ASML announced its second-quarter 2023 results on July 19. The Netherlands-based company reported revenue of EUR6.9 billion (US$7.74 billion), with gross margin at 51.3%. Net income was EUR1.9 billion. It also expects third-quarter revenue between EUR6.5 billion and EUR7.0 billion, with a gross margin around 50%.

Peter Wennink, ASML CEO, put the company's Q2 revenue and gross margin at the high end of its guidance, mainly driven by DUV immersion revenue in the quarter. Also thanks to incremental DUV revenue, full-year 2023 revenue also expects a 30% growth compared to 2022 and a "slight improvement" in gross margin. However, uncertainty persists.

"Our customers across different market segments are currently more cautious due to continued macro-economic uncertainties, and therefore expect a later recovery of their markets," noted Wennink. "The shape of the recovery slope is still unclear. However, our strong backlog of around EUR38 billion provides us with a good basis to navigate these short-term uncertainties."

As presented during ASML's Investor Day in November 2022, the company modeled an opportunity to reach annual revenue in 2025 between approximately EUR30 billion and EUR40 billion, with a gross margin between approximately 54% and 56%. For 2030, it targets an annual revenue between approximately EUR44 billion and EUR60 billion, with a gross margin between approximately 56% and 60%.

In terms of lithography system sales, net bookings in Q2 amounted to EUR4.5 billion, of which EUR1.6 billion came from EUV lithography systems. In the first half of 2023, a total of 203 new lithography systems were sold, while 10 used lithography machines were sold in the same period. Revenue breakdown reveals that ArF immersion systems accounted for 49% of net system sales, up 10 percentage points compared to Q1 2023. EUV machines accounted for 37% of net system sales, down 17 percentage points from Q1.

"On our EUV business we see some shift in demand timing," said Wennink, indicating that it is predominantly driven by fab readiness. "The fabs are not ready and why is that? There are skills issues. We've said that before and whether it is in Taiwan or in the US, there are skills issues."

Accelerating shipment to China

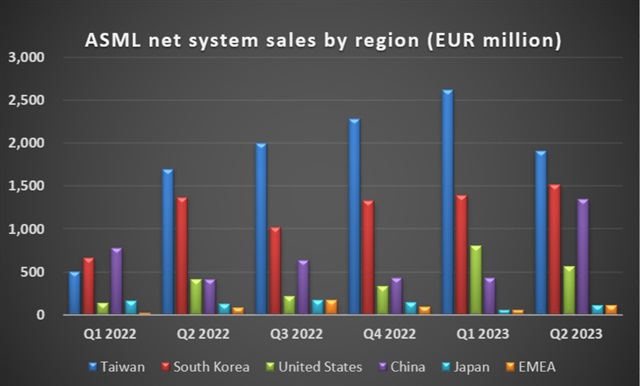

Taiwan, meanwhile, remained ASML's largest market with 34% share in net system sales. South Korea, as the second largest, took 27%. Most important of all, China's share of ASML net system sales has grown from 8% in Q1 2023 to 24% in Q2 2023. Eric Chen, DIGITIMES Research analyst, believes that ASML has sped up shipment to China – now its third largest market.

Regarding the recent export controls announced by the Dutch government toward China, the ASML CEO noted that the final ruling "was more or less in line with what we communicated about a quarter ago," reiterating that the regulations, effective per September 1, dealt with NXT:2000i and subsequent models of DUV immersion systems.

Nevertheless, Wennink also pointed to the need to understand what the US government has done. "The Japanese government has come out with their ruling end of May. The Dutch government a few weeks ago. So, we're waiting for the American rules to come out," said Wennink. "There have been some media reports that the Americans are contemplating some additional measures. Of course that is speculative. We don't know what it is." All in all, the ASML CEO emphasized that the company doesn't expect the export control measures to have a significant impact on 2023 performance. Nor will it impact the longer-term outlook presented during the Capital Markets Day in 2022.

Source: ASML, compiled by DIGITIMES