Vehicle sales in 2020 and 2021 showed widespread adoption of battery electric vehicles (BEVs). Typical BEVs currently use lithium-ion batteries, which are unstable and require expensive rare minerals, notably cobalt. Because it is crucial to refining these minerals, China controls several key chemicals even though it does not contain deposits of the ores from which these chemicals originate. Other countries, including Portugal, Sweden, Germany, France, and the USA, are seeking to localize their supply chains to resist China's market dominance.

A DIGITIMES Asia recent report, "2022 EV battery value-chain outlook in Asia," highlights current challenges for clean energy, battery electric vehicles from 1990 to 2022, and promising battery startup companies. Below is the summary of the report.

As cobalt has been subjected to increasing criticism, many electric car enthusiasts have begun to favor lithium Ferro-phosphate (LiFePO4 or LFP) batteries. Elon Musk, who founded Tesla, has promoted LFP batteries in Tesla cars.

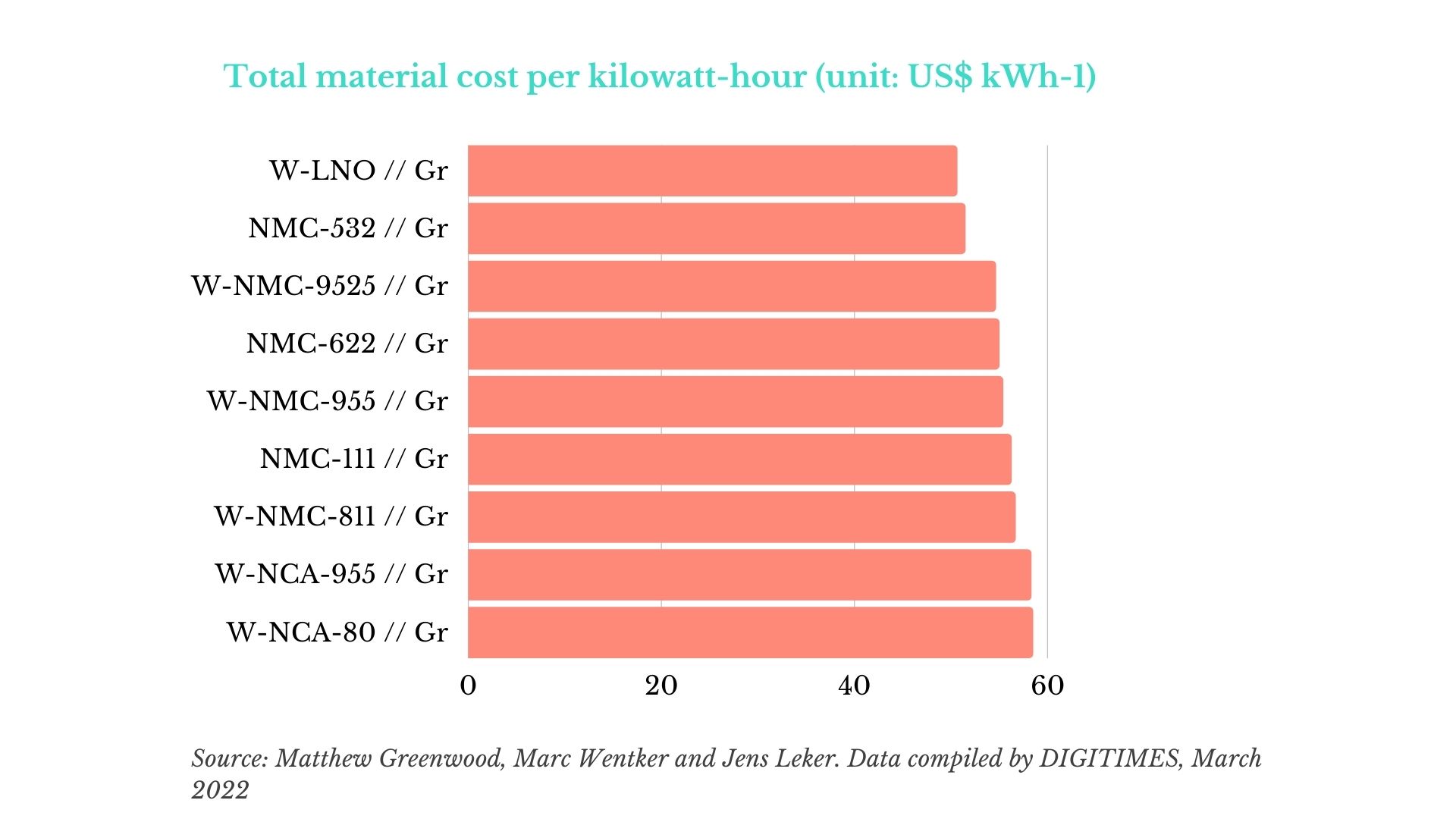

Data compiled by DIGITIMES

Several startup companies are developing disruptive battery technologies. Some batteries are more stable than current offerings. Some batteries use earth-abundant minerals. Solid Power offers a battery with a solid electrolyte for superior stability. Our Next Energy has demonstrated a high-capacity battery that avoids the use of nickel and cobalt. CATL has a battery pack that combines lithium and sodium to provide reliable power in cold temperatures that would impair ordinary lithium-ion batteries. Sparkz had received subsidies for a cobalt-free lithium battery. PJPEye has a proven small-scale carbon-based battery that is adequate for e-bikes but has not been scaled up for automobiles. ElecJet has a graphene-based battery but has not yet proven that it can deliver graphene products at an affordable price.

Despite the momentum of the electric car trend, the transition already has been costly and will continue to force difficult decisions on car companies. In December 2021, Stellantis CEO Carlos Tavares warned that if the transition goes too fast, vehicle quality may suffer, jobs may be lost, and corporate profits could suffer. But still, the EV trend seems unstoppable.

To get the full content of this article, you may download the report via "2022 EV battery value-chain outlook in Asia."

Editor note: DIGITIMES Asia just released a series of industry reports, focusing on the "2022 EV battery value-chain outlook in Asia." The reports are divided into 3 parts – Overview of East and Northeast Asia EV battery supply chains, Southeast Asia, India EV battery and material supply chains, and EV battery tech trends and promising startups. These member-exclusive reports are now available for EV Weekly Subscribers.