The aging of Japanese society comes with a shortage of labor in the logistics industry, and more and more of its people are finding it more inconvenient to make daily purchases. Worse still, the rapid growth of e-commerce has increased the demand for labor in the logistics industry.

Delivery robots can carry out last-mile delivery to alleviate the problem of labor in the logistics industry. The Japanese government has already given the green light to delivery robots since April 2023, and operators of delivery robots only need to obtain the safety certification from the Robot Delivery Association before applying for a permit from the government of the region where it intends to operate.

Delivery robots in Japan mostly rely on LiDARs, which are quite expensive and are mostly imported. They need relatively higher computing power, which means they have to be supported by higher-performance PCs/CPUs. The batteries, the machine chassis and the components are all made in small volumes, adding to the hardware costs. Since software for item recognition and navigation is a rather new domain for Japanese developers, they are required to up their investments in related development.

Introduction

Japan's delivery robot market is still at its initial stage of development, according to DIGITIMES Research's observation. The costs for producing the machines and their operation afterward were still high. On the hardware side, the machines are made in small volumes and components prices are high.

On the operation side, human intervention is still required for remote control and in the event of machine malfunctioning. In a bid to resolve problems arising from its aging society, Japan hopes that delivery robots can ease the labor shortage in the logistics sector. Japan is making plans for three specific application scenarios – urban areas, sparsely populated regions, and healthcare systems – as it keenly promotes the standardization of robot-friendly facilities.

The aging of Japanese society comes with a shortage of labor in the logistics industry, and more and more of its people are finding it more inconvenient to make daily purchases. Worse still, the rapid growth of e-commerce has increased the demand for labor in the logistics industry.

Delivery robots can carry out last-mile delivery to alleviate the problem of labor in the logistics industry. The Japanese government has already given the green light to delivery robots since April 2023, and operators of delivery robots only need to obtain the safety certification from the Robot Delivery Association before applying for a permit from the government of the region where it intends to operate.

Delivery robots in Japan mostly rely on LiDARs, which are quite expensive and are mostly imported. They need relatively higher computing power, which means they have to be supported by higher-performance PCs/CPUs. The batteries, the machine chassis and the components are all made in small volumes, adding to the hardware costs. Since software for item recognition and navigation is a rather new domain for Japanese developers, they are required to up their investments in related development.

At the early stage of operating delivery robots, manual controllers are still required to conduct one-on-one monitoring and control of the robots: the personnel are still needed to load and unload the goods, recharge the batteries, and handle traffic incidents and failed deliveries. And when a robot delivery firm expands to a new region, it will have to communicate with the local people, trying to convince them of the benefits of their services. These all add to the costs of operating delivery robot services.

Japan is targeting three application scenarios: urban areas, sparsely populated regions and healthcare systems for its delivery robots. However, the present delivery robots are not equipped with the capability to climb stairs or ride the elevator, which prevents them from carrying goods into buildings. Japanese firms have formed a task force seeking to standardize the use of flooring materials, the evenness of the floor levels, and the inclination of slopes. They are seeking to standardize the communication protocols of automatic doors and elevators, creating more robot-friendly environments.

Labor shortage in Japan

According to Persol's studies, Japan will see a labor shortage of 6.44 million workers by 2030.

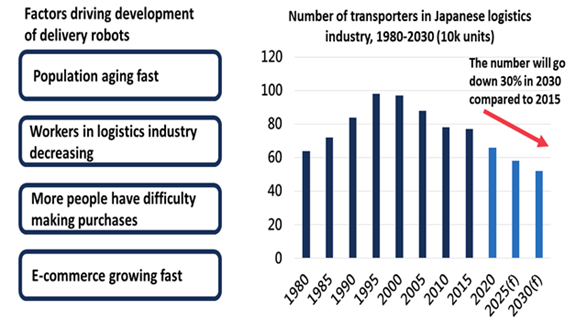

According to Japan Institute of Logistics Systems (JILS), the average age of workers in the logistics industry is rising, while the number of workers in the industry has been decreasing annually since 2000. It is estimated that the number of workers in the industry will have decreased by at least 30% by 2030 compared to 2015, creating a huge gap in labor supply.

The rapidly growing e-commerce has increased demand for logistics support. In 2020, the pandemic-driven needs boosted home deliveries by 11.9% and the e-commerce market shot up by 21.7%.

In addition to the labor shortage caused by the aging of Japan's population, the aging of consumers and the disappearance of small local retail stores have led to a rise in the number of residents who find it difficult and inconvenient to purchase daily necessities. The closure of many brick-and-mortar stores during the pandemic has subsequently led to a significant increase in the number of people who find it difficult to make purchases, and there has been a great need for home delivery services, as well as services such as purchasing of household goods on behalf of the elderly.

In addition to opening up the labor market to foreign migrant workers, delivery robots are another much-anticipated solution for the logistics industry in Japan. Delivery robots are machines that perform last-mile deliveries over short distances, frequently delivering small quantities and a wide variety of items and are suitable for traveling on sidewalks, bicycle paths, and regular roads.

In order to reduce delivery costs, delivery robots around the world are mainly low-cost, four-wheeled robots that lack the capability of entering buildings or climbing the stairs. The robot can only reach as far as the entrance of the first floor of the building where the customer is located, and then let the customer take out the goods from its storage box.

Delivery robots traveling on sidewalks, bike paths or roads need to identify and avoid pedestrians, vehicles and other moving objects, and must maintain environmental awareness amid weather changes. Therefore, delivery robots are mainly autonomous mobile robots (AMR) with the ability to plan their routes. They are equipped with a number of sensors such as LiDARs, radars, and cameras. Depending on the routes of travel, there are delivery robots that are autonomous vehicles driving on the road, and sidewalk robots that take the sidewalks and bike paths.

Chart 1: Number of transporters in Japanese logistics industry and factors driving development of delivery robots

Source: JILS; compiled by DIGITIMES Research, October 2023

In Europe and the US, the wide sidewalks and low population densities are suitable for delivery robots. Delivery robots are better regulated in the US, which attracts major global players to test and operate their services in the US. US personal delivery device legislation was first introduced in 2017 and so far 22 states have related regulations in place. As different interests are behind the laws and regulations in different states, the requirements for loads, speed limits, and accountability vary greatly from state to state.

US delivery robot service providers have already teamed up with delivery platforms such as Uber Eats, Grubhub, Shopify and 7-Eleven, as well as e-commerce operators and retailers to provide services. In Europe, Norway's postal service has adopted delivery robots in Oslo.

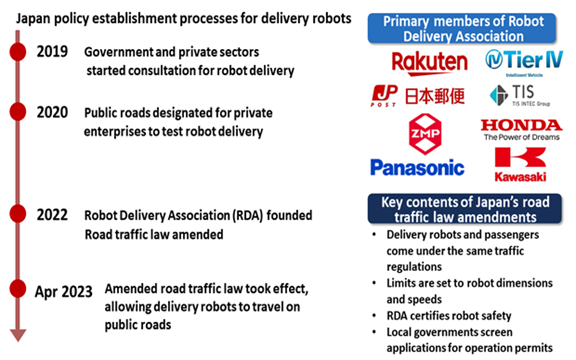

The development of delivery robots in Japan has been slower than in Europe and the US. In 2019, the Japanese government began studying the feasibility of delivery robots. In 2020, the Japanese government designated some public roads in specific areas for small-scale testing. And in 2022, it amended its road traffic law, allowing delivery robots to use public roads starting April 2023.

The 2022 amendment to Japan's road traffic law stipulates that delivery robots are limited to a traveling speed of 6km per hour, and their size cannot exceed that of a motorized wheelchair (70cm in length x 120cm in width x 120cm in height). They need to comply with the same regulations governing pedestrians but need to yield the right of way to pedestrians. After obtaining safety certification from the Robot Delivery Association (RDA), a service provider may apply for a permit from the government of the district where it intends to operate robot delivery services.

The RDA plays the role of gatekeeper for the safety of delivery robots, scrutinizing the speeds, sizes, and emergency stop mechanisms of the robots, as well as ensuring that the specifications for remote monitoring/operation, conflict avoidance mechanisms, and the number of remotely operable units are perfected.

Table 1: Japan policy establishment processes for delivery robots and details

Source: Japan METI; compiled by DIGITIMES Research, October 2023

Delivery robot details

Components and infrastructure

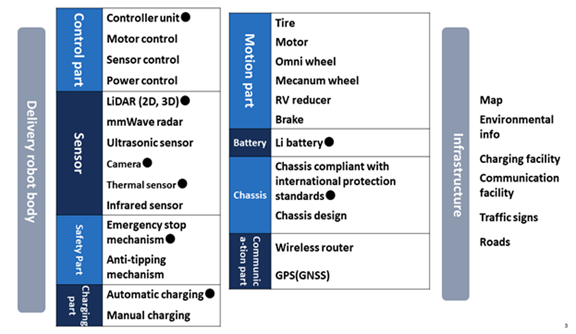

Delivery robots and pedestrians share the streets, so it is necessary to optimize the robot software, hardware and environmental infrastructure to minimize the possibility of hazards caused by robots to pedestrians.

The robotic system of the delivery robot performs simultaneous localization and mapping (SLAM) while planning the route of travel through sensors. It also detects and bypasses obstacles during the ride. It also has to enable remote monitoring and a certain degree of remote operation, because when the robot encounters a problem that it cannot resolve by itself, it needs human intervention.

As far as Japan's delivery robot hardware is concerned, the LiDAR, camera, and thermal sensor are important and expensive sensors, some of which still need to be imported, such as LiDARs from Ouster and Slamtec, and thermal sensors from Teledyne FLIR. Japanese companies can provide various other key components, such as emergency stop devices from IDEC and mmWave radars from Asahi Kasei.

Delivery robots also need external infrastructure support for their services. Robot operators need to have a 3D point cloud map of the area they work in and obtain real-time environmental intelligence such as weather information, traffic conditions, and pedestrian flow. Also, stable wireless network coverage is required for the robot to travel along the road, and a 5G network with ultra-high reliability and ultra-low latency is the safest option to minimize the latency during remote monitoring and operation.

Four-wheeled delivery robots need to run on flat and stable road surfaces. And due to the robot's size limitations, there is a need for support of an extensive network of charging facilities. Delivery robots also need the support of cameras and image recognition AI systems to identify traffic signs. If they can connect to traffic signal systems through the Internet of Things to directly receive traffic information, they will depend less on image recognition.

Table 2: Key components used in delivery robots and infrastructure

*Note: Components with a black dot indicate the key parts that have a major influence on cost.

Source: PwC; compiled by DIGITIMES Research, October 2023

Cost

Delivery robots are still in the early stage of development in Japan, with the cost of a single unit roughly over JPY5 million yen (US$33,406), and monthly operating costs of about JPY1 million per robot.

LiDARs are important components for Japan's delivery robots. LiDAR providers are mostly foreign vendors asking for high prices for their supplies but offering rather unstable delivery schedules. LiDARs also need relatively higher computing power from PCs and CPUs. Japanese firms are looking to develop camera-based delivery robots, replacing the use of the more expensive LiDARs. Mitsubishi is introducing Cartken robots from the US that use only cameras without any LiDARs to reduce the cost of the machine.

In the early stage of the development of Japanese delivery robots, batteries, chassis, and maintenance parts are made in small quantities, which incurs high costs. Japanese manufacturers have strong manufacturing capabilities, and manufacturing costs could come down when the production scale enlarges.

Operating delivery robots in Japan incurs high personnel costs at the initial stage. They still require one-on-one monitoring/control by operating staff and on-site personnel to assist in loading, unloading, and battery charging. Operating personnel need training. In the event of traffic accidents and delivery errors, manpower support and insurance claim processing are needed. When introducing its business into a new region, the service provider will need to communicate with the residents to convince them of the benefits of the services.

Delivery robots rely on stable wireless networks, and 5G technology is currently the most stable option. However, 5G network deployments are still progressing slowly, and as a single telecom operator is unable to cover all of Japan, the robots need to install multiple SIM cards and switch between 4G/5G networks, currently the more stable way of connectivity.

Japan's delivery robots run only nine hours a day at the early stage of operation, and the robot's battery can only last for three to four hours. With the operational personnel gaining more experience and each of them able to monitor more robots at the same time, the daily service hours for robots may increase and the personnel cost may drop.

Source: PwC; compiled by DIGITIMES Research, October 2023

Player

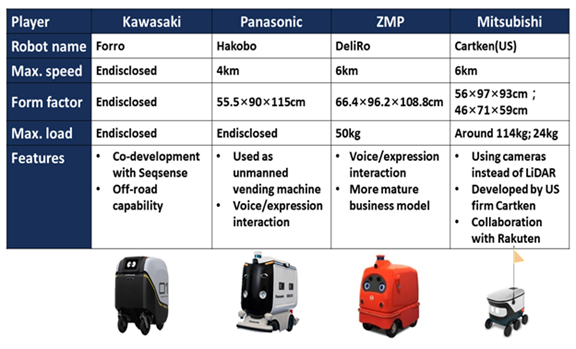

Kawasaki, leveraging its experience in the production of off-road vehicles, has introduced Forro, a robot that can travel on rough roads and slopes. The Fujita Medical University Hospital has already adopted it to help transport experiment samples on its premises and is trialing it in urban areas of Tokyo for delivering prescription drugs and daily necessities.

Panasonic has developed X-Area, a robotic mobile service platform covering cleaning robots, automated transport vehicles and delivery robots. Its Hakobo, a delivery robot that travels at a speed of only 4km per hour, has been tested with Rakuten in Tsukuba City to provide delivery services and assisted pharmacies in delivering medicine to homes in Fujisawa City. It can also be used as a mobile vending vehicle, and a trial run of the unmanned vending machine was conducted in Marunouchi in the heart of Tokyo in 2021.

ZMP has introduced the most commercially available delivery robot in Japan so far. Its DeliRo robot can carry a load of up to 50kg, and ZMP has already partnered with Japan Post to launch a dedicated robot to assist with postal deliveries. In 2021, it teamed up with Eneos to provide delivery services catering for a number of restaurants and supermarkets in specific areas of Tokyo, at a delivery fee of JPY330 per order. ZMP also provides RaaS (robot as a service) commercial services, which charge a monthly fee of JPY120,000 per robot and an upfront installation cost of JPY2 million.

Kawasaki, Panasonic and ZMP robots all interact with human beings. The two eyes on the front of the robot can make different expressions, and the machines can emit sounds to greet and interact with pedestrians.

Mitsubishi has adjusted Cartken-developed robots. A Cartken robot combines six cameras to enable visual SLAM, without using LiDARs, which sharply reduces the production cost of the robot. Mitsubishi, in cooperation with Rakuten, has been testing delivery services in Yokosuka City and some areas of Tsukuba City.

Table 4: Delivery robot players in Japan and product details

Source: Companies; compiled by DIGITIMES Research, October 2023

Application fields

The three main scenarios of applications for delivery robots in Japan are urban areas, sparsely populated regions, and healthcare systems. Urban areas include offices, residential areas and parks, where delivery services are provided to residents and commuters for meals, daily necessities, parcels, and refrigerated goods.

The sparsely populated areas include intermediate farmlands (those lying on slopes between farms on the flatland and in the mountains), and outlying islands. These areas are characterized by small-scale farming by individual farmers. Such farmlands account for approximately 70% of Japan's land area, but only 1% of its population. Intermediate agricultural areas and outlying islands are both facing problems of aging, diminishing population, and a lack of labor in the logistics sector. The transported items are mainly crops and daily necessities.

Services for the healthcare system cover transportation on hospital premises and medicine delivery in the community. The impact of the COVID pandemic and the shortage of medical personnel have popularized contactless deliveries. Pharmacies can dispatch robots to deliver prescription drugs to patients who cannot show up in person to obtain them.

Existing mobile robots can only travel on level ground and are unable to climb stairs or use elevators. They have difficulty navigating indoor areas, limiting their use.

Japanese companies have formed a facility management technology committee with the goal of creating a robot-friendly environment that facilitates the introduction of robots to transportation, cleaning, and security in service spaces such as office buildings, commercial facilities, train stations, hotels, and hospitals, and allows indoor mobile robots to move through buildings to the fullest extent possible without being confined to a specific area.

The committee has been working to standardize the physical characteristics of the facilities, such as flooring materials, differences in heights, inclination of slopes, and lighting, in order to create a space where four-wheeled robots can move around. It is also seeking to design communication protocols for elevators and automatic doors so that the robots can freely use the elevators and automatic doors to move through different floors and spaces.

A clear measurement standard has been introduced for the management of robot-friendly facilities concerning the physical characteristics of the environment. A protocol for robot communication with elevators and automatic doors was also unveiled in 2022, and the Japanese government intends to promote the protocol as an international standard.

Starting in 2022, Mitsubishi Estate has begun adopting the communication protocol between robots and elevators/automatic doors in its buildings.

Summary

DIGITIMES Research has found that in the US, the development of the delivery robot sector has usually begun with companies first rolling out technologically mature products, and then lobbying for state government support for commercial operations. In Japan, government support has been playing a much bigger and more active role in the development of delivery robots – first identifying the needs arising from changes in social structure and the needs of small towns and villages, and then extending help to private firms in carrying out on-site testing. The Japanese government has also amended the laws and launched efforts to provide a robot-friendly environment through the standardization of specifications.

In addition to the introduction of foreign migrant workers, the development of delivery robots is expected to alleviate the shortage of logistics labor and fill the manpower gap in the three major application scenarios: urban areas, sparsely populated regions, and the healthcare system.

However, Japan has not been strong in developing mobile robots in the past. It was no surprise that Mitsubishi gave up its own development and instead introduced delivery robots from the US firm, Cartken. Japan's domestically made delivery robots are still functionally inferior to those developed by foreign companies, and Japanese developers also lack the kind of experience that their foreign counterparts have in testing the robots. In the early stages of operations, Japanese firms have to invest more in personnel costs in order to make up for the deficiencies in the function of the robot.

Japan is able to produce most of the components itself. The costs of making chassis, batteries and other components can be reduced after the production scale increases. However, Japanese firms are relatively inexperienced in developing software supporting SLAM, object recognition, and navigation, and they need to invest more resources in developing such software support. And sensors are still expensive. As customers pay low fees for the delivery services, there is still a long road ahead for Japan's delivery robot sector to recover the costs.