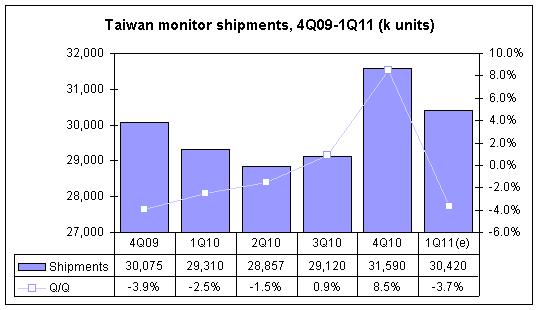

Taiwan-based manufacturers shipped a total of 30.42 million LCD monitors in the first quarter of 2011, down 3.7% sequentially, according to latest data collected by Digitimes Research.

While the contraction rate for the first-quarter monitor shipments suffered by Korea makers was higher than that of Taiwan vendors', the ratio of shipments from Taiwan makers to global monitor shipments dropped 0.1 percentage point to 69.9% in the first quarter due to increased shipments from China and other emerging countries, the Digitimes Research data show.

First-quarter monitor shipments from Taiwan makers still represented an increase of 3.8% from a year earlier, indicating the industry remained healthy. Additionally, the impact of the March 11 Japan earthquake on global monitor shipments was limited, as evidenced by over 30-40% sequential shipment growth rates recorded by Taiwan makers in March.

Source: Digitimes Research, April 2011