While LEDs are widely regarded as the star lighting technology of tomorrow, OLED - another emerging new technology - is also playing an increasingly conspicuous role in next-generation lighting. This is chiefly because both LED and OLED are solid-state lighting technologies, and as such are likely to massively surpass the luminous efficacy (efficiency) performance of fluorescent lights in the relatively near future; moreover, they do not involve the use of mercury and are capable of meeting the requirments of next-generation lighting in terms of eliminating ultraviolet rays, improved color rendition and added light adjustability.

Only a tiny number of OLED lighting products are currently available on a commercial basis, largely because the technology has not yet been developed to the point where it can compete with other common forms of lighting in terms of luminous efficacy or luminous flux performance. OLED lighting panels currently achieve luminous efficacy of 35-66 lm/W, levels which are far from ideal in comparison to mainstream lighting technologies; the goal for future development is to increase this figure to a level comparable to other energy-saving light bulb technologies, that is a luminous efficacy of 80 lm/W and a luminous flux approaching 1,000lm.

OLED lighting is still very much a fledgling industry. In order to expedite its development, many major nations have launched OLED lighting development plans, examples of which include the United States' Department of Energy (DOE) R&D Plan and Roadmap, Europe's OLED 100.eu plan, and Japan's Next Generation SSL (solid-state lighting) Plan. In the following report, Digitimes Research describes in detail the OLED plans, targets and schedules of each country or region.

Digitimes Research has also followed the progress of several manufacturers that have already begun to launch commercial OLED lighting products on the market. Examples include Philips, Osram, Panasonic and Lumiotec - companies that are also the world's most proactive developers of OLED lighting. Consequently, this Digitimes Research report also provides a detailed overview of the route that each of the major OLED lighting manufacturers is taking in terms of development progress, technology, commercial products and future goals, as well as the likely impact on the future of the OLED lighting industry, costs and the size of the market.

Chart 1: Comparison of the features of next-generation LED and OLED lighting technologies

Chart 2: Luminous flux and luminous efficacy of various types of lighting

Table 1: Different manufacturers progress on OLED panel development (I)

Table 2: Different manufacturers progress on OLED panel development (II)

Chart 5: OLED panel material cost drops, 2012-2020 (US$/square meter)

Chart 6: Target and deveopment goals for the OLED 100.eu plan

Chart 8: Results of the OLED lighting development undertaken as part of the OLED 100.eu project

Chart 9: Developmental strategies for Japan’s next generation of lighting

Chart 14: Structure of OLED at Philips, with product designs

Table 5: Comparison of the efficiency and lifespan of OLED light-emitting materials

Table 6: Comparison of light extraction structure efficiency

Chart 15: Comparison of methods of increasing OLED extraction rates

Table 7: Philips' OLED efficiency and light extraction effects on performance

Chart 17: Philips has collaborated with Konica Minolta to jointly sell OLED lighting panels

Chart 22: Flexible OLED lighting products under development by Osram

Chart 23: Osram developing transparent OLED lighting using transparent electrodes

Chart 24: Timeline of Panasonic's development of OLED lighting

Chart 26: Conventional ways of increasing the efficiency of OLED lighting

Chart 27: Panasonic's method of delivering high-efficiency OLED lighting

Chart 28: Panasonic is using Tazmo's slit coating technology

Chart 30: Specifications of OLED lighting panels marketed by PIOL

Chart 33: Timeline of Lumiotec's development of OLED lighting

Chart 34: Lumiotec's volume production facility for OLED lighting panels

Table 9: Comparison of film production processes for OLED light-emitting materials

Table 10: Specifications of Lumiotec OLED lighting already on the market

Chart 35: Overview of standard OLED lighting panels from Lumiotec

Chart 36: Lumiotec's short-term goals for developing OLED lighting panels

Chart 37: Different manufacturers' start dates for volume production of OLED lighting panels

Chart 38: Lumiotec's plans for the OLED lighting panel business

Chart 39: Comparison of luminous efficacy of OLED and other lighting (lm/W)

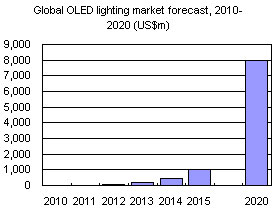

Chart 41: Global OLED lighting market forecast, 2010-2020 (US$m)