The global hard disk drive (HDD) industry, already facing challenges from solid state drives (SSDs), cloud computing and limitation of vertical read-write technologies, is expected to face even more challenges resulting from the March 11 earthquake in northeastern Japan, which has severely damaged the plants of local HDD component makers including hard disk maker Showa Denko, and HDD-use substrate makers Furukawa Denko and Kobe Steel. These makers have all reported damage to facilities as well as injuries of employees and have shut down their operations pending further evaluation.

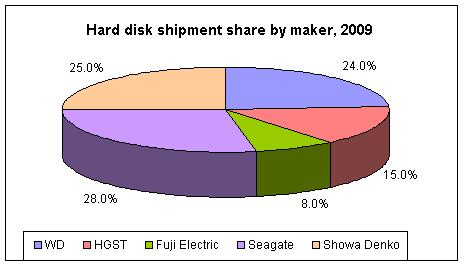

Showa Denko currently has about 25% share of the global hard disk market and in addition to its plants in Japan, the company also has plants in Taiwan and Singapore that can fill in for the suspended capacity at the damaged plants in Japan. Since Showa Denko's clients Western Digital and Seagate also have a portion of their hard disk supplies from in-house production, Digitimes Research believes that the hard disk market will not see any immediate shortages.

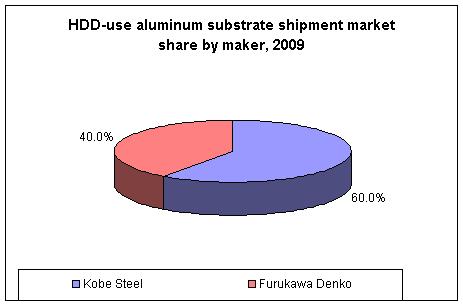

Furukawa Denko and Kobe Steel produce HDD-use substrates using aluminum mainly for desktop PCs. The two makers together dominate the entire HDD-use substrate market. Since their capacities are all located in the disaster zones, if the two makers continue to shut down their operations, the HDD industry may see substrate shortages.

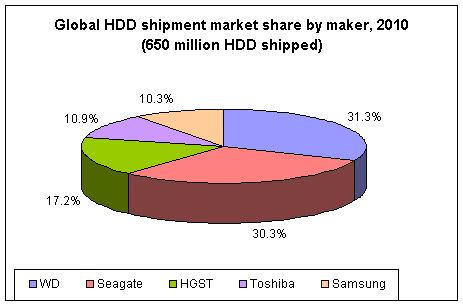

With Western Digital set to acquire Hitachi's HDD subsidiary Hitachi Global Storage Technology, only four major makers will remain in the HDD industry - Western Digital, Seagate, Toshiba and Samsung Electronics. Western Digital and Seagate both produce their hard drives in house, while Toshiba's and Samsung's shipments are partly from in-house production and partly from outsourcing partners. The HDD makers have different lineups of component suppliers, but as the number of HDD component suppliers is limited, any impact on the upstream component sector should have a direct effect on the downstream HDD makers.

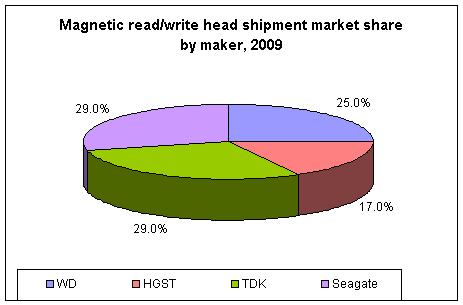

An HDD is constructed with key components such as magnetic read/write heads, disks and electric motors. Japan-based TDK, Showa Denko and Fuji Electric are all suppliers of magnetic read/write heads and disks, while Western Digital and Seagate both manufacture part of their read/write heads and disks, and source from Japan makers.

TDK currently owns about 30% of the global magnetic read/write head market and since its plants in Japan are away from the disaster zones, the company has not seen much impact from the earthquake. However, Showa Denko's two disk manufacturing plants in disaster-stricken areas have shut down.

Showa Denko currently can produce about 22 million disks each month, accounting for 25% of the global market. In addition to its suspended plants in Chiba and Yamagata in Japan, the company also has production lines in Taiwan and Singapore. The company started expanding capacity at its Singapore facilities last year and the new capacity will be able to cover the shortfall at its Japan plants.

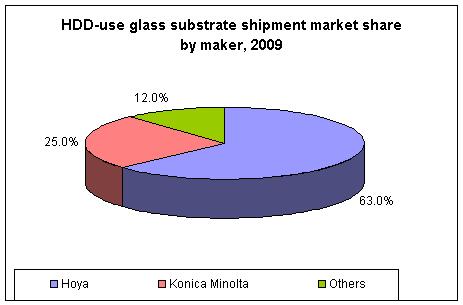

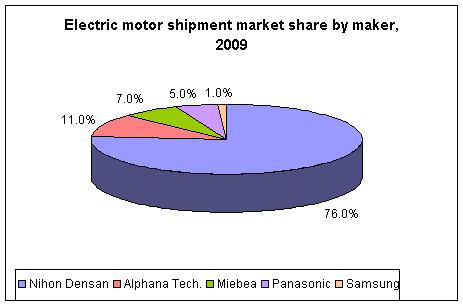

Supply of HDD-use substrates and electric motors is dominated by Japan-based makers. Hoya is a major supplier of glass substrates, while Kobe Steel is a main player for aluminum substrates. Nihon Densan is a top supplier of motors. Most of the substrate and motor makers including Hoya, Nihon Densan and Konica Minolta do not have plants in the disaster zones, and they only have seen limited impact from the earthquake. But both Furukawa Denko and Kobe Steel have plants in the disaster zones.

There are two types of materials used for HDD-use substrates - aluminum and glass. The substrates are mainly supplied to players such as Japan-based Showa Denko and Toyokoban as well as Seagate and Western Digital. Due to its low price, the aluminum substrate has been broadly used in the PC market, especially the desktop segment, while glass substrate, which features strong shock-resistance, is gradually penetrating into the notebook market. Since aluminum substrate is still the mainstream materials for hard drives, the substrate industry is almost dominated by Kobe Steel and Furukawa Denko.

Kobe Steel's and Furukawa Denko's HDD substrate plants are both located in Tochigi, Japan with Kobe Steel capable of producing 30 million and Furukawa Denko 20 million units each month. Since both companies' capacities are all located in the disaster zones, their production issues should significantly impact the HDD industry, especially the desktop segment.

HDD makers have some of the magnetic read/write head and hard disk supply coming from their in-house production, but they still have to rely heavily on substrates and electric motors from Japan suppliers.

Both Seagate and Western Digital are capable of producing hard drives and can make adjustments when needed, and the pair should not see much trouble from possible hard drive shortages. As for Toshiba and Samsung, the two can also receive support from Showa Denko's overseas plants to resolve their shortage issues.

Since HDD substrates are mainly supplied by Kobe Steel and Furukawa Denko, it means that even if the two makers can repair their damaged equipment quickly, their production would still be affected by Japan's rolling power cuts.

Hoya and Nihon Densan were not impacted by the earthquake, but they will still feel the impact of the power brownout policy. They might consider moving their production overseas to lower their revenue losses.

| HDD makers' component supply status | |||||

| HDD maker | HDD | Magnetic read/write head | Hard disk | HDD substrate | Electric motor |

| Seagate | All in-house | Partly in-house, partly outside supply | Party in-house, partly outside supply | All outside supply | All outside supply |

| WD | All in-house | Partly in-house, partly outside supply | Partly in-house, partly outside supply | All outside supply | All outside supply |

| Toshiba | Partly in-house, partly outside supply | All outside supply | All outside supply | All outside supply | All outside supply |

| Samsung | Partly in-house, partly outside supply | All outside supply | All outside supply | All outside supply | Partly in-house, partly outside supply |

Source: Digitimes Research, compiled by Digitimes, March 2011

Source: Digitimes Research, compiled by Digitimes, March 2011

Source: Digitimes Research, compiled by Digitimes, March 2011

Source: Digitimes Research, compiled by Digitimes, March 2011

Source: Digitimes Research, compiled by Digitimes, March 2011

Source: Digitimes Research, compiled by Digitimes, March 2011

Source: Digitimes Research, compiled by Digitimes, March 2011