Following the Taiwanese government's decision in late 2022 to procure five types of small and medium-size commercial-grade military reconnaissance drones from civilian manufacturers under the auspices of the Ministry of Economic Affairs, the contractors involved have declared success to have their prototypes delivered and passed military trials.

Noting the increasingly intact drone supply chain, Taiwan's Ministry of Defense will also on October 13 unveil its procurement strategy and spec requirement for commercial-grade military drones, seeking to get commercial contractors further involved in the country's military drone industry. As a domestic drone supply chain is taking shape, Taiwanese drone manufacturers have stepped up partnerships with overseas peers as a stepping stone into the global market, though the challenge remains to find a balance between sourcing indigenous solutions and mastering key drone technologies, such as motor and the electro-optical/infrared & communication payloads, and keeping the costs down.

According to publicly available sources, a total of 848 drones from the commercial-grade military drone program will be procured by the defense ministry in 2024. Back in September, contractors engaged in the program have also announced success in military trials, including Geosat Aerospace & Technology Inc., Coretronic Intelligent Robotics Corp.,Thunder Tiger Group, and Taiwan UAV.

In the same month, Geosat, widely deemed as a spearhead in Taiwan's drone industry, entered an agreement with UK-based Flyby Technology and its Turkish subsidiary FlyBLOS to acquire the technologies needed to volume produce and exclusively sell new variants of JACKAL multi-role attack drones in Asia-Pacific, with Flyby agreeing to offer payload solutions, testing, and production planning. Apart from Flyby, Geosat has also entered a similar partnership with France-based drone maker Cavok UAS. While the development certainly broadens the Taiwanese company's reach in market overseas, it remains to be seen if such cooperations will eventually lead Geosat to master more critical technologies.

In addition, though Taiwan's indigenous drone industry is taking off, few Taiwan-designed drones have seen actual combat. In this context, as Geosat founder and CEO Max Lo indicated to Business Today, it is crucial to cooperate with partners with combat experiences to quickly assimilate battle-hardened drone designs. The JACKAL drones, for instance, were already adopted by the British military. In return, Geosat can source from the Taiwanese supply chain and accelerate component procurement for its Western partners, especially as they seek a "China-free" supply chain.

Indeed, to build a drone free of China-sourced components and with a high proportion of Taiwan-sourced components, as required by the Taiwanese military, is deemed a major challenge by Geosat in an industry previously dominated by China with its cost advantage.

An indiginous supply chain is only part of the story

Geosat indicates that tens of Taiwanese suppliers have been recruited for its commercial-grade military drone project, and the foundation of an Electric Motor Technology Center (EMTRC) under Taiwan's National Cheng Kung University, in partnership with Geosat and multiple Taiwanese manufacturers like TECO and Ta Ya Electric Wire & Cable Co. represents a major milestone, as the final prototype is successfully equipped with an indigenous motor. The battery module in the prototype is also supplied by E-One Moli Energy Corp, a subsidiary of Taiwan Cement Corp.

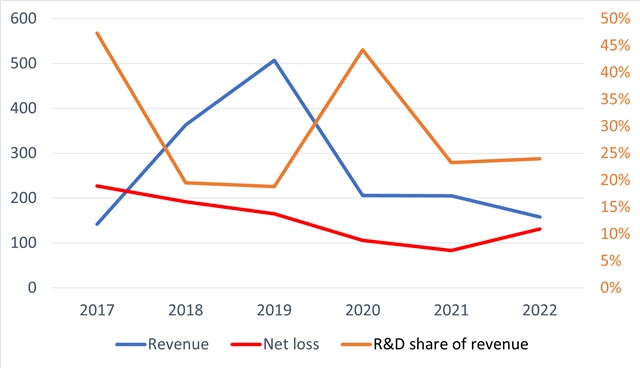

The supply chain put together in this process is expected to underpin Geosat's ambition to hit into the global drone market. As of 2022, however, 98.92% of Geosat's sales still come from the domestic market. In addition, though the defense sector is gradually increasing its share in Geosat revenue, rising from 18.2% in 2021 to 36.7% in 2022, showing the company's effort to orient its main focus onto commercial-grade military drones, profit margin in 2022 turned negative. Geosat partially attributed it to the rising costs of undertaking certain projects from NCSIST, Taiwan's state-owned defense contractor and military R&D institute, such as its Albatross II drones under development. The figure also shows cost to be a persistent challenge.

In July 2023, Geosat resumed trading on Taiwan's Emerging Stock Market (ESM) in a sign showing its optimism towards its drone strategy. The ESM is established for investors to trade unlisted stocks in a regulated environment, but with no review procedures similar to those for TWSE. Geosat was originally trading on the ESM in 2016, but ceased in September 2020 amid company strategic overhaul and persistent net loss. As annoounced by the company following the move, it aimed to improve revenue structure as well as profitability and expand overseas, notably in Southeast Asia, before seeking to resume trading on the ESM and ultimately pursuing IPO.

In the first half of 2023, Geosat's revenue was NT$49.6 million (US$1.61 million), but continues to see a net loss of NT$84.1 million. To qualify for Taiwan's Over-The-Counter (OTC) Exchange - an alternative securities exchange with lower listing criteria than the TWSE - or even for the TWSE itself, Geosat has to turn a profit first. Whether or not it can do so will be a key indicator for those watching over Taiwan's commercial-grade military drone sector.

Geosat revenue, net profit and R&D/revenue share (Unit: NTD million)

Source: DIGITIMES, based on Geosat annual report