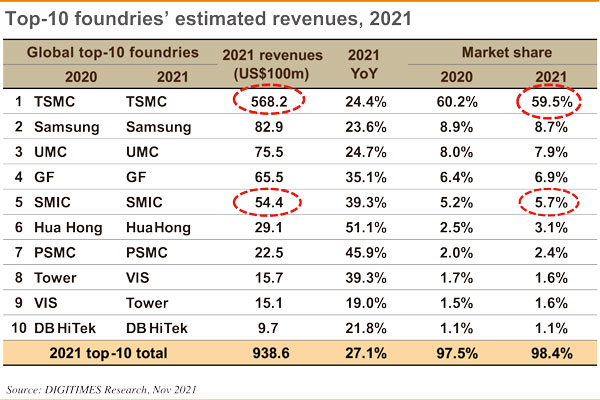

The wafer foundry business is a highly concentrated industry in terms of revenue, with the top-10 players accounting for 98.4% and the top-5 for nearly 90% of global contribution ratio. It is apparent that in this capital-intensive, technology-intensive sector where tight relationships with clients are important, one could not dominate the market without multiple competitive edges.

According to DIGITIMES Research's 2021 industry statistics, TSMC's revenue reached US$56.82 billion, with a global market share of 59.5%, and an almost complete dominance in the 7nm and 5nm matket segments. Samsung in second place has reported a total revenue of about US$18 billion in its System LSI division, with external orders contributing about US$8.2 billion. Samsung's aggregated revenues of non-memory businesses amount to about 1/3 of TSMC's revenues, while Samsung's wafer foundry businesses are only 14.5% of TSMC's revenues.

TSMC's capital expenditure is expected to represent 54% of revenue in 2021 and will exceed US$40 billion in 2022, while TSMC's R&D budget is usually set at 8% of revenue. Samsung may want to overtake TSMC, but its non-memory division cannot afford hefty capex or R&D expenses. Therefore, Samsung would not spin off the wafer foundry business. At some point Samsung may be able to beat TSMC in node advancements, or win over one or two customers, in general the Korean firm can barely pose a significant threat to TSMC's global leadership.

The most likely mode of operation is vertical or/and horizontal integration with strategic partners. Samsung may partner with UMC, and even prepay to secure production capacity. Samsung is eyeing not just CIS-related contract businesses. Already among UMC's top-5 clients, Samsung will soon advance to the top-3 group. Partnership with UMC in 28nm business allows Samsung to concentrate on its advanced processes.

UMC also has similar ecosystem support in Taiwan to the one TSMC enjoys. The government's incentives do not play favorites with TSMC. If UMC came up with some stratagems like headhunting young talent from TSMC, it might pose a fresh threat to TSMC.

Samsung will certainly seek more collaboration with UMC. Although it is rumored that TSMC is tailor-making a 3nm process for Intel, partnership between Intel and UMC could still take place. Since UMC has declared that it will not develop more advanced process beyond 7nm, it won't pose a threat to Intel or Samsung in terms of technology development, but instead generate opportunities of collaboration in mutual business deployment. Once in a blue moon, the favorable industry development is pitching a bunch of trump cards to UMC, the third largest wafer fab. It may be a fascinating game, but UMC doesn't have the cards. Let's just see how it goes.

Players following UMC basically will not pose a threat to the leaders quadrant. What's more, with the China-US trade war, second-tier manufacturers are not eligible to participate in the global race of the top tier. SMIC can secure China's business opportunities at best, while Powerchip and VIS are acting on their own initiatives. The industrial order and model of division of labor for the wafer foundry industry will be considerably stable during 2022-2025. The captivating technology-centric initiatives deployed by the industry leaders TSMC, Samsung and Intel are to drive the future industry development.