Introduction

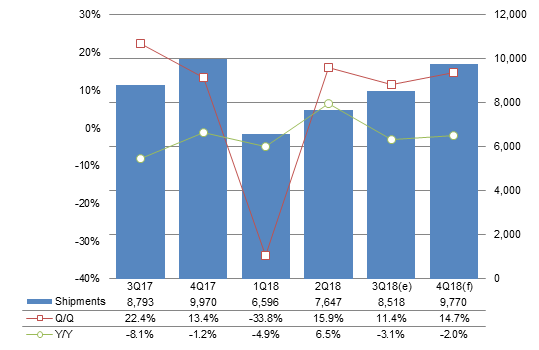

Chart 1: Taiwan LCD TV shipments, 3Q17-4Q18 (k units)

Source: Digitimes Research, October 2018

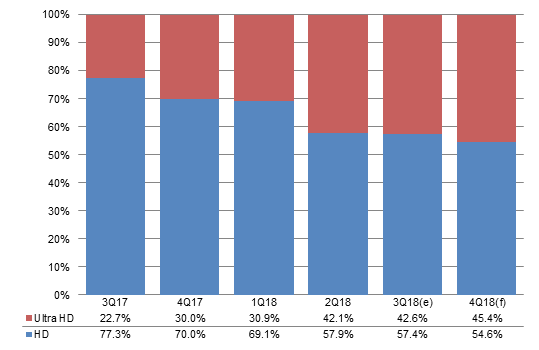

Taiwan's LCD TV shipments increased 11.4% sequentially, but down 3.1% on year to arrive at 8.52 million units in the third quarter of 2018. (NOTE: Unless otherwise indicated, all figures and tables in this report refer to output from Taiwan makers.)

Shipments will climb another 14.7% sequentially to come to 9.77 million units in the fourth quarter, but will still be 2% less than the volumes in the same time a year ago. The shipment ratio for the first and second halves of 2018 will reach 43:57.

Shipments breakdown

Business models

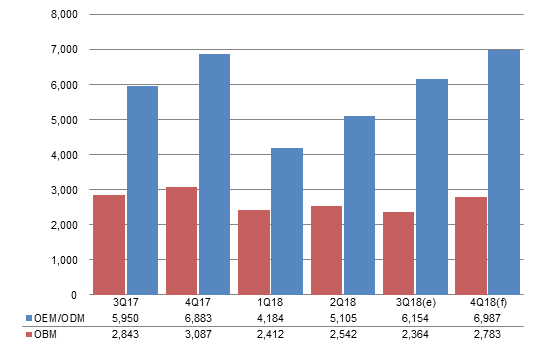

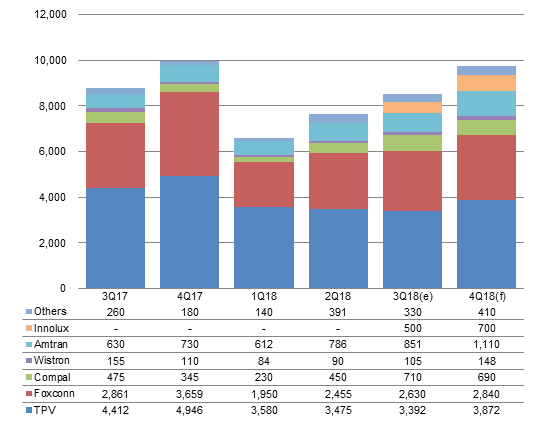

Chart 2: Shipments by business model, 3Q17-4Q18 (k units)

Source: Digitimes Research, October 2018

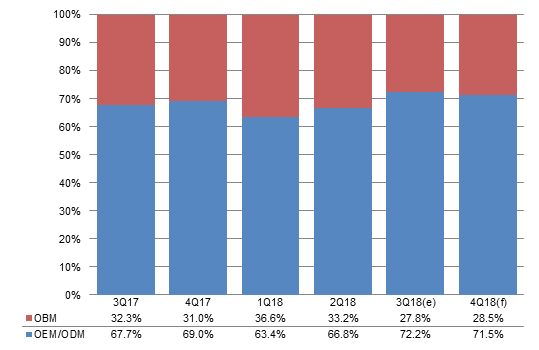

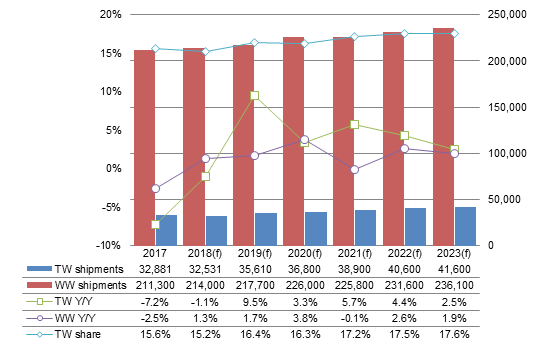

Chart 3: Shipment share by business model, 3Q17-4Q18

Source: Digitimes Research, October 2018

Taiwan's OEM/ODM shipments received a strong boost from seasonality and picked up over 20% sequentially to surpass six million units in the third quarter with the shipment share increasing to 72.2%.

TPV, the largest OBM player in Taiwan, also witnessed its OEM/ODM shipment share increase in the quarter.

Compal Electronics' OBM shipments (Toshiba in the US) performed better than its OEM/ODM orders from Toshiba Japan. Compal has a license from Toshiba for running a LCD TV business using the Japanese brand in the US.

In the fourth quarter, TPV will try to push its OBM shipments in order to achieve its annual shipment goals and help Taiwan's overall OBM shipments grow 17.7% sequentially, stronger than OEM shipments' 13.5%.

Geographic markets

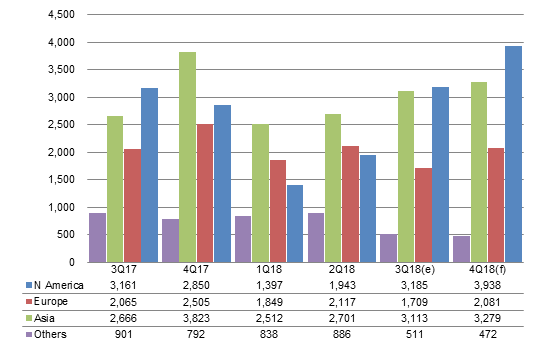

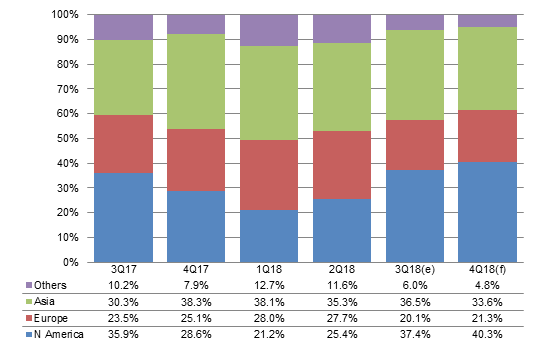

Chart 4: Shipments by region, 3Q17-4Q18 (k units)

Source: Digitimes Research, October 2018

Chart 5: Shipment share by region, 3Q17-4Q18

Source: Digitimes Research, October 2018

Taiwan's shipments to North America grew 63.9% sequentially in the third quarter, boosting the region's shipment share by 12pp to 37.4% thanks to year-end holiday demand.

Taiwan's shipments to Asia continued rising in the third quarter and were only slightly behind those to North America.

Shipments to Europe slipped to only 1.71 million units in the third quarter as most consumers in the region already purchased new LCD TVs in the first half for the FIFA World Cup.

In the fourth quarter, shipments to North America will grow to almost four million units as demand continues rising.

Screen sizes

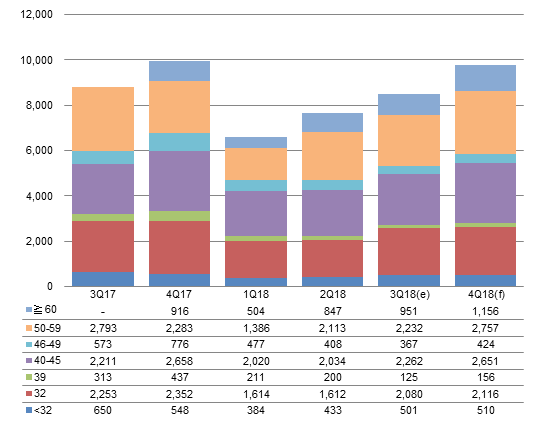

Chart 6: Shipments by screen size, 3Q17-4Q18 (k units)

Source: Digitimes Research, October 2018

Chart 7: Shipment share by screen size, 3Q17-4Q18

Source: Digitimes Research, October 2018

Taiwan's shipments of 60-inch and larger LD TVs will maintain a share of over 11% in the second half.

Shipments of 32-inch LCD TVs grew 29% sequentially in the third quarter mainly thanks to the contribution from TPV.

Shipments of 50-inch and above LCD TVs will account for 40% of Taiwan's overall volumes in the fourth quarter as demand for large-size LCD TVs from North America will pick up strongly for the year-end holiday season.

Makers

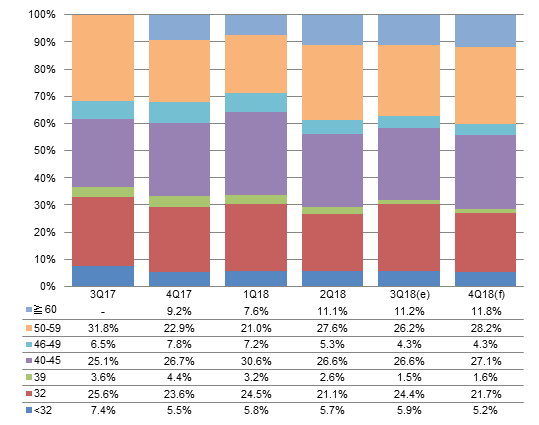

Chart 8: Shipments by top makers, 3Q17-4Q18 (k units)

Source: Digitimes Research, October 2018

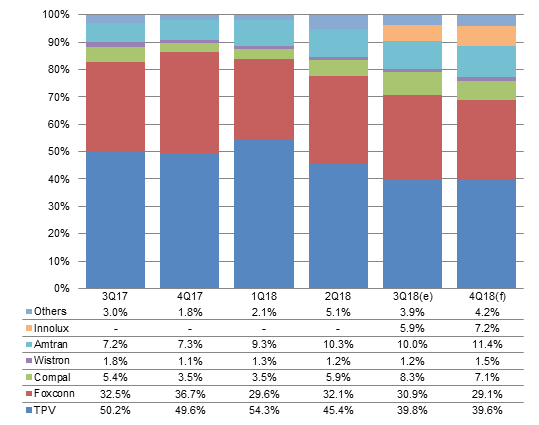

Chart 9: Shipment share by top-6 makers, 3Q17-4Q18

Source: Digitimes Research, October 2018

TPV's shipments of LCD TVs slid 2.4% sequentially in the third quarter to arrive at 3.39 million units. Although TPV's ODM/OEM volumes were up on quarter in the third quarter, the growth was still not sufficient to fully offset the drop in OBM shipments. Thanks to seasonal demand, TPV's shipments are expected to rise 14% sequentially in the fourth quarter with its ODM/OEM and OBM shipments to both enjoy growths.

The Foxconn Group's shipments went up 7% sequentially to come to 2.63 million units in the third quarter and will continue growing to 2.84 million units in the fourth quarter. Although Foxconn's orders from its major client Sony remain stable in the second half, its orders from Sharp were weaker than the same period a year ago. Foxconn's orders from Vizio have been stabilizing since the second quarter.

Amtran's shipments have been gradually recovering in 2018 and will reach above one million units in the fourth quarter. Xiaomi has surpassed Vizio as Amtran's top client, but the maker is still seeing strong orders from Vizio for year-end holidays. Amtran also has begun supplying LCD TVs to a Korea-based vendor in fourth-quarter 2018, which will boost Amtran's overall shipments in the quarter.

Compal Electronics' shipments surged 57.8% sequentially in the third quarter thanks to shipment growth for its Toshiba-brand LCD TVs that are pre-installed with Amazon's Fire TV platform in North America. However, the maker's shipments are expected to slip 2.8% sequentially in the fourth quarter due to weakening orders from Toshiba Japan.

Innolux and AU Optronics (AUO), originally pure panel suppliers, have begun providing TV assembly services in 2018. Innolux's orders started mass shipments in the third quarter and the company is now listed as an independent maker. Prior to the third quarter Innolux was included in the the "Others" category in this report.

Source: Digitimes Research, October 2018

Sharp president JW Tai has taken over the management of Sharp China beginning from September and has turned the business focus to profitability instead to shipment volumes. As a result, Foxconn's orders from Sharp China are expected to drop.

Taiwan's shipments to clients in North America will grow strongly in the second half due to demand from the year-end holiday season. Best Buy and Vizio have both placed more orders for the second half. Vizio also has begun outsourcing orders to Innolux in the second half.

Xiaomi is the largest China-based client for Taiwan makers. In addition to Taiwan-based partners, Xiaomi also places orders with China-based suppliers including TCL.

With China-based BOE cutting panel supply support to its TV manufacturing affiliate BOE TV, its client Vizio is expected to turn to Taiwan makers for more shipments.

Best Buy's own-brand Insignia LCD TVs that are pre-installed with Amazon Fire TV platform are also manufactured by Taiwan-based makers.

HD standard

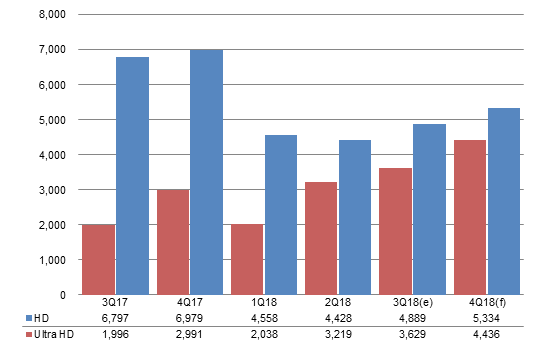

Chart 10: Shipments by HD standard, 3Q17-4Q18 (k units)

Source: Digitimes Research, October 2018

Chart 11: Shipment share by HD standard, 3Q17-4Q18

Source: Digitimes Research, October 2018

Taiwan's shipments of LCD TVs featuring Ultra HD resolution will continue rising to reach 45.4% in the fourth quarter. So far, Taiwan's shipments of 48-inch and above LCD TVs are mostly Ultra HD models.

Compal and Amtran both have around 60% of their shipments being 4K Ultra HD LCD TVs.

Annual shipments

Chart 12: Taiwan and worldwide LCD TV shipments, 2017-2023 (k units)

Source: Digitimes Research, October 2018