Table 1: Key factors affecting China smartphone AP shipments in 2Q21 (Demand/Supply)

Table 2: Key factors affecting China smartphone AP shipments in 2Q21 (Suppliers)

Chart 6: Shipments by manufacturing process, 1Q20-2Q21 (m units)

Chart 8: MediaTek smartphone AP shipments, 1Q20-2Q21 (m units)

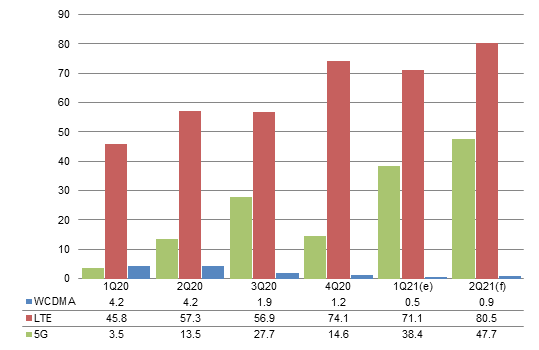

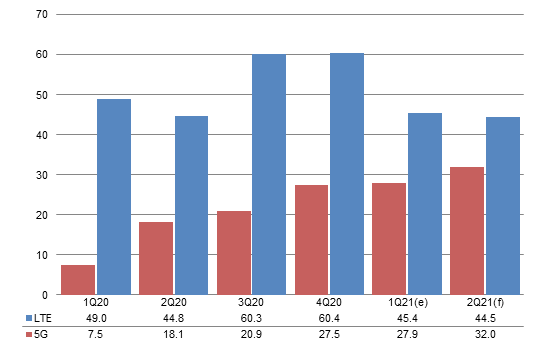

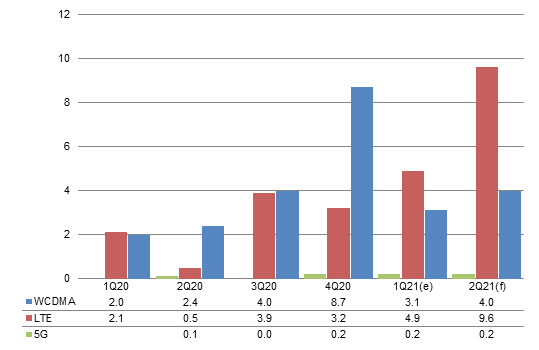

Chart 9: MediaTek shipments by baseband type, 1Q20-2Q21 (m units)

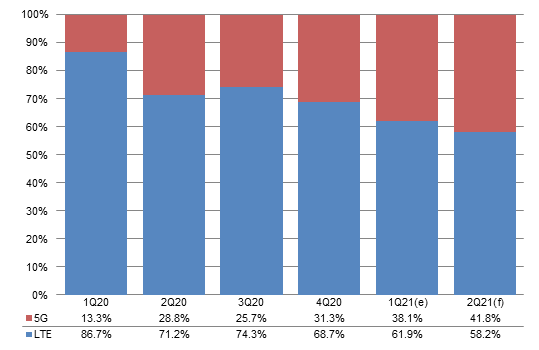

Chart 10: MediaTek shipment share by baseband type, 1Q20-2Q21

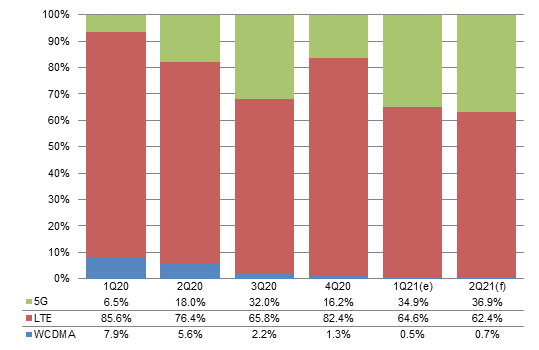

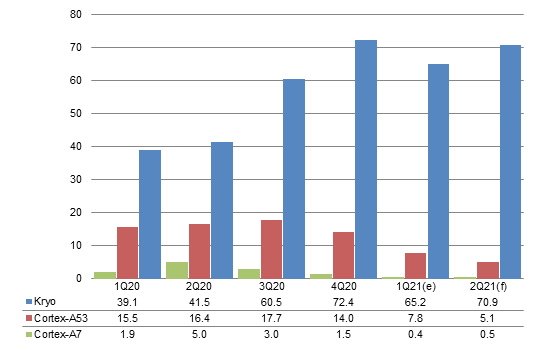

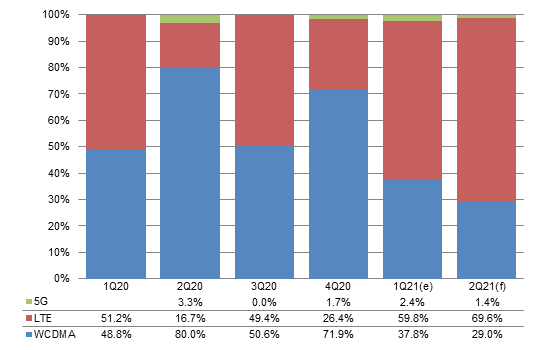

Chart 11: MediaTek shipments by architecture, 1Q20-2Q21 (m units)

Chart 12: MediaTek shipment share by architecture, 1Q20-2Q21

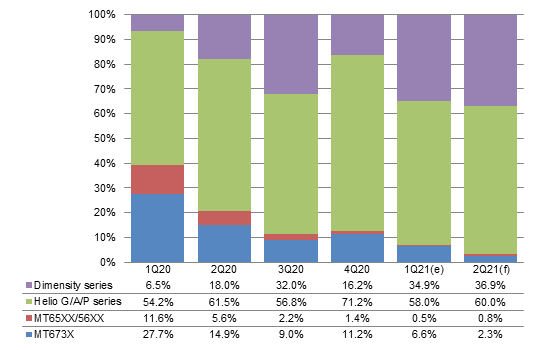

Chart 13: MediaTek shipment share by product line, 1Q20-2Q21

Chart 14: Qualcomm smartphone AP shipments, 1Q20-2Q21 (m units)

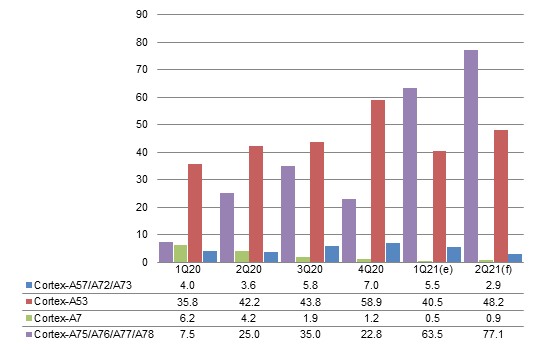

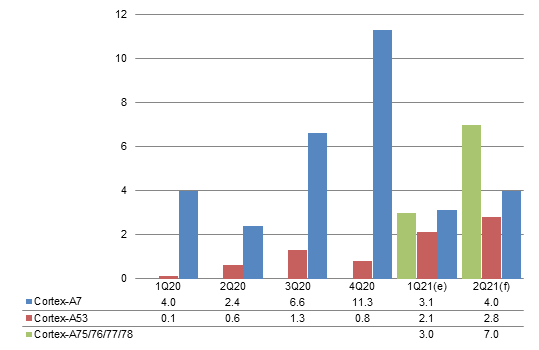

Chart 15: Qualcomm shipments by baseband type, 1Q20-2Q21 (m units)

Chart 16: Qualcomm shipment share by baseband type, 1Q20-2Q21

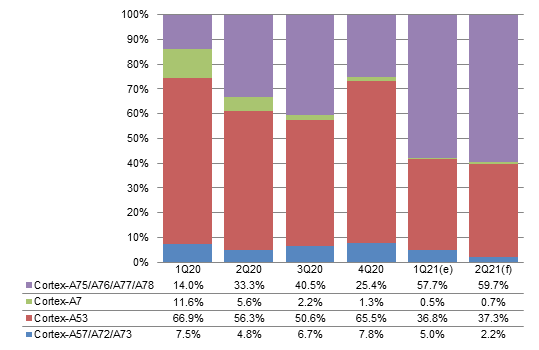

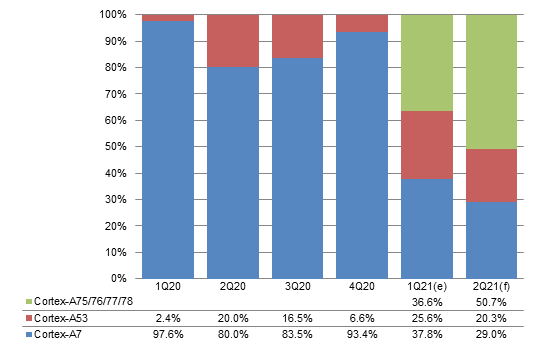

Chart 17: Qualcomm shipments by architecture, 1Q20-2Q21 (m units)

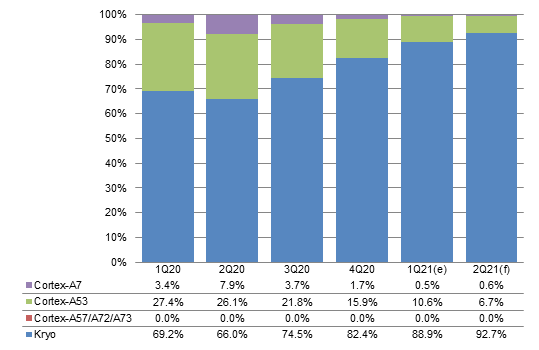

Chart 18: Qualcomm shipment share by architecture, 1Q20-2Q21

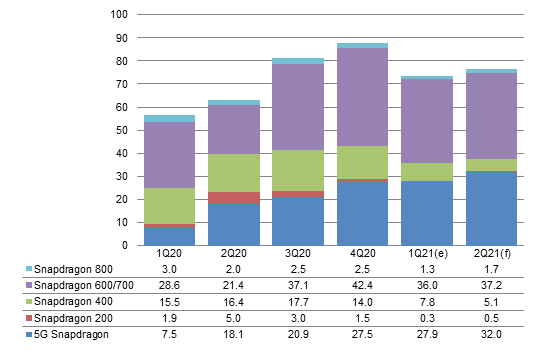

Chart 19: Qualcomm shipments by product line, 1Q20-2Q21 (m units)

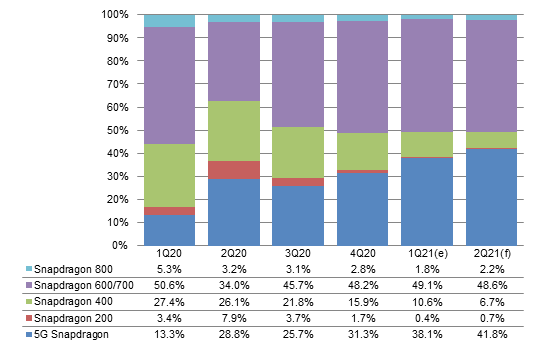

Chart 20: Qualcomm shipment share by product line, 1Q20-2Q21

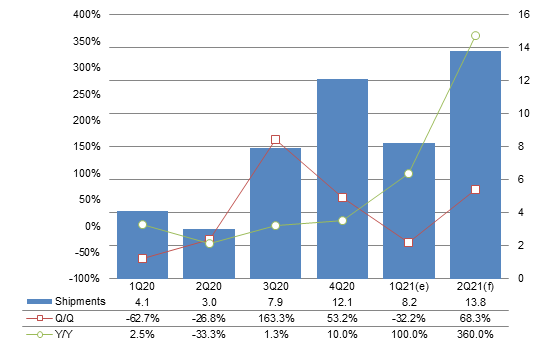

Chart 21: Unisoc smartphone AP shipments, 1Q20-2Q21 (m units)

Chart 22: Unisoc shipments by baseband type, 1Q20-2Q21 (m units)

Chart 24: Unisoc shipments by architecture, 1Q20-2Q21 (m units)

Chart 26: Hisilicon smartphone AP shipments, 1Q20-2Q21 (m units)

Introduction

According to Digitimes Research's survey and analysis, smartphone application processor (AP) shipments to China-based smartphone brands amounted to 212 million units in first-quarter 2021, up 0.2% quarter-over-quarter as China-based smartphone brands adopted the strategy to maintain high inventory levels and kept stocking up.

MediaTek's market share rose significantly to exceed 50%. As China-based smartphone brands' order momentum remains in high gear while Qualcomm and MediaTek secure additional smartphone AP and PMIC capacity, second-quarter 2021 smartphone AP shipments to China-based vendors are estimated to increase 9.6% quarter-over-quarter and 29.2% year-over-year.

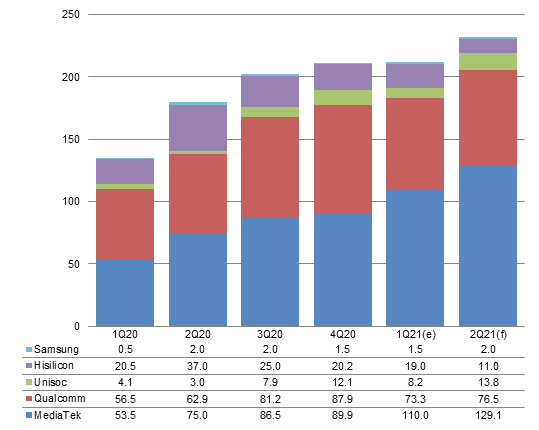

First-quarter 2021 smartphone AP shipments to China-based vendors came to a similar level seen in the prior quarter. The sequential growth outperformed the exceedingly 20% decline usually seen in the first quarter of years past (30% sequential decline in first-quarter 2020 due to the COVID-19 outbreak). Among leading AP suppliers, MediaTek held onto its top ranking with a sequential increase of 9.4pp in its market share while Qualcomm saw its market share fall 6.9pp.

Going into second-quarter 2021, Qualcomm will continue to sustain impact from the tight supply of Samsung's 5nm and 8nm process capacity. Its shipments will be affected to a larger extent than MediaTek's. Moreover, MediaTek's 4G processors feature a more compelling cost-performance (CP) ratio and MediaTek allots more resources for its 4G chips. As such, MediaTek is expected to still lead Qualcomm by a wide margin in terms of market share. Hisilicon can only ship existing stock so its market share will get surpassed by Unisoc.

In terms of manufacturing process technology, Samsung largely boosting the adoption of MediaTek's 12nm processors in its phones in first-quarter 2021 caused the supply of MediaTek's 4G APs to China-based smartphone brands to shrink. The share of 12nm processors among first-quarter 2021 smartphone AP shipments to China-based vendors therefore lowered to 35.1%, falling behind the share of 6/7/8nm chips.

Moving forward into second-quarter 2021, Transsion and newcomer Honor will significantly raise their use of Unisoc's 12nm 4G processors. The share of 12nm processors is therefore estimated to rebound to 39.5% on par with the share of 6/7/8nm chips.

Key factors affecting China smartphone AP shipments

Demand and supply: 2Q21

On the AP demand side, although consumer confidence in China is still to recover and the market will be in a low season, second-quarter 2021 smartphone AP shipments to China-based vendors (excluding Samsung processors made on OEM basis) are estimated to still grow 9.6% sequentially as smartphone brands continue to ramp up their component inventory levels.

The supply of 8-inch/12-inch wafer foundry capacity remains tight. Honor ramps up AP orders. US-China relations intensify. Xiaomi, Oppo and Vivo compete for Huawei's lost market share. In view of these factors, China-based smartphone brands will keep boosting their AP inventory levels so AP demand will not be affected by the declining 5G phone demand in the China market.

On the AP supply side, due to smartphone PMIC shortage, tight supply of Samsung's foundry capacity and the production halt at Samsung's Texas plant, AP supply will come short of smartphone vendors' demand to stock up on chips.

Samsung's 5nm process yield has only improved moderately. Moreover, Samsung's Texas plant halted operation due to snow storms, which impacts Qualcomm's shipments of 5G phone RF transceivers, putting its Snapdragon 888 chips in short supply.

Samsung has no plan to expand its 8nm process capacity so Qualcomm's Snapdragon 480 and 720G/730G processors will remain in shortage.

Although MediaTek's and Qualcomm's OEM added production capacity for smartphone PMIC, with 8-inch/12-inch wafer foundry capacity still in tight supply and the large increase in PMIC demand by 5G phones, PMIC supply still cannot keep up with demand.

Source: Digitimes Research, May 2021

Suppliers: 2Q21

In response to multiple uncertainties, China-based brands continue to ramp up orders. MediaTek secures large orders as it offers a more complete product portfolio for 5G phones across entry-level, mid-range and high-end segments than Qualcomm and its chips are produced on TSMC's 6nm and 7nm nodes with stable yield and ample capacity.

MediaTek's smartphone PMICs are produced by Powerchip Semiconductor Manufacturing (PSMC), which expanded its production capacity in late first-quarter 2021. This will help ease the shortage.

Compared to Qualcomm, MediaTek devotes more resources into 4G AP and its 4G chips feature more compelling CP ratios. With its 4G AP supply falling behind vendors' demand to stock up in first-quarter 2021, some shipments will get deferred to second-quarter 2021.

Tight supply of Samsung's 5nm process will curtail the shipment momentum of Qualcomm's high-end 5G AP Snapdragon 888.

The limited improvement on Samsung's 5nm process yield is expected to only slightly help Snapdragon 888 production. Moreover, priority will be given to Samsung Galaxy S21.

Samsung's 8nm process will remain in short supply with no capacity expansion plan. On top of that, Nvidia Geforce RTX300 will still be competing for Samsung's 8nm process capacity with Qualcomm's Snapdragon 480 and 720G/730G, thus limiting their shipment momentum in second-quarter 2021.

Qualcomm and MediaTek have limited 4G AP capacity and they will give priority to Samsung, Xiaomi, Oppo and Vivo. As such, Transsion and Honor will significantly raise their use of Unisoc's 4G AP, largely fueling Unisoc's growth momentum.

Subject to the US government's ban, Hisilicon cannot design and produce chips on its own. It can only provide its existing AP stock to Huawei so its whole-year 2021 shipments are estimated to come to only 40 million units, to be surpassed by Unisoc.

Despite Vivo raising its orders for Exynos 1080, Samsung's shipments will come short of expectation due to its limited capacity. Its whole-year 2021 shipments are estimated to climb to 9 million units.

Source: Digitimes Research, May 2021

China smartphone AP

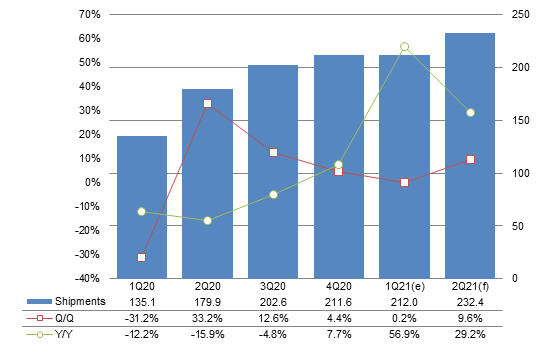

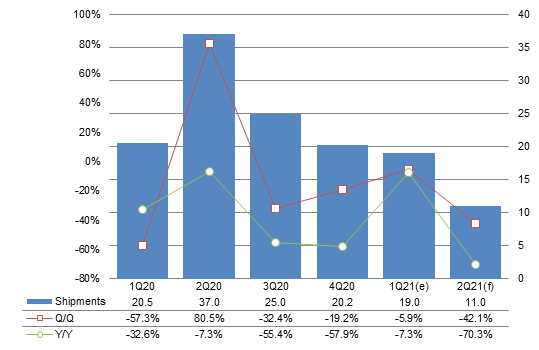

Chart 1: China smartphone AP shipments, 1Q20-2Q21 (m units)

Source: Digitimes Research, May 2021

First-quarter 2021 smartphone AP shipments to China-based vendors amounted to 212 million units, maintaining a similar level to the prior quarter and soaring 56.9% from a year ago.

In an effort to grab market shares and ensure uninterrupted chip supply, China-based smartphone brands adopted the strategy to maintain high inventory levels and continued to ramp up orders. However, Qualcomm's 4G and 5G AP supply got curtailed by process yield and capacity. Shipments of Snapdragon 888 and 480 were affected. As a result, smartphone AP shipments to China-based vendors only edged upward 0.2% quarter-over-quarter.

The China market underwent 4G to 5G transition in first-quarter 2020 and lacked killer applications for 5G phones. Moreover, 5G phones' high price tags could hardly spur phone upgrade interest. On top of that, the COVID-19 outbreak took a heavy toll on market demand so China-based brands were conservative with their AP orders. In contrast, first-quarter 2021 smartphone AP shipments to China-based vendors soared 56.9% from the first-quarter 2020 level.

Second-quarter 2021 smartphone AP shipments to China-based vendors are estimated to come to 232.4 million units, up 9.6% quarter-over-quarter and 29.2% year-over-year mainly as smartphone brands continue to ramp up orders and smartphone AP and PMIC capacity continues to expand.

Xiaomi, Oppo and Vivo will likely maintain strong AP order momentum amid tight 8-inch/12-inch wafer foundry capacity supply and concerns over Xiaomi and Honor getting banned by the US government in addition to Huawei.

PSMC produces a portion of MediaTek's smartphone PMIC and expanded its smartphone PMIC production capacity in first-quarter 2021, which will help ease the shortage of MediaTek's smartphone PMIC.

MediaTek's 4G chips feature more compelling CP ratios than Qualcomm's and their supply could not keep up with vendors' demand to stock up in first-quarter 2021. As such, MediaTek's 4G AP shipments are expected to be deferred to second-quarter 2021.

Qualcomm's 5G AP Snapdragon 7325 and MediaTek's 5G AP Dimensity 850 are in volume production on TSMC's 6nm node with good yield and ample capacity.

Shipments by supplier

Chart 2: Shipments by supplier, 1Q20-2Q21 (m units)

Source: Digitimes Research, May 2021

Chart 3: Shipment share by supplier, 1Q20-2Q21

Source: Digitimes Research, May 2021

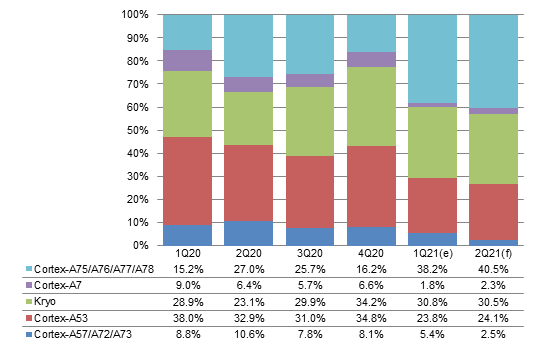

Shipments by architecture

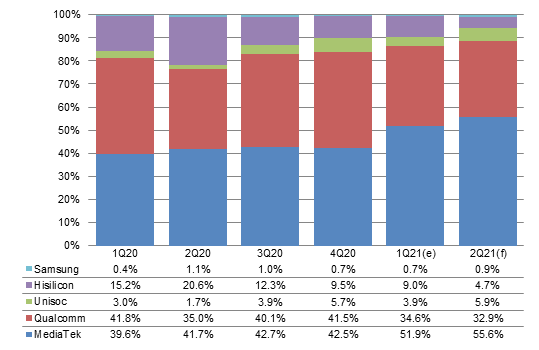

Chart 4: Shipments by architecture, 1Q20-2Q21 (m units)

Source: Digitimes Research, May 2021

Mainly contributed by Qualcomm, the share of self-developed architectures among smartphone AP shipments to China-based vendors fell to 30.8% in first-quarter 2021 as shipments of Qualcomm's 4G and 5G AP based on its own architecture got largely limited, causing its market share to shrink. The share of self-developed architectures is estimated to further decline to 30.5% in second-quarter 2021.

Mainly contributed by MediaTek, the share of Cortex-A75/76/77/78 among smartphone AP shipments to China-based vendors surged to 38.2% in first-quarter 2021 as Dimensity 700 and 1100/1200 went into volume production in first-quarter 2021 and were adopted by Xiaomi, Oppo, Vivo and Honor while their rivals, Qualcomm's Snapdragon 480 and 888, suffered insufficient capacity. The share of Cortex-A75/76/77/78 is expected to further climb to exceed 40% going forward into second-quarter 2021.

The share of Cortex-A53 is mainly contributed by MediaTek, followed by Qualcomm. Cortex-A53-based processors are mainly used in entry-level and mid-range 4G phones. Samsung raising the use of MediaTek's 4G AP in its phones took away the 4G AP capacity needed by China-based smartphone brands. Moreover, smartphone PMIC shortage further dampened the share of Cortex-A53 among smartphone AP shipments to China-based vendors, causing it to plunge to 23.8% in first-quarter 2021.

With Transsion and Honor largely using Unisoc's Cortex-A53-based processors, the share of Cortex-A53 among smartphone AP shipments to China-based vendors is expected to rise to 24.1% in second-quarter 2021.

The share of Cortex-A57/72/73 among smartphone AP shipments to China-based vendors is mainly contributed by Hisilicon and is expected to keep trending lower as Hisilicon can only supply its existing stock of processors in first-half 2021. The share is estimated to decline to 2.5% in second-quarter 2021.

Chart 5: Shipment share by architecture, 1Q20-2Q21

Source: Digitimes Research, May 2021

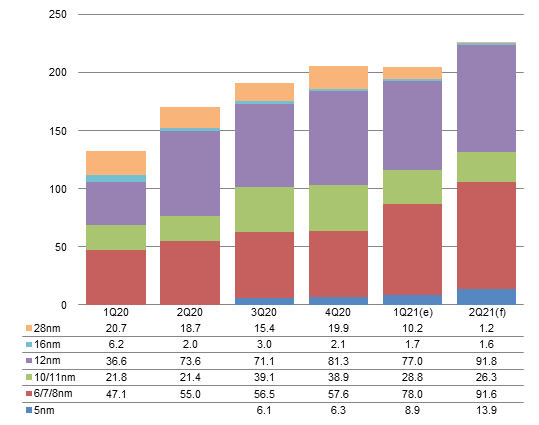

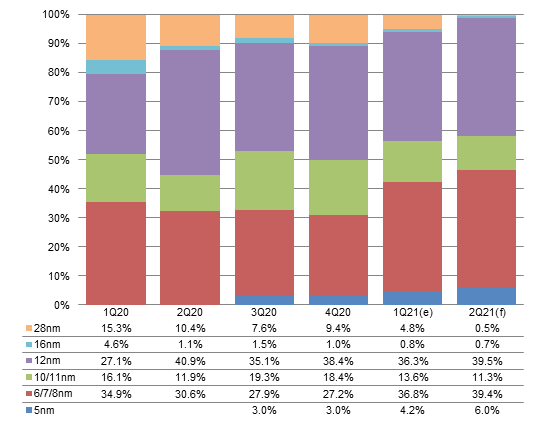

Shipments by manufacturing process

Chart 6: Shipments by manufacturing process, 1Q20-2Q21 (m units)

Source: Digitimes Research, May 2021

The share of 5nm smartphone AP among those shipped to China-based vendors rose to 4.2% in first-quarter 2021, buoyed by Qualcomm's Snapdragon 780G and 888 as well as Samsung's Exynos 1080 going into volume production and Hisilicon shipping its existing Kirin 9000 stock.

The share of 5nm smartphone AP is estimated to increase moderately to 6% in second-quarter 2021 amid limited AP production capacity expansion.

Qualcomm and MediaTek make the most contribution to shipments of smartphone AP fabricated on the 6/7/8nm node. The large-volume production of Qualcomm's Snapdragon 730G/720G and 870 as well as MediaTek's Dimensity 1100/1200 manufactured on the 6/7/8nm node boosted the share of 6/7/8nm smartphone AP among those shipped to China-based vendors to 36.8%, again exceeding the share of 12nm smartphone AP.

The share of 6/7/8nm smartphone AP is expected to grow to 39.4% in second-quarter 2021 with Qualcomm's new 5G AP Snapdragon 7325, manufactured on TSMC's 6nm node with good yield and ample capacity, going into volume production.

Qualcomm makes the most contribution to shipments of smartphone AP fabricated on the 10/11nm node, which are mostly used in 4G phones. Qualcomm's big customer Xiaomi began to gradually reduce the use of 10/11nm smartphone AP in first-quarter 2021, making the share of 10/11nm smartphone AP among those shipped to China-based vendors lower to 13.6%. It is expected to further decline to 11.3% going into second-quarter 2021.

The share of 12nm smartphone AP is largely contributed by MediaTek, followed by Unisoc. They are mostly used in 4G phones.

Samsung significantly boosted its use of MediaTek's 12nm smartphone AP, which affected the 4G AP supply to China-based smartphone brands. The share of 12nm smartphone AP among those shipped to China-based vendors therefore fell to 36.3% in first-quarter 2021.

Going forward into second-quarter 2021, Transsion and Honor will significantly hike their use of Unisoc's 4G AP made on the 12nm node. On top of that, shipments to fill 4G AP orders placed in first-quarter 2021 are being deferred. As such, the share of 12nm smartphone AP is estimated to climb to 39.5%, on par with the share of 6/7/8nm smartphone AP.

Chart 7: Shipment share by manufacturing process, 1Q20-2Q21

Source: Digitimes Research, May 2021

Supplier analysis

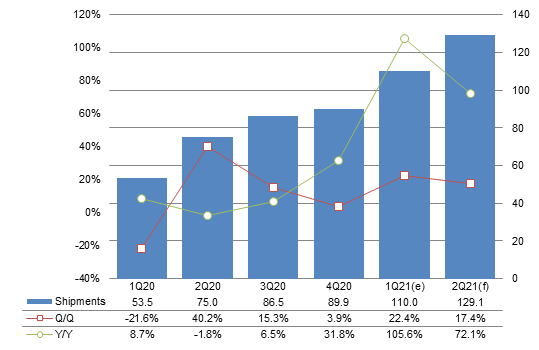

MediaTek

Chart 8: MediaTek smartphone AP shipments, 1Q20-2Q21 (m units)

Source: Digitimes Research, May 2021

MediaTek shipped 110 million smartphone processors to China-based vendors in first-quarter 2021, representing a 22.4% sequential growth and a 105.6% annual growth.

MediaTek's growth was driven by successful overseas market expansion on the part of Xiaomi, Oppo and Transsion. Furthermore, MediaTek was able to add orders for its 4G AP Helio G35, G80 and G95 to be made on TSMC's 12nm node and thus ramp up shipments. Still, the supply of 4G AP could hardly keep up with demand due to 4G PMIC shortage.

Supply of Qualcomm's 5G AP Snapdragon 870 and 888 produced by Samsung was curtailed by Samsung's limited capacity. MediaTek's Dimensity 1100/1200 chips were made by TSMC with stable yield and more adequate capacity so they got largely used by Vivo and Oppo, enjoying the benefit of transferred orders.

MediaTek's second-quarter 2021 smartphone AP shipments to China-based vendors are estimated to climb 17.4% quarter-over-quarter and soar 72.1% year-over-year to reach 129.1 million units.

With its 4G AP supply falling behind vendors' demand to stock up in first-quarter 2021, some shipments will get deferred to second-quarter 2021.

PSMC produces smartphone PMIC for MediaTek and expanded its smartphone PMIC production capacity in first-quarter 2021, which will help ease the shortage of MediaTek's smartphone PMIC.

In response to multiple uncertainties, China-based brands continue to ramp up orders. MediaTek offers a more complete product portfolio for 5G phones than Qualcomm and its chips are produced on TSMC's 6nm and 7nm nodes with stable yield and ample capacity so it is able to secure large orders.

Compared to the level seen in second-quarter 2020, MediaTek's second-quarter 2021 smartphone AP shipments to China-based vendors are estimated to surge 72.1%.

Smartphone shipments to the China market showed a large rebound. However, India implemented nationwide lockdown for two months starting March 2020 in the face of the COVID-19 outbreak, which took a heavy toll on smartphone demand and sales. The market did not begin to recover until early June, which offset the large rebound in shipments to the China market.

Chart 9: MediaTek shipments by baseband type, 1Q20-2Q21 (m units)

Source: Digitimes Research, May 2021

Chart 10: MediaTek shipment share by baseband type, 1Q20-2Q21

Source: Digitimes Research, May 2021

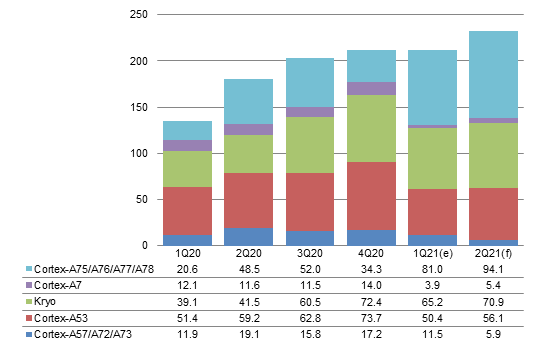

Chart 11: MediaTek shipments by architecture, 1Q20-2Q21 (m units)

Source: Digitimes Research, May 2021

MediaTek's 5G chips – Dimensity 1200/1100/1000 and 800/700/600 are based on Cortex-A75/A76/A77/A78.

Starting first-quarter 2021, Dimensity 1100/1200 chips are being produced on TSMC's 6nm node with high yield and adequate capacity. They were largely used by China-based brands so the share of Cortex-A75/A76/A77/A78 soared to 57.7% in first-quarter 2021 and is expected to further climb to 59.7% in second-quarter 2021.

Helio A22 and P22 processors are based on Cortex-A53 and were the pillars supporting the shipments of Cortex-A53-based chips 2019 through 2020. Going into first-half 2021, China-based smartphone brands are upgrading from Helio A22 and P22 to G85 and G95, which are based on Cortex-A75/A76. Meanwhile, Samsung is also hiking its use of MediaTek's 4G AP, which is squeezing the 4G AP supply to China-based smartphone brands. As such, the share of Cortex-A53 is estimated to plunge to 37.3% in second-quarter 2021.

The share of Cortex-A7-based MT65/56 series will fall below 1% in first-half 2021 due to a decline in Transsion's adoption, 3G network being shutting down in China and PMIC being supplied to high-end AP at a higher priority.

Chart 12: MediaTek shipment share by architecture, 1Q20-2Q21

Source: Digitimes Research, May 2021

Chart 13: MediaTek shipment share by product line, 1Q20-2Q21

Source: Digitimes Research, May 2021

The share of Dimensity series among MediaTek's AP shipments to China-based vendors shot up to 34.9% in first-quarter 2021 as its high-end 5G AP Dimensity 1100/1200 and entry-level 5G AP Dimensity 700 entered volume production at TSMC. MediaTek's Dimensity series enjoyed more adequate capacity than Qualcomm's processors competing in the same segment and adoption by Xiaomi, Oppo and Vivo. Qualcomm also lacked new 6nm chips and thus was less competitive.

With MediaTek's new 5G AP Dimensity 850 going into volume production and MediaTek's access to more adequate 5G AP production capacity compared to Qualcomm, MediaTek will continue to enjoy transferred orders. The share of Dimensity series among MediaTek's AP shipments is therefore expected to grow to 36.9% in second-quarter 2021.

The combined share of Helio G, P and A series among MediaTek's AP shipments plummeted to 58% in first-quarter 2021 mainly as a result of tight global supply of 8-inch wafer foundry capacity curtailing 4G phone PMIC availability.

The share of MT673X series will continue to decline throughout first-half 2021, lowering to 2.3%, as 4G feature phones gradually get replaced by low-end smartphones, smartphone PMICs remain in tight supply and Transsion switches to using Helio processors.

Qualcomm

Chart 14: Qualcomm smartphone AP shipments, 1Q20-2Q21 (m units)

Source: Digitimes Research, May 2021

Qualcomm's first-quarter 2021 smartphone AP shipments to China-based vendors came to 73.3 million units, down 16.6% quarter-over-quarter but up 29.7% year-over-year.

Qualcomm's 4G AP shipments were curtailed by insufficient capacity resulting from smartphone PMIC shortage. Moreover, its 4G chips came with less attractive CP ratios compared to MediaTek's. There were also few new 4G chips being launched. Worse yet, its big customer Xiaomi largely reduced the use of Qualcomm's chips. All these factors resulted in a decline in Qualcomm's 4G AP shipments.

Multiple production side factors limited Qualcomm's 5G supply, including insufficient capacity of Samsung's 5nm and 8nm processes and Samsung halting operation of its Texas plant due to snow storms, which affected shipments of smartphone RF IC. This took a heavy toll on Snapdragon 780G, 888 and 480 shipments.

Qualcomm lacked new 6nm processors for mid-range 5G phones. Its product mix was not as complete as MediaTek's, which prompted vendors to transfer orders to MediaTek for its Dimensity 1100/1200.

Qualcomm's second-quarter 2021 smartphone AP shipments to China-based vendors are estimated to come to 76.5 million units, up 4.4% quarter-over-quarter and 21.6% year-over-year.

Qualcomm's new 5G AP Snapdragon 7325, manufactured on TSMC's 6nm node with good yield and ample capacity, will go into volume production and will be used by multiple vendors. This will fuel Qualcomm's shipment momentum.

Qualcomm has successfully added orders for its 5G AP Snapdragon 870 to be produced on TSMC's 7nm node and can expect expanded capacity.

Chart 15: Qualcomm shipments by baseband type, 1Q20-2Q21 (m units)

Source: Digitimes Research, May 2021

Chart 16: Qualcomm shipment share by baseband type, 1Q20-2Q21

Source: Digitimes Research, May 2021

Chart 17: Qualcomm shipments by architecture, 1Q20-2Q21 (m units)

Source: Digitimes Research, May 2021

Qualcomm's 5G processors are mostly based on its self-developed architecture, including Snapdragon 888, 870, 860 and 480, scheduled for launch in first-half 2021.

The share of Qualcomm's self-developed architecture is set to exceed 90% in first-half 2021.

The share of Cortex-A53 is estimated to fall below 10% in second-quarter 2021 as continuingly tight smartphone PMIC supply prompts its customers to transfer orders to MediaTek and Unisoc.

With few new projects in emerging markets on top of tight smartphone PMIC capacity forcing Qualcomm to give priority to high-end phones, the share of Cortex-A7 is estimated to come short of 1% in first-half 2021.

Chart 18: Qualcomm shipment share by architecture, 1Q20-2Q21

Source: Digitimes Research, May 2021

Chart 19: Qualcomm shipments by product line, 1Q20-2Q21 (m units)

Source: Digitimes Research, May 2021

Although Qualcomm started to ship its high-end 5G AP Snapdragon 888 and entry-level 5G AP Snapdragon 480 in late fourth-quarter 2020, it made lower-than-expected contribution to the share of 5G AP among Qualcomm's shipments to China-based vendors in first-quarter 2021 due to insufficient supply of Samsung's 5nm and 8nm process capacity. The share only increased 6.8pp to 38.1%.

The share of 5G AP among Qualcomm's shipments to China-based vendors is expected to grow to 41.8% in second-quarter 2021.

Qualcomm's 5G AP Snapdragon 7325, manufactured on TSMC's 6nm node with good yield and ample capacity, will enter volume production to become the main shipment driver of S800/700/600/400 series (5G).

Qualcomm has successfully added orders for its 5G AP Snapdragon 870 to be produced on TSMC's 7nm node and can expect expanded capacity.

The limited improvement on Samsung's 5nm process yield could only slightly help Snapdragon 888 production. Moreover, priority would be given to Samsung Galaxy S21. On top of that, Samsung's Texas plant halting operation affected Qualcomm's shipments of 5G phone RF transceivers. These factors curtailed Snapdragon 888 shipments.

The share of S600/700 (4G) series among Qualcomm's AP shipments to China-based vendors showed little change between fourth-quarter 2020 and first-quarter 2021.

Chart 20: Qualcomm shipment share by product line, 1Q20-2Q21

Source: Digitimes Research, May 2021

Unisoc

Chart 21: Unisoc smartphone AP shipments, 1Q20-2Q21 (m units)

Source: Digitimes Research, May 2021

Chart 22: Unisoc shipments by baseband type, 1Q20-2Q21 (m units)

Source: Digitimes Research, May 2021

Chart 23: Unisoc shipment share by baseband type, 1Q20-2Q21

Source: Digitimes Research, May 2021

Chart 24: Unisoc shipments by architecture, 1Q20-2Q21 (m units)

Source: Digitimes Research, May 2021

Chart 25: Unisoc shipment share by architecture, 1Q20-2Q21

Source: Digitimes Research, May 2021

Hisilicon

Chart 26: Hisilicon smartphone AP shipments, 1Q20-2Q21 (m units)

Source: Digitimes Research, May 2021