of recommendations to help organizations understand and disclose their exposure to climate-related issues.

The TCFD was tasked with developing a set of voluntary, financially relevant, climate disclosure recommendations that could promote informed investment, credit, and insurance underwriting decisions that could in turn enable stakeholders to better understand assets exposed to climate-related risks.

Its objective is to enable stakeholders to allocate capital efficiently through the transition to a low-carbon economy without a potential dislocation of capital in the financial markets.

The TCFD's final report presents a principle-based set of recommendations for voluntary disclosure that aims to balance the needs of data users with the challenges faced by preparers. The report provides the overarching core recommendations with supporting information on climate-related risks, opportunities, financial impacts, and scenario analysis.

The Climate Disclosure Standard Board (CDSB): The CDSB Framework for reporting environmental and social information is designed to make it easier for organizations to prepare mainstream reports that are inclusive of environmental and social information. This information can benefit investors.

Released in 2010, the first CDSB framework focused on risks and opportunities posed to an organization's strategy, financial performance, and condition by climate change.

In 2015, after two public consultations, the CDSB Framework for reporting environmental and climate information was released.

CDSB Framework was updated in April 2018 to align with the recommendations of the TCFD and other key mainstream reporting requirements, helping to streamline the reporting cycle for many organizations

This version of the CDSB Framework has been expanded to include two new categories: social and environmental. Following public consultation, the CDSB Framework for reporting environmental and social information was released in 2022.

CDSB hopes that the latest version of framework provides conservation information on natural, human and social capital as a way of encouraging investors to make decisions that recognize the different dependencies between economic and financial stability on these types of assets.

A comparison of the ESG standards and frameworks | |||||

Standard/Framework | Description | Audience | Report Focus | ESG Focus | Scoring |

GRI | Set of standards used by companies to report the topics that are material to their business | All stakeholders | How business impacts on society | ESG | No |

The Value Reporting Framework (SASB & IIRC) | Industry-specific standards to help companies to select topics that may impact their financial performance | Investors | How ESG issues impact the business | ESG | No |

CDP | Disclosure of environmental information through questionnaires-ability to benchmark against peers and engage supply chain | All stakeholders | How business impacts on society | EG | Yes |

TCFD | Guidance for disclosing the impact of climate-related risk on your business | Investors and financial stakeholders | How business impacts the climate | EG | No |

CDSB | Framework for reporting environmental and natural capital information, closely aligned to TCFD | All stakeholders | How business impacts the climate | EG | No |

Constraint: Negative impacts might one day become a strength

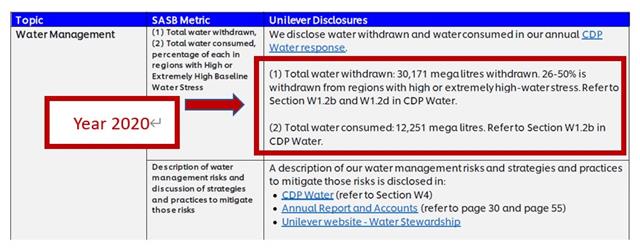

The SASB standards are designed to identify a minimum set of sustainability issues most likely to impact the operating performance or financial condition of the typical company in an industry, regardless of location.

The SASB has developed 77 industry-specific sustainability accounting standards. Each SASB standard describes the industry that is the subject of the standard, including any assumptions about the predominant business model and industry segments that are included.

According to SASB, companies in the household and personal products industry must supply information about water management in the following structure:

Sustainability Disclosure Topics | |||

Topic | Accounting Metric | Unit of Measure | Code |

Water management | *Total water withdrawn | *Thousand cubic meters (m3) | CG-HP-140a.1 |

Description of water management risks and discussion of strategies and practices to mitigate those risks | n/a | CG-HP-140a.2 | |

Source: Excerpt from the SASB, Consumer Goods Sector: Household and Personal Products, compiled by DIGITIMES, June 2022.

The below figure shows how Unilever discloses its water management information using SASB standards.

Source: Unilever's SASB Report p.1.

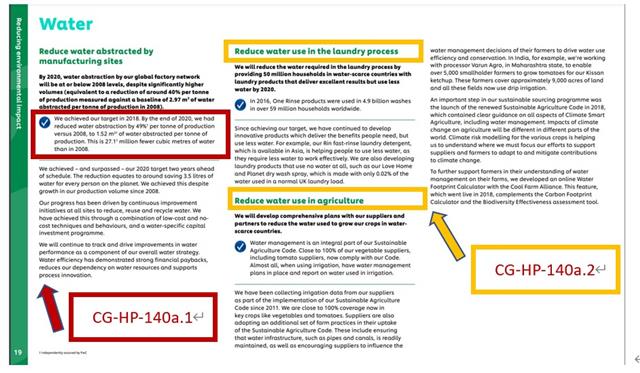

Achieving its target set in 2018, Unilever had successfully reduced water abstraction by 49% per ton of production versus 2008, to 1.52 m3 of water abstracted per ton of production, 27.1 million fewer cubic meters of water than in 2008.

Source: Unilever Sustainable Living Plan 2010 to 2020, p. 19.

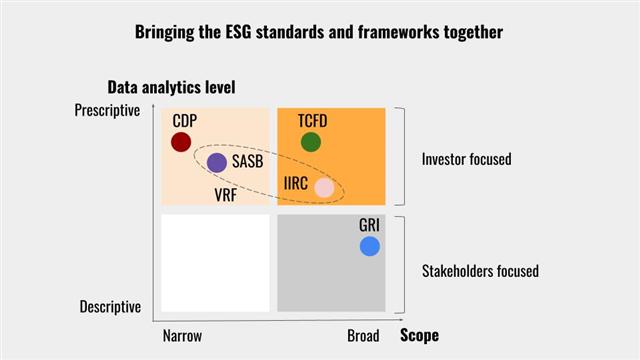

Combination: Bringing the ESG standards and frameworks together

Source: DIGITIMES, June 2022

True transparency is achieved by comprehensive reporting. This can be achieved by connecting a set of standards or frameworks to best elucidate your company's value to the stakeholders.

This idea is supported by Professor Ching-pin Tung, the CEO of the National Taiwan University Office of Sustainability. He said, "I think GRI, SASB, and TCFD might be the best combination, whereas the CDP questionnaire serves as a self-check tool." He has been researching and consulting about ESG reporting and how it pertains to climate change for his entire career.

GRI: The materiality principle can help you identify which company activities may affect the triple bottom line. It will also inform you about the impact your actions have on various aspects of stakeholders.

More specifically, GRI operates through a comprehensive and democratic approach including civil society, business enterprises, investment institutions, labor organizations, and mediating institutions in order to ensure the participation and expertise of diverse stakeholders in the developing world.

The latest GRI Standards consist of two categories, namely universal standards and topic-specific standards. The universal standards (101, 102, 103) and their associated disclosures are applicable to every organization adhering to the GRI framework.

Topic-specific standards, on the other hand, are divided into Economic (200), Environmental (300), and Social (400) categories. An organization's material topics will determine which topic-specific standards and associated disclosures are reported.

GRI outlines five steps for comprehensive stakeholder inclusiveness and engagement. They are benchmarking and gap analysis; identification and prioritization of various stakeholders; designing a stakeholder engagement plan; engaging your stakeholders; and collecting and analyzing information. This broad range of information benefits a company to describe and diagnose its impact.

TCFD: The TCFD is a useful tool for ensuring that governance, strategy, and risk management processes take account of climate change. To integrate climate considerations into your business, you need to understand what your company is currently doing and not doing in regards to climate action.

That's what a lot of the TCFD recommendations come down to - from surfacing the relevant data that you need to understand your current impact story and beginning a climate maturity journey.

Fully implementing the TCFD recommendations would result in some of your key departments being aware of and understanding climate change. They will consequently have to read up on the issues, impacts, and effects.

Engaging multiple aspects of your organization will help better address climate-related risks. Not only that but many hazards also have a financial impact that needs to be understood and accounted for.

The TCFD recommendations are not only about risk management but also about finding opportunities related to climate change. Part of being resilient in the face of climate change is understanding what opportunities come with it: for instance, going green.

The TCFD is always relevant as it aims to be up-to-date with the latest climate science. Organizations are disclosing their level of climate maturity but the TCFD does not review disclosures or provide judgments for organizations on which types of thresholds they should reach.

In this way, a company can make their claims and get a better understanding of what offers are available to them and how they can use the latest data for a more accurate decision.

CDP: Responding to the CDP questionnaires is a flexible, cost-effective way to track sustainability performance and show leadership in sustainability. For two reasons, one is to raise internal awareness and two is to reflect on changes.

One of the major risks in business is climate change and the decision-makers of your company need to be aware. CDP questionnaires provide an output to engage them and put them on their agenda. Also, the CDP questionnaire reflects changes in the sustainability reporting landscape and reflects accepted best practice in environmental sustainability reporting.

The CDP partners with various schemes that drive forward activity in sustainability such as the Science Based Targets Initiative and the RE100 initiative. Initiatives like these show that significant risk is being taken to address the challenges of climate change. Companies are able to pursue new opportunities by understanding what a constrained future might look like.

VRF: (Refer to the constrast section.) VRF, TCFD, and CDP - these three frameworks predict business impacts and will provide a prescription for sustainability and increased profits.

The ESG reporting needs creativity. The ESG standards and frameworks are based on a set of environmental, social, and governance (ESG) principles that are not always easy to apply.

There is no one-size-fits-all approach to the ESG reporting. It needs creativity to figure out how to apply the principles of the framework or standard to a specific company's situation. The same framework may be applied differently in two different companies with two different sets of circumstances.