The American Chamber of Commerce in Taiwan (AmCham) recently released its 2024 Business Climate Survey, revealing a notable upswing in confidence among its members regarding Taiwan's economic outlook. Despite prevailing global uncertainties, 92% of respondents expressed intentions to maintain or increase their investments in Taiwan throughout 2024.

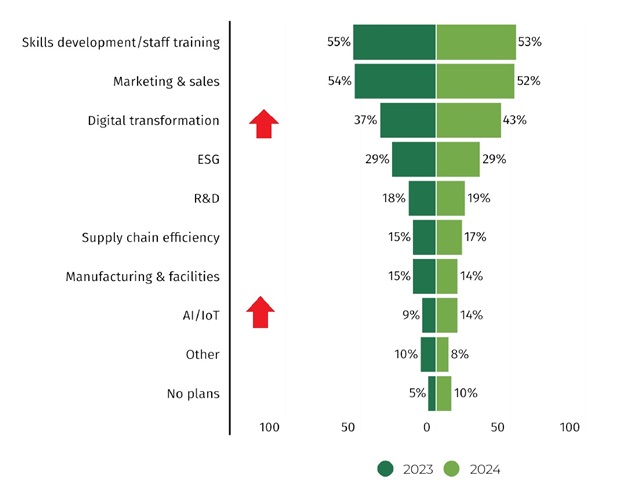

Renewed optimism permeates Taiwan's business landscape. Notably, digital transformation and advancements in AI/IoT sectors garnered heightened interest, with a 5-6% increase compared to the previous year.

Areas of investment

Credit: AmCham

While the tech sector faced challenges in 2023 due to subdued global demand and post-pandemic inventory issues, a turnaround is anticipated in 2024. Factors such as a resurgence in demand and the proliferation of AI chips are expected to fuel growth in this sector.

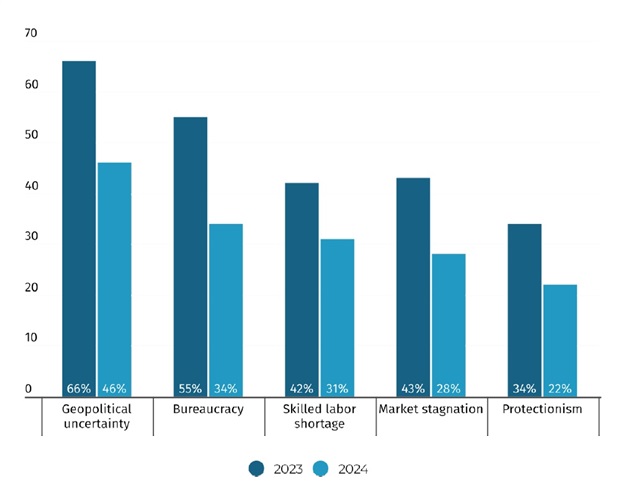

Despite positive economic signals, geopolitical uncertainties persist as a top concern for investors, with 46% of respondents citing it as a potential deterrent. "For Taiwan, a prominent challenge remains its international standing. When we asked about what factors deter their companies from expanding or investing in Taiwan, fewer people mentioned geopolitical uncertainty compared with last year. This dropped by almost 20% of points versus last year. So while they see geopolitics as a risk, it is not so much of a deterrence." said AmCham Chairperson Dan Silver.

Top factors deterring companies from expanding or investing in Taiwan

Credit: AmCham

Cross-strait relations emerged as an area of concern, prompting companies to revise business continuity plans and consider diversifying supply chains. Within the ICT industry, which accounted for 10% of survey respondents, nearly a quarter of companies that relocated business from China were represented. To reduce the impact of possible future disruption, 35% said they are revising business continuity plans. Readjusting supply chains (23%) and expanding to additional locations outside of Taiwan (16%) were other top options considered by respondents.

The significance of trade relations between the United States and Taiwan was underscored, with a bilateral trade agreement deemed to be crucial for enhancing economic prosperity. The U.S.-Taiwan Initiative on 21st-Century Trade garnered substantial support, particularly within the ICT sector, echoed by 68% of respondents. "Taiwan has just completed its election in January; the United States is moving into the peak of its election cycle in the coming months. Therefore, there is a sense that urgency is needed now to close the second part of the 21st-Century Trade Initiative." emphasized by Dan Silver.

Energy availability and sustainability emerged as pressing concerns, with 71% expressing apprehensions regarding Taiwan's green energy availability. Renewable energy and grid resilience were highlighted by 74% of respondents, underscoring the need for robust energy infrastructure.

Conducted between November 20 and December 15, 2023, the survey was completed by 223 members. 81% of respondents expressed confidence in Taiwan's economic outlook over the coming year, an increase of 11% points compared with 2023. AmCham urges authorities in Taiwan and the United States to heed these findings to enhance high-tech investment and Taiwan's economic prospects.