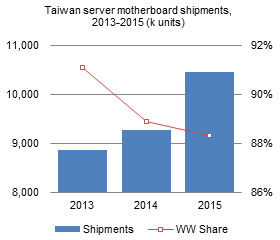

The server market did not perform well in 2014 though rising demand from Internet data centers (IDCs) and China brands helped global shipments (measured by motherboards) grow 7.1% to 10.4 million. Using this as the base for growth, in 2015 the market is expected to see shipment growth of 13.5%, with Taiwan makers accounting for 88%. With Taiwan playing a major role in the global supply chain, this Digitimes Research Special Report focuses on shipment data and customer relationships between Taiwan makers and global OEMs and major data centers.

Chart 3: Global server shipments by vendor location, 2013-2015 (k units)

Chart 4: Global server shipments by vendor, 2013-2015 (k units)

Chart 5: Taiwan server motherboard shipments, 2013-2015 (k units)

Chart 6: Server motherboard shipments by Taiwan maker, 2013-2015 (k units)

Chart 7: Shipment share by maker, for major server OEMs, 2014

Chart 8: Shipment share by maker, for major server OEMs, 2015

Chart 9: Taiwan-based server maker revenues, 2013-2015 (NT$b)

Chart 11: Server revenues as share of total Foxconn revenues, 2013-2015

Chart 12: Foxconn server mobo shipments, 2013-2015 (k units)

Chart 13: Foxconn server motherboard shipments by customer, 2014-2015 (k units)

Chart 14: Server revenues as share of total Quanta revenues, 2013-2015

Chart 16: Quanta server motherboard shipments by customer, 2014-2015 (k units)

Chart 17: Server revenues as share of total Inventec revenues, 2013-2015

Chart 19: Inventec server motherboard shipments by customer 2014-2015 (k units)

Chart 20: Server revenues as share of total Wistron revenues, 2013-2015

Chart 22: Wistron server motherboard shipments by customer, 2014-2015 (k units)

Chart 23: Server revenues as share of total Mitac revenues, 2013-2015