This report takes Google's core businesses as a starting point to analyze how Google is competing in the one-cloud, many-screen environment. This is followed by an analysis of the strategic expansion of the Android and Chrome OS platforms, complemented by an exploration of Google's presence in the digital content service business and its goals in operating in this sector. Lastly, the report examines Google's strategic thinking and positioning with regard to the launch of Google-branded smartphones, tablets and notebooks, as well as an overview of key supply chain partners for these products.

Google's core businesses and overall platform development strategies

Chart 5: Android is the major device operating platform for Google's cloud computing business

Google's presence and role in the digital content service sector

Table 1: Google has a comprehensive presence in cloud services and digital content

Chart 11: The Nexus 4 was priced much lower than the previous 3 Nexus handsets

Table 4: Major component suppliers for Nexus-branded handsets

Chart 12: Nearly 6m Nexus 7 tablets were shipped in 2012 (m units)

Chart 13: Huge shipments of Nexus tablets have made Google a major client for OEMs

Chart 15: The first-generation Nexus 7 was the first Android tablet to feature NFC

Chart 16: The second-generation Nexus 7 will add wireless charging

Chart 18: Google's development strategy and activities in the notebook market

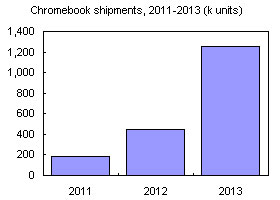

Increasing familiarity and support for Chrome in markets and among channels

Chart 19: Google's collaborative business model for notebook brands making Chromebooks

Table 6: Supply chain overview for the Google-branded Chromebook Pixel

Table 9: Google notebooks planned for 2013 but subject to delays

Table 10: Androidbook models that could be launched in the second half of 2013

Chart 21: Project Glass is a Google forward-looking Google-branded device

Chart 22: Google Smart-watch patent concept drawings and schematics