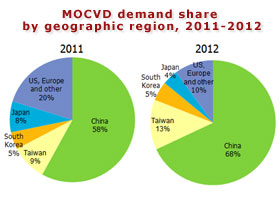

Asia is playing an ever more important role in upstream LED chip manufacturing. Digitimes Research projects that the region will account for 90% of global demand for MOCVD units in 2012, up ten percentage points on the share in the previous year. China accounts for 68% of this figure, although its LED chip makers still need to make major improvements to their technology; consequently, manufacturers in Taiwan, Japan and South Korea continue to have a competitive edge at present.

South Korean manufacturers are generally more competitive in terms of their LED industry chain than their counterparts in Japan and Taiwan, largely thanks to their all-in-one, integrated modes of production, with value added by strong brands in the case of Samsung in particular. However, in terms of LED chip manufacturing capabilities alone, Japanese manufacturers are the most competitive, followed by players in Taiwan, South Korea and China in that order.

Japanese manufacturers are projected to have the highest total output value of any Asian nation/region for their LED businesses in 2012 at US$3.6 billion with year-on-year growth of 17%; followed by South Korean firms with US$3.2 billion and growth of 49.6%, thanks to vertical integration and the fact that output value figures also include modules; and Taiwan-based players with US$1.69 billion, due to their focus on LED component production. However, if modules are removed from the output value equation, Taiwan-based manufacturers will in fact outperform their South Korean counterparts in 2012.

China-based manufacturers that have recently prospered are projected to increase output value by 30% year on year to US$1.42 billion in 2012 as their newly acquired MOCVD capacity comes online. However, most China-based manufacturers mainly produce medium and low power LEDs, and as such pose little threat to the global industry standing of other players in the Asia region at the current time.

Table 2: Industry chain and competitiveness score for LED chip makers by region

Table 3: Products and development trends for LED chip makers, by region

Chart 2: LED chip manufacturing revenues by region, 2011-2012 (US$m)

Table 4: Changes in key data and trends in the LED industry in 2H12 over the whole year

Chart 3: Major Taiwan-based LED chip maker revenues, 1H12 and 1H11 (NT$m)

Chart 4: Quarterly share of annual revenues for Taiwan's major LED chip makers, 2011-2012

Chart 5: Major Taiwan-based manufacturers' 2012 LED chip capacity (units)

Table 5: Capacity plans for major Taiwan-based LED chip makers

Chart 8: Epistar's revenue share by application sector, 2012

Chart 9: Lextar revenue share by application sector, customer and region, 2012

Chart 10: Genesis revenue share by application sector and region, 2012

Comparison of Epistar and Huga's comabined revenues for 1H12 with major players in Japan and Korea

Chart 13: Epistar and Huga have a combined capacity of 210 MOCVD units

Chart 15: Revenues and operating profits for TG's LED optoelectronics division, 3Q10-1Q12 (JPYb)

Chart 16: TG's LED optoelectronics division revenues, 2007-2012 financial years (JPYb)

Chart 18: TG adds new LED chip production lines to its Saga factory

Chart 20: TG's main types of LED package product for lighting use

Table 8: TG's new high-brightness LED chips and ordinary lighting LED chip comparison

Chart 21: Revenues and operating profits for Nichia's LED division, 2H09-2011 (JPYb)

Chart 22: Equipment investment for Nichia's LED division, 2008-2012 (JPYb)

Chart 23: Nichia's development of LED package products for lighting use

Chart 25: LED TV share of TV market and Samsung share of LED TV sales, 4Q11-3Q12

Table 10: Comparison of different types of LED TV backlight module types

Chart 26: LED lighting as a share of Samsung's LED revenues, 2009-2011

Table 12: International recruitment at Samsung Electronics' LED division

Chart 27: LG Innotek's LED division, financial performance, 1Q11-2Q12 (KRWb)

Table 13: Measures taken by LG Innotek to make its LED business more profitable

Chart 28: Capital expenditure for LG Innotek's LED business, 2010-2012 (KRWb)

Chart 30: Lighting as a percentage of LED division revenues, 2011-2015

Chart 31: Seoul Semi's revenues and operating profits, 3Q11-3Q12 (KRWb)

Chart 32: SOC revenues and operating profits, 3Q11-3Q12 (KRWb)

Chart 33: Seoul Semi's LED chip suppliers and cross-licensing partners

Chart 34: Direct-lit LED TV products as a share of revenues, 1H12

Chart 35: Seoul Semi's low-priced direct-lit LED TV clients and sales methods

Chart 36: Comparison of Seoul Semi's Acrich 2 lighting modules with ordinary LEDs

Chart 37: Share of revenues contributed by Acrich 2 products in 2012

Chart 38: Features of Seoul Semi's nPola LED technology and products

Chart 41: Sanan's total cumulative patent applications, 2010-2011

Table 16: Sanan Optoelectronics presence in the LED and green industries

Chart 42: Timeline of Sanan subsidiary Jingan Optoelectronics

Chart 43: Financials of Electech's LED business, 1H2010-1H12

Chart 45: Electech's funding increase plans and subsidies received, 2H11-1H12