Mobile DRAM bit demand is set to exceed 400 million gigabits (Gb) in the fourth quarter of 2013, up 35.5% on quarter and over 70% on year, according to Digitimes Research.

DRAM bit demand for smartphones will rise to 334 million Gb in the fourth quarter of 2013, up 39.1% sequentially and 92.1% on year, while that for tablets will increase 41.9% on quarter and 40.5% from a year ago to 65.8 million Gb, Digitimes Research said.

Mobile DRAM will spur a 26.8% increase in overall DRAM bit demand in 2013, Digitimes Research noted. Overall mobile DRAM bit demand is forecast to reach 1.28 billion Gb in 2013, up 74.8% from 733.5 million Gb in 2012, Digitimes Research said.

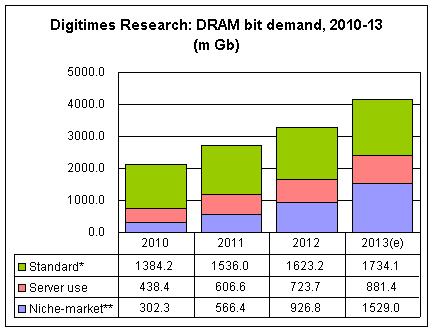

Overall niche-market DRAM bit demand will come to 502.8 million Gb in the fourth quarter of 2013, representing growth of 29.1% on quarter and 61.7% on year, Digitimes Research projected. In all of 2013, the bit demand is forecast to total about 1.53 billion Gb, up 65% from 926.8 million Gb in 2012, Digitimes Research said.

The overall DRAM market, which consists of PC- and server-use DRAM, and niche-market memory, is forecast to consume 4.145 billion Gb in 2013, according to Digitimes Research.

This article is an excerpt from a Chinese-language Digitimes Research report. Click here if you are interested in receiving more information about the content and price of a translated version of the full report.

*Consisting of DRAM parts for desktops, notebooks/netbooks and upgrade modules for PCs

**Consisting of mobile DRAM, specialty DRAM and graphics RAM

Source: Digitimes Research, September 2013