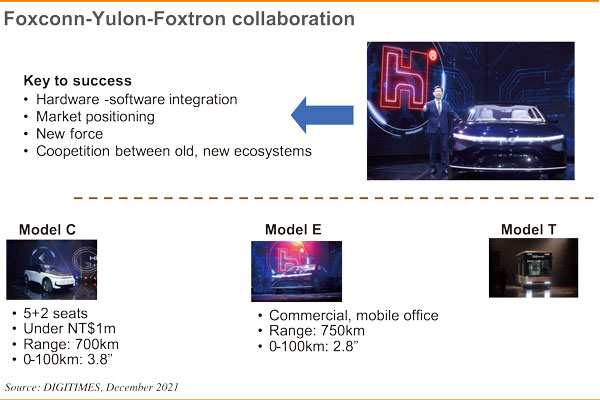

Foxconn (Hon Hai) unveiled three EV models, Model C, Model E and Model T, during its recent Hon Hai Tech Day, apparently targeting at three different market segments. Aiming at personal consumption at a reasonable price of under NT$1 million (US$35,939) Model C features comfortable seating for 5+2 people, accelerates from 0km to 100km in 3.8 seconds and delivers an extended range of 700km. The Model E is positioned as a dedicated mobile office with a wider range of 750km and acceleration in 2.8 seconds from 0km to 100km. Overall, Model C with moderate specs is likened to a consumer notebook with wheels for personal transportation. Model E is a commercial notebook which features "business specs" from Internet connection to interior design. The application scenarios should sound familiar to people in the ICT industry.

Model T is positioned as an electric bus, regarded as a large industrial computer with wheels. Take passenger cars as an example. The specifications are usually determined by the carmakers who implement small changes every three years and major revamps every five years. With the evolution of industrial design and introduction of electronic products and applications, it is estimated that in 2022 alone there will be more than 500 EV models launched into the market. How will the traditional automobile industry respond to the needs of different customers will be the most challenging task for smart manufacturing, but changes will be inevitable.

Types of electric buses considerably vary. With an annual global market size of 15,000 buses and 15,000 coach buses, the buyers decide their specs because of the different circumstances where each bus is used. The buyers determine the size of seats, screen layout and a variety of related services based on their own market positioning. Taiwan's strengths in industrial control outright meet the distinctive requirements. I believe Hon Hai's electric bus market strategy tend to capitalize on business opportunities in industrial control applications.

In the midst of supply chain disruptions in 2021, GM is looking to TSMC, and Ford to GlobalFoundries. The new practices of going direct with the upstream would affect the ecosystem of the automotive industry. Within the relatively closed supply chain, Tier 1 contract manufacturers like Denso, Bosch, Continental, Magna and ZF have been adopting a "one-stop shop" business model. They are the gatekeepers to deter upstream suppliers from entering the automotive supply chain.

It may take at least sx or seven years to become a member of the automotive supply chain for panel makers, according to AUO. Nonetheless, a slew of Taiwan's ICT players have gained a foothold in the future EV industry, such as AUO's panel solutions, Quanta's ECU (engine control unit), Delta Electonics' power management, Garmin's GPS navigators and Macauto's automotive interior sunshades. They have been developing businesses on their own without forming an ecosystem for the EV industry. In the past, Tier 1 automakers were relatively reluctant to accept changes in supply chain structures, but now they are overwhelmed by structural changes of the industry. Foxconn or other supply chain members from the ICT industry can be either their partners or rivals, depending on the nature of businesses.

The ICT industry is bound to be the game changer of the traditional automotive industry. Each player seeks to shorten the development period of their EV models. Like the open-source model of Linux OS, Foxconn's is open to free development and innovation for each individual EV kit subject to the final assembly stage implemented through the MIH platform. The platform allows Taiwan enterprises to exploit what they are good at with successful experiences learned in PC and software development.

Foxconn's platform MIH stands for "Mobility in Harmony." Whether the ecosystem can run smoothly will certainly depend on the leader's strategic deployment and visions.

(Editor's note: This is part of a series of analysis of Taiwan's role in the global ICT industry.)