To raise SiC capacity while lowering the cost, leading global IDMs including Wolfspeed, STMicroelectronics (ST) and Rohm undertake plans to volume produce 8-inch SiC wafers sometime between 2022 and 2024.

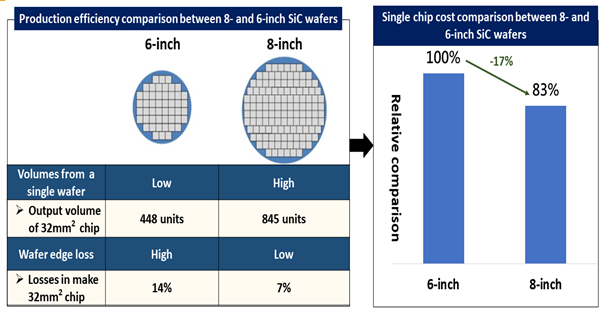

To meet the enormous SiC demand from EVs, SiC wafer producers are on course to transition toward 8-inch wafer production. In comparison to a 6-inch wafer, 1.8 times more dies can be produced on an 8-inch wafer and the yield loss at the wafer edge is 7pp lower.

Moreover, the production equipment for 8-inch wafers costs not much higher than that for 6-inch wafers so the unit cost for components made from an 8-inch wafer is 17% lower than from a 6-inch wafer.

Introduction

Based on DIGITIMES Research's observations, soaring silicon carbide (SiC) demand from electric vehicles (EV) is leading to a tight supply of 6-inch SiC wafers, of which the cost will unlikely go down. To raise SiC capacity while lowering the cost, leading global IDMs including Wolfspeed, STMicroelectronics (ST) and Rohm undertake plans to volume produce 8-inch SiC wafers sometime between 2022 and 2024.

To meet the enormous SiC demand from EVs, SiC wafer producers are on course to transition toward 8-inch wafer production. In comparison to a 6-inch wafer, 1.8 times more dies can be produced on an 8-inch wafer and the yield loss at the wafer edge is 7pp lower. Moreover, the production equipment for 8-inch wafers costs not much higher than that for 6-inch wafers so the unit cost for components made from an 8-inch wafer is 17% lower than from a 6-inch wafer.

In terms of the developments of leading global IDMs, a large part of the SiC capacity that No.1 player Wolfspeed has added is for 8-inch wafer production. Wolfspeed unveiled its Mohawk Valley, New York facility in April 2022, which is the world's first 8-inch SiC wafer fab. The production is expected to ramp up in 2023. More than that, the company recently announced its plan to build another 8-inch SiC wafer fab in North Carolina, which, when running at full capacity in 2030, will increase Wolfspeed's SiC output to 10 times its capacity today.

Given the tight SiC supply, ST plans to volume produce 8-inch SiC wafers in 2023 mainly at its Catania site in Italy. ST supplies SiC components to 80 customers and 20 of them are automakers. Tesla, in particular, gets access to a larger share of ST's capacity due to the early adoption of SiC power components in its EVs.

Seeing the surging sales of its SiC power components and the long lead time, Rohm plans to invest up to JPY170 billion in fiscal years 2021 through 2025 to increase its SiC capacity. As part of the plan, 8-inch SiC wafers and components are scheduled to enter volume production in 2024 and 2025 respectively. Rohm expects its SiC revenue to top JPY100 billion and its SiC market share to reach 30% by 2025.

Application

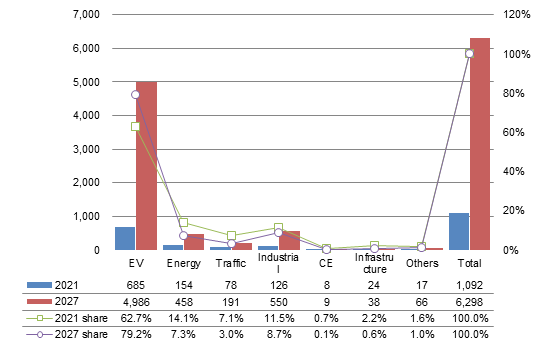

Chart 1: SiC component sales by application, 2021, 2027 (US$m)

Source: Yole, compiled by DIGITIMES Research, September 2022

Breaking down the SiC component application market by applications, EVs represented the largest share in 2021, reaching 62.7% and US$685 million. EVs are expected to continue dominating the SiC component application market, with the share to climb to 79.2% by 2027.

An EV uses four to ten times more semiconductor chips than a fuel car and requires power components that can withstand high voltages and high temperatures so SiC components are ideal for EVs.

Source: DIGITIMES Research, September 2022

In the next three years, SiC capacity will not be able to keep up with the large demand for EVs.

Driven by the large growth of the global EV market, the usage of 6-inch and equivalent SiC wafers (the currently mainstream size) will increase 10 times from 2022 through 2025, leading to a SiC shortage in the next three years.

For example, Tesla has gotten hold of virtually all of ST's SiC capacity.

As the cost of 6-inch SiC wafers cannot go much lower, suppliers are transitioning to 8-inch wafers as a strategy to reduce cost.

In 2022, 6-inch SiC wafers cost US$900 to US$1,000, comparable to the 2021 level. Going into 2023, the prices will unlikely go down because SiC will be in tight supply.

SiC suppliers are transitioning to 8-inch wafers in view of the higher production efficiency and wafer utilization as 1.8 times more dies can be produced on an 8-inch wafer than on a 6-inch wafer.

For example, if all the power components in an EV are SiC-based, the SiC components produced on a 6-inch wafer can satisfy the use of two EVs while those produced on an 8-inch wafer can satisfy the use of three.

Leading suppliers and newcomers are developing 8-inch SiC wafers to strengthen their competitive edge.

For now, 6-inch wafers are the mainstream produced by leading suppliers and they will focus capacity expansion on 8-inch wafers in an attempt to widen their lead over the competition.

Even newcomers will directly go for 8-inch wafer production. This way, not only can they compete against existing players but they also have a chance to overtake existing players on a curve.

Industry breakdown

Cost

*Note: The comparison assumes both technologies have already matured for volume production.

Source: DIGITIMES Research, September 2022

Except for wafer costs, there are no significant differences between the costs incurred during the stages of 8-inch and 6-inch SiC processes, including epitaxy, fabrication and packaging.

Concerning wafer costs, although an 8-inch SiC wafer, when reaching mature volume production, will have a price tag 1.5 times that of a 6-inch SiC wafer, the number of dies that can be produced will be 1.8 times higher so the cost per die is lower.

The epitaxy costs are about the same between the two different wafer sizes mainly because the processes use the same gas.

The epitaxy equipment can support the production of different wafer sizes. For example, the equipment designed for 8-inch SiC wafers can be used for 6-inch SiC wafers.

Concerning the photolithography and component fabrication processes, the cost for 8-inch SiC wafers is only slightly higher than that for 6-inch SiC wafers.

The packaging costs are not correlated to the wafer size.

Production efficiency

Table 3: Production efficiency comparison between 8- and 6-inch SiC wafers

*Note: The wafer images are for reference only; the reduction in costs of chips made via 8-inch SiC wafers refers only to when the technology is matured for volume production.

Source: Wolfspeed, compiled by DIGITIMES Research, September 2022

Furthermore, the unit cost for SiC components made from an 8-inch wafer is 17% lower than from a 6-inch wafer.

For example, 845 dies of size 32mm2 can be produced from an 8-inch wafer, which is 88.6% more than the quantity made from a 6-inch wafer. Also, the yield loss at the wafer edge is 7pp lower.

Especially now that SiC wafers are in tight supply, the cost of mainstream 6-inch SiC wafers can hardly go down. As such, with 8-inch SiC wafers enabling a higher yield and 8-inch SiC wafer equipment costing virtually the same as 6-inch SiC wafer equipment, the unit cost for components made from an 8-inch wafer is 17% lower than from a 6-inch wafer.

IDMs

Source: Companies, compiled by DIGITIMES Research, September 2022

Driven by soaring SiC demand from EVs, on top of many automakers' plans to adopt SiC power components in their 2025 new cars, leading global IDMs are on course to volume-producing 8-inch SiC wafers.

Leading IDMs including Wolfspeed, ST and Rohm have scheduled their 8-inch SiC wafer volume production for some time between 2022 and 2024.

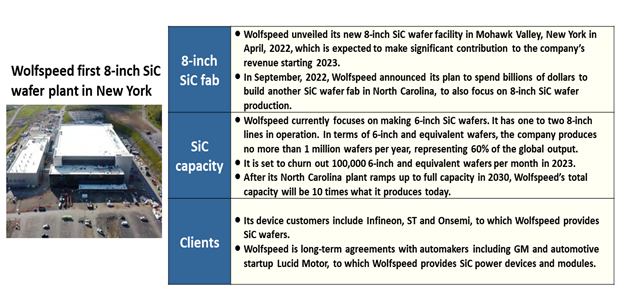

Wolfspeed

Table 5: Wolfspeed SiC business deployment

Source: Wolfspeed, compiled by DIGITIMES Research, September 2022

With three decades of experience in SiC production, Wolfspeed enjoys more than 60% of the worldwide SiC wafer market. To keep up with the enormous SiC demand, Wolfspeed focuses its capacity expansion on 8-inch wafers.

For the time being, 6-inch wafers still represent a large portion of Wolfspeed's SiC wafer products. It makes no 4-inch SiC wafers. The SiC production lines Wolfspeed plans to build going forward will all output 8-inch wafers to meet the great demand from EVs.

Wolfspeed unveiled its Mohawk Valley, New York facility in April 2022, which is the world's first 8-inch SiC wafer fab. The production is expected to significantly ramp up in 2023 when the total capacity will be 30 times the 2017 level according to the company's projection.

In September 2022, Wolfspeed announced its plan to build another 8-inch SiC wafer fab in North Carolina, which will boost Wolfspeed's SiC output to 10 times what it produces today when the facility cranks up to full capacity in 2030.

Alongside the increase in SiC wafer output, the efficiency of the epitaxy process is also on the rise.

The speed of the epitaxy process increased five to seven times between 2017 and 2021 and the speed and yield are positively correlated.

Wolfspeed supplies products to component manufacturers and automakers.

Component manufacturers including Infineon and ST signed long-term supply contracts worth US$1.3 billion with Wolfspeed to secure a stable supply of SiC wafers.

Wolfspeed also engages in a supply guarantee with American automaker GM to produce the SiC power components GM needs at the Mohawk Valley plant.

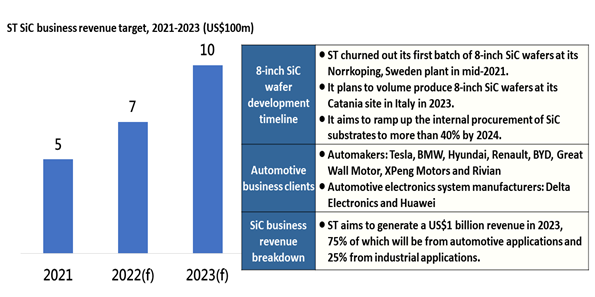

STMicroelectronics

Table 6: STMicroelectronics SiC business deployment

Source: STMicroelectronics, compiled by DIGITIMES Research, September 2022

Given the tight SiC supply and the large SiC demand from automotive products, ST looks to volume produce 8-inch SiC wafers starting in 2023.

Its Catania site in Italy will be its major 8-inch SiC wafer production hub and the large-size wafer fabrication technology will come from its subsidiary Norstel, which ST acquired in 2019.

ST currently makes its mainstream 6-inch SiC wafers at its plants in Catania and Ang Mo Kio, Singapore.

ST supplies SiC components to 80 customers and 20 of them are automakers. Tesla gets access to a larger share of ST's capacity due to the early adoption of SiC power components in its EVs.

ST's SiC business revenue is set to trend upward year after year following the volume production of its 8-inch SiC wafers, on course to top US$1 billion in 2023, doubling its 2021 figure.

Rohm

Table 7: Rohm SiC business deployment

Source: Rohm, compiled by DIGITIMES Research, September 2022

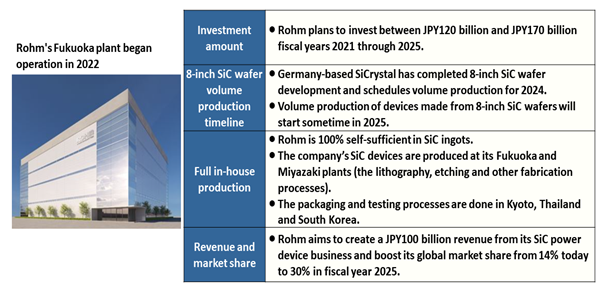

Seeing the surging sales of its SiC power components and the long lead time (one year as of 2022), Rohm plans to invest up to JPY170 billion in fiscal years 2021 through 2025 to increase its SiC capacity.

The investment targets include front-end SiC crystal growth, SiC wafer production and SiC component fabrication.

Rohm's SiC production is all done in-house. The SiC ingots Rohm needs are 100% supplied by SiCrystal, its subsidiary acquired in 2009. Due to the tight capacity, the share of external supply is low. Rohm purchases no SiC ingots from any third-party supplier.

The SiC production lines that Rohm plans to build include one in Chikugo, Fukuoka (a JPY20 billion investment project) to kickstart operation in 2022 for fabricating SiC components and another one in SiCrystal's plant in Germany mainly for growing SiC crystals and producing SiC wafers.

Part of Rohm's added capacity will be allocated toward 8-inch SiC wafer production, which is expected to reach volume production in 2024, with the volume production of SiC components to follow in a year (2025).

Rohm is currently operating a larger 6-inch wafer capacity than 4-inch. The Chikugo facility has machines that support both 6-inch and 8-inch wafer production. Although some of the machines can make 8-inch wafers, they will be used to make 6-inch wafers for now and recalibrated to make 8-inch wafers in 2024-2025.

Rohm's SiC power component capacity in 2025 will soar to six times its 2021 capacity, hoisting its SiC revenue to JPY100 billion and its global market share to 30%.