Introduction

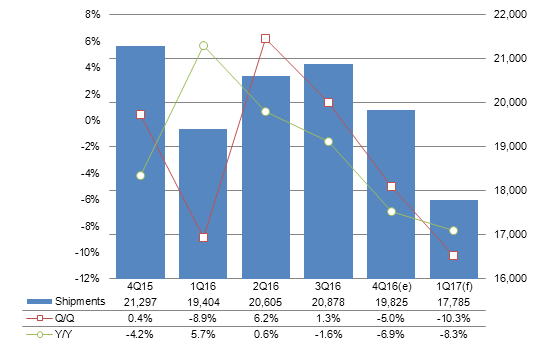

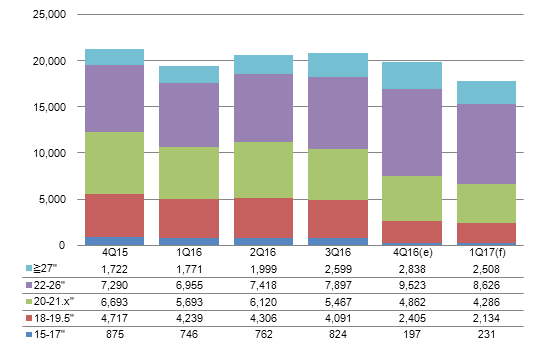

- Taiwan makers shipped 19.83 million LCD monitors in the fourth quarter of 2016, registering a sequential decrease of 5% and an on-year decline of 6.9%.

- Taiwan makers' LCD monitor shipments will drop 10.3% sequentially and 8.3% on year in the first quarter of 2017.

NOTE: Unless otherwise indicated, all figures and tables in this report refer to output from Taiwan makers.

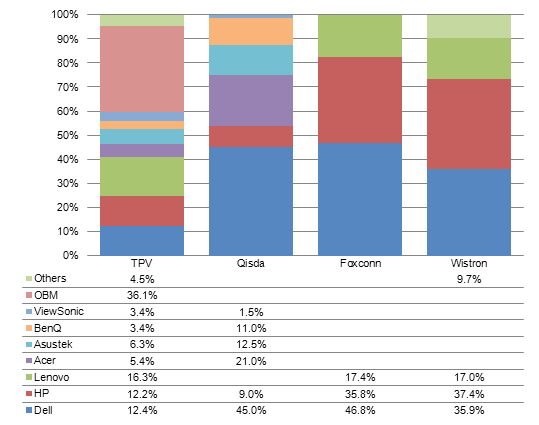

Chart 1: LCD monitor shipments, 4Q15-1Q17 (k units)

Source: Digitimes Research, February 2017

- Taiwan's LCD monitor shipments declined 6.9% on year in the fourth quarter of 2016, dropping below the 20 million mark to reach only 19.83 million units. The shipments also represent a 5% sequential drop.

- The shipments are expected to drop further by over 8% on year and 10% sequentially in the first quarter of 2017, a sign that the LCD monitor market has not yet reached the bottom.

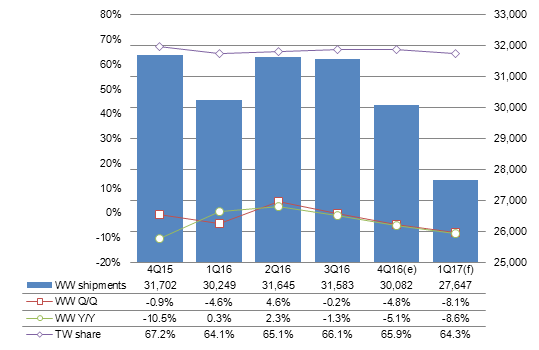

Chart 2: Taiwan's worldwide market share, 4Q15-1Q17 (k units)

Source: Digitimes Research, February 2017

- Taiwan's share of worldwide monitor shipments dropped below 66% in the fourth quarter of 2016. This is because Taiwan-based monitor vendors and China-based Lenovo which outsource most of their LCD monitor production to Taiwan-based makers had weak sales, undermining these upstream partner's shipments.

- In the first quarter of 2017, the share will slip to only 64.3%. With the exception of Wistron, all Taiwan-based makers will suffer more than 10% sequential declines in the quarter, while Korea-based Samsung Electronics and LG Electronics will see their shipments stay at similar levels to those they saw a quarter ago.

Shipments breakdown

Production value and ASP

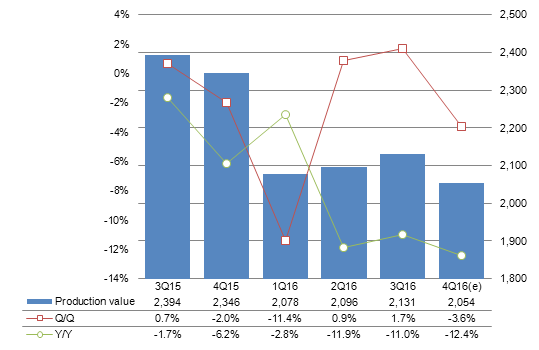

Chart 3: Taiwan LCD monitor production value, 3Q15-4Q16 (US$m)

Source: Digitimes Research, February 2017

Chart 4: Taiwan LCD monitor ASP, 3Q15-4Q16 (US$)

Source: Digitimes Research, February 2017

- Taiwan's LCD monitor production value dropped 3.6% sequentially in the fourth quarter of 2016 to reach US$2.05 billion, slightly better than the unit shipments' 5% decline. Because of LCD monitor panel shortages and vendors focusing more on releasing large-size models, LCD monitor ASP went up 1.5% sequentially to reach US$103.6.

Makers

Chart 5: Shipments by maker, 4Q15-1Q17 (k units)

Source: Digitimes Research, February 2017

- Of the Taiwan-based makers, Qisda was the only one with on-year shipment growth in the fourth quarter of 2016 despite its sequential shipment drop.

- Qisda's shipments to Dell, Asustek Computer, BenQ and ViewSonic all achieved on-year growths in the fourth quarter of 2016. Thanks to its panel-making affiliate AU Optronics' (AUO) full support on panel supply, Qisda's total solution pricing is more flexible, increasing its LCD monitors' competitiveness.

- Qisda will continue to perform the best of all makers on a yearly basis in the first quarter of 2017 and will see an on-year shipment drop of only 1.7%. Its competitors will all see over 6% on-year drops.

- In terms of on-quarter performance, TPV, Qisda and Foxconn will all suffer over 10% shipment declines in the first quarter.

- Wistron's shipments in the fourth quarter of 2016 were more stable than others and will remain so in the first quarter of 2017.

- TPV's shipment volume includes public display products that contribute around 500,000 in unit shipments per quarter.

- Samsung Electronics shipped 3.21 million and 3.18 million LCD monitors in the third and fourth quarter of 2016, respectively, while LG Electronics shipped 2.95 million and 2.78 million units.

- Samsung outsourced orders for about 350,000 and 200,000 LCD monitors to China-based BOE in the third and fourth quarter of 2016, respectively.

- TPV was the largest LCD monitor player worldwide in the fourth quarter of 2016, followed by Qisda in second place, Samsung in third, Foxconn in fourth and LG in fifth. However, LG's shipments will surpass those of Foxconn by 20,000-30,000 units and become the fourth largest player in the first quarter of 2017.

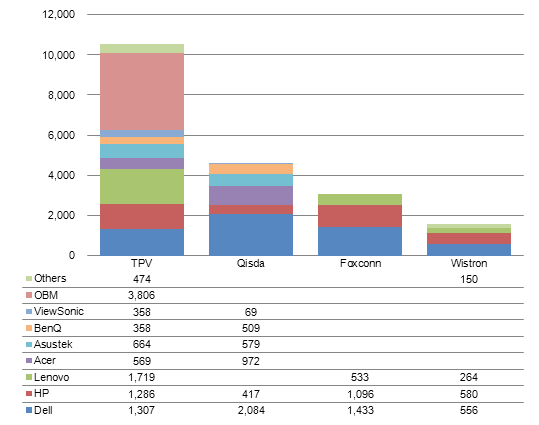

Chart 6: Top-4 makers' shipments by client, 4Q16 (k units)

Source: Digitimes Research, February 2017

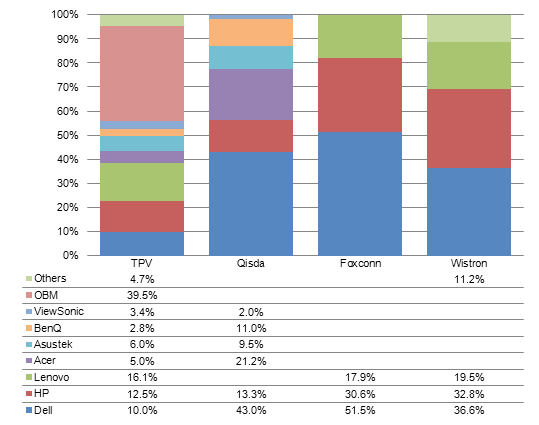

Chart 7: Top-4 makers' shipment share by client, 4Q16

Source: Digitimes Research, February 2017

Chart 8: Top-4 makers' shipments by client, 3Q16 (k units)

Source: Digitimes Research, February 2017

Chart 9: Top-4 makers' shipment share by client, 3Q16

Source: Digitimes Research, February 2017

- TPV's OBM (own brand) shipments were down 17.3% sequentially in the fourth quarter of 2016, causing OBM's share to drop 3.4pp. This was mainly because its brand LCD monitor sales in China had not been performing well.

- Foxconn's orders from HP grew strongly by 26.7% sequentially in the fourth quarter of 2016 and increased the US vendor's share of the maker' shipments by 5.2pp sequentially.

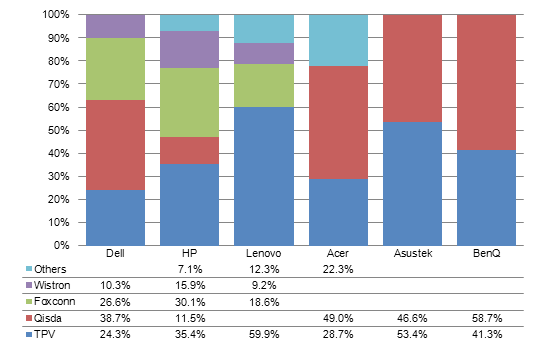

Chart 10: Major vendors' order distribution, 4Q16

Source: Digitimes Research, February 2017

Chart 11: Major vendors' order distribution, 3Q16

Source: Digitimes Research, February 2017

Business models: OBM, OEM/ODM

Chart 12: Shipments by business model, 3Q15-4Q16 (k units)

Source: Digitimes Research, February 2017

- TPV is the only Taiwan maker that has OBM shipments. TPV has several brand products including AOC, Philips, Envision, Topview and Maya.

- Because TPV's OBM shipments were down 17.3% sequentially in the fourth quarter, Taiwan's overall OEM/ODM shipment proportion rose to above 80% in the quarter.

Screen sizes

Chart 13: Shipments by screen size, 4Q15-1Q17 (k units)

Source: Digitimes Research, February 2017

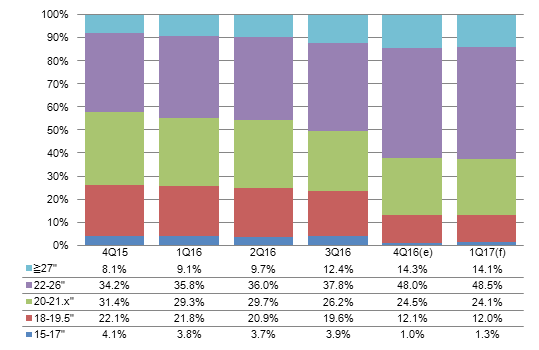

Chart 14: Shipment share by screen size, 4Q15-1Q17

Source: Digitimes Research, February 2017

- Most of Taiwan's LCD monitor shipments are 22-inch and larger units. The combined share of the 22- to 26-inch segment and the 27-inch and above segment grew strongly from 50.3% in the third quarter of 2016 to 62.4% in the fourth quarter.

- The two segment's combined share will rise further to 62.6% in the first quarter of 2017.

Annual shipments

Chart 15: Taiwan and worldwide LCD monitor shipments, 2012-2016 (k units)

Source: Digitimes Research, February 2017

- Worldwide LCD monitor shipments were down slightly by 1% in 2016 and reached 123.56 million units.

- Taiwan's LCD monitor shipments stayed above 80 million units in 2016 and were down less than 1% on year; however, Taiwan's share of worldwide shipments continued to rise and reached 65.3% in 2016.

- Despite 2016's stable shipment performance, the 8.3% on-year decline expected for Taiwan's LCD monitor shipments in first-quarter 2017 will be a sign of uncertainty in the LCD monitor market in 2017.

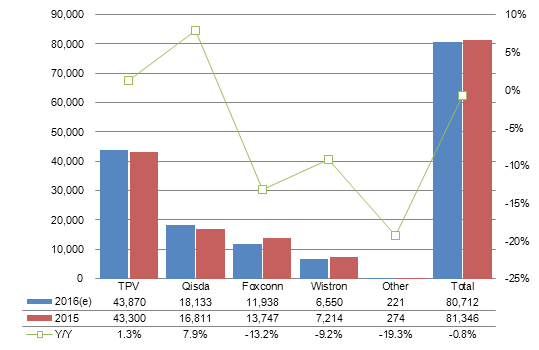

Chart 16: Shipments by top makers, 2015-2016 (k units)

Source: Digitimes Research, February 2017

- Despite Taiwan's on-year shipment decline of 0.8% in 2016, Qisda still managed to achieve nearly 8% growth in the year.

- TPV also enjoyed a small growth in 2016 shipments.

- Foxconn had been aggressively vying for orders in the second half of 2016, but the company's shipments still slumped by 13.2% on year as the company was not able to maintain the shipment momentum it had seen in 2015.

- Some of Wistron's orders were taken by its competitors in the second half of 2016, causing its shipments in 2016 to drop 9.2% on year.