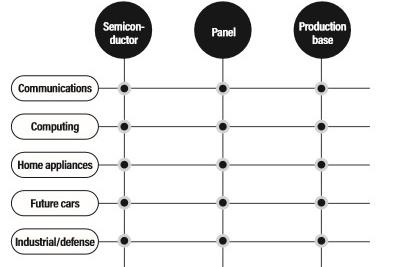

To give a clear picture of the ICT industries, we can divide them into five major market segments - communication, computing, home appliances, automotive electronics, and industrial automation/defense. For example, computing and communication contribute about 65-70% of the ICT sales, with consumer electronics, automotive devices, and industrial control each accounting for about 10%. Automotive devices promise explosive growths, while industrial control involves large varieties of applications. But the arrival of 5G is also promising huge business opportunities for industrial applications. Consumer electronics still have potentials coming from smart home applications, such as TVs.

The display panel industry is also a key sector along with semiconductor. But the next stage of development will rely on emerging markets and decentralized supply chains. COVID-19 has disrupted carmakers' supply chains, but for Japanese and Korean carmakers, it was the lack of low-end parts, such as wiring harnesses, that stalled their production. Japanese and Korean carmakers rely on China for 30% of their parts supply, while the US reliance is only about 13%. What's difference between them?

These show the opportunities for Vietnam, Indonesia, India and the Philippines to become manufacturing hubs. Will Canada and Mexico stand a chance in the carmaking industry with US support? In my new book, Disconnected ICT Supply Chains, I try to answer some of the questions raised in the wake of COVID-19.

Correlation between 3 core ICT sectors and 5 major market segments