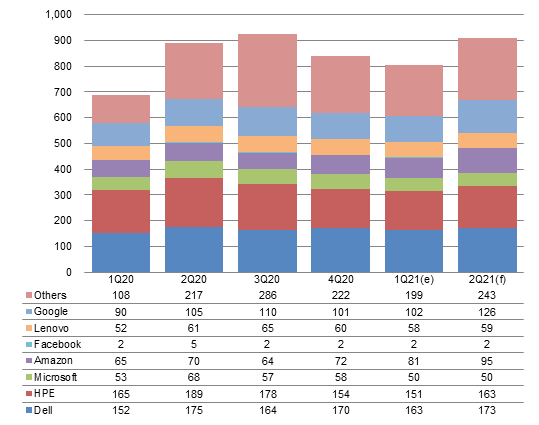

Chart 2: Global shipments by top-10 player, 1Q20-2Q21 (k units)

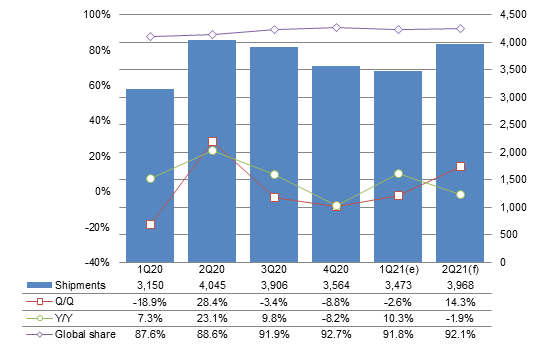

Chart 4: Taiwan server shipments and global share, 1Q20-2Q21 (k units)

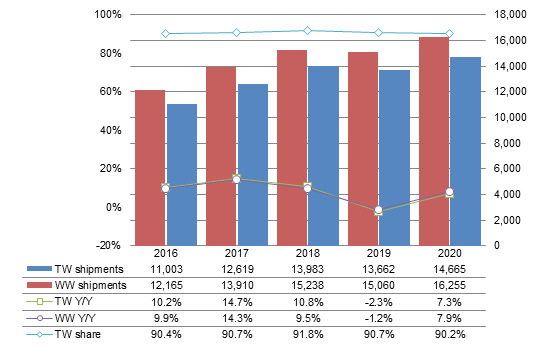

Chart 34: Taiwan and global server shipments, 2016-2020 (k units)

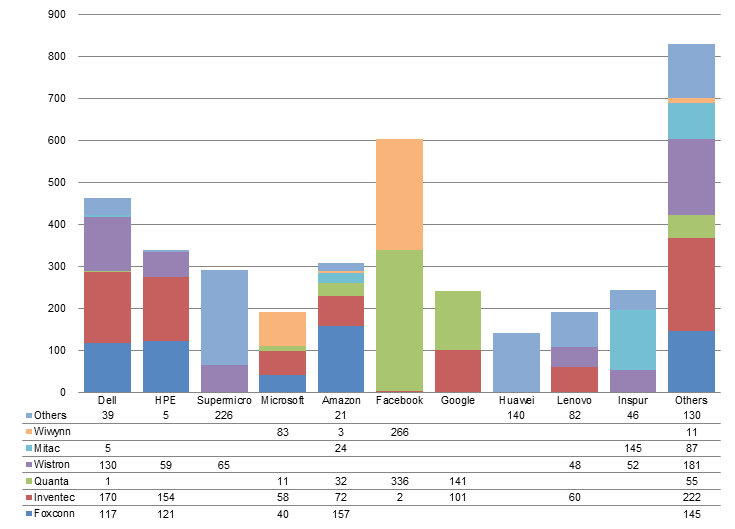

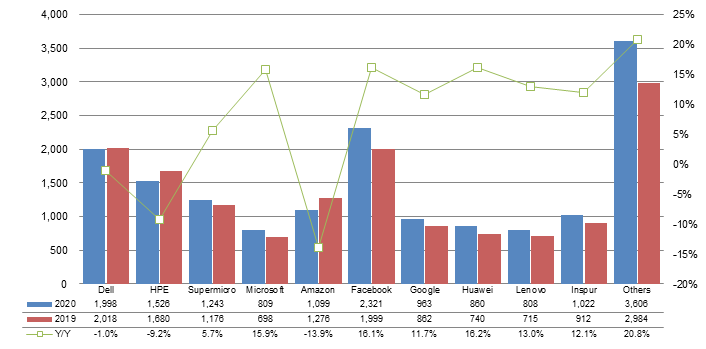

Chart 35: Global server shipments by top-10 player, 2019-2020 (k units)

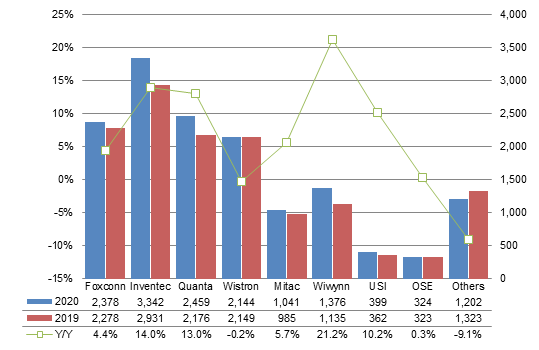

Chart 36: Taiwan server shipments by top maker, 2019-2020 (k units)

Introduction

Global server shipments are expected to slip by only 1.6% sequentially in the first quarter of 2021 despite the quarter being a traditional slow season.

After experiencing a slowdown in server order pull-ins in the second half of 2020, demand from several datacenter operators began to resume in the first quarter of 2021, as shortages of ICs and components remained fierce.

Server shipments are expected to grow around 14% sequentially in the second quarter of 2021 thanks to increasing orders from cloud computing service providers, e-commerce platforms and enterprises, as well as the replacement trend stimulated by the releases of Intel's new-generation server CPUs, Digitimes Research's numbers show.

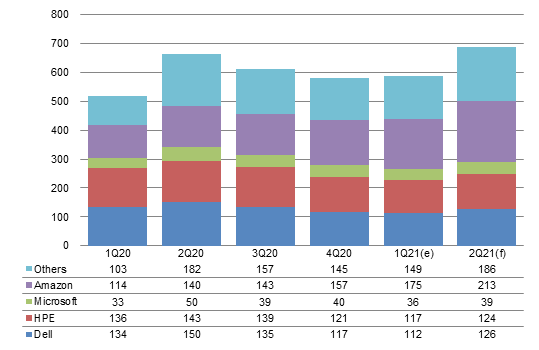

In the second quarter, Amazon and Google will both need to install more servers to satisfy their e-commence and cloud computing services, while Dell and HP Enterprise (HPE) are seeing increasing server orders from traditional enterprises.

Supermicro's shipments will pick up in the second quarter as it has obtained server system projects from its US-based datacenter clients.

Because of concerns over IC and component shortages and possible prolonged delivery schedules, datacenter operators and server brands have advanced some of their orders with their manufacturing partners.

Global server shipments are expected to reach 8.09 million units in the first half of 2021, remaining flat from the same period a year ago.

(Note: Shipments in server tracker reports refer to the number of motherboards shipped. A server motherboard supporting multiple CPUs is still considering one unit. A rack server that is equipped with multiple motherboards is counted based on the number of its motherboards. Shipments of other networking devices such as switches, routers and storages, are not included in the figures.)

Key factors affecting the global server market

Source: Digitimes Research, April 2021

Next-generation server CPU platforms including Intel's Whitley and AMD's third-generation EPYC processors will start to fuel shipments of new server models to cloud datacenters and server brands in second-quarter 2021.

Shortages of power management ICs, circuit control components and passive components will result in two to three times longer lead time for server to be delivered to datacenters and server brands while delaying the production schedule of server motherboards and the shipment schedule of whole rack server systems.

Demand from US-based datacenter operators will rebound in second-quarter 2021. In particular, combined server orders from Amazon and Google will climb 18% sequentially as they try to meet growing cloud service and e-commerce demand and new CPU platforms spur upgrade demand.

With COVID-19 effectively contained in China, economic activities are recovering. On top of that, state policies supporting datacenter infrastructure build-up drives server demand from cloud datacenters and enterprises. As such, server orders from Inspur are expected to grow nearly 15% sequentially.

Dell and HPE will begin to place OEM orders for servers based on new CPU platforms. With server demand from their enterprise customers on the rebound, second-quarter 2021 shipments by the two server brands are expected to increase 8% to 9% quarter-over-quarter.

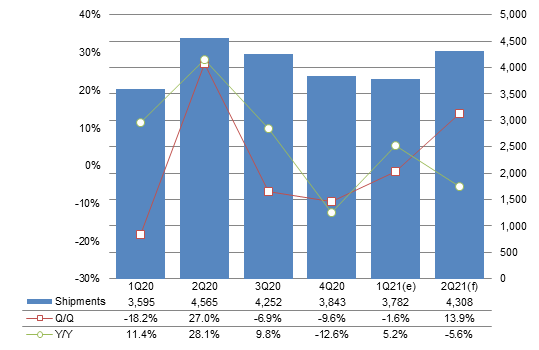

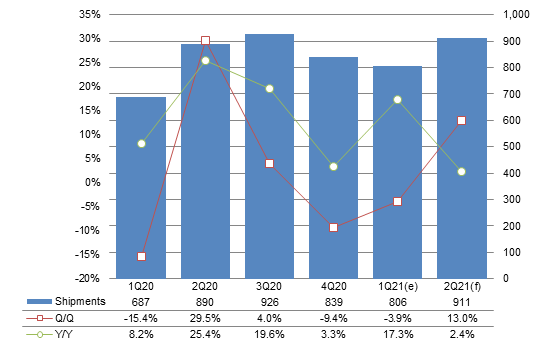

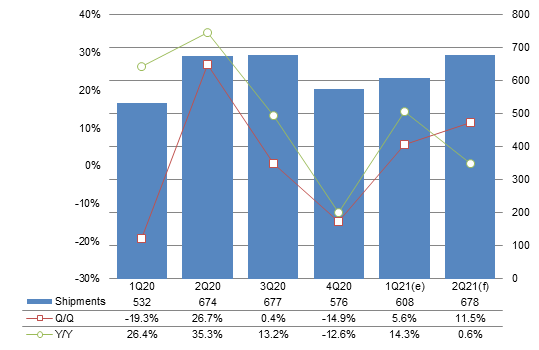

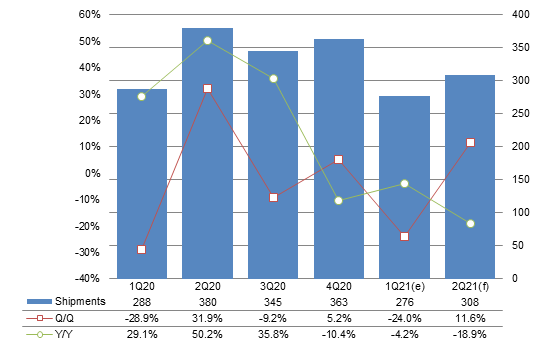

Chart 1: Global server shipments, 1Q20-2Q21 (k units)

Source: Digitimes Research, April 2021

First-quarter 2021 global server shipments amounted to 3.78 million units, down only 1.6% quarter-over-quarter and up 5.2% year-over-year.

Supply disruption arising from the COVID-19 outbreak in early 2020 resulted in a low first-quarter 2020 base period.

The supply chain resumed normal operation starting in second-quarter 2020. Shipment momentum then slowed down in second-half 2020 with fourth-quarter 2020 shipments showing a 10% sequential decline. Demand from cloud datacenters began to rebound in first-quarter 2021, helping global server shipments beat slow season.

According to Digitimes Research's estimates, second-quarter 2021 global server shipments will show a sequential increase of 14% to come to 4.31 million units as datacenter operators and server brands aggressively ramp up orders out of concerns over component shortage and new CPU platforms begin to spur some upgrade demand.

However, second-quarter 2021 global server shipments will decline 5.6% on a year-over-year basis due to a high second-quarter 2020 base period.

Shipments breakdown

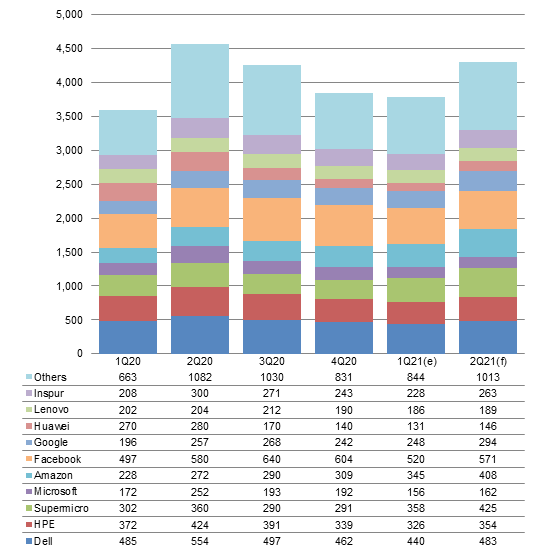

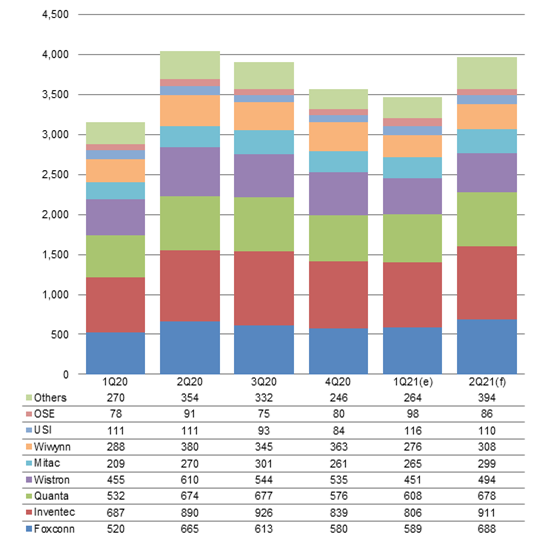

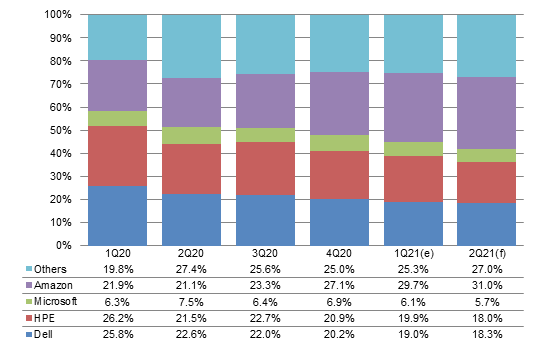

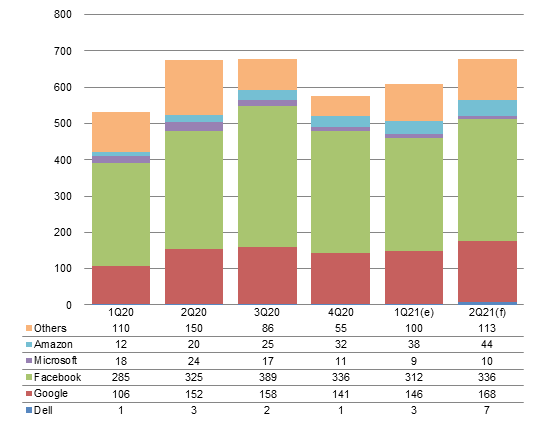

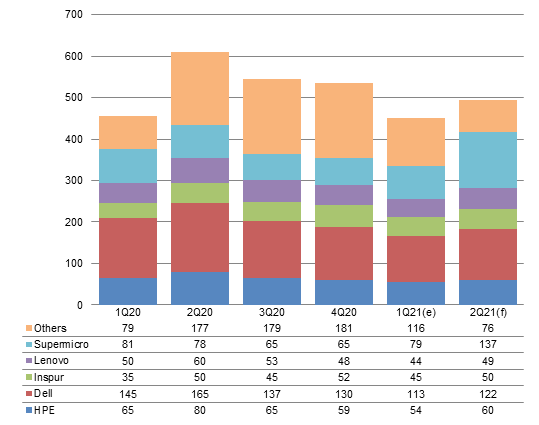

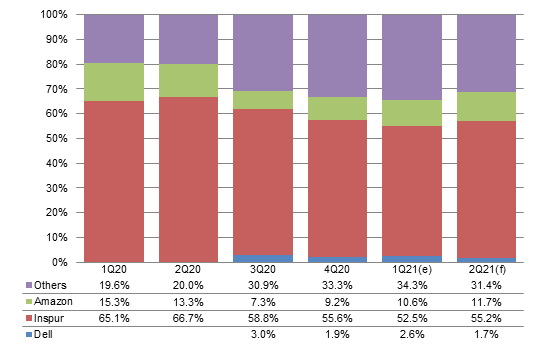

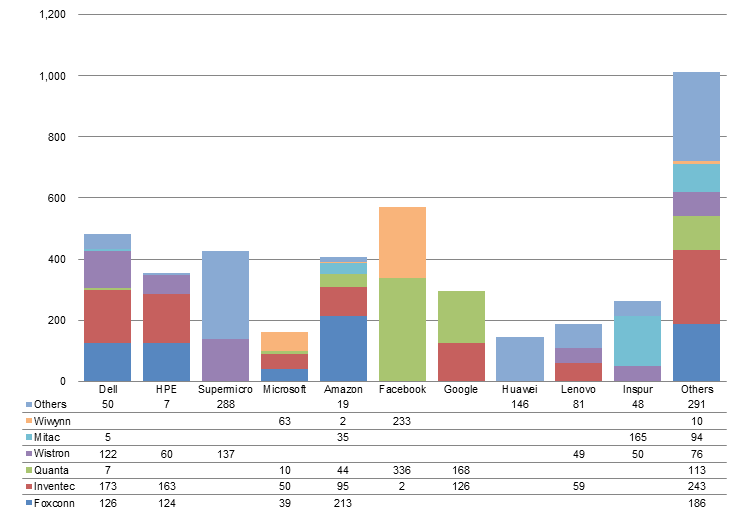

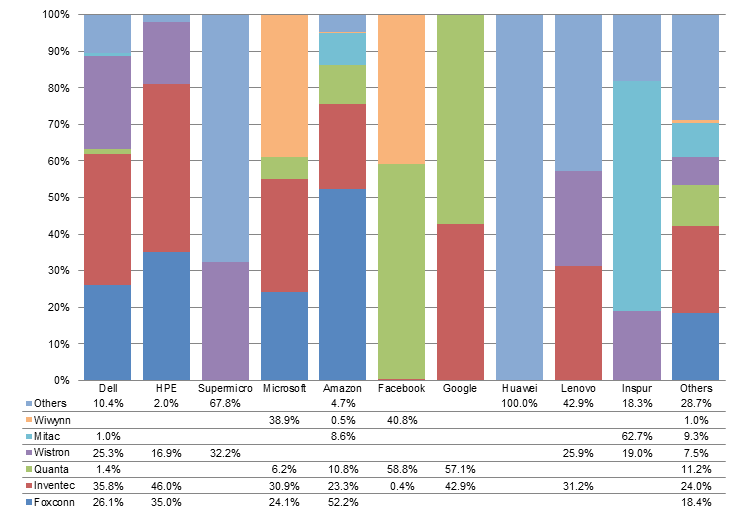

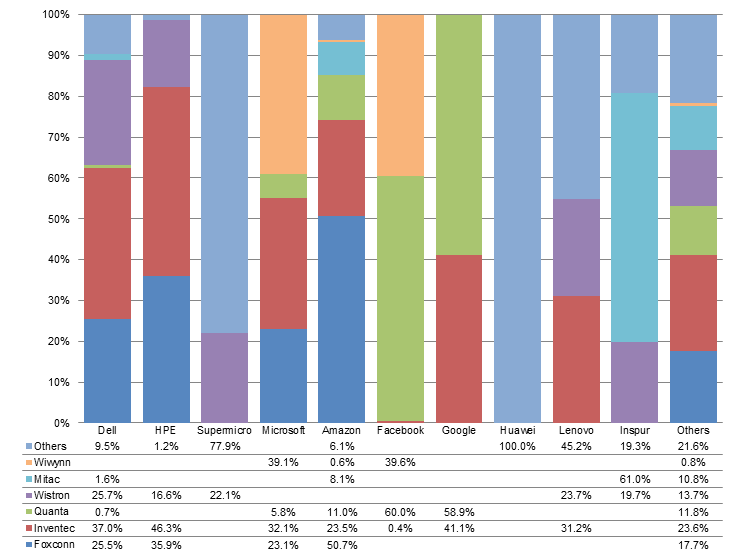

Chart 2: Global shipments by top-10 player, 1Q20-2Q21 (k units)

Source: Digitimes Research, April 2021

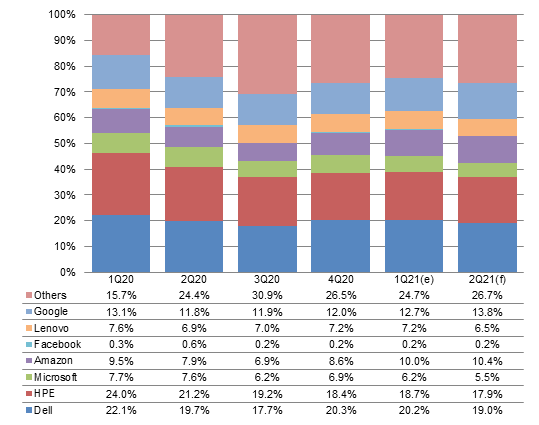

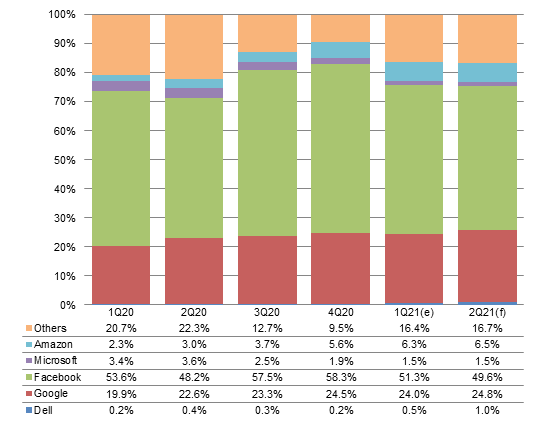

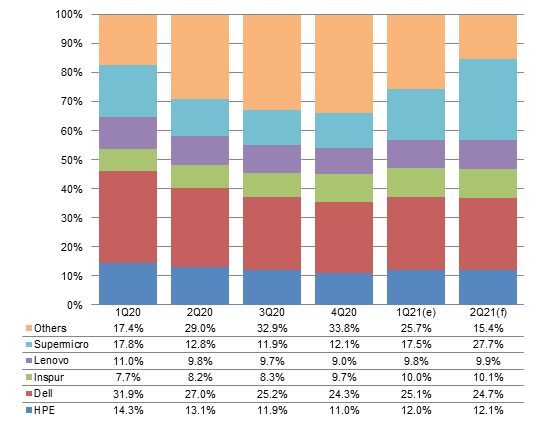

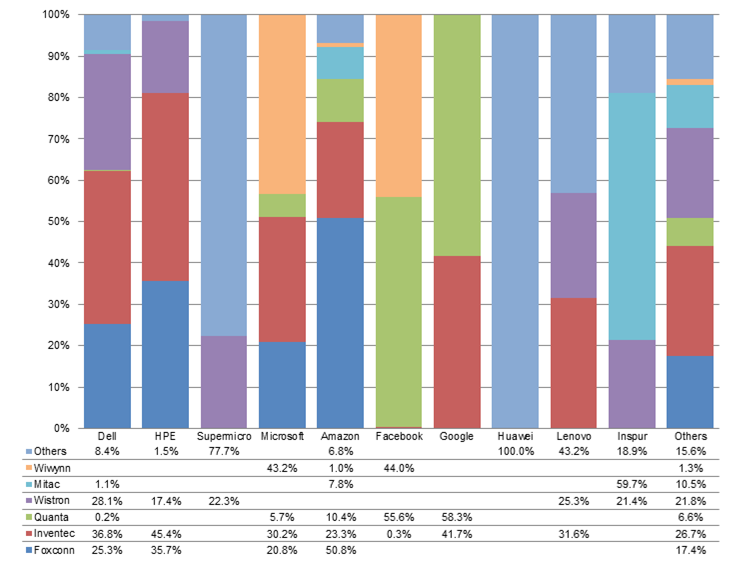

The shares of server shipments to Amazon, Google, Supermicro (SMC) and Inspur among the global total are estimated to grow in second-quarter 2021.

Amazon's share is set to edge upward 0.4pp to 9.5%, buoyed by demand from its cloud services and e-commerce platform as well as new CPUs being introduced to datacenter infrastructure.

Google's share is expected to increase 0.2pp to 6.8%, driven by cloud service demand and new server models.

Supermicro's share will further expand 0.4pp to come close to 10%, thanks to demand from US-based enterprises and datacenter projects (including LinkedIn and Intel).

Inspur's share is poised to slightly increase 0.1pp to 6.1%, contributed by rebounding demand from China-based datacenters and enterprises.

Due to a late start in adopting servers with next-generation CPUs, Microsoft's share is expected to fall below 4% in second-quarter 2021. Server shipments to Microsoft will begin to ramp up in third-quarter 2021.

Facebook mostly places orders for custom-made servers which need to undergo specific safety certification and data management processes for deployment in its datacenters throughout the world. As such, Facebook's order momentum will not be as strong as that of Amazon and Google, causing its share to lower to 13.3% in second-quarter 2021.

Demand from server brands including Dell, HPE and Lenovo will rebound but will only show single-digit sequential growth in second-quarter 2021 so their shares will fall about 0.4-0.5pp.

Chart 3: Global shipment share by top-10 player, 1Q20-2Q21

Source: Digitimes Research, April 2021

Shipments from Taiwan makers

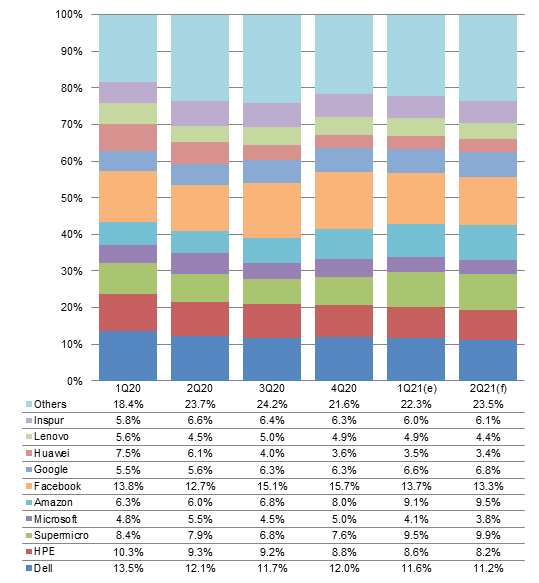

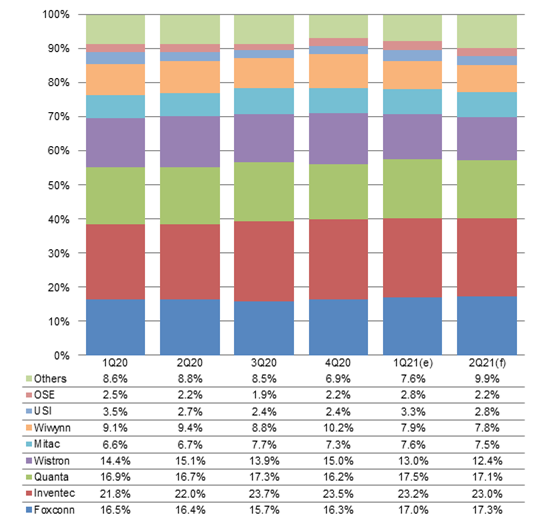

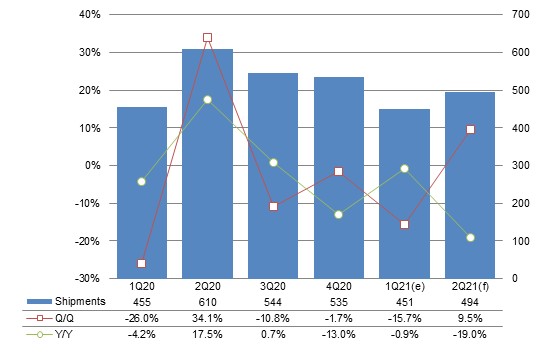

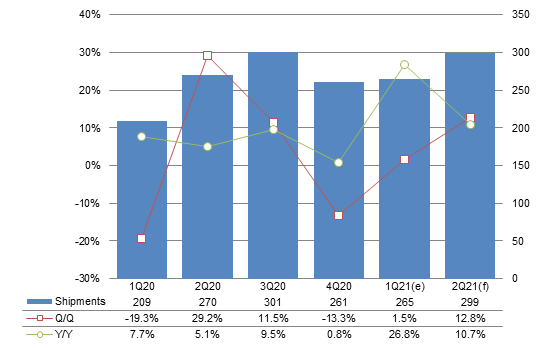

Chart 4: Taiwan server shipments and global share, 1Q20-2Q21 (k units)

Source: Digitimes Research, April 2021

Shipment momentum of the Wistron Group, which consists of Wistron and Wiwynn, slowed down due to shortages of some components in first-quarter 2021. On top of that, its server brand customers showed relatively weaker demand. As a result, its shipments plunged nearly 20% sequentially, much worse than the global average. This also caused the shipment share of Taiwan-based server manufacturers among the global total to dip 0.9pp to 91.8%.

Going into second-quarter 2021, large US-based and China-based datacenter operators will ramp up orders. Among them, Amazon and Google, which mainly place orders with Taiwan-based server manufacturers, will especially have stronger demand.

Amazon and Google's combined orders are estimated to climb 18% sequentially, growing by a larger extent than those of Huawei, which fully produce servers in house, and Lenovo, which has about 19% of its servers made in house. The share of server shipments by Taiwan-based server manufacturers among the global total is therefore expected to edge upward 0.3pp to 92.1%.

Supermicro's shipment momentum weakened in second-half 2020 but it started to see rebounding demand in first-quarter 2021. Going into second-quarter 2021, its shipments are estimated to soar 19% sequentially, boosted by demand from US-based datacenter projects. The growth will outperform the global average. This will prompt Supermicro to hike the share of its orders to Wistron by nearly 10pp to 32%.

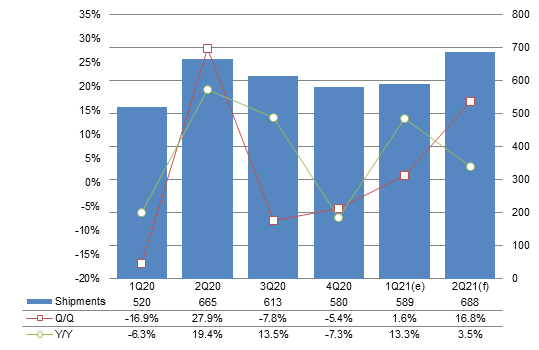

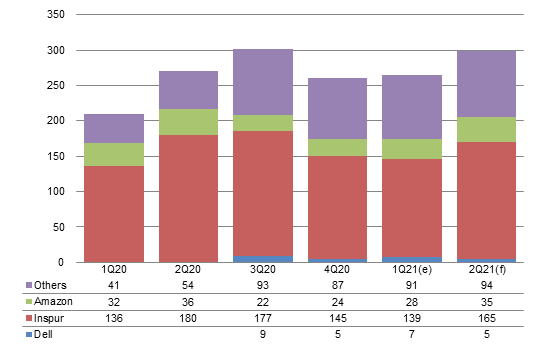

Chart 5: Taiwan shipments by top maker, 1Q20-2Q21 (k units)

Source: Digitimes Research, April 2021

The rankings among Taiwan-based manufacturers in terms of server shipments showed some changes between fourth-quarter 2020 and first-quarter 2021. Quanta overtook Foxconn to become No. 2.

Quanta benefited from Amazon and Google hiking their orders was able to deliver a 5.6% sequential shipment growth in contrast to the decline in global server shipments.

Despite seeing a sequential growth in shipments to Amazon, Foxconn had weak shipments to its US-based customers including Dell, HPE and Microsoft, which resulted in only a 1.6% sequential increase in Foxconn's overall shipments in the first quarter of 2020.

Wiwynn's first-quarter 2020 shipments are estimated to plunge 24% from the prior quarter and its share is expected to lower to 7.3% due to slowing order momentum from its major customers Microsoft and Facebook as well as IC shortages disrupting its delivery schedule for some server models.

Going into second-quarter 2021, Foxconn will enjoy rebounding demand from customers so its share will further expand, allowing it to surpass Quanta again.

Foxconn's share will rise 0.4pp to 16%, buoyed by Amazon's stronger order momentum on top of rebounding demand from China-based datacenters and US-based customers including Dell and HPE.

Wistron, which mainly supplies products to server brands, will see its shipments climb 9% sequentially in second-quarter 2021 thanks to rebounding customer demand. However, its growth will come short of that in global server shipments so Wistron's share may again fall 0.4pp to 11.5%.

Chart 6: Taiwan shipment share by top maker, 1Q20-2Q21

Source: Digitimes Research, April 2021

Foxconn

Chart 7: Foxconn server shipments, 1Q20-2Q21 (k units)

Source: Digitimes Research, April 2021

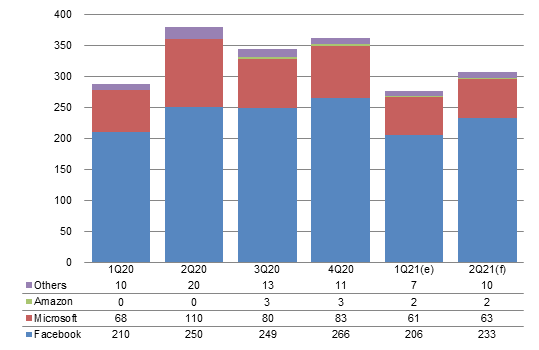

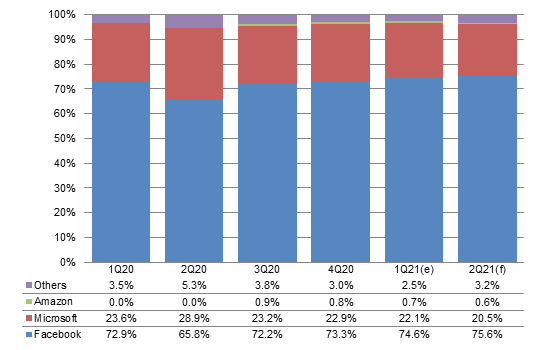

Chart 8: Foxconn shipments by client, 1Q20-2Q21 (k units)

Source: Digitimes Research, April 2021

Chart 9: Foxconn shipment share by client, 1Q20-2Q21

Source: Digitimes Research, April 2021

Inventec

Chart 10: Inventec server shipments, 1Q20-2Q21 (k units)

Source: Digitimes Research, April 2021

Chart 11: Inventec shipments by client, 1Q20-2Q21 (k units)

Source: Digitimes Research, April 2021

Chart 12: Inventec shipment share by client, 1Q20-2Q21

Source: Digitimes Research, April 2021

Quanta

Chart 13: Quanta server shipments, 1Q20-2Q21 (k units)

Source: Digitimes Research, April 2021

Chart 14: Quanta shipments by client, 1Q20-2Q21 (k units)

Source: Digitimes Research, April 2021

Chart 15: Quanta shipment share by client, 1Q20-2Q21

Source: Digitimes Research, April 2021

Wistron

Chart 16: Wistron server shipments, 1Q20-2Q21 (k units)

Source: Digitimes Research, April 2021

Chart 17: Wistron shipments by client, 1Q20-2Q21 (k units)

Source: Digitimes Research, April 2021

Chart 18: Wistron shipment share by client, 1Q20-2Q21

Source: Digitimes Research, April 2021

Mitac

Chart 19: Mitac server shipments, 1Q20-2Q21 (k units)

Source: Digitimes Research, April 2021

Chart 20: Mitac shipments by client, 1Q20-2Q21 (k units)

Source: Digitimes Research, April 2021

Chart 21: Mitac shipment share by client, 1Q20-2Q21

Source: Digitimes Research, April 2021

Wiwynn

Chart 22: Wiwynn server shipments, 1Q20-2Q21 (k units)

Source: Digitimes Research, April 2021

Chart 23: Wiwynn shipments by client, 1Q20-2Q21 (k units)

Source: Digitimes Research, April 2021

Chart 24: Wiwynn shipment share by client, 1Q20-2Q21

Source: Digitimes Research, April 2021

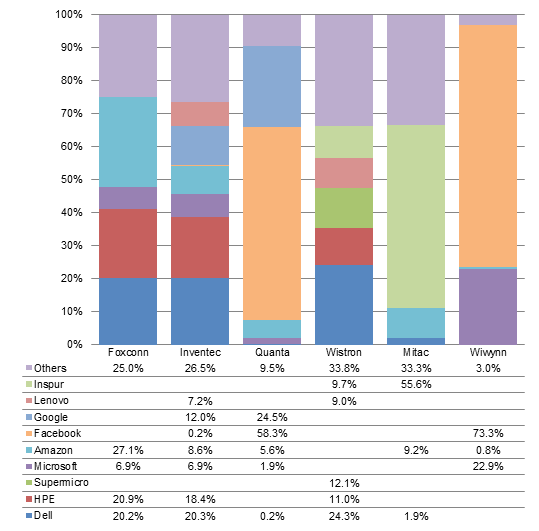

Client-maker server shipment matrix

Chart 25: Client-maker partnership matrix, 2Q21 (k units)

Source: Digitimes Research, April 2021

Inspur will increase its share of orders to Mitac by 1.8pp from a quarter ago to nearly 63% in second-quarter 2021 as it enjoys rebounding demand from China-based cloud datacenters and enterprise customers while further strengthening its long-term close partnership with Mitac.

Google will boost its share of orders to Inventec by 1.7pp to come close to 43% in second-quarter 2021, driven by cloud service and next-generation storage server demand.

Facebook will have stronger demand for large-capacity storage servers to meet online media platform needs in second-quarter 2021. Its total sever demand is expected to climb nearly 10% sequentially, prompting it to hike its share of orders to Wiwynn by 1.2pp to go above 40% again.

Amazon's server demand will soar 18% quarter-over-quarter as it tries to meet cloud service and e-commerce platform demand while starting to order servers based on new CPUs. Its share of orders to Foxconn, which secures an advantageous position in global critical component supply, will expand 1.5pp to exceed 52%.

Chart 26: Client shipment share by maker, 2Q21

Source: Digitimes Research, April 2021

Inventec's dependency on Google is estimated to rise 1.2pp to nearly 14% in second-quarter 2021.

The increase in Inventec's dependency on Google is due to Google's growing demand for cloud service and storage servers.

With COVID-19 getting contained throughout China and state policies supporting datacenter infrastructure build-up spurring server demand, Inventec's and Foxconn's dependency on vendors in the “others” category will each climb nearly 2pp.

Inspur, mainly supplying servers to China-based datacenters and enterprise customers, will see its server orders grow 15% sequentially in second-quarter 2021, buoying Mitac's dependency on Inspur up 2.7pp to 55%.

Demand from US-based datacenter projects will start to ramp up in second-quarter 2021 so Supermicro's server orders are expected to surge 19% sequentially. It will raise its orders for entry-level servers to Wistron while lowering those to OSE and USI. As a result, Wistron's dependency on Supermicro will jump 10.2pp to come close to 28%.

Amazon's orders to Taiwan-based manufacturers are poised to climb 18% in second-quarter 2021, buoyed by cloud service and e-commerce platform demand as well as next-generation CPU spurring a replacement trend. This will drive Mitac's and Foxconn's dependency on Amazon up 1-2pp.

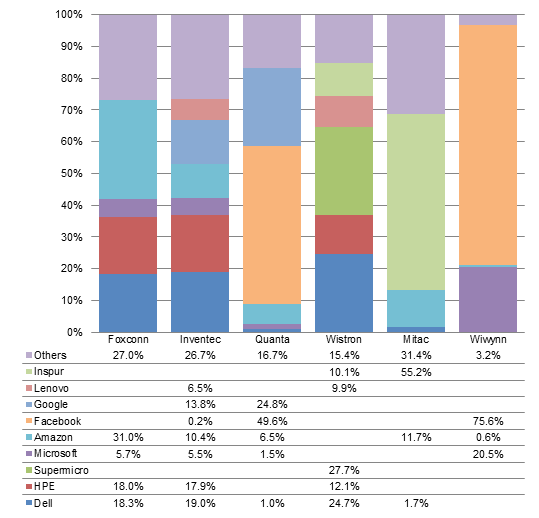

Chart 27: Maker shipment share by client, 2Q21

Source: Digitimes Research, April 2021

Chart 28: Client-maker partnership matrix, 1Q21 (k units)

Source: Digitimes Research, April 2021

The share of Dell's orders to Compal (in the "others" category) rose 1.1pp sequentially in first-quarter 2021 to arrive at 9.3%.

Dell began to purchase servers based on new Intel CPUs in small volumes, which hiked its share of orders to Compal in late first-quarter 2021.

Inspur raised its share of orders to Mitac, which it has maintained long-term close R&D collaborations with, by 1.3pp in first-quarter 2021 due to growing server demand from China-based datacenters including Alibaba and Tencent.

Quanta was able to keep adequate inventory of IC chips for Facebook's specially customized models. As a result, Facebook's share of orders to Quanta climbed 4.4pp in first-quarter 2021.

Server demand from Microsoft's datacenters fell weak in first-quarter 2021 so its orders are estimated to decline 19% sequentially. On top of that, inadequate component inventory for some models resulted in disruption to Wiwynn's shipments. Consequently, Microsoft raised its share of orders to Inventec and Foxconn by 1.8 and 2.2pp respectively.

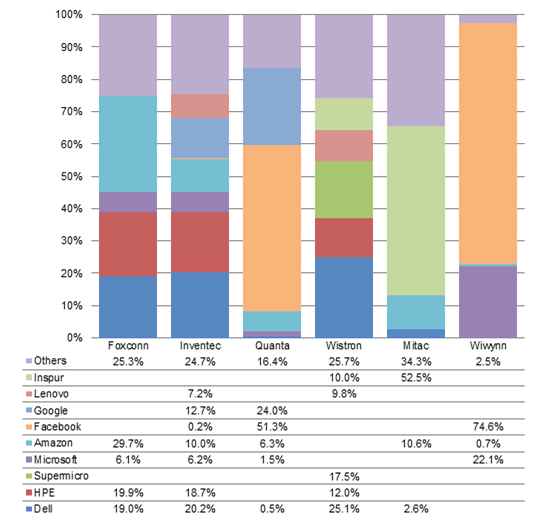

Chart 29: Client shipment share by maker, 1Q21

Source: Digitimes Research, April 2021

Outperforming the average, Amazon's server orders grew nearly 12% in first-quarter 2021 thanks to cloud service and e-commerce platform demand. As a result, Foxconn's, Inventec's and Mitac's dependency on Amazon rose 1.5, 2.6 and 1.4pp, respectively.

Wiwynn's dependency on Facebook climbed 1.4pp to 74.6% in first-quarter 2021.

Microsoft's server orders weakened and plunged nearly 19% sequentially, resulting in a decline in Wiwynn's dependency on Microsoft.

Supermicro's shipment momentum slowed down in second-half 2020. However, it started to see rebounding demand in first-quarter 2021 and with demand from US-based datacenter projects, Supermicro's first-quarter 2021 shipments surged 23% sequentially. In response, Supermicro raised its OEM orders to Wistron for entry-level servers, therefore buoying Wistron's dependency on Supermicro by 5.4pp to reach 17.5%.

Chart 30: Maker shipment share by client, 1Q21

Source: Digitimes Research, April 2021

Chart 31: Client-maker partnership matrix, 4Q20 (k units)

Source: Digitimes Research, April 2021

Chart 32: Client shipment share by maker, 4Q20

Source: Digitimes Research, April 2021

Chart 33: Maker shipment share by client, 4Q20

Source: Digitimes Research, April 2021

Annual shipments

Chart 34: Taiwan and global server shipments, 2016-2020 (k units)

Source: Digitimes Research, April 2021

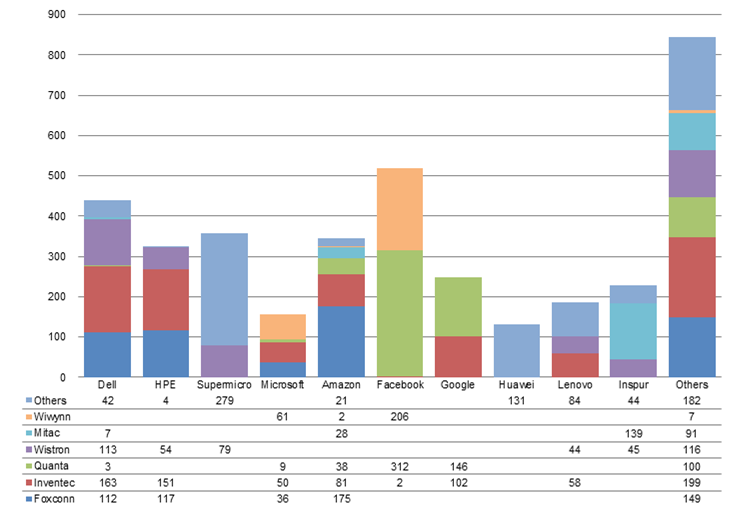

Chart 35: Global server shipments by top-10 player, 2019-2020 (k units)

Source: Digitimes Research, April 2021

Chart 36: Taiwan server shipments by top maker, 2019-2020 (k units)

Source: Digitimes Research, April 2021