China's Tri-network Integration Policy has eased restrictions on the broadcasting and telecom industries in China and allowed them to offer each other's services. This has brought new competitive challenges to the local video market, especially its Internet video/TV market, which has expanded at a scale and speed surpassing that of other regions in the world. This Digitimes Research Special Report provides insights and analysis into the regulations, and content and service providers in the complicated and explosive China Internet TV market.

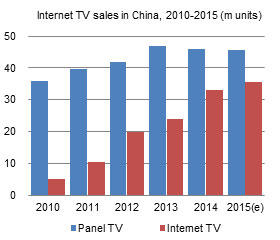

Chart 1: Major forms of TV content delivery in China (m units)

Chart 3: China Internet video viewer and device breakdown, 2011-2015 (m units)

Chart 5: Influence of Tri-network Integration on TV services

Relationship between tri-network integration and media services

Chart 7: Major Internet TV service competitors and their advantages

Table 1: SARFT additional regulations on Internet TV after 181 Code

Hunan TV & Broadcast raises bargaining power with exclusive content offering

Wasu Media expands OTT box partnerships by leveraging Alibaba Cloud

Table 2: Major OTT box partners with Internet TV licensees in 2015

ICNTV, Guangdong Radio & Television Station, China Radio International, and China National Radio

Baidu - Hardware (YingBang)+content (iQIYI)+channel (Baidu Video Game Hall)

Alibaba - Platform (Alibaba TV system)+content (Wasu)+hardware (Tmall box)

Tencent - Content (Tencent Video)+social application (QQ/WeChat on TV)

Chart 13: Major China video websites penetrating into living room entertainment market

Chart 14: Expanding into OTT boxes from different directions

Chart 17: Video fees compensate for hardware revenues - CAN TV

Chart 19: Strategies for traditional TV brands and sub-brands

Chart 20: LeTV featuring platform+content+device+application