The ESG world has come a long way in a very short time. Not so long ago, those who wanted to encourage companies to increase their level of ESG disclosure had to resort to data points and charts that showed the increasing assets under management and superior performance of sustainable/ESG investment funds.

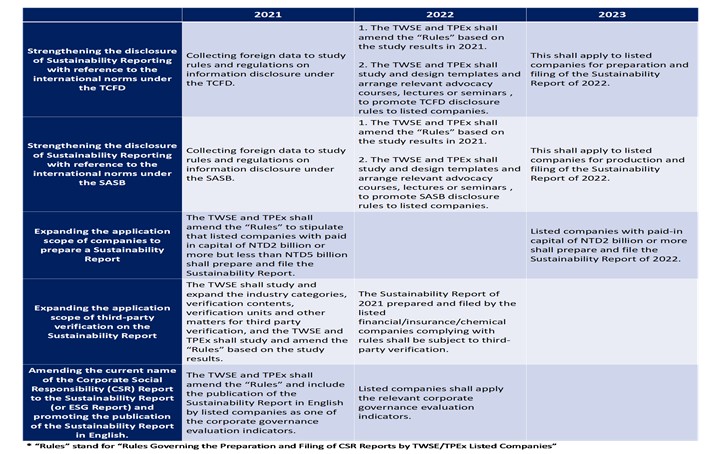

Since that time, investing in the capability to meet the demands of global ESG disclosure frameworks such as SASB and TCFD has become a must for many companies. We anticipate that it will soon become the norm. As we noted, increased ESG disclosure requirements are a key aspect of Taiwan's updated corporate governance requirements for companies. See the table below for more detail.

Taiwan corporate governance 3.0 schedule for enhanced ESG disclosure

Credit: QIC

G7 finance ministers & central bank governors communique

The biggest news in the ESG space recently was that the G7 finance ministers and central bank governors met in late May and early June with the heads of the International Monetary Fund (IMF), the World Bank Group, the Organisation for Economic Cooperation and Development (OECD), and the Financial Stability Board (FSB) to discuss how to build a strong, sustainable, balanced and inclusive global economic recovery in the post-pandemic world. A communique was issued which made the following key points:

The group committed to a multi-year effort to deliver the structural changes needed to meet its net-zero global greenhouse gas and environment objectives in a way that is positive for jobs, growth, competitiveness, and fairness. They committed to properly embedding climate change and biodiversity loss considerations into economic and financial decision-making. They agreed on the need for a baseline global reporting standard for sustainability and welcomed the IFRS Foundation's program to develop this standard using the Task Force on Climate-related Financial Disclosures (TCFD) framework. They suggested that an International Sustainability Standards Board be established before November 1st of this year when the 26th UN Climate Change Conference (COP26) will be held. They suggested that a Task Force on Nature-related Financial Disclosures (TNCD) be set up to address the global crisis of biodiversity loss and indicated that two reports were important resources: The Dasgupta Review on the Economics of Biodiversity and the OECD Policy Guide on Biodiversity.

These statements regarding Biodiversity are a very strong signal by the G7 that they are taking a holistic approach to ESG reporting. We would also like to sound a note of warning. ESG disclosure requirements are increasing at a geometric rate for listed companies. Keeping up will require vigilance and continued investment in ESG disclosure capabilities.

SASB and GRI complete their first joint document – 'Reporting on Enterprise Value'

One of the most positive steps towards a unification of ESG reporting frameworks was taken by the Sustainability Accounting Standards Board (SASB) and the Global Reporting Initiative (GRI). On July 12, 2020, the two organizations announced plans to collaborate. In their announcement, they said, "SASB and GRI understand that the sustainability disclosure landscape can appear complicated. For companies that use both standards, the reporting effort can be high. To help address this, the two organizations will collaborate to demonstrate how some companies have used both sets of standards together and the lessons that can be shared." Their first deliverable was issued in December 2020, with the title 'Reporting on enterprise value: Illustrated with a prototype climate-related financial disclosure standard.' An encouraging aspect of the document was that SASB, GRI, the International Integrated Reporting Council (IIRC), the Climate Disclosure Standards Board (CDSB), and CDP (formerly known as 'the Carbon Disclosure Project') all collaborated on it.

Establishment of the Value Reporting Foundation

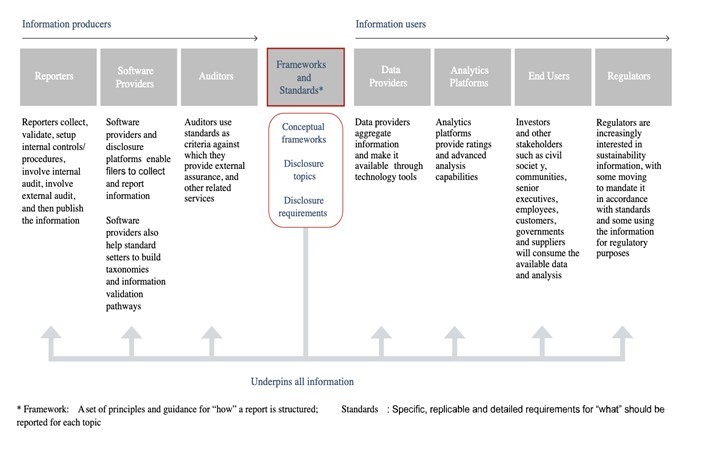

The consolidation in the ESG universe took another step forward on June 9th of 2021, when SASB and the IIRC announced that they had merged to form the Value Reporting Foundation. In the press release announcing their merger, the organization stated: "The Value Reporting Foundation supports business and investor decision-making with three key resources: Integrated Thinking Principles, Integrated Reporting Framework and SASB Standards. These tools help businesses and investors develop a shared understanding of enterprise value and how it is created, preserved or eroded over time." On the Value Reporting Foundation's new website, a useful pictorial description of the global sustainability reporting ecosystem is provided. We share it below. We also share this link to a January 2021 'International Integrated Reporting Framework' authored by the IIRC – pages 7 & 8 provide a concise summary of the 'Guiding Principles' and 'Content Elements' that should shape any integrated reporting effort.

Sustainability reporting ecosystem

Credit: QIC

Making sense of the alphabet soup phenomenon in ESG World

We highly recommend reading this article from the Center for American Progress: 'The SEC's Time to Act: A New Strategy for Advancing US Corporate and Financial Sector Climate Disclosures' written on February 19th, 2021. In addition to making salient recommendations, the authors do an excellent job of describing the history of the ESG disclosure effort and the various organizations that have helped spearhead it.

How to navigate the rapidly changing world of ESG disclosure and reporting

Consolidation amongst the top ESG reporting framework providers is making it somewhat easier to keep up with changes in this space. We recommend that companies keep close track of publications from and news about the Value Reporting Foundation, International Sustainability Standards Board, TCFD & TNCD.

Editor Note: DIGITIMES has invited QIC as a contributing partner to share their insights in a 5-part series: 1) Should companies invest in ESG? 2)Third-party ESG reporting 3)ESG metrics matter 4) Resource guide for staying up to date on global unification of ESG reporting standards and 5) Getting ready for climate-related financial disclosures. The article is the fourth part of the QIC ESG Series, which was originally published on QIC website.

About QIC