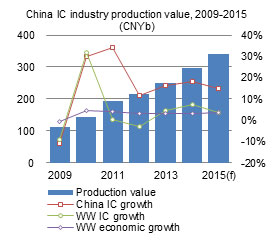

Global economic growth is forecast to reach 3.8% in 2015, up from 3.3% in 2014. From the perspective of the electronics industry though, PC shipments will continue to decline, smartphone shipment growth will drop, and tablet shipments may decline. Despite the gloomy outlook, Digitimes Research forecasts that China's IC industry output will reach CNY340.4 billion, up 15% annually. While the growth rate will be down from the 18% seen in 2014, it still represents a far better growth rate than the 3.6% annual growth rate of the global IC industry.

Chart 1: China IC industry production value, 2009-2015 (CNYb)

Chart 2: China IC design industry production value, 2009-2015 (CNYb)

Chart 4: China government support for IC industry during latter period of 12th FYP

Acquisition of company shares or direct financial assistance

Chart 6: China government sets up CNY120 billion IC industry investment fund

Chart 7: Impact of IC industry investment fund set up by China Central Government

Chart 10: China antitrust policy pushes cooperation between Qualcomm and SMIC

Chart 11: China strengthens technologies and completes the supply chain via global acquisitions

Chart 12: Establishing joint ventures becomes development direction of China semiconductor industry

Chart 15: Intel investments in Tsinghua Unigroup creates a triple-win situation

Chart 17: China IC businesses improving technology capability

China to build large-scale IDM through overseas acquisitions

Chart 18: Establishing world-class IDMs may be China policy goal under the 13th FYP

Chart 19: IC industry segment likely to receive government support during 13th FYP

Chart 20: Potential targets China may acquire and make equity investments during 13th FPY

Three major developments driving continuous growth of China IC industry

Chart 21: China IC industry developments during 13th FYP period

Changes in China IC industry growth patterns and 13th FYP predictions

Chart 22: Changes in China IC industry growth pattern and predictions during 13th FYP period